Bruce Bennett

The current situation in the Middle East as well as recent voluntary production limitations on the part of major OPEC+ members strongly indicate that BP (NYSE:BP) could be set, not for a record year in 2024, but for a solid year in terms of earnings nonetheless. After the escalation of the Israel-Gaza conflict in October, Iran-backed Houthis have started to attack shipping in the Red Sea and tensions with Iran also put at risk one of the most important oil arteries in the world: the Strait of Hormuz. Given this backdrop, I believe oil companies in general could do well in 2024 and if OPEC+ continues to support product pricing throughout the year, BP could deliver strong results in 2024.

Previous rating

Only fairly recently, in September, did I come around and upgraded shares of BP to buy in the context of OPEC+’s voluntary supply limitations. Shares of BP have declined 12% since, mainly due to falling petroleum prices. Saudi Arabia and Russia, two of the largest oil-producing countries in the world, decided to voluntarily limit crude oil production: Saudi Arabia at the time curtailed its production by 1M barrels a day and Russia announced a 300 thousand barrel a day export reduction. Since then, however, OPEC+ members agreed to deepen production cuts and the security situation in the Middle East has greatly deteriorated which I believe will ultimately boost BP’s earnings potential. OPEC+ price actions especially are a reason for me to double down on BP as the company is set from higher average petroleum prices. BP is also one of the cheapest production companies in the large-cap energy sector, with a P/E ratio of 6.5X.

Deteriorating Middle East security setup

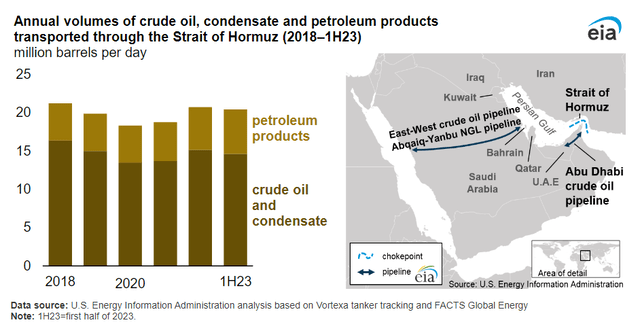

A lot has happened since I last worked on BP. Israel and Gaza are at war and Iran-backed Houthis are conducting attacks on container ships in the Bab-el-Mandeb Strait and the Red Sea. Iran is also a threat to global oil supplies by flexing its muscles in the Strait of Hormuz, the strait that connects the Persian Gulf and the Gulf of Oman. The Strait of Hormuz is one of the most important oil arteries in the world and, according to the Energy Information Administration, the equivalent of 20% of global petroleum liquids production passes through this strait.

EIA

Houthi attacks in the Red Sea escalated as the group as the largest attacks on shipping on Tuesday. Obviously, escalating tensions in the Middle East, which is still one of the world’s most important geographies for petroleum production, is a potential catalyst for higher product prices. A barrel of petroleum currently costs about $72.68 which provides energy companies like BP with the potential to grow their earnings if prices remain high throughout 2024. The setup in the Middle East is at least favorable to such a scenario at the moment.

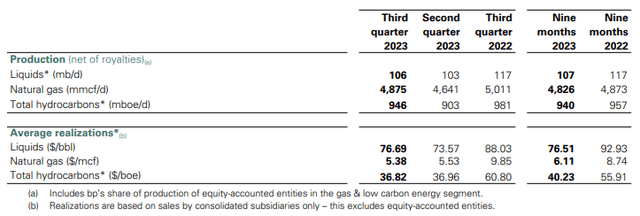

BP’s average petroleum price in the third-quarter, as an example, was $76.69 per barrel which showed a decline of 13% compared to the year-earlier period. BP’s quarterly price breakdown was released at the end of October 2023 (Source). However, with tensions in the Middle East increasing again, there is a considerable chance for BP to benefit from an uptick in pricing as well. Additionally, OPEC+ members reached an agreement in Q4’23 to deepen production cuts until the end of Q1’24. My expectation for 2024 is that these output cuts will be extended throughout the year with additional price support measures likely should petroleum prices decline.

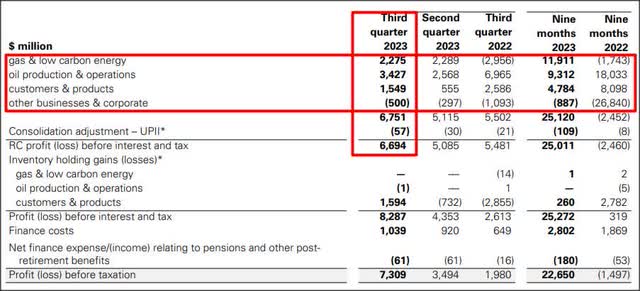

BP

BP’s business trend improved in the third-quarter of FY 2023 due to a slight rebound in petroleum prices (the average petroleum price increased 4% Q/Q in Q3’23). In total, BP generated $6.7B in profits (before interest and taxes) in the third-quarter, the majority coming from its oil production and operations segment ($3.4B). Obviously, BP is widely profitable at a ~$73-74 price level which was about equal to the average price achieved for its petroleum products in the second-quarter ($73.57). During Q2’23, BP generated more than $5.1B in earnings for its shareholders and the energy firm has achieved an average quarterly profit of $8.3B in FY 2023 (up until September).

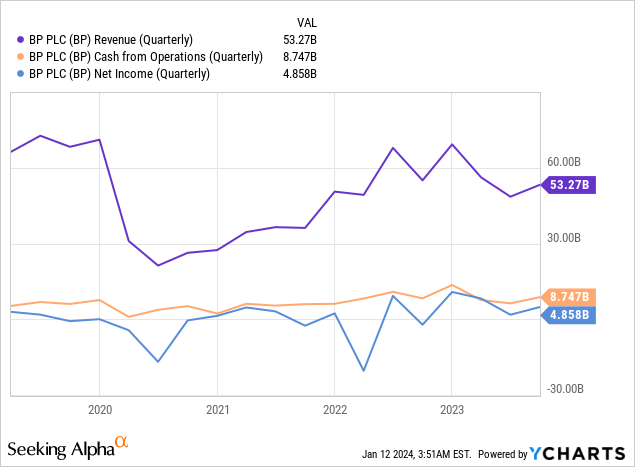

BP

In the long term, BP’s revenues, cash flows and earnings have proven to be highly volatile… which is a reflection of broader market dynamics. BP’s earnings nose-dived during the pandemic, but they have since steadily recovered. The next bear market, however, may result in yet another draw-down in BP’s revenues and earnings.

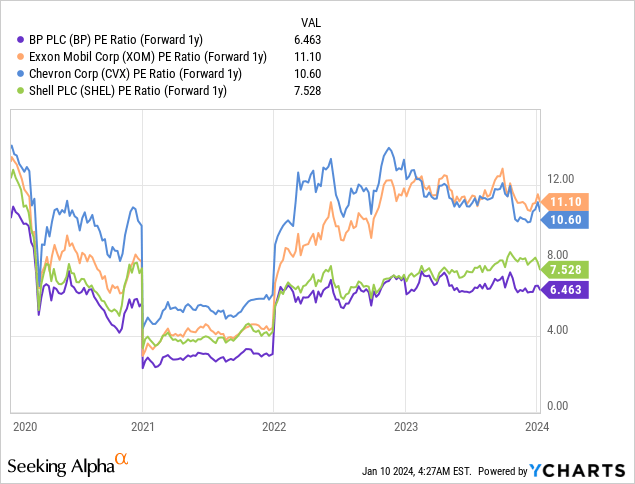

BP’s valuation vs. U.S. rivals

BP seems to be trading at a truly cheap valuation multiplier. With high prices for petroleum products boosting the energy sector’s earnings, BP has seen a decline in its P/E ratio. However, even under consideration of cyclically-inflated EPS, BP is trading at an attractive price-to-earnings ratio of 6.5X, in my opinion, and the British energy company is even cheaper than Shell (SHEL) which has a 7.5X P/E ratio. BP is projected, on a consensus basis, to earn $5.35 per-share next year which underpins the valuation and the firm is expected to grow its earnings ~5% annually in the next two years.

ExxonMobil (XOM) and Chevron (CVX), to include the two biggest U.S. rivals in the market, trade at P/E ratios of 11.1X and 10.6X. I believe BP could easily trade at 8-9X FY 2024 earnings given its high level of quarterly profitability and assuming that petroleum prices remain high in FY 2024, which implies a fair value range of $42-47. My multiplier range (8-9X) and fair value estimate do not change with short term fluctuations in petroleum prices. U.S. rivals also trade at higher valuation ratios than BP, suggesting that the firm has revaluation potential as well.

BP might be undervalued relative to U.S. companies due to their stronger dividend records and aggressive stock buybacks which have provided support for their share prices. U.S. companies are also heavily invested in U.S. shale regions which, at least theoretically, offer the potential for faster production growth.

Risks with BP, Outlook 2024

Petroleum prices are unpredictable and influenced by world events such as terrorist attacks, wars, natural catastrophes and economic declines. Current tensions in the Middle East especially have the potential to lead to a sharp uptick in petroleum pricing if the security situation further deteriorates. On the other hand, a resolution of the Israel-Gaza conflict and especially a less aggressive posture of Iran in the Strait of Hormuz could lead to much lower petroleum prices and therefore diminished earnings potential for BP.

As a result, BP’s specific product pricing risks translate into potentially depressed profitability during a down-turn in the energy market which then could cascade into a slower pace of dividend growth or a lower amount of stock buybacks that support BP’s stock price. Petroleum prices are obviously the biggest influence on BP’s financials and given the price support the OPEC+ has provided here most recently, OPEC+ output decisions should be closely followed and monitored. My expectation is for OPEC+ to continue to be price-supportive force in 2024. BP’s average prices in the production business are also worth following as a decline in pricing will immediately translate to lower revenues and earnings.

If petroleum prices remain high, however, I would not be surprised to see stock buybacks or potentially even new acquisitions in 2024 and beyond. BP is therefore, chiefly, a capital return play for investors in a market where OPEC+ may play a more aggressive role going forward.

Final thoughts

Middle Eastern tensions, especially in Israel-Gaza, the strait of Hormuz and the Red Sea are concerning trends. An escalation of the Israel-Gaza situation, which may draw Iran further into the conflict, would be a worst-case scenario given the importance of the Strait of Hormuz for global crude oil supplies, but likely favorable from a pricing point of view. BP is still widely profitable at petroleum prices of $73 per barrel and I believe the current security situation in the Middle East, a low P/E ratio relative to U.S. rivals and an aggressive OPEC+ organization make BP overall a top bet on petroleum markets in FY 2024!