NicoElNino

Ultra short-term bonds, especially treasuries, have become extremely popular recently. Investment-grade short-term bonds have little risk and due to the inverted yield curve pay high dividends. Practically zero risk and a high yield are extremely attractive to investors, especially considering many investors, including myself, are predicting a recession in the near future. If you want to take advantage of this rate situation, two potential ETFs to buy are the very popular BIL ETF and its much lesser-known peer ULST.

BIL

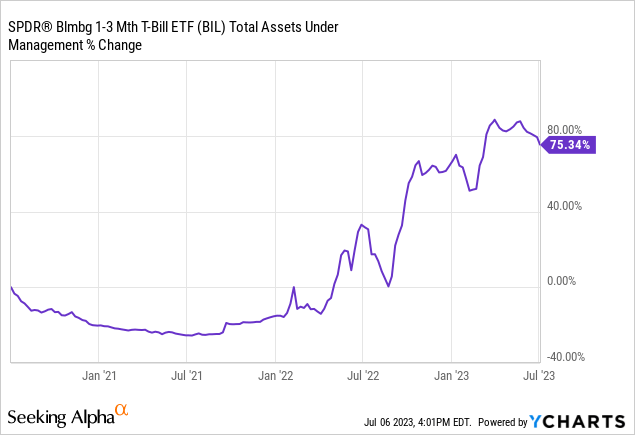

SPDR Bloomberg 1-3 Month T-Bill ETF (NYSEARCA:BIL) is a popular short-term treasury (t-bill) ETF. In the last year, this ETF has grown over 75%.

BIL has AUM of $28B and a 30-day SEC yield of about 5%. As its name suggests, it holds 1-3 month t-bills and tracks the Bloomberg 1-3 Month U.S. Treasury Bill Index. BIL provides investors with a high yield and very low volatility.

I think BIL is an excellent Buy for investors who are looking for a close to risk-free asset and a high yield. However, BIL does fall short for investors who want a low-risk asset that has a high yield and capital appreciation in the future. Because of the extremely low-risk nature of BIL’s holdings, when rates inevitably get cut, it won’t appreciate very much. While this isn’t necessarily a bad thing and I still consider BIL a Buy, many investors want to add just a little more risk in order to receive a higher dividend and have the potential for capital appreciation. I found a small ETF that does just that.

ULST

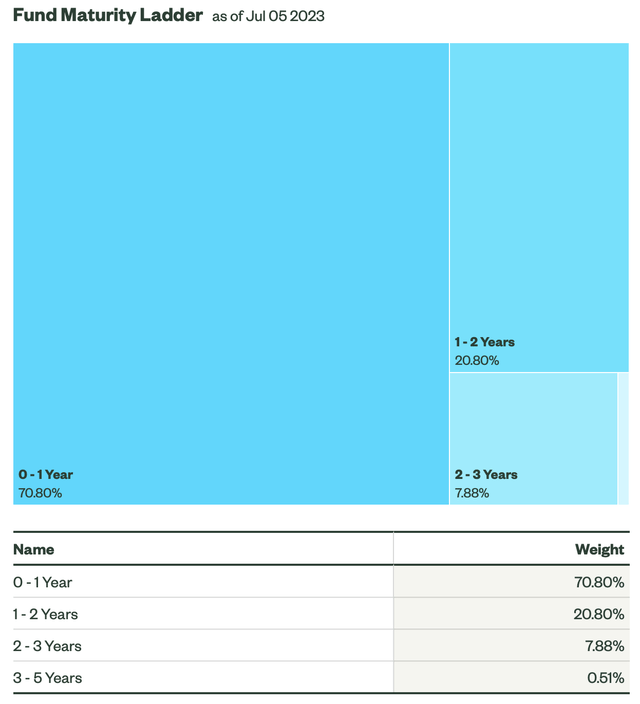

SPDR SSgA Ultra Short Term Bond ETF (NYSEARCA:ULST) is an actively managed bond ETF that mainly holds ultra short-term assets across the fixed-income sector. ULST’s AUM is only $550M, about $27.5B less than BIL’s. ULST 30-day SEC yield is about 5.4%, higher than BILs, but very slightly. According to the ETF’s website, ULST “invests in slightly longer-term securities than traditional cash vehicles with a goal of generating a better total return.” a little over 70% of the ETF is in 0-1 year bonds.

ULST’s holdings by maturity (ssga.com)

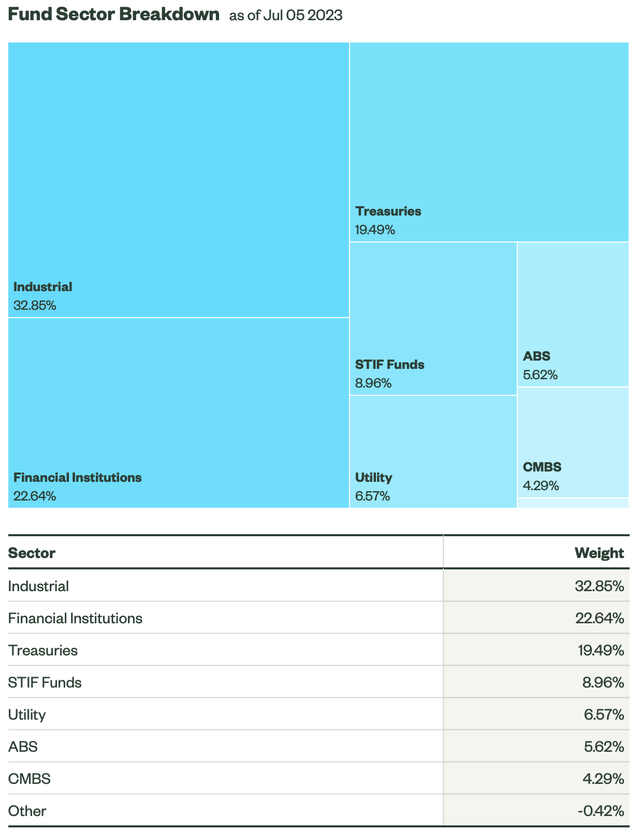

Adding about 30% of the ETF’s AUM in longer-term bonds makes gives ULST a higher yield, but also slightly higher risk than a purely short-term bond ETF. Another major difference between BIL and ULST is that ULST is only about 20% in treasuries whereas BIL is 100%.

ULST’s holdings by sector (ssga.com)

This too adds risk in return for higher yield. ULST has shown it has the ability to maintain relatively low risk while having a high yield.

Performance

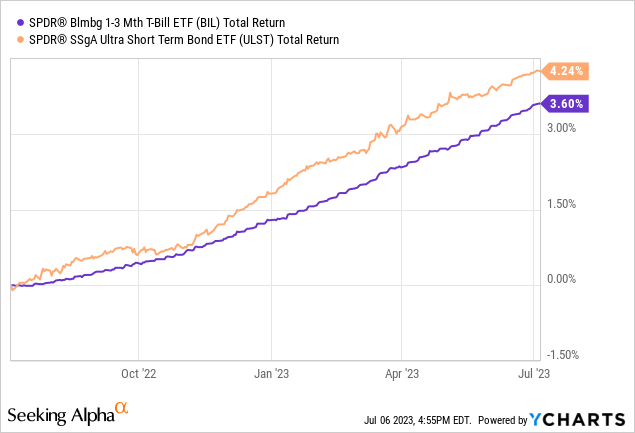

ULST and BIL perform pretty similarly. This is expected, considering how they are both moved primarily by interest rates. The chart below shows the total returns for Both ETFs.

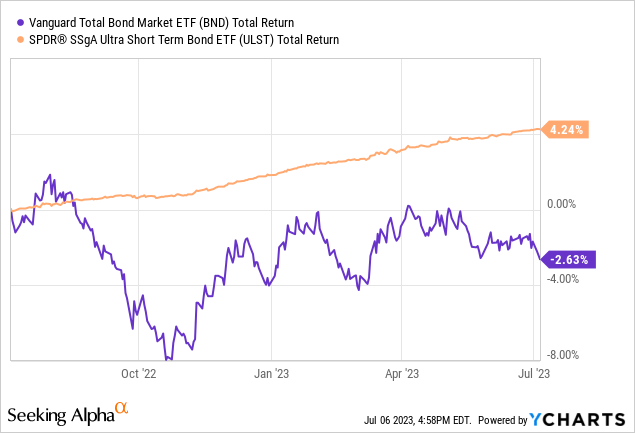

It’s pretty easy to see that ULST is more volatile than BIL. However, comparing ULST to BND (Vanguard Total Bond Market Index Fund ETF Shares) gives a better picture of just how little its volatility is. The following chart shows the past year’s total return of ULST and BND.

Comparing ULST to an average bond fund shows a better picture of its volatility because almost every ETF will look rather volatile compared to BIL.

Yield

BIL and ULST both boast impressive yields.

| ETF | 30-day SEC yield |

| BIL (SPDR Bloomberg 1-3 Month T-Bill ETF) | 4.98% |

| ULST (SPDR® SSgA Ultra Short Term Bond ETF) | 5.36% |

| BND (Vanguard Total Bond Market Index Fund ETF Shares) | 4.37% |

| VTC (Vanguard Total Corporate Bond ETF ETF Shares) | 3.73% |

ULST has the highest yield out of these peers while BIL is in a close second. Bill and ULST are also far less risky than BND and VTC. So by investing in BND or VTC, investors would be adding more risk to their portfolio while receiving a lower yield.

Capital Appreciation

It’s important to note that while ULST offers more capital appreciation than BIL, it’s still a short-term bond ETF, meaning that when rates are cut, its yield will fall and its price won’t increase nearly as much as other bond ETFs like BND. BIL is for investors who will not tolerate much risk and are willing to give up some profits to keep risk low. Its lesser-known peer, ULST, is for investors looking to take advantage of the high short-term rates but want the potential for some capital appreciation.

Expense Ratio

BIL is an Index ETF and ULST is actively managed. Knowing this, it’s reasonable to assume that ULST would have a much higher expense ratio. However, that is not the case. While it is higher, it’s only about 0.06% more. BIL’s expense ratio is about 0.14% while ULST is only 0.20%. This means investors don’t need to worry too much at all about the ETFs’ expense when choosing which is right for them.

Conclusion

Investors seeking high-income and low-volatility ETFs likely will buy short-term fixed-income funds. In my opinion, two of the best are BIL and ULST. Depending on your risk tolerance, one of these two ETFs can help you wait out the coming recession.