cagkansayin/iStock through Getty Pictures

The PIMCO Lively Bond Trade-Traded Fund (NYSEARCA:BOND) is an actively-managed, leveraged, diversified bond fund. BOND’s funding managers persistently choose bonds with above-average yields and returns, however with out materially larger threat or volatility. BOND’s diversified, high-quality holdings, above-average 3.0% yield, and above-average returns, make the fund a purchase.

BOND’s high-quality holdings are notably acceptable for extra risk-averse earnings buyers and retirees. Extra aggressive, yield-seeking buyers ought to think about higher-yielding alternate options. PIMCO has a collection of incredible high-yield CEFs, all of which yield considerably greater than BOND, however are considerably riskier as nicely. Of those, the PIMCO Dynamic Earnings Alternatives Fund (PDO) is wanting notably low-cost, with a 9.7% low cost to NAV.

BOND – Fundamentals

- Sponsor: PIMCO

- Dividend Yield: 2.99%

- Expense Ratio: 0.55%

- Whole Returns CAGR (Inception): 2.96%

BOND – Funding Thesis

BOND’s funding thesis is kind of easy, and rests on the fund’s diversified, high-quality holdings, above-average yield, and above-average returns. These mix to create a robust, high-quality fund, acceptable for extra conservative earnings buyers and retirees. Let’s take a look at every of those factors.

Diversified Excessive-High quality Holdings

BOND is an actively-managed bond fund, administered by PIMCO, essentially the most profitable and well-known fixed-income funding managers on this planet. In Searching for Alpha retirement circles, PIMCO is best-known for its assortment of high-yield leveraged CEFs, however the firm does produce other completely different choices, together with BOND.

BOND itself invests in a diversified portfolio of bonds, specializing in high-quality securities like treasuries, investment-grade company bonds, and mortgage-backed securities. BOND additionally invests in some riskier bonds, together with high-yield company bonds, however in a lot decrease portions.

As talked about beforehand, BOND is an actively-managed fund, so asset allocations and safety choice are each considerably depending on the fund’s funding administration crew. From what I’ve seen, the fund is presently considerably underweight treasuries, possible on account of considerations about rising rates of interest. Treasuries have underperformed these previous few months, so being underweight stated asset class appears to have been the correct name, to date at the very least.

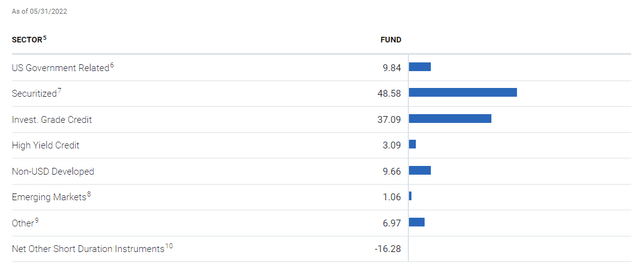

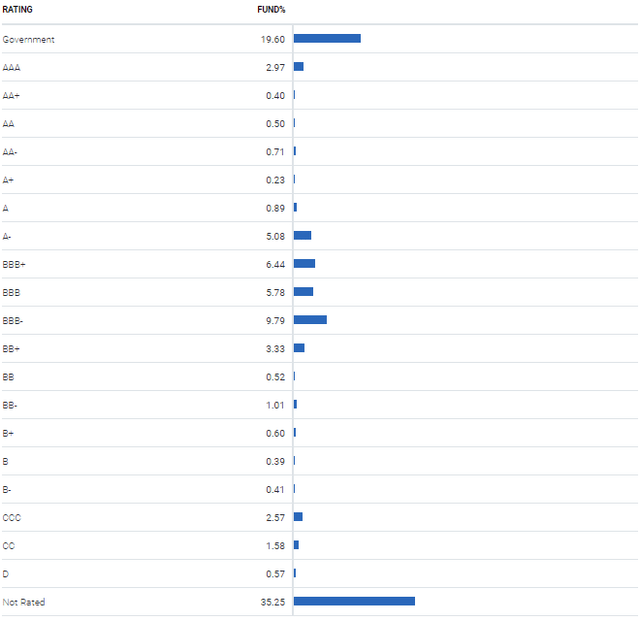

Asset allocations and credit score weights are as follows.

BOND Company Web site BOND Company Web site

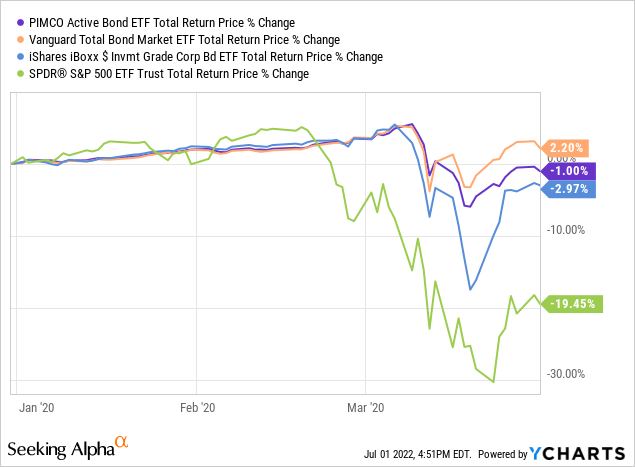

BOND’s diversified, high-quality holdings considerably scale back portfolio threat, volatility, and losses throughout downturns. For instance, the fund suffered losses of 1.0% throughout 1Q2020, the onset of the coronavirus pandemic. Losses had been extraordinarily low, as anticipated. Losses had been considerably decrease than these skilled by most broad-based fairness indexes, and someplace between these of broad-based bond indexes and investment-grade company bond indexes.

As must be clear from the above, BOND is a typically protected, high-quality fund, which ought to nearly definitely expertise few, if any, losses throughout any future downturn or recession.

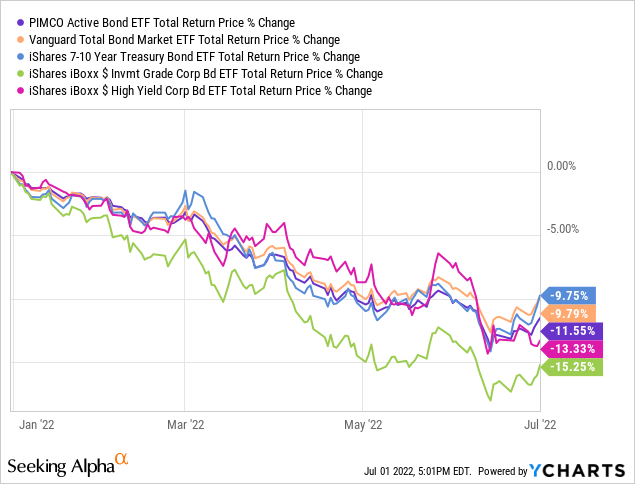

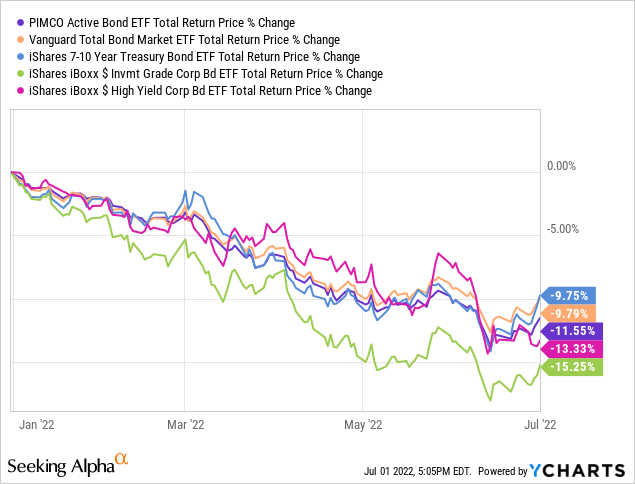

BOND’s underlying holdings sport a median length of 6.2 years, indicating reasonable/common rate of interest threat. Count on, nicely, reasonable/common losses when rates of interest rise, as has been the case YTD. BOND’s losses are in the course of its friends, fairly actually so.

BOND’s common length and rate of interest threat shouldn’t be a adverse per se, it is a vital truth for buyers to think about. Different bond funds try to cut back rate of interest threat, to cut back losses in periods of rising rates of interest. BOND principally does not do that, so buyers searching for low-duration funds ought to look elsewhere.

As an apart, BOND is a leveraged fund, sporting a 1.52x leverage ratio. Leverage nearly all the time will increase portfolio threat, volatility, and losses throughout downturns, however the state of affairs appears considerably completely different for BOND. From what I’ve seen, among the fund’s leverage is canceled out by quick positions, and a few is used for swaps and different derivatives which could not essentially improve potential dangers. BOND’s leverage has not led to elevated losses throughout prior downturns, and it may not result in elevated losses throughout future downturns both. As such, I don’t suppose that BOND’s leverage detracts from the general high quality and security of its holdings: the fund stays a protected alternative, acceptable for extra conservative earnings buyers and retirees.

Above-Common Yield

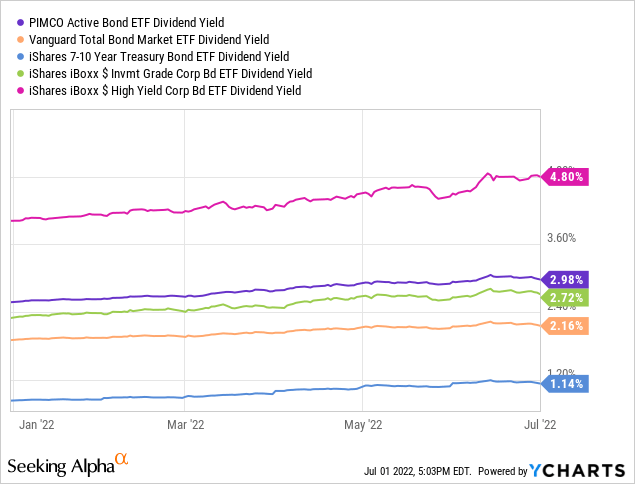

BOND presently yields 3.0%. Though the fund’s yield shouldn’t be notably excessive on an absolute foundation, it is larger than that of its closest friends, broad-based bond indexes, and investment-grade company bond indexes. BOND’s yield is kind of good for a diversified, high-quality bond fund, a profit for the fund and its shareholders. The fund does yield fairly a bit lower than high-yield company bond funds, however these are materially riskier funds too.

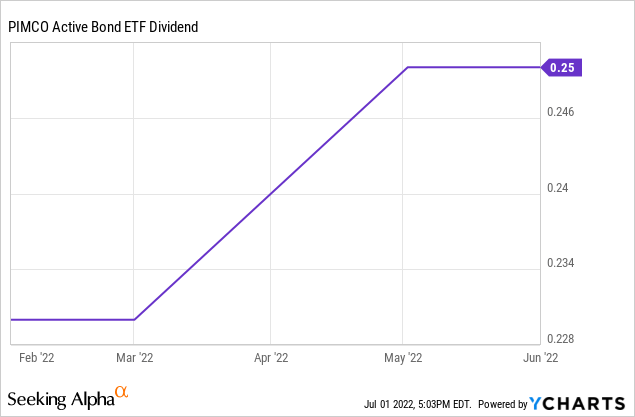

BOND’s dividend will possible see some progress within the coming months, because the Federal Reserve is climbing charges to fight rising inflation. BOND’s dividend has already elevated twice previously few months, and is up 8.7% YTD. Additional progress is probably going, because the fund sports activities a 30-day SEC yield, a short-term yield metric, of three.8%, and a yield to maturity, a forwards-based measure of anticipated returns, of 5.7%.

BOND’s 3.0% yield is considerably above-average for a diversified, high-quality bond fund, and can possible see sturdy, constant progress within the coming months, benefitting the fund and its shareholders.

Above-Common Returns

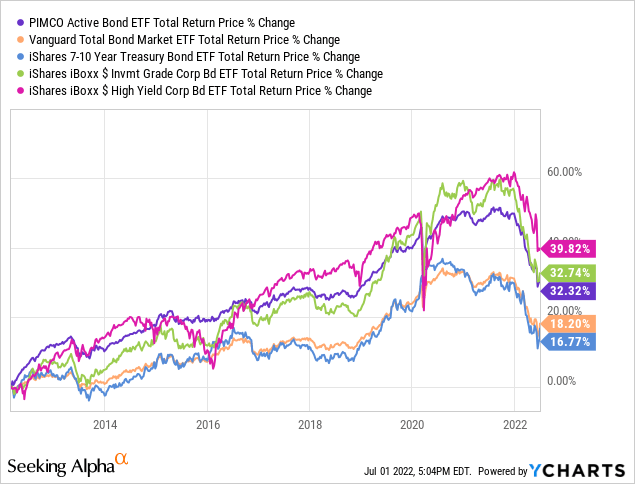

BOND’s above-average dividend yield typically leads to above-average return for shareholders, at the very least relative to the fund’s degree of threat. BOND has achieved annual returns of about 2.9% since inception, vastly outpacing treasuries and bonds typically, matching the efficiency of investment-grade company bonds, however underperforming relative to the high-yield company bonds.

BOND’s returns are above-average for a fund of its sort and degree of threat. For instance, the fund outperformed relative to investment-grade company bonds throughout 1Q2020, a recession, and YTD, a interval of rising rates of interest.

In easy phrases, BOND supplies buyers with the returns of an investment-grade company bond fund, the extent of threat of a diversified bond fund, and a better yield than each, a stable mixture. Generally phrases, the fund is superior to most comparable alternate options on most metrics, though not considerably so. It’s a good fund, and higher than the index, however nothing too spectacular.

Conclusion

BOND’s diversified, high-quality holdings, above-average 3.0% yield, and above-average returns, make the fund a purchase.