Jim Vondruska/Getty Images News

The bond market is entering broken territory when it comes to volatility, according to Kit Juckes, FX analyst at Societe Generale.

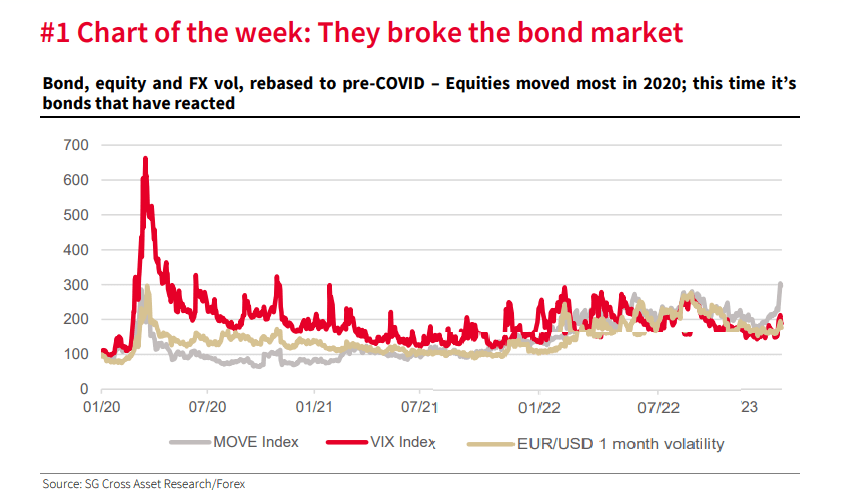

Looking at stock volatility with the VIX index (VIX), one-month volatility on the euro (FXE) vs. the U.S. dollar (DXY) and the MOVE index that tracks U.S. Treasuries volatility can help investors figure out “who is driving the bus,” Juckes wrote in a note Wednesday.

All three surged at the onset of COVID.

“If I look at the same chart starting just before Russia invaded Ukraine in 2022, EUR/USD led the rise in volatility at that point, but if I look only at the last few weeks, the rise in EUR/USD volatility and in the VIX is modest, whereas MOVE has risen to its highest level since 2009,” Juckes wrote. Recent “news commentary suggested that the current crisis was all but over, with little risk of further contagion, but these levels of bond market volatility are dangerous and unsustainable.”

“Big changes in interest rates, along with violent yield curve moves and severe inversion, have side-effects that can take a while to materialize but have their own second-round effects,” he added. “How much more have financial conditions tightened than a casual glance suggests? How much of the post-COVID easy monetary policy has now been unwound, and most important of all, how much economic deceleration is now in the pipeline and will materialize once the usual lags have played out, regardless of what the Fed does next?”

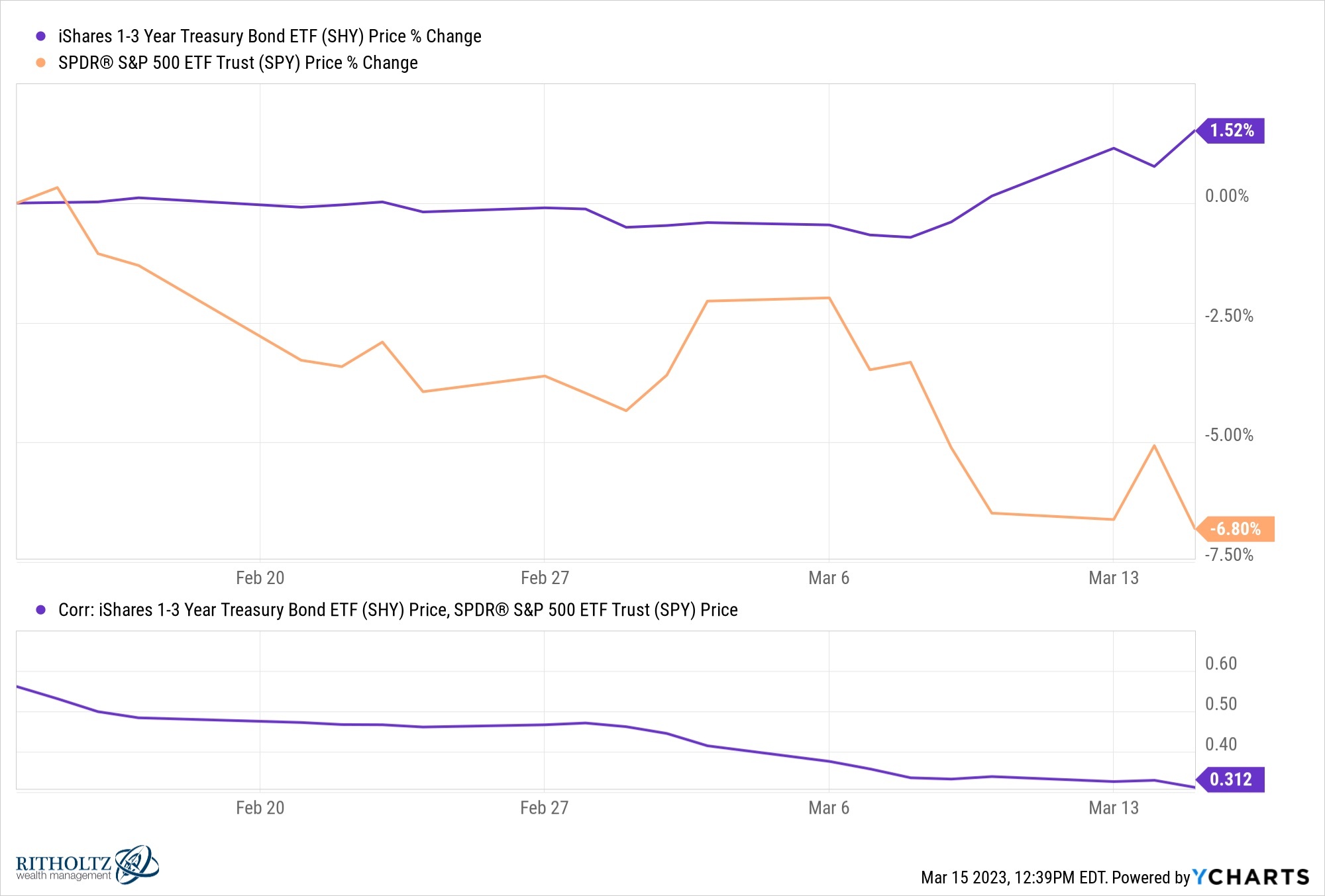

The 2-year Treasury yield (US2Y) (NASDAQ:SHY) fell 42 basis points to 3.81% and the 10-year yield (US10Y) (NYSEARCA:TBT) (NASDAQ:TLT) fell 24 basis points to 3.40%. The inversion is down to 41 basis points having been above 100 bps recently.

“The inversion in 2y-10y US rates seems to be at a maximum level and the corresponding differential in USD 1y swaptions to be capped below 50bp. Hawkish Fed pricing has already gone very far, while the SVB crisis and a … CPI (in line with expectations) suggest that the peak in US rates pricing is behind us,” Juckes said. “With the Fed now in a tough position, caught between inflation and banking risks, the rates differential remains a key bullish force for EUR/USD this spring.”

On the stock side, the SocGen equities team is sticking with its forecast with a second-half recession and the S&P 500 (SP500) (NYSEARCA:SPY) in a trading range of 3,500-4,200 and a year-end target of 3,800.

Positive risks to the base case include “oil price (USO) (BNO) below $60 would lead US 5y5y forward inflation back to 2%, marking the start of a new bull cycle in US equities” and “US jobless claims reach the 300-400k range, confirming a mild recession.”

Negative risks include default fears, “US HY (HYG) (JNK) spreads follow fixed-income volatility to reach 800bp, signaling a credit shock rooted in the Fed hiking cycle” and “the US is unable to raise the debt ceiling (the X date), likely a concern from June.”

More on the bank crisis