By Leika Kihara and Satoshi Sugiyama

TOKYO (Reuters) – The Financial institution of Japan maintained ultra-low rates of interest on Thursday and signalled the necessity to scrutinise international financial developments, highlighting its give attention to dangers to a fragile home restoration in deciding when to subsequent tighten coverage.

However the central financial institution projected inflation to maneuver round its 2% goal in coming years, stressing its resolve to maintain mountain climbing borrowing prices if the financial system sustains a reasonable restoration.

“The BOJ must pay due consideration to the longer term course of abroad economies, notably the U.S. financial system, and developments in monetary markets,” the BOJ mentioned in a quarterly outlook report.

“It additionally wants to look at how these elements will have an effect on the outlook for Japan’s financial exercise and costs, the dangers surrounding them, and the chance of realising the outlook.”

The phrases have been added to the report’s portion explaining the BOJ’s coverage steerage, which additionally repeated that the financial institution would proceed to boost charges if the financial system and costs transfer according to its forecasts.

As extensively anticipated, the BOJ saved short-term rates of interest regular at 0.25% at its two-day assembly that ended on Thursday.

The board lower its core client inflation forecast for fiscal 2025 to 1.9% from 2.1% within the earlier estimate in July, however mentioned dangers have been skewed to the upside for that 12 months. It saved unchanged its fiscal 2026 core inflation forecast at 1.9%.

It additionally noticed “core-core” inflation, which strips away the impact of gas prices and is intently watched by the BOJ as a key gauge of demand-driven value strikes, hit 1.9% in fiscal 2025 and a couple of.1% in 2026 – each unchanged from July.

The yen remained below stress on the BOJ’s choice to maintain ultra-low charges, standing at 153.34 versus the greenback. The benchmark 10-year authorities bond yield was little modified after the announcement.

The report repeated the BOJ’s view that it expects underlying inflation to converge round 2% a while round late 2025 or past, as service costs proceed to rise reasonably.

“The choice was as anticipated because it was doubtless arduous for the BOJ to hike charges at this timing. The BOJ in all probability will not have the ability to shift coverage till the political scenario stabilises,” mentioned Kazutaka Maeda, an economist at Meiji Yasuda Analysis Institute.

“I nonetheless suppose there’s an opportunity of a December charge hike,” although there’s an growing danger of the timing being delayed on account of uncertainty over the home political scenario and the result of the U.S. presidential election, he mentioned.

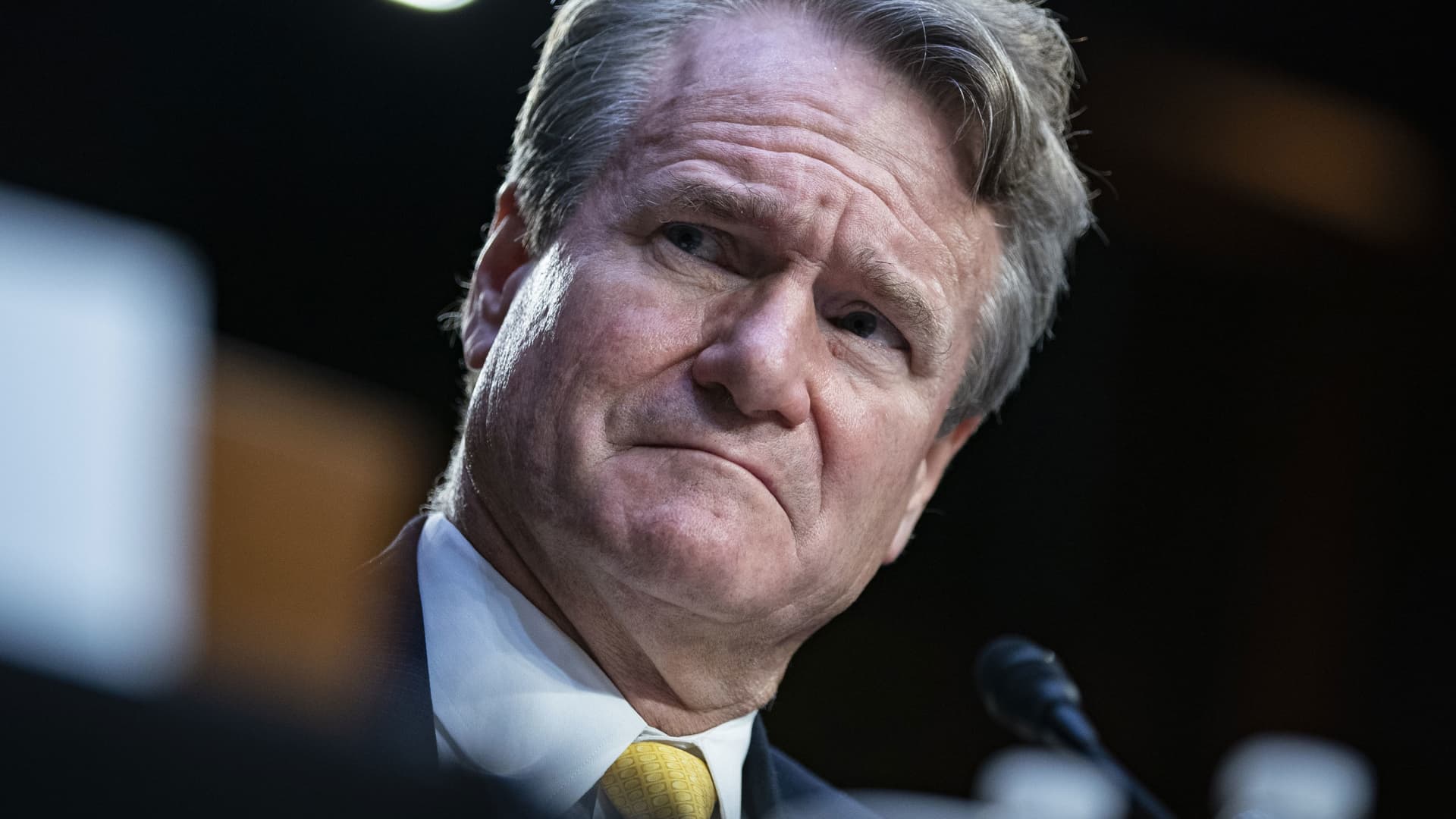

Markets will give attention to Governor Kazuo Ueda’s post-meeting briefing, scheduled to be held at 3:30 p.m. (0630 GMT) for clues on the timing and tempo of additional rate of interest hikes.

The BOJ ended damaging charges in March and raised short-term charges to 0.25% in July on the view Japan was making progress in direction of sustainably attaining its 2% inflation goal.

Ueda has repeatedly mentioned the BOJ will hold elevating charges if the financial system strikes according to its forecast. However he has additionally mentioned the financial institution was in no rush as inflation remained reasonable.

Knowledge launched on Thursday confirmed Japan’s manufacturing unit output and retail gross sales rose in September, suggesting the financial system was on observe for a reasonable restoration.

The ruling coalition’s lack of a majority in a weekend election has heightened considerations about coverage paralysis, which might elevate the hurdle for extra charge hikes, analysts say.

A slim majority of economists polled by Reuters anticipate the BOJ to forgo a hike this 12 months, although most anticipate one by March.