anusorn nakdee

I am following up on my previous analysis for bluebird bio, Inc. (NASDAQ:BLUE) in light of the recent financing news.

In November and just before the FDA announcement on Bluebird’s Sickle Cell treatment, I rated Bluebird a buy for the following reasons:

- FDA Approval was likely based on signaling.

- Cash flow was tight but manageable.

- The stock had a floor value of approximately $300 million on IP alone.

While the FDA did approve the treatment, it came with a black box safety warning and a 40% higher price than its competitor. This sent the stock plunging and it is down 64% from my last analysis.

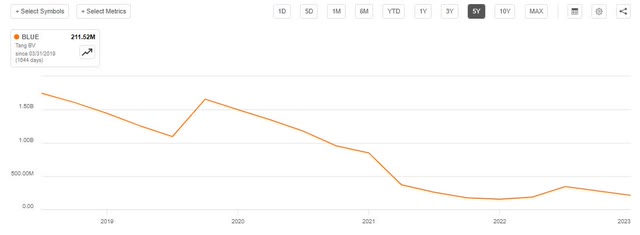

BLUE Price Trend (Seeking Alpha)

Despite these challenges, I believe Bluebird Bio is priced below the value it would sell for on intellectual property alone. In addition, the company has secured $175 million in debt financing to attempt growth to profitability which would represent additional upside. With that in mind, I continue to rate Bluebird Bio a buy.

Potential Sale Value

As shown above, Bluebird’s market cap sits just above $280 million today. I believe this is below the likely sale value if Bluebird was dissolved and sold for IP.

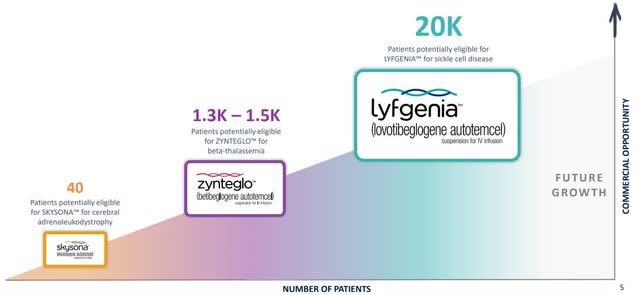

Bluebird Bio has three approved gene therapies, with more R&D in the pipeline, and thousands of potentially eligible patients.

Bluebird Bio Therapies (BLUE Investor Relations)

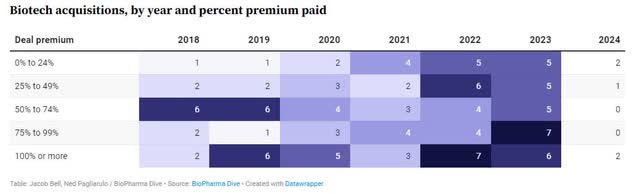

Furthermore, biotech acquisitions accelerated in 2022 and 2023, and the average deal premium increased to 50-60%.

Biotech Acquisition Premium (BioPharma Dive)

Bluebird’s tangible book value has been trending down as cash is burned, sitting around $200 million today.

BLUE Book Value (Seeking Alpha)

At the average deal premium of 50-60%, and with no debt, this suggests a value of $300 to $320 million today, a significant upside from the market cap of $280 million.

Cash Runway Has Been Extended

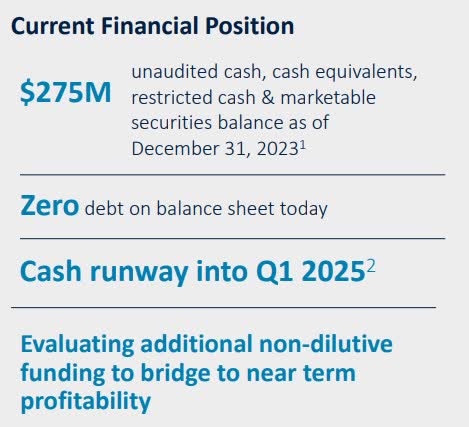

As of the company’s last presentation in January, it had $275 million in cash on hand, zero debt, and an estimated runway into Q1 2025.

Cash Position (BLUE Investor Relations)

On Monday, March 18th, Bluebird announced they had secured an additional $175 million financing from Hercules Capital.

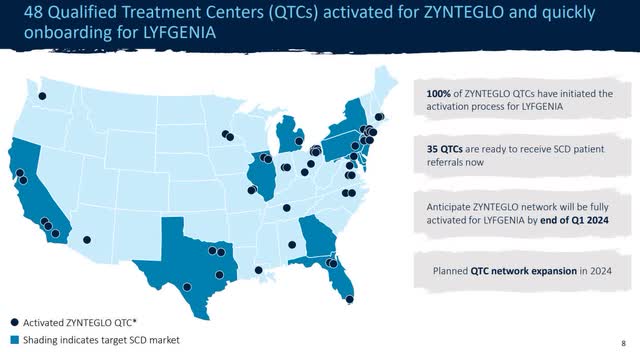

Adjusting for cash burn since January (approximately $20 million) and a restricted $50 million tranche, Bluebird should have around $380 million in available cash. This would extend them well into 2025 and further if profitability improves. This gives the company some breathing room to continue executing its strategy and expanding distribution.

Distribution Strategy (BLUE Investor Relations)

Path To Profitability

While the IP value alone offers an upside, we still want to consider additional value from the company turning profitable, enabled by the extended cash runway.

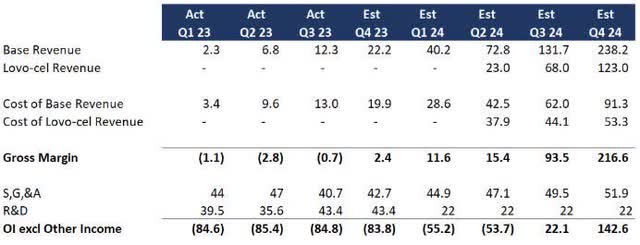

The company reaffirmed its 2024 commercial guidance with the first LYFGENIA patients in Q1 2024 and 85 to 105 patients in 2024 in total (roughly $180 million in lifetime value). And in the absence of new financials, Bluebird is on track for my previous analysis. As a refresher, I assumed the following:

- Therapies will show linear growth and the cost of revenue will improve with the scale.

- Lyfgenia (formerly Lovo-cel) will grow at the same rate as prior treatments except 10x reflecting the larger market.

- No material changes to SG&A and a significant reduction in R&D following Lyfgenia’s approval.

BLUE Profitability Forecast (Data: SA; Analysis: Mike Dion)

A lot has to go right on the distribution and acquisition side. In addition, Bluebird needs to convince payers to pay, although preliminary discussions have reportedly gone well. Bluebird has signed outcome-based agreements with payers covering over 200 million individuals in the US.

Regardless of how exactly this plays out, existing revenue on top of new treatments puts profitability or if nothing else, a reduction in cash burn, within the near term. Near-term profitability would represent an outsized upside to the current price, but I will hold back on a specific price target from profitability until further earnings are released.

Downside Risk

While possible, I believe it is highly unlikely the IP would have $0 value on a sale. The more likely downside risk is that Bluebird would not be able to command the same premium as other biotechs and fall short of the 50-60% premium discussed above.

The other downside risk is the FDA withdrawing approval since Bluebird’s treatments have gone through the accelerated approval process. The good news is that only 20-25% of drugs that receive accelerated approval are withdrawn putting this in a lower risk category.

Verdict

Bluebird Bio’s stock price plummeted following safety warnings and a high price point on their innovative gene therapy for sickle cell disease. In fact, it is down 64% from my last analysis in November.

However, I believe there is strong upside potential. Bluebird bio appears underpriced even for an IP sale with a market cap of $280 million versus a potential sale price of $300 – 320 million based on comparable biotech sales.

Beyond the floor value from IP, the company has extended their cash runway and profitability is still possible within the next year based on patient trends and payer negotiations.

With the above in mind and risks fairly well mitigated, I maintain my buy rating for Bluebird Bio.