Printed on August ninth, 2022 by Josh Arnold

Usually, when scanning lists of shares with nice dividend longevity, one will discover healthcare firms characteristic closely. Typically, healthcare firms supply inherent defensiveness, and due to this fact earnings stability, a mix that makes for the potential to be a fantastic dividend inventory. Healthcare firms are usually extra recession-resilient than many different sectors just because the products and providers they promote are non-discretionary. This implies they’ll climate financial shops extra so than client discretionary firms.

One such firm is Medtronic plc (MDT), which presents buyers a staggering 45 12 months streak of consecutive dividend will increase. Medtronic is considered one of greater than 350 firms on the record of Blue Chip shares, that are firms with at the least 10 consecutive years of dividend raises. We see this record as start line for locating nice dividend shares as a result of these firms have confirmed their skill to face the take a look at of time in terms of dividend longevity.

We see such shares that fulfill the 10-year payout development streak criterion among the many most secure dividend shares that buyers should buy, with built-in recession resistance, and administration groups which can be keen and in a position to return capital to shareholders.

With all this in thoughts, we created a listing of 350+ Blue-Chip shares which you’ll be able to obtain by clicking beneath:

Along with the Excel spreadsheet above, we’re individually reviewing the highest 50 Blue Chip shares immediately as ranked utilizing anticipated whole returns from the Positive Evaluation Analysis Database.

This installment of the 2022 Blue Chip Shares In Focus collection will analyze Medtronic in additional element.

Enterprise Overview

Medtronic is a medical therapies firm that operates in 4 segments, and sells its merchandise globally. The Cardiovascular Portfolio presents implantable pacemakers, defibrillators, monitoring programs, valves, and associated merchandise. The Medical Surgical Portfolio presents stapling units, sealing devices, robotic-assisted surgical procedure merchandise, mesh implants, and extra. The Neuroscience Portfolio sells surgical merchandise to a wide range of practitioners, together with spinal surgeons neurosurgeons, neurologists, ache administration specialists. This section produces robotic steerage programs as properly. Lastly, the Diabetes Working Unit sells insulin pumps and consumables, glucose monitoring programs, and associated merchandise.

Medtronic was based in 1949, employs about 95,000 folks globally, generates $32 billion in annual income, and trades with a market cap of $124 billion.

Medtronic reported fourth quarter and full-year earnings on Might 26th, 2022, and outcomes had been weaker than anticipated. Adjusted earnings-per-share for the quarter got here to $1.52, which was 4 cents mild in opposition to expectations. Income was off fractionally year-over-year at $8.09 billion, and missed estimates by $340 million.

The corporate reported a $215 million headwind from foreign exchange translation through the quarter, in addition to what it known as momentary provide chain points, notably in China.

US income was down 2% year-over-year, and was 51% of whole income within the quarter. Rising Markets income was up 7%, however was simply 17% of whole income.

Medical Surgical income was off 5%, whereas Surgical Improvements income was down 3%, on provide chain constraints. Diabetes income was down 8% year-over-year, together with a 20%+ decline within the US on lack of recent product approvals. Cardiovascular income was up 2%, whereas Neuroscience was primarily unchanged.

Supply: This autumn earnings presentation, web page 23

Full-year earnings had been up 26% on an adjusted foundation at $5.55, as income for the 12 months rose simply over 5%. The corporate’s Diabetes section stood out because the weakest enterprise, however the different three had been in a position to develop decently and produce the corporate’s prime line – and earnings – increased for the complete 12 months.

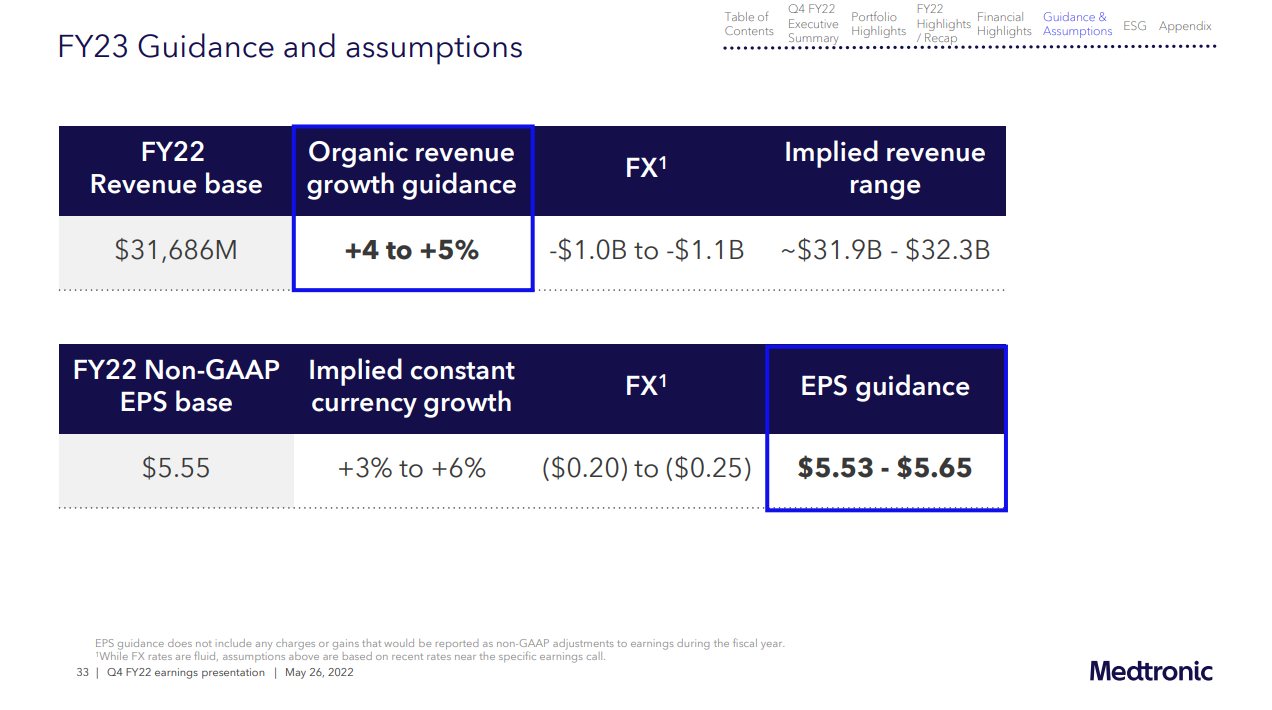

Supply: This autumn earnings presentation, web page 33

Medtronic supplied up steerage of natural income development of between 4% and 5%, and adjusted earnings-per-share of $5.53 to $5.65 for fiscal 2023. That was beneath consensus earnings estimates of $5.75, and would symbolize very modest development year-over-year ought to it come to fruition. Our preliminary estimate is for $5.60 in fiscal 2023 earnings-per-share.

Progress Prospects

Medtronic’s common earnings-per-share development prior to now decade has been simply 4%, together with some years with earnings declines. Along with some volatility within the firm’s income and earnings, it has issued an enormous variety of new shares prior to now decade to fund acquisitions. That dilution makes it more difficult to develop on a per-share foundation, and Medtronic’s outcomes have suffered for it.

Trying ahead, we count on to see 6% annual earnings-per-share development off of 2023 earnings estimates, which we imagine can be pushed primarily by income beneficial properties within the mid-single digits. The corporate makes sizable acquisitions once in a while, which provides to the highest line. As well as, it’s shopping for again a small variety of shares, so the mix of those elements may result in ~6% earnings-per-share development over time.

Dividend development has been greater than double that of earnings development, with the previous averaging a ten% annual achieve prior to now decade.

As a result of the dividend has outpaced earnings by way of development, the payout ratio has risen considerably, rising from lower than 30% of earnings a decade in the past to nearly 50% immediately. We see extra measured dividend development going ahead because of this, but additionally imagine the corporate will stay a robust dividend inventory for years to return.

Aggressive Benefits & Recession Efficiency

Medtronic’s aggressive benefit is its broad and deep portfolio of mental property. Given there are numerous medical system and provide makers, Medtronic should stand out with its distinctive functions, with merchandise equivalent to its robotic surgical procedure aids. The corporate has a really lengthy historical past of remaining aggressive via technological modifications, and we don’t imagine that’s in danger in any means.

Medtronic has some parts of its portfolio which can be discretionary, however on the entire, its portfolio ought to proceed to face up properly to recessions. With the payout ratio at lower than 50%, we don’t see any significant threat to the dividend within the years to return.

Valuation & Anticipated Returns

Shares have traded in a valuation vary of between 11 and 24 instances earnings prior to now decade, and we assess honest worth in the course of that vary at 17. The inventory is actually in keeping with honest worth immediately, going for 16.7 instances our 2023 earnings estimate, so we see nearly no influence to whole returns from the valuation.

We famous 6% anticipated development above, and the present dividend yield is 2.9%, which is about double that of the S&P 500. All informed, between the valuation, anticipated development, and the present yield, we count on 9% whole annual returns within the years to return, which is sweet sufficient for a strong maintain ranking on the inventory.

Remaining Ideas

Whereas Medtronic has confronted years the place it has struggled to develop earnings prior to now, it additionally sports activities a virtually half-century streak of elevating the dividend. We imagine the dividend can be raised indefinitely, and that the inventory’s earnings prospects are good.

The yield is about twice that of the broader market, and shareholders get 9% estimated whole annual returns, so we charge the inventory a maintain for income-focused buyers, and people on the lookout for dividend development.

The Blue Chips record shouldn’t be the one technique to rapidly display for shares that usually pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].