Printed on August tenth, 2022 by Josh Arnold

Healthcare tends to be a sector with plenty of nice dividend shares, as a result of firms within the trade are likely to have pretty defensive earnings profiles. It’s no marvel then that dividend inventory lists are likely to have a good variety of healthcare firms as elements.

That is true of the listing of Blue Chip shares as effectively, which is a listing of greater than 350 firms with a minimum of a decade of consecutive dividend will increase.

With a staggering 60 years of consecutive dividend will increase, healthcare large Johnson & Johnson (JNJ) is one such firm. The corporate has one of many longest dividend enhance streaks on this planet, and has confirmed its skill to lift its dividend by every kind of financial environments. We see the listing of Blue Chips as an incredible place to begin in an effort to discover nice dividend shares, like Johnson & Johnson.

We see Blue Chip shares that fulfill the 10-year payout progress streak criterion as among the many most secure dividend shares that buyers should purchase.

Accordingly, we created a listing of all 350+ Blue Chip shares which you’ll be able to obtain by clicking under:

Along with the Excel spreadsheet above, we’re individually reviewing the highest 50 blue chip shares right this moment as ranked utilizing anticipated complete returns from the Certain Evaluation Analysis Database.

This installment of the 2022 Blue Chip Shares In Focus collection will analyze Johnson & Johnson intimately.

Enterprise Overview

Johnson & Johnson’s excellent dividend streak is available in half from its extremely diversified enterprise mannequin. It has a pharmaceutical enterprise, a shopper well being enterprise, and a medical machine enterprise all beneath one roof. By way of these segments the corporate engages in all kinds of markets, together with consumer-facing consumable merchandise like child care, female care, skincare, over-the-counter medicines, mouthwash, and the listing goes on.

As well as, it has a pharmaceutical enterprise that provides merchandise for rheumatoid arthritis, psoriasis, HIV/AIDS, sure cancers, and COVID-19. The medical machine enterprise produces an enormous slate of merchandise that deal with heart problems, neurovascular care merchandise for hemorrhagic an ischemic stroke, orthopedics, disposable contact lenses, and extra.

Johnson & Johnson traces its roots to 1886, generates about $96 billion in annual income, and trades right this moment with a market cap of $447 billion.

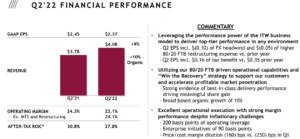

The corporate’s most up-to-date earnings report was delivered on July nineteenth 2022, for the second quarter. Outcomes had been higher than anticipated on each income and earnings, however the firm lowered steerage for the complete 12 months, which it attributed to a a lot stronger US greenback.

Supply: Investor presentation, web page 14

For the second quarter, adjusted earnings-per-share got here to $2.59, which was 4 cents forward of expectations. Income was $24 billion, up 3% year-over-year and $180 million forward of estimates.

Operational progress, which adjusts for sure non-recurring objects comparable to COVID-19 vaccine gross sales, rose 8% through the quarter, portray a considerably rosier image of the corporate’s prime line efficiency.

The pharma phase noticed $13.3 billion in gross sales, which was up 7% year-over-year thanks partly to 14% progress in Stelara. Considerably offsetting that was a 13% decline in Imbruvica, which dropped under a billion {dollars} in quarterly gross sales in Q2. Darzalex, which is a therapy for a number of myeloma, noticed 39% progress year-over-year to $2.0 billion.

The patron enterprise – which Johnson & Johnson intends to spinoff – posted income of $3.8 billion, a fractional decline year-over-year.

The medical machine enterprise noticed a 1% decline in income to $6.9 billion, or up 3% on an adjusted foundation.

Administration reiterated gross sales and earnings steerage on a continuing foreign money foundation for this 12 months, however as a result of very sturdy US greenback, lower each gross sales and earnings steerage on an reported foundation to ~$93.8 billion and $10.05 per share, respectively. Each of those had been under consensus however we observe if and when the US greenback weakens, the corporate ought to reap the good thing about increased gross sales and earnings on a reported foundation.

Our estimate of earnings-per-share stands at $10.05 following Q2 outcomes.

Progress Prospects

Johnson & Johnson has averaged 7% progress in earnings-per-share for the previous decade, which is spectacular given its large dimension. The corporate has been capable of transfer the needle steadily by a mix of upper gross sales, higher revenue margins, and a slight discount within the float by buybacks.

We see related 6% progress going ahead, which we imagine will likely be pushed by the identical components. We observe the spinoff of the patron enterprise – ought to it come to fruition – would probably see us revising that progress estimate increased, however we’ll wait to reassess at the moment.

The dividend has grown at a fee of 6.5% prior to now decade, nearly precisely the identical as earnings. We proceed to see this type of fee going ahead, and given the payout ratio continues to be simply 45% of earnings for this 12 months, we imagine the dividend is extraordinarily secure. In reality, we see what’s more likely to be many years of additional dividend will increase forward for shareholders.

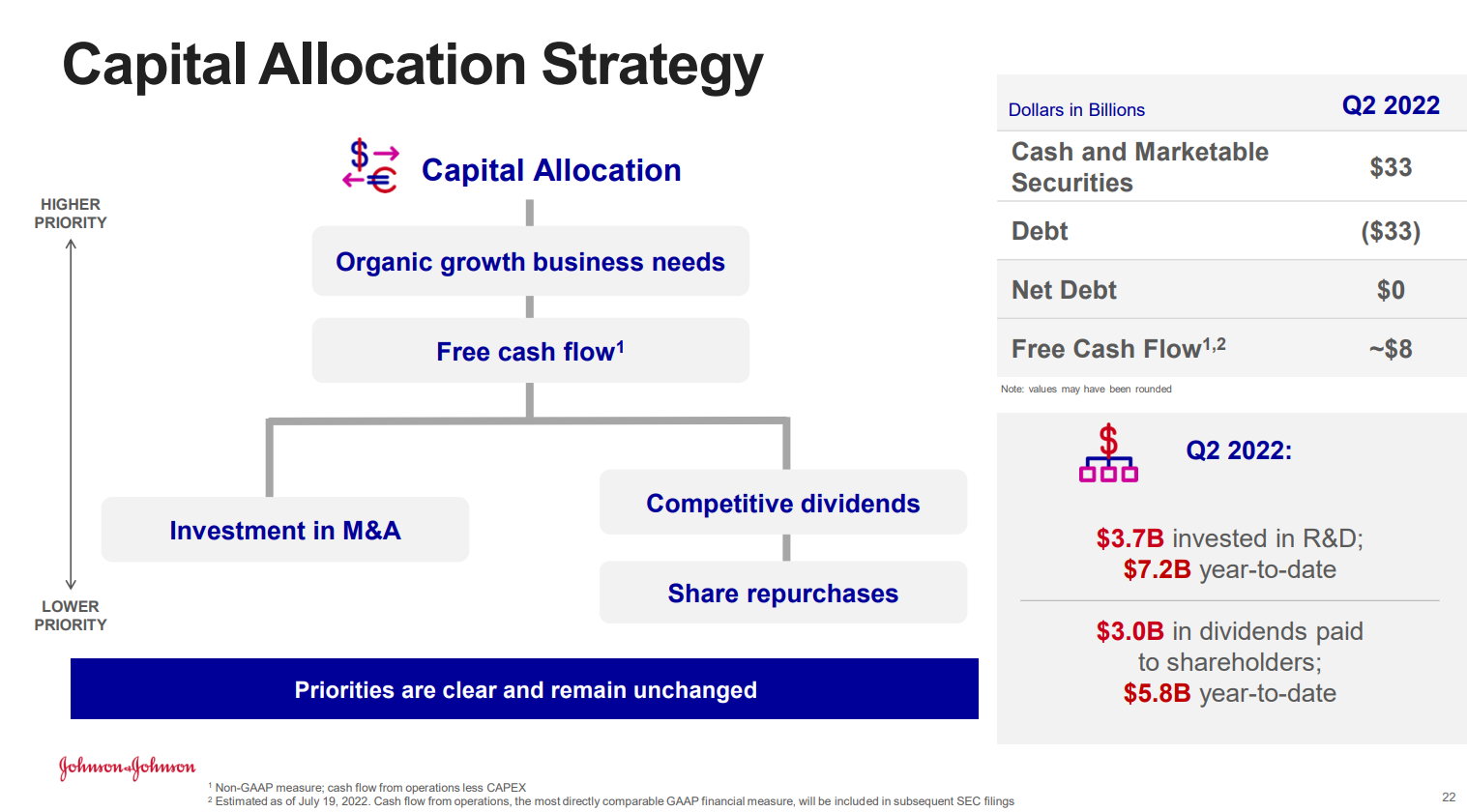

Supply: Investor presentation, web page 22

The corporate has made it clear that dividends are a precedence with its capital allocation technique, and it continues to take care of a really sturdy steadiness sheet. Additional the corporate’s money stream technology is excellent, and affords it the power to proceed to spice up capital returns whereas investing sooner or later progress of the enterprise.

Aggressive Benefits & Recession Efficiency

Johnson & Johnson’s aggressive benefit is actually in its dimension and scale. The corporate affords an array of shopper, pharmaceutical, and medical machine merchandise that’s unmatched. This, paired with the corporate’s century-plus working historical past and commensurate model recognition makes it a compelling long-term maintain.

Recessions are unkind to medical machine makers, usually, as a few of these are discretionary. Nevertheless, the corporate’s pharmaceutical enterprise is very resilient to recessions, as is the patron enterprise, as long as it stays a part of Johnson & Johnson. We’ve little question the dividend can proceed to be raised for a few years to return, whether or not recessions strike or not.

Valuation & Anticipated Returns

Johnson & Johnson trades right this moment nearly precisely at our estimate of truthful worth of 17 instances earnings. We due to this fact don’t see any impression to complete returns on the valuation.

We famous 6% anticipated progress above, and the dividend yield is at present 2.7%, which is sort of double that of the S&P 500. All instructed, we anticipate to see complete annual returns of 8.5% within the years to return. That’s not fairly ok for a purchase score, however given this and the corporate’s exemplary dividend longevity, it’s actually a powerful maintain.

Remaining Ideas

Johnson & Johnson isn’t among the many highest complete return shares in our protection universe, however it’s actually the most effective by way of dividend longevity. Even among the many Blue Chips, the corporate stands above the gang by way of dividend excellence, and we see it as producing sturdy complete returns within the years to return, with a yield that’s nearly double that of the broader market.

The Blue Chips listing just isn’t the one strategy to rapidly display for shares that usually pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].