Revealed July twenty sixth, 2022 by Nathan Parsh

With market uncertainty leading to vital strikes up and down for a lot of the yr, traders could possibly be seeking to put money into safer and extra dependable investments as an alternative of putting up with a rollercoaster trip.

To that finish, we advise that traders give attention to proudly owning shares of blue chip shares. The time period “blue chip” can have a distinct that means to completely different traders. To us, we view blue chips as these firms with no less than 10 consecutive years of dividend will increase.

A longtime observe document of dividend development of no less than a decade implies that an organization has confirmed profitable at rising its distribution over an extended interval and that administration groups are dedicated to rising the payout.

For firms that measure dividend development streaks within the a number of a long time, they’ve proven that they’ll increase their funds by way of all parts of the financial cycle. This contains recessionary durations, which are sometimes probably the most troublesome surroundings to develop dividends.

In consequence, we really feel that blue chip shares are among the many most secure dividend shares that traders should buy.

With all this in thoughts, we created an inventory of 350+ blue-chip shares which you’ll be able to obtain by clicking beneath:

Along with the Excel spreadsheet above, we are going to individually evaluate the highest 50 blue chip shares in the present day as ranked utilizing anticipated whole returns from the Positive Evaluation Analysis Database.

The following installment of the 2022 Blue Chip Shares in Focus sequence will analyze Franklin Sources, Inc. (BEN)

Enterprise Overview

Franklin Sources was based in 1947 and is headquartered in San Mateo, CA. Franklin Sources is a world asset supervisor that has an extended and profitable historical past. The corporate provides funding administration companies, which contributes nearly all of charges that Franklin Sources collects. As well as, the corporate supplies gross sales, distribution, and shareholder companies. The corporate is valued at near $13 billion and generates annual income in extra of $8 billion.

Franklin Sources reported second quarter outcomes on Could third. Income grew 0.2% to $2.1 billion whereas adjusted earnings-per-share of $0.96 in contrast favorably to $0.79 within the prior yr.

Franklin Sources’ property beneath administration (AUM) is among the largest in the whole asset administration area.

Supply: Investor Presentation

As of the tip of the primary quarter of 2022, Franklin Sources had $1.5 trillion in AUM. The corporate’s AUM have vastly outperformed friends and benchmarks over a number of durations of time.

AUM did decline $100.6 billion in comparison with the final quarter, principally as a consequence of $81.8 billion of internet market change, distributions, and different objects. The corporate additionally had $11.7 billion of long-term internet outflows and $7.1 billion of money administration internet outflows.

Progress Prospects

Franklin Sources has a number of avenues for development. First, the emergence of change traded funds has turn into a serious supply of energy within the asset administration enterprise. That is true for Franklin Sources as effectively. For instance, the corporate had $12.7 billion of outflows over the last quarter, however the ETF enterprise had $13 billion of internet flows as this funding technique stays highly regarded with traders even because the markets have seen violent swings in costs.

Subsequent, Franklin Sources has augmented its core enterprise by way of using acquisitions, particularly in areas that the corporate doesn’t have as a lot of a presence. One such space is different investments, which incorporates personal debt, structured credit score, high-yield funds, industrial actual property, and collateralized mortgage obligations.

To that finish, Franklin Sources has made a number of acquisitions through the years to enhance the corporate’s positioning on this area.

On April 1st, Franklin Sources introduced that it had accomplished its beforehand introduced buy of Lexington Companions, a number one international supervisor of secondary personal fairness and co-investment funds, for $1.75 billion. This added $34 in AUM to Franklin Sources and prolonged the corporate’s footprint in different investments.

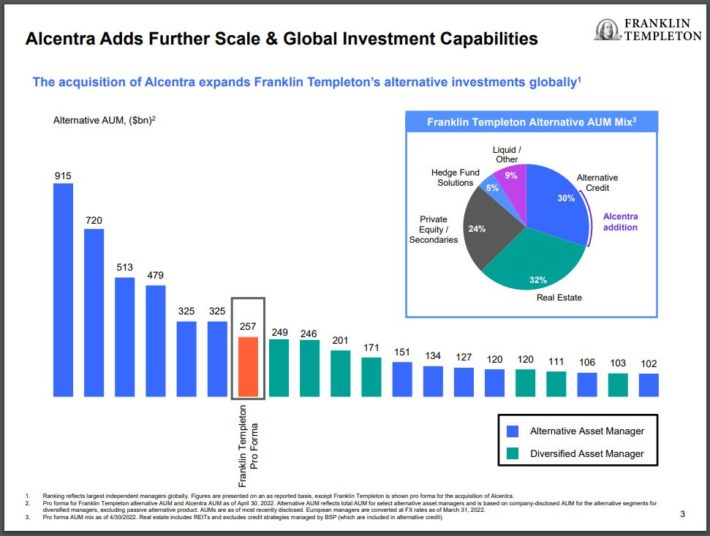

Extra just lately, Franklin Sources introduced on Could thirty first that it had agreed to accumulate Alcentra Group Holdings from The Financial institution of New York Mellon Company (BK) for as much as $700 million. Alcentra has $38 billion in AUM and can double Franklin Sources’ different credit score capabilities in Europe. Following the shut of this transaction, the corporate will likely be one of many bigger names in different investments, an area Franklin Sources had restricted scope only a few years in the past.

Supply: Investor Presentation

As well as, Franklin Sources has lowered its share rely by a median of two.5% per yr over the past decade. The corporate repurchased virtually 3 million shares of inventory in the latest quarter because it stays dedicated to returning capital to shareholders.

Given the dimensions of the corporate’s AUM, bolt on acquisitions, and share repurchases, we venture that Franklin Sources will develop earnings-per-share at a charge of three% per yr over the subsequent 5 years. This development charge is almost in-line with the common for the final decade.

Aggressive Benefits & Recession Efficiency

Asset administration is a really aggressive area that doesn’t afford a particular firm any main aggressive benefits.

That mentioned, Franklin Sources does seem to have a leg up on the competitors given its title and fund efficiency over the long-term.

The corporate has the AUM that it does as a result of its funds have outperformed friends, which attracts new traders. Franklin Sources’ long-term mutual funds have had robust returns over the past one-, five-, and 10-year durations of time relative to competing funds, exhibiting that Franklin Sources’ methodology for investing works over a number of time frames. Practically half of Franklin Sources’ funds are rated 4 or 5 stars by Morningstar.

Performances like this are probably a driving power behind the corporate’s potential to draw capital.

The draw back to the asset administration enterprise is that recessionary durations will be troublesome for companies to navigate. Beneath are Franklin Sources’ annual earnings-per-share outcomes earlier than, throughout, and after the final recession:

- 2006 earnings-per-share: $1.85

- 2007 earnings-per-share: $2.37 (28% improve)

- 2008 earnings-per-share: $2.24 (5.5% lower)

- 2009 earnings-per-share: $1.30 (42% lower)

- 2010 earnings-per-share: $2.12 (63% improve)

- 2011 earnings-per-share: $2.89 (36% improve)

Earnings-per-share for Franklin Sources declined 45% peak to trough from 2007 to 2009, which wasn’t uncommon for a corporation within the asset administration trade. The corporate did see a fast rebound the very subsequent earlier than setting a brand new excessive for earnings-per-share in 2011, pointing to the energy of Franklin Sources’ enterprise mannequin.

Importantly for earnings traders, Franklin Sources continued to develop its dividend all through the final recession, with shareholders receiving a complete dividend improve of 47.4% for the interval. The corporate has a dividend development streak of 42 consecutive years, which has earned Franklin Sources the title of Dividend Aristocrat.

And with a projected payout ratio of simply 31% for 2022, Franklin Sources is poised to proceed elevating its dividend for years to return. Shares yield 4.6%, which is almost thrice the common yield for the S&P 500 Index.

Valuation & Anticipated Returns

Franklin Sources is at the moment buying and selling at simply 6.8 occasions anticipated earnings-per-share of $3.71 for the yr. For a lot of the final decade, the inventory has traded with a low double-digit price-to-earnings ratio.

Given the competitiveness of the asset managed enterprise, we consider {that a} goal price-to-earnings ratio of 9 for the inventory is suitable as this takes under consideration Franklin Sources’ title and efficiency with the competitiveness of the trade.

If the valuation have been to broaden to fulfill our goal by 2027 then Franklin Sources would see a 5.7% annual tailwind from a number of enlargement.

Subsequently, we venture that Franklin Sources may have whole annual returns of 12.3% over the subsequent 5 years, stemming from a 3% earnings development charge, a beginning yield of 4.6%, and a mid-double-digit contribution from a number of enlargement.

Closing Ideas

In occasions of market volatility, we advise traders take into account proudly owning blue chip shares. Franklin Sources, with a dominate management place in its trade and greater than 4 a long time of dividend development, has all of the makings of blue chip title.

Simply as vital, the inventory might present annual returns within the low double-digit vary based mostly on modest earnings development, a secure excessive yield, and the potential for an increasing a number of. In consequence, Franklin Sources earns a purchase advice from Positive Dividend as a consequence of projected returns.

For these causes, we view Franklin Sources as a high-quality blue chip inventory that would present traders glorious whole returns.

The Blue Chips listing will not be the one strategy to rapidly display for shares that usually pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].