Printed on August sixth, 2022, by Felix Martinez

There isn’t any actual definition for blue chip shares. We outline it as a inventory with at the very least ten consecutive years of dividend will increase. We consider a longtime monitor document of annual dividend will increase going again at the very least a decade reveals an organization’s potential to generate regular development and lift its dividend, even in a recession.

Consequently, we really feel that blue chip shares are among the many most secure dividend shares buyers should buy.

With all this in thoughts, we created an inventory of 350+ blue-chip shares, which you’ll be able to obtain by clicking beneath:

Along with the Excel spreadsheet above, we are going to individually assessment the highest 50 blue chip shares in the present day as ranked utilizing anticipated complete returns from the Certain Evaluation Analysis Database.

This text will analyze First of Lengthy Island Corp. (FLIC) as a part of the 2022 Blue Chip Shares In Focus collection.

Enterprise Overview

The First of Lengthy Island Company is the holding firm for The First Nationwide Financial institution of Lengthy Island. This small-sized financial institution gives a spread of monetary companies to shoppers and small to medium-sized companies. Its choices embody enterprise loans, client loans, mortgages, financial savings accounts, and so forth. FLIC operates round 50 branches in two Lengthy Island counties and several other NYC burrows, together with Queens, Brooklyn, and Manhattan. FLIC was a historical past of just about 100 years since being based in 1927, and the corporate is headquartered in Glen Head, New York.

Supply: Investor Presentation

On July twenty eighth, 2022, the corporate reported the second quarter and 6 months outcomes for Fiscal Yr (FY)2022. Web earnings for the primary six months of 2022 was $24.6 million, a rise of $1.9 million, or 8.4%, versus the identical interval final yr. The rise is primarily because of development in web curiosity earnings of $4.9 million, or 9.2%, and noninterest earnings of $695,000, or 12.1%, excluding 2021 securities features. This stuff had been partially offset by will increase within the provision for credit score losses of $2.8 million and earnings tax expense of $364,000.

Web earnings for the second quarter of 2022 of $12.5 million elevated $1.1 million, or 9.6%, from $11.4 million earned in the identical quarter of final yr. The rise is principally because of development in web curiosity earnings of $2.8 million, or 10.3%, for considerably the identical causes mentioned above in regards to the six-month intervals.

The Company’s stability sheet stays robust, with a leverage ratio of roughly 9.9%. The corporate repurchased 488,897 shares of frequent inventory throughout the first half of 2022 for $9.8 million. The administration group expects to proceed frequent inventory repurchases throughout 2022.

The corporate ROE was 12.9% and 12.4% for the three-month and six-month intervals ended June 30, 2022, respectively, a rise in comparison with 11.0% and 11.1% for a similar intervals in 2021. The will increase in ROE had been because of increased web earnings for each intervals and a rise in gathered different complete losses because of a big enhance within the web unrealized loss within the available-for-sale securities portfolio from increased rates of interest.

The corporate continues to deal with strategic initiatives supporting the expansion of its stability sheet and a worthwhile relationship banking enterprise. Such initiatives embody bettering the standard of know-how by persevering with digital enhancements, optimizing its department community throughout extra intensive geography, utilizing new branding and “CommunityFirst” focus to enhance title recognition, enhancing its web site and social media presence, together with the promotion of FirstInvestments, and recruitment of skilled banking professionals to assist our development and know-how initiatives.

Development Prospects

The corporate’s earnings per share have grown constantly over the past decade, with an annual enhance of 5%, although its development fee has been uneven. Their dividend yield has grown even sooner, at a 10-year common annual fee of greater than 7%. We anticipate the corporate to extend future earnings at a 4% fee over the subsequent 5 years.

Additionally, revenues roughly doubled over the past decade, because the financial institution was in a position to develop its presence in its markets whereas additionally producing increased revenues per department throughout that timeframe. Low-interest charges, that are usually seen as a headwind for banks as a result of they often go hand in hand with low web curiosity margins, haven’t been a big headwind for the corporate.

With the rate of interest will increase, this could present a tailwind for the corporate as it is going to assist enhance its web curiosity margin.

The corporate additionally has been lowering its share depend trough out the years. This has helped the corporate to proceed to extend earnings due to the schooling of share depend.

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

FLIC is a small regional financial institution centered on New Jersey and a few burrows of New York. As such, it has benefited from a rising inhabitants and a robust housing market within the lively areas. One might thus say that it has a aggressive benefit when it comes to being centered on a lovely geographical market, though FLIC doesn’t take pleasure in large-scale advantages.

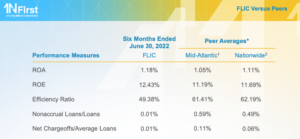

Nonetheless, FLIC has stable fundamentals, together with an above-average return on fairness of ~11% and strong mortgage stability, with below-average credit score charge-offs, even throughout the present disaster. In the course of the Nice Recession, FLIC carried out higher than lots of its friends, proving the below-average degree of threat.

You possibly can see a rundown of First of Lengthy Island Company’s earnings-per-share from 2007 to 2011 beneath:

- 2007 earnings-per-share of $0.67

- 2008 earnings-per-share of $0.79 (18% enhance)

- 2009 earnings-per-share of $0.82 (3% enhance)

- 2010 earnings-per-share of $1.02 (25% enhance)

- 2011 earnings-per-share of $0.98 (4% lower)

First of Lengthy Island Company was remarkably resilient throughout the Nice Recession. It solely suffered a 4% decline in 2011 after the Nice Recession, which is spectacular contemplating that this firm is within the monetary business. The corporate once more carried out nicely in 2020, a yr wherein the U.S. financial system entered a recession as a result of pandemic. And but, First of Lengthy Island Company continues to extend its dividend reliably every year, together with a 5.3% enhance in 2022.

The corporate has an impressive stability sheet. The corporate sports activities a debt-to-equity ratio of 0.6 and a long-term debt-to-capital ratio of 44.1.

Valuation & Anticipated Returns

Over the previous ten years, the corporate has tended to common a PE ratio of 14.5x earnings. Nevertheless, we expect a PE of 12x earnings is best fitted to this firm.

The corporate at present sports activities a PE of 9.5x 2022, with anticipated earnings of $2.11 per share. Thus, the corporate shares look undervalued on the present value. If the inventory value had been to revert to a PE of 12 over the subsequent 5 years, this would supply the investor with an annual fee of return of 5.4% over the subsequent 5 years.

Combining the present dividend of 4.2% and an anticipated earnings development of 4% over the subsequent 5 years will give us a 13.6% annual return.

As you’ll be able to see beneath, if an investor introduced $100 value of shares on January 1st, 2012, whereas reinvesting the dividend, the return would have been over 100%.

Supply: Investor Presentation

Remaining Ideas

The First of Lengthy Island just isn’t a big financial institution however is lively in a lovely regional market and operates fairly profitably. FLIC has not been a high-growth enterprise previously, however by a mixture of dividends and a few earnings development, returns have nonetheless been stable. Primarily based on our complete return estimates, FLIC looks like a lovely inventory proper right here, and its valuation is beneath our honest worth estimate. We thus fee FLIC a purchase at present costs.

The Blue Chips listing just isn’t the one option to shortly display for shares that commonly pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].