Revealed on August 2nd, 2022 by Josh Arnold

The monetary companies sector tends to see quite a lot of corporations which are eager to return money to shareholders. As well as, earnings are usually pretty dependable – barring a dangerous recession – which suggests corporations have the willingness and skill to ship rising quantities of money to shareholders every year.

It’s no shock, then, that so many monetary companies corporations are counted among the many Blue Chip shares. This can be a group of shares that every have not less than 10 years of dividend will increase, and immediately, there are greater than 350 of them. Extremely, a couple of quarter of them are monetary companies corporations.

With a particularly spectacular streak of 36 years of consecutive dividend will increase, Eagle Monetary Providers (EFSI) counts itself among the many Blue Chips. Eagle has stood the take a look at of time relating to dividend longevity, by means of recessions and aggressive threats.

We discover blue chip shares that fulfill the 10-year payout progress streak criterion are among the many most secure dividend shares that traders should buy immediately, just because their monitor data on dividend longevity are already confirmed.

We’ve created a full record of 350+ Blue Chips, which is obtainable for obtain by clicking under:

Along with the Excel spreadsheet above, we’re individually reviewing the highest 50 blue chip shares immediately as ranked utilizing anticipated complete returns from the Positive Evaluation Analysis Database.

This installment of the 2022 Blue Chip Shares In Focus sequence will analyze Eagle Monetary Providers, together with latest earnings, progress prospects, and anticipated returns.

Enterprise Overview

Eagle Monetary Providers is a financial institution holding firm for Financial institution of Clarke County, which is in Virginia. The corporate gives numerous conventional retail and business banking services and products within the Shenandoah Valley, and elements of Northern Virginia.

Deposit merchandise embrace checking, cash market, financial savings accounts, and time deposits. Its mortgage portfolio consists of residential actual property, business actual property, development and land improvement, private loans, bank cards, car loans, and extra. Eagle additionally affords funding companies, and sure kinds of insurance coverage.

Eagle has twelve full-service branches in operation, and traces its roots to 1881. Right this moment, it generates about $42 million in annual income, and has a market cap of $125 million, making it one of many smallest Blue Chip shares.

Eagle launched second quarter earnings on July 28th, 2022, and the quarter was a document by way of earnings for the corporate.

Internet earnings got here to $4.0 million, up 23% from Q1, and up 33% from final yr’s Q2. The acquire was pushed primarily by elevated internet curiosity earnings, which was led by robust mortgage progress.

Internet curiosity earnings was $11.9 million in Q2, which was up 7% from Q1, and up 19% from the comparable interval a yr in the past.

Common loans for the quarter have been $1.07 billion, up from $876 million a yr in the past. The tax-equivalent yield on common loans was 4.36%, a decline of 11 foundation factors year-over-year. The decline was attributed to decrease prevailing market mortgage yields on new loans, relative to these being paid off.

The corporate’s common investments have been $189 million, up from $176 million a yr in the past. The common yield on these investments was 2.04%, up 49 foundation factors from final yr’s Q2.

Internet curiosity margin was 3.70% for Q2, up from 3.56% in final yr’s comparable interval, and really excessive by any normal in immediately’s price surroundings.

Noninterest earnings was $3.8 million in Q2, up from $2.7 million in final yr’s Q2. The rise was because of distributions from small enterprise funding corporations.

Noninterest expense was up 6% year-over-year, which was due primarily to enlargement of the wealth administration enterprise, in addition to its marine lending enterprise. We subsequently wouldn’t anticipate related will increase going ahead, which can assist enhance margins.

Following Q2 outcomes, we anticipate to see about $4 in earnings-per-share for this yr.

Progress Prospects

Ought to Eagle hit $4 in earnings-per-share for this yr, that may put its common earnings progress price for the previous decade at greater than 7%. That’s fairly spectacular for a group financial institution, and the corporate is continuous to outperform a lot of its friends.

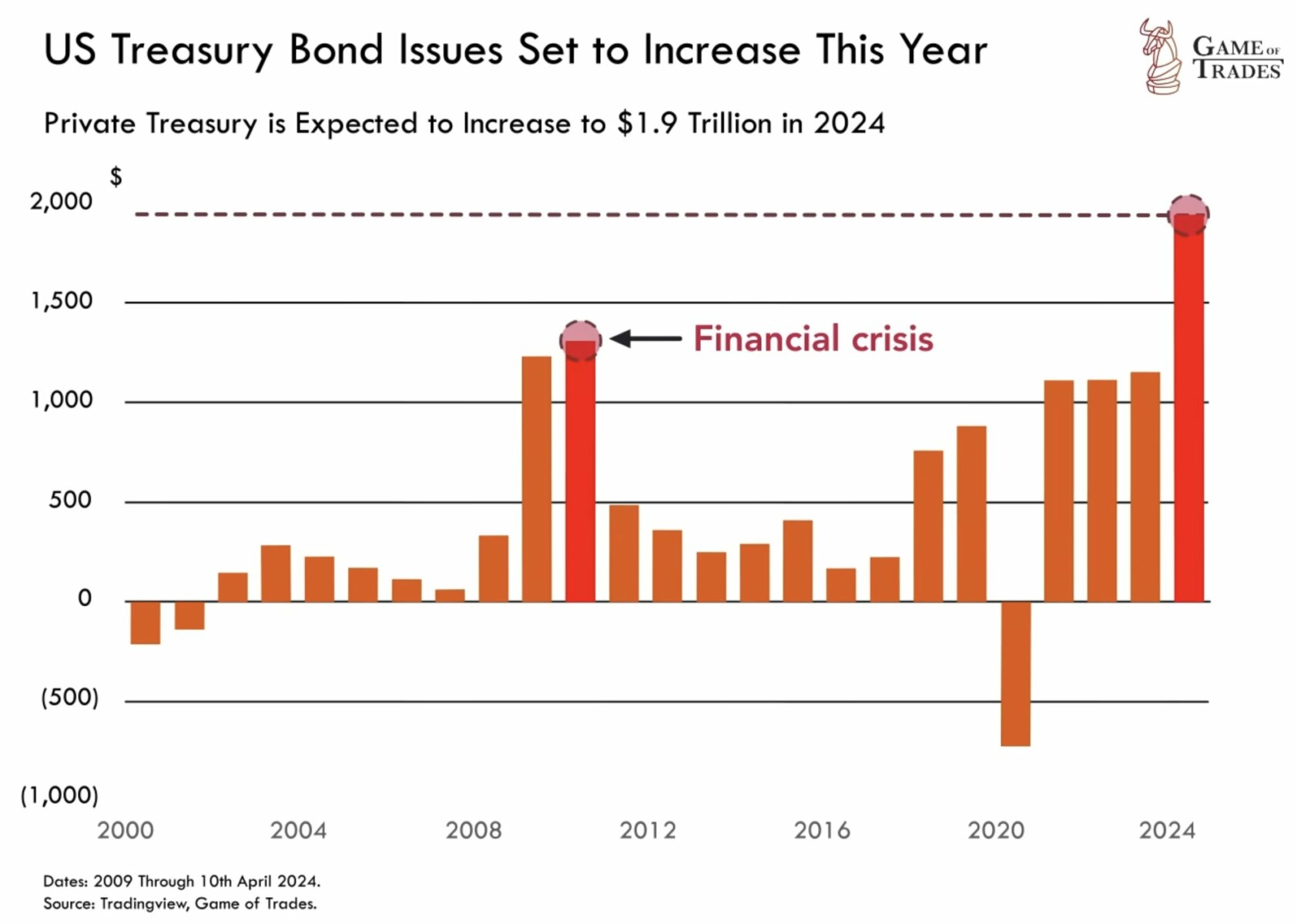

We see 5.5% progress going ahead, as a few of that robust earnings progress up to now decade was as a result of comparatively low base popping out of the monetary disaster. Nonetheless, mid-single digit long-term progress for a group financial institution is kind of respectable.

Supply: Q2 earnings launch

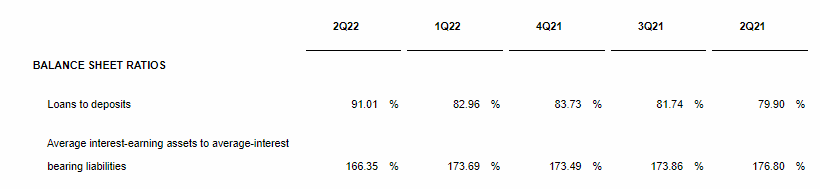

A method we see Eagle rising earnings is thru constantly boosting its incomes belongings. We are able to see that in latest quarters, the corporate has managed to sustainably, and considerably, transfer its asset depend larger. As well as, this asset progress has come from mortgage progress, which has soared from $869 million in Q2 of 2021 to $1.11 billion in only one yr. The loans held on the market has declined as properly, which means Eagle is conserving extra of its loans on its books to accrue curiosity earnings.

As yields are additionally now rising, we predict Eagle is properly positioned for earnings progress within the years to return.

Supply: Q2 earnings launch

One factor that we see doubtlessly offsetting that progress is the truth that Eagle has lent out deposits fairly aggressively in latest quarters. Its loan-to-deposit ratio was 80% in Q2 of 2021 however ended the latest quarter at 91%. That has afforded the corporate robust mortgage progress, but it surely additionally means there isn’t a lot left by way of loan-to-deposit enlargement.

Dividend progress has averaged slightly below 5% yearly for the previous decade, and we see related progress going ahead at 4.5%. With the corporate’s dividend enhance streak approaching 4 a long time, we predict this price of dividend progress is kind of enticing, all issues thought of.

Aggressive Benefits & Recession Efficiency

As a group financial institution, aggressive benefits are troublesome to return by. Banks all promote basically the identical merchandise, in order that they function a bit like commodity corporations in that means. Nonetheless, Eagle has grown its area of interest over the a long time the place cash heart banks aren’t prepared to go, and the formulation works.

Recessions are clearly unkind to banks as properly, and Eagle is way from immune. Nonetheless, it has held up properly in latest recessions, owed to prudent underwriting practices that concentrate on danger up entrance.

We additionally wouldn’t anticipate the dividend to be in any kind of hazard throughout a recession, given the financial institution’s excellent monitor document, in addition to the truth that the payout needs to be beneath 30% of earnings this yr.

Valuation & Anticipated Returns

Eagle’s valuation has been fairly regular all through the years, hovering typically within the low-double digits. We assess honest worth at 11 occasions earnings, given multiples have come down within the banking sector in 2022. Nonetheless, shares commerce for simply 9 occasions this yr’s earnings, which means we see the inventory as fairly moderately priced.

That might drive a ~4% tailwind to complete returns ought to the inventory reverts to honest worth over time. Along with our estimate of 5.5% progress and the three.2% present yield, we consider Eagle may produce ~12% complete annual returns within the coming years.

Remaining Ideas

Whereas Eagle is without doubt one of the smallest corporations in our protection universe – and certainly within the realm of Blue Chips – it has very enticing prospects for shareholders. We see a sturdy mixture of progress, yield, and valuation enlargement driving double-digit common annual returns for patrons of the inventory immediately.

As well as, shareholders get an almost four-decade streak of dividend will increase, and excessive ranges of dividend security. Given all of this, we price Eagle a purchase.

There are different methods to display for robust dividend shares in addition to simply the Blue Chips.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].