Printed on August seventh, 2022, by Felix Martinez

There isn’t a actual definition for blue chip shares. We outline it as a inventory with not less than ten consecutive years of dividend will increase. We consider a longtime observe report of annual dividend will increase going again not less than a decade exhibits an organization’s potential to generate regular progress and lift its dividend, even in a recession.

Because of this, we really feel that blue chip shares are among the many most secure dividend shares traders should buy.

With all this in thoughts, we created an inventory of 350+ blue-chip shares, which you’ll obtain by clicking beneath:

Along with the Excel spreadsheet above, we’ll individually overview the highest 50 blue chip shares right now as ranked utilizing anticipated complete returns from the Positive Evaluation Analysis Database.

This text will analyze Caterpillar Inc. (CAT) as a part of the 2022 Blue Chip Shares In Focus collection.

Enterprise Overview

Caterpillar was based in 1925 and right now competes within the manufacturing and promoting of building and mining tools. The corporate additionally manufactures ancillary industrial merchandise akin to diesel engines and fuel generators. Caterpillar inventory has a market capitalization of ~$97.8 billion, making it one of the crucial intensive industrial shares on this planet.

Industrial producers benefited from robust demand in 2021, which fueled progress and spurred world financial exercise off the low base established in 2020 amid the pandemic. Caterpillar can also be explicitly uncovered to the vitality and mining industries, which have benefited as a result of rising commodity costs.

The corporate reported second and 6 months outcomes for Fiscal 12 months (FY)2022. Gross sales for the second quarter elevated 11% to $14.2 billion from $12.9 billion within the second quarter of 2021.

The working revenue margin was 13.6% for the quarter, in contrast with 13.9% for the second quarter of 2021. The second-quarter 2022 revenue per share was $3.13, in contrast with the second-quarter 2021 revenue per share of $2.56. Adjusted revenue per share in 2Q2022 was $3.18, in contrast with 2Q2021 adjusted revenue per share of $2.60. Adjusted revenue per share for each quarters excluded restructuring prices.

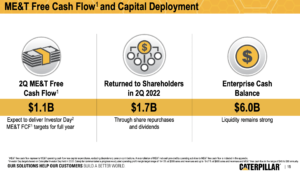

The corporate returned $1.7 billion to shareholders by means of share repurchases and dividends within the quarter. General, the administration crew was happy with the outcomes for the quarter. The outcomes mirror a wholesome demand throughout many of the firm’s finish markets. The corporate continues to deal with executing its technique for long-term worthwhile progress.

For the six months of the fiscal 12 months, gross sales elevated 12.3% in comparison with the primary six months of 2021. General revenue is up barely by 0.4% in comparison with the identical interval of 2021.

Supply: Investor Presentation

Development Prospects

Caterpillar is carefully tied to world financial progress and commodity costs. Its clients extract sources from the earth and construct and assemble all kinds of buildings, so financial progress is important to funding that growth.

This results in some excessive cyclicality in Caterpillar’s outcomes, which then sees the inventory swing wildly between extremes of the sentiment scale.

The coronavirus pandemic weighed closely on the corporate, however traders hope the worldwide financial restoration continues in 2022. This could be the very best alternative for Caterpillar’s fundamentals to enhance.

Additional, Caterpillar’s cost-cutting measures have pushed working margins greater for years. Whereas the majority of the positive factors might have been realized, we see additional potential for expense reductions to spice up earnings positively.

We anticipate earnings to enhance once more in 2022, with the potential to generate report outcomes. We’re forecasting $12.30 in earnings-per-share for 2022 to associate with a 5% progress fee over the following 5 years.

This displays some warning concerning the cyclical nature of the enterprise and Caterpillar’s potential to bounce again when demand returns.

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

Aggressive benefits in industrial functions will be difficult on condition that for many functions, there are opponents that make related merchandise. Nevertheless, through the years, Caterpillar has constructed itself into one of the crucial vital gamers in profitable finish markets akin to building, vitality, and mining.

Throughout world financial downturns, Caterpillar’s enterprise will be hit exhausting. This was illustrated throughout the Nice Recession when EPS declined by 61% in 2009 and 90% in 2010. Additionally, throughout the COVID-19 pandemic, the corporate’s earnings dropped 41% in 2020 to $6.56 per share in comparison with 2019 earnings of $11.06.

You may see a rundown of Caterpillar’s earnings-per-share from 2007 to 2011 beneath:

- 2007 earnings-per-share of $5.37

- 2008 earnings-per-share of $5.66 (5% enhance)

- 2009 earnings-per-share of $2.18 (61% lower)

- 2010 earnings-per-share of $4.15 (90% enhance)

- 2011 earnings-per-share of $7.40 (78% enhance)

The corporate has an ample steadiness sheet. The corporate sports activities a debt-to-equity ratio of two.4 and a long-term debt-to-capital ratio of 49.7. Additionally, the curiosity protection ratio is 20.0, which is a excessive ratio, that means that the corporate covers the curiosity on its debt very nicely. General, the corporate sports activities an S&P credit standing of A, an funding grade ranking.

Valuation & Anticipated Returns

Caterpillar’s present price-to-earnings ratio is 15.7, based mostly on 2022 anticipated EPS of $12.54. It is a low valuation degree for Caterpillar. Since 2012, shares of Caterpillar have traded with a mean P/E ratio of about 16.5. We consider 16 is an inexpensive, truthful worth estimate for Caterpillar, given its cyclical enterprise and vulnerability to recessions.

Intervals of cyclicality are common for Caterpillar on the subject of valuation. On the present PE ratio, this might enhance future returns; if the P/E a number of will increase from 15.7 to 16.0 over the following 5 years, it will enhance annual returns by 1.3% per 12 months in that timeframe.

The opposite constructive facet of shares with decrease than common valuations is that additionally they have the next dividend yield. As Caterpillar’s share value has fallen this 12 months, its dividend yield has elevated to 2.4%. Dividends and earnings-per-share progress are anticipated to be 5% per 12 months. This may add to shareholder returns.

Primarily based upon the above elements, we see complete returns of 8.7% per 12 months. This leads us to fee Caterpillar a maintain right now.

Remaining Ideas

Caterpillar is a frontrunner in its business, with risky earnings. Complete return potential comes at 8.7% every year, from 5% progress, a 2.4% beginning dividend yield, and a slight assist from the potential for a valuation tailwind. We’re cautious in regards to the cyclical nature of the enterprise. Shares earn a maintain ranking.

The Blue Chips listing just isn’t the one solution to shortly display for shares that usually pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].