Printed on August seventeenth, 2022, by Felix Martinez

There is no such thing as a precise definition for blue chip shares. We outline it as a inventory with no less than ten consecutive years of dividend will increase. We imagine a longtime observe file of annual dividend will increase going again no less than a decade reveals an organization’s skill to generate regular development and lift its dividend, even in a recession.

Because of this, we really feel that blue chip shares are among the many most secure dividend shares traders should buy.

With all this in thoughts, we created a listing of 350+ blue-chip shares, which you’ll be able to obtain by clicking under:

Along with the Excel spreadsheet above, we’ll individually assessment the highest 50 blue chip shares right this moment as ranked utilizing anticipated whole returns from the Positive Evaluation Analysis Database.

This text will analyze Atmos Vitality (ATO) as a part of the 2022 Blue Chip Shares In Focus sequence.

Enterprise Overview

Atmos Vitality can hint its beginnings again to 1906, when it was fashioned in Texas. Since then, it has grown organically and thru mergers to a $16.5 billion market capitalization.

The corporate distributes and shops pure gasoline in eight states, serves over 3 million clients, and will generate about $3.7 billion in income this yr. Atmos Vitality manages proprietary pipeline and storage belongings, together with one in every of Texas’s largest intrastate pure gasoline pipeline techniques. Atmos has a 38-year historical past of elevating dividends, placing it in a uncommon firm amongst dividend shares.

Atmos reported third-quarter earnings on August third, 2022, and outcomes have been higher than anticipated on each the highest and backside traces. Earnings-per-share got here to $0.92, which was seven cents forward of estimates. Whole funding revenue soared 34.8% to $816.4 million, beating expectations by $128.67 million.

Consolidated working revenue elevated by $21.2 million to $154.6 million for the third quarter from $133.4 million within the third quarter of 2021.

Distribution working revenue decreased to $66.1 million for the quarter in comparison with $68.1 million within the third quarter of 2021. Key working drivers for this phase embody a internet $30.5 million improve in charges, a $2.6 million improve resulting from internet buyer development, a $3.3 million improve in consumption, internet of the corporate climate normalization changes (WNA), and a $1.8 million lower in different operation and upkeep expense primarily resulting from decrease unhealthy debt expense within the current-year quarter, partially offset by a $13.7 million improve in depreciation and property tax bills and a $5.0 million improve in system upkeep expense.

Pipeline and storage working revenue elevated from $23.3 million to $88.5 million in comparison with $65.3 million for a similar interval of 2021. Key drivers for this phase have been a $21.0 million improve in fee resulting from GRIP filings authorized in 20211 and 2022. Additionally, a $6.1 million lower in system upkeep bills.

Supply: Investor Presentation

Progress Prospects

Earnings development throughout the utility trade usually mimics GDP development. Nonetheless, we count on Atmos Vitality to proceed outperforming this development resulting from its concentrate on capital funding in its regulated operations, a constructive regulatory setting in Texas, and inhabitants development.

Because of this, the corporate ought to profit from stable fee base development, which can generate annual earnings per share development in accordance with administration’s 6% – 8% steerage. For instance, the corporate was authorized to extend its charges final yr.

The expansion drivers for Atmos Vitality are new clients, fee will increase, and aggressive capital expenditures. One advantage of working in a regulated trade is that utilities are permitted to boost charges regularly, which just about assures a gentle degree of development.

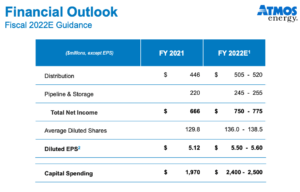

The corporate supplied a 2022 outlook. The corporate expects a rise in distribution and whole internet revenue for the yr. In addition they count on earnings development from $5.12 per share in 2021 to $5.55 per share in 2022.

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

Atmos Vitality’s major aggressive benefit is the excessive regulatory hurdles of the utility trade. Gasoline service is important and important to society. Because of this, the trade is very regulated, making it just about unattainable for a brand new competitor to enter the market. This supplies nice certainty to Atmos Vitality and its annual earnings.

One other aggressive benefit is the corporate’s steady enterprise mannequin and sound steadiness sheet, giving it a lovely price of capital. This allows it to fund accretive acquisitions and development capital expenditures, driving outsized earnings per share development.

As well as, the utility enterprise mannequin is very recession-resistant. Whereas many firms skilled giant earnings declines in 2008 and 2009, Atmos Vitality’s earnings per share saved rising. Earnings-per-share through the Nice Recession are proven under:

- 2007 earnings-per-share of $1.91

- 2008 earnings-per-share of $1.99 (4% development)

- 2009 earnings-per-share of $2.07 (4% development)

- 2010 earnings-per-share of $2.20 (6% development)

The corporate nonetheless generated wholesome development even through the worst financial downturn. This resilience allowed Atmos Vitality to proceed growing its dividend every year.

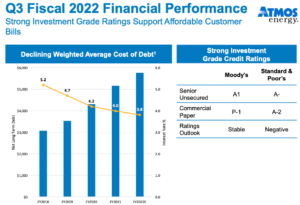

The corporate has a sturdy steadiness sheet. The corporate sports activities a debt-to-equity ratio of 0.9 and a long-term debt-to-capital ratio of 33.4. Additionally, the curiosity protection ratio is 10.3, which is an admirable ratio, that means that the corporate covers the curiosity on its debt effectively. The corporate additionally has an A- S&P credit standing. That is an funding grade score.

Supply: Investor Presentation

Valuation & Anticipated Returns

Atmos Vitality is anticipated to earn $5.55 this yr. Primarily based on this, the inventory trades with a price-to-earnings ratio of 21.4. That is above our truthful worth estimate of 19X. The present ratio can also be above the corporate’s ten-year common ratio of 19.6x earnings. Nonetheless, it’s under the five-year common of twenty-two.3x earnings.

Thus, Atmos Vitality shares seem like overvalued. If the inventory valuation retraces to the truthful worth estimate over the following 5 years, the corresponding a number of contractions will scale back annual returns by 1.9%. This could possibly be a slight headwind for future returns.

The inventory may nonetheless present optimistic returns to shareholders by way of earnings development and dividends. We count on the corporate to develop earnings by 6% per yr over the following 5 years.

As well as, the inventory has a present dividend yield of two.3%. Atmos Vitality final raised its dividend by 8.8% in November 2021. This marked the thirty eighth yr of dividend development for Atmos Vitality. We count on the corporate to develop its dividend this November at a excessive single-digit fee.

Total, if we add all this collectively, we will count on the corporate to have a 6.4% annual fee of return for the following 5 years.

Last Ideas

Atmos has sturdy fundamentals and an extended observe file of stable efficiency, however the valuation has risen of late. We’re forecasting whole annual returns of 6.4%, consisting of the present 2.3% yield, 6% earnings-per-share development, and a slight potential headwind from the valuation. Thus, the inventory earns a maintain score.

The Blue Chips record is just not the one strategy to rapidly display screen for shares that commonly pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].