Printed on August 2nd, 2022 by Josh Arnold

Agricultural and commodity shares are usually extraordinarily cyclical. Not solely is demand no less than considerably dependent upon financial development, however costs are likely to fluctuate wildly for many commodities. That makes it tougher for corporations within the sector to develop their dividend over time, as earnings make outsized strikes, significantly in recessions.

That makes the 47-year dividend streak of Archer Daniels Midland (ADM) much more spectacular. The corporate has paid dividends to shareholders for an unimaginable 90 consecutive years, and we see no finish in sight for both of these streaks. The corporate has confirmed keen and in a position to return ever-higher quantities of capital to shareholders, even throughout robust recessions.

That places Archer firmly within the camp of Blue Chip shares, which is a gaggle of greater than 350 corporations with no less than 10 consecutive years of dividend will increase.

We see these shares as among the many higher dividend inventory buys out there at this time, merely due to their willingness and talent to return increasingly capital to shareholders every year.

We’ve created a full checklist of the 350+ Blue Chips accessible at this time, which you’ll be able to obtain beneath:

Along with the spreadsheet above, we’re individually reviewing the highest 50 Blue Chip shares at this time as ranked utilizing anticipated complete returns from the Certain Evaluation Analysis Database.

This text within the 2022 Blue Chip Shares In Focus sequence will analyze Archer Daniels Midland, together with current earnings, development prospects, and complete returns.

Enterprise Overview

Archer is a extremely diversified commodities firm that’s targeted within the agricultural house. The corporate has a totally built-in mannequin the place it sources, transports, shops, processes, and distributes commodities, merchandise, and components throughout the globe. The three segments it operates are Ag Providers and Oilseeds, Carbohydrate Options, and Diet.

Supply: Investor presentation, web page 7

Via these segments, it procures, processes, and distributes merchandise together with uncooked commodities, animal feed, components for human consumption, and associated merchandise. Archer additionally presents futures fee service provider providers, commodity brokerage providers, money margins and securities pledged, and different associated monetary providers.

Archer was based in 1902, and has paid consecutive dividends to shareholders since 1932. In the present day, it produces about $97 billion in annual income, and trades with a market cap of $47 billion.

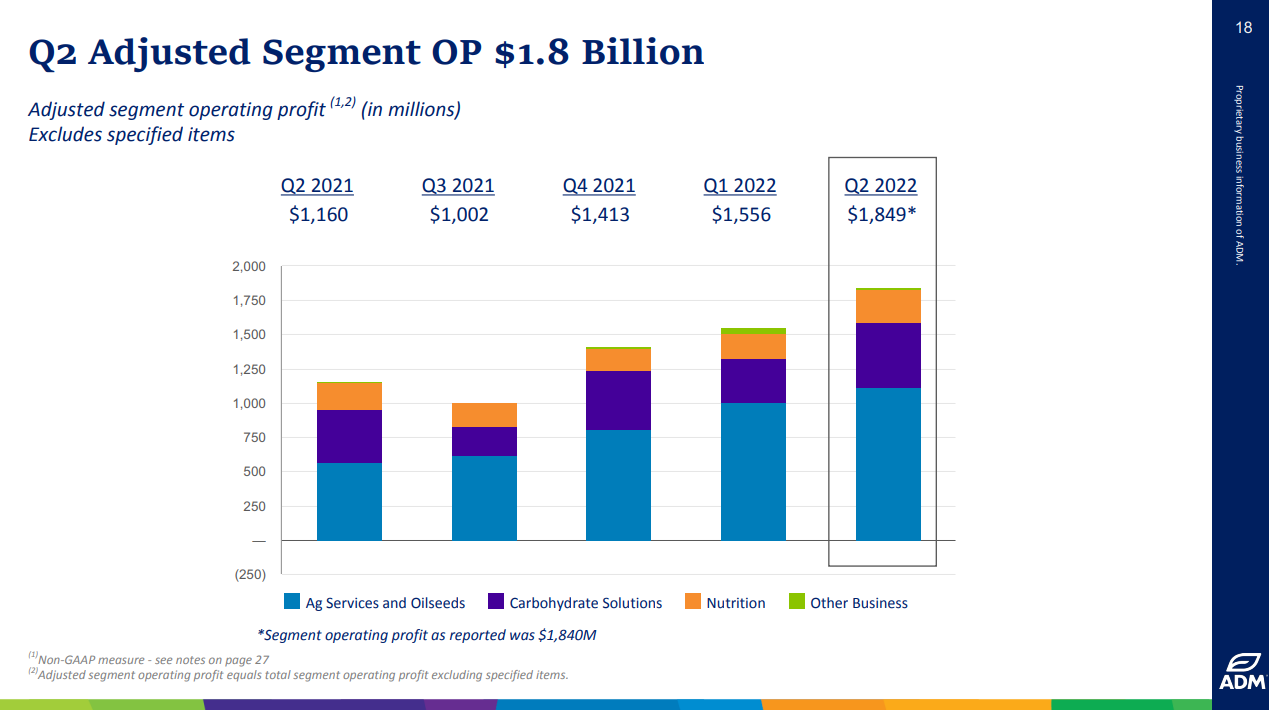

Archer reported second quarter earnings on July 26th, 2022, and the corporate’s outcomes handily beat estimates on each the highest and backside strains.

Archer’s earnings-per-share got here to $2.15 on an adjusted foundation, which was 43 cents forward of estimates. Income soared 19% year-over-year to $27.3 billion, blowing previous estimates by greater than $2.4 billion.

Ag Providers & Oilseeds was a significant driver of the earnings beat, with the corporate seeing working revenue on this section greater than double year-over-year. Archer cited robust volumes and margins as producing a confluence of constructive elements that drove income in Q2. Administration cited good international demand for export volumes, particularly, grain. Soybean meal and soybean oil demand was very robust as properly.

Carbohydrate Options have been additionally a lot larger than the year-ago interval. Starches and Sweeteners have been significantly better as robust demand from meals providers was near pre-pandemic ranges. Corn merchandise additionally noticed excessive demand, and efficient working controls improved margins.

Diet noticed 16% income development and 19% larger working revenue, which truly made it a relative laggard for Archer in Q2; such was the power demonstrated.

The corporate noticed robust demand throughout the portfolio, together with flavors, proteins, and texturants. Animal diet merchandise noticed robust volumes and margins as properly.

Supply: Investor presentation, web page 18

Following Q2 outcomes, we now see $6.73 in earnings-per-share for this yr, which, if achieved, would simply be a report for the commodities firm.

Development Prospects

Archer has managed a particularly spectacular common earnings development charge of virtually 12% up to now decade. A part of that development was normalization out of the recession that accompanied the monetary disaster, however to its credit score, the corporate has continued to develop strongly within the years since.

We see 5% as extra cheap given the very excessive base of earnings in place for 2022, nonetheless.

Margin enlargement by means of productiveness efforts and rising volumes, natural development from robust international demand, and periodic acquisitions ought to all assist Archer develop within the years to return. We notice that development is unlikely to be linear given the inherent volatility in commodities, however over time, we anticipate the corporate will ship.

Dividend development has averaged about 9% yearly up to now decade, however we’re anticipating extra like 3% development within the years to return. The corporate has confirmed it desires to spend further capital on investing within the enterprise, both organically or by means of acquisitions. It has been shopping for again shares as properly, so we don’t see significant enlargement of the dividend within the years to return.

Aggressive Benefits & Recession Efficiency

Provided that commodities corporations are inherently like opponents, Archer has created a robust area of interest for itself. It presents extra worth to clients given its large scale as a one-stop-shop for all issues meals commodity associated. That provides it endurance amongst opponents, and helps it drive decrease pricing whereas sustaining margins over time.

Recessions are considerably unkind to Archer, not essentially due to plummeting demand, however as a result of it lacks pricing energy on a few of its merchandise. Nonetheless, the corporate has managed to climate recessions for the previous 90 years whereas persevering with to pay dividends to shareholders, and we don’t see any trigger for concern. Certainly, the payout ratio for this yr is simply 24%, so Archer’s dividend is ultra-safe in our view.

Valuation & Anticipated Returns

We see respectable 9% complete returns for Archer over the approaching years, pushed by the 1.9% dividend yield, 5% development, and a 2%+ tailwind from the valuation. Shares commerce at this time at 12.5 occasions this yr’s earnings, however we assess honest worth at 14 occasions earnings. That means a tailwind from a rising valuation over time, and we notice that 14 occasions earnings is a conservative estimate. Archer has traded within the upper-teens a number of occasions up to now decade. With these elements in thoughts, Archer is rated a maintain.

Closing Ideas

Archer is dividend royalty given its streak of 90 years of consecutive dividends, in addition to its nearly-half-century streak of dividend raises. There are few corporations on the earth with streaks that may match.

We just like the inventory for its cheap valuation, above-market yield, and future development prospects, but it surely simply misses the minimize for a purchase score.

There are lots of different methods to display screen for nice dividend shares apart from the Blue Chips.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].