On a warm August morning in 2013, I took a meeting that changed my life.

The topic of discussion? How bitcoin would change the world.

As I ate breakfast alongside venture capitalists and hedge fund traders, our featured guest Barry Silbert took the floor.

I learned that day that Barry and I share more than a love of bitcoin. We both started at Salomon Brothers in the late ‘90s. I was in bond trading and he was on the other side of the firm in asset management.

After Salomon, Barry went on to start Second Market, a popular trading exchange for pre-IPO stocks. As the last decade of venture capital activity has shown us, Barry’s got a knack for recognizing big opportunities.

He said, very plainly: “I’ve invested a substantial portion of my net worth in bitcoin, and I believe this will one day be the world’s global reserve currency.”

At the time, this was verging on the insane.

Bitcoin was still trading below $100 after falling from over $1,000. Very few people were taking it seriously.

Criminals used it to buy illegal goods on dark web sites like Silk Road. It was difficult to invest in for the everyday person, and impossible for financial institutions who had to follow rules. Even if you did manage to buy it, people were being hacked and exchanges were imploding left and right.

But despite all this, after hearing Barry’s pitch … I knew I needed to learn more.

If this was going to be the next big thing, I didn’t want to miss it. But I also wanted to test it out first.

So I bought 2.5 bitcoins for $250. I even found the transaction receipt, down to the second I placed the order.

And I wish I’d bought much more.

Over the next few years, Barry nailed it.

Bitcoin blew up! It went from $100 on that August day to a high of $20,000 in 2017 — a 19,900% gain. That was the peak of “bitcoin mania.”

Barry founded Digital Currency Group two years after our meeting … which, through its subsidiary Grayscale, eventually introduced the first-ever bitcoin investment vehicle to the stock market.

But bitcoin’s emergence was only the start of the crypto revolution.

Since it burst onto the scene 14 years ago, thousands of cryptocurrencies have sprung up. Each has a different use, but they all share a common theme: transacting without a middleman.

Today, like Barry did 10 years ago, I’m going to stick my neck out and say something you might think is a little bit insane.

Investing in cryptocurrency now is akin to investing in dot-com companies back in 2004.

If you had bought eBay, Google, or Amazon back then — after they collapsed from their highs — you’d be sitting on a gain of 248%, 3,400%, 4,200% respectively.

I pick out these three companies because they all launched during the bubble and still stand strong today. They were the “next generation” tech companies after the “first-gen” Apple and Microsoft that came before.

Like them, Bitcoin was the first generation of cryptos.

As this technology matures, the next generations of cryptocurrencies are going to be lifechanging — and incredibly profitable.

Here’s what I mean…

Why Blockchain & Web 3.0 Is a Big Deal

The reason I’m so bullish on bitcoin and many other cryptos is because of blockchain technology.

If you don’t know much about blockchain, just think of it as a digital ledger that ensures the accuracy of transactions with computer code.

Each platform built on a blockchain has a native cryptocurrency. These are used to keep tabs on who owns what within that specific network.

Since each user’s history is stored on the blockchain, you can transact to anyone in the world without a middleman or centralized entity to approve. Anyone can see any transaction at any time, and this shared record effectively replaces the middleman.

This system is extremely secure. It’s actually considered impossible to hack, because a hacker would have to change the transaction history on every computer on the network to do so.

But blockchain technology isn’t simply an alternative payment system. It’s also set to give us more control of our private data.

In fact, it’s set to power a trend that I expect will massively disrupt every facet of our lives.

Everything from real estate, insurance, health care, energy, supply chains, the government — you name it.

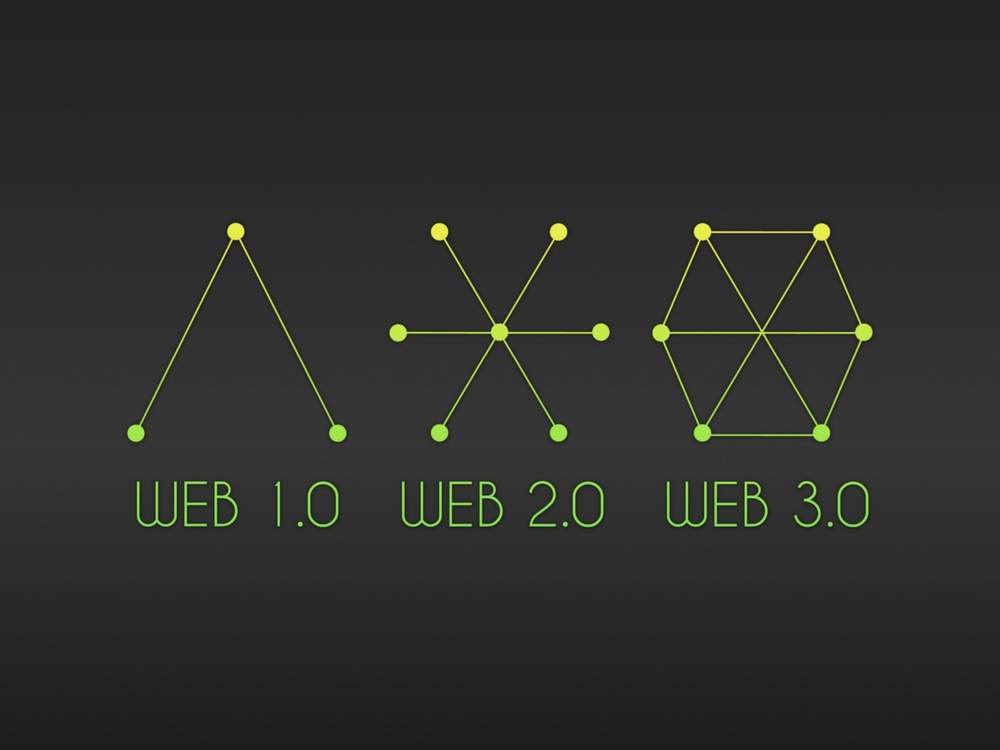

This movement is called Web 3.0 — the third, newest generation of the internet.

Before I define exactly what that is — and how blockchain is powering it — let’s look at how we got here.

Remember dial-up modem? When you had to have a phoneline to connect to the internet, and it took hours to download a song?

That was Web 1.0. In this era, major companies like Microsoft and Yahoo controlled the internet.

Web 1.0 is largely known as the “Read” version of the internet. This is because everyday users could only really read what big companies put on the internet, not add or engage with it in any way. It also wasn’t easy to talk to other internet users outside of email and instant messengers.

Then came the rise of content generation, interactive web applications and social media. Seemingly overnight, anyone with an internet connection could create their own blogs, share their party photos on Facebook or their political opinions on Twitter. Instead of just “Read,” the internet became “Read and Write.”

This was Web 2.0. This phase of the internet also unleashed innovative companies with massive market caps. It enabled podcasting and music streaming (Spotify), vlogging (YouTube and TikTok), and social media (Facebook and Twitter).

With this innovation came the long tech boom we’ve seen since the market bottomed in 2009. And some analysts estimate the internet has generated $10 trillion of economic value since it was invented — largely thanks to Web 2.0.

But while Web 2.0 unleashed a brave new world of investment, it came at a price: our personal data.

In Web 2.0, user data became the world’s most valuable commodity. It allowed Big Tech firms to control the internet. And their algorithms had one mission: to capture your attention by choosing what you should read or watch.

Don’t get me wrong. Gmail, Airbnb, Twitter and the like are useful platforms. But the downside is that Big Tech companies like these now have access to our likes, photos and even private conversations. And they get to determine what their algorithms show us.

That’s why the world is ready for the next generation of the internet — Web 3.0.

The biggest change Web 3.0 will bring is the way we reclaim our data.

Instead of centralized companies controlling the internet — Amazon, Facebook, Google — we’ll be able to hold onto our own data and share it only when (and if!) we want to. It’s adding an “Ownership” layer onto the Read and Write capabilities of Web 2.0.

And what’s the technology driving this revolution in digital privacy?

That’s right — blockchain.

That’s why when I hear others say “Oh, bitcoin is a scam” or “Crypto is just to make the scam artists richer,” I’m confused.

Being anti-crypto in 2023 is a lot like being anti-internet in 2004.

Sure, is crypto dangerous in the wrong hands? Absolutely.

But to be fair, the same can be said of the internet. And that didn’t stop internet companies like Amazon, eBay and Alphabet from amassing massive gains over the past 20 years.

So, here’s the thing: You don’t have to “believe” in crypto to get rich on it. In fact, you don’t even need to understand everything about it.

That’s why I’m here.

Crypto’s Turning Point

Everyone loves to slam crypto. In fact, bitcoin just celebrated its 14th birthday — despite the fact that it’s been declared dead 471 times by everyone from Forbes, to Bloomberg, to The New York Times.

With that kind of track record, clearly the mainstream media doesn’t know what it’s talking about.

I’ve been following cryptocurrencies for the past decade. I founded and currently run a trading service dedicated to trading crypto. At this point, I eat, breathe and sleep crypto.

And I’m telling you, crypto is not dead. In fact, it’s about to enter a new bull market.

And today, I’m revealing the two indicators I follow that are telling me it’s time to get back into crypto.

If you’d like to watch my webinar and get the facts for yourself, just click right here.

And afterwards, I want to hear from you. Email me at [email protected] and let me know two things:

- Are you bullish or bearish on crypto?

- If you are completely “anti-crypto,” tell me why. Do you think it’s a scam? Do you think the fundamentals are just not there? Don’t hold back.

I’ll be writing in this Sunday’s Banyan Edge article. Who knows — maybe your feedback is the one I’ll feature!

Regards,

Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

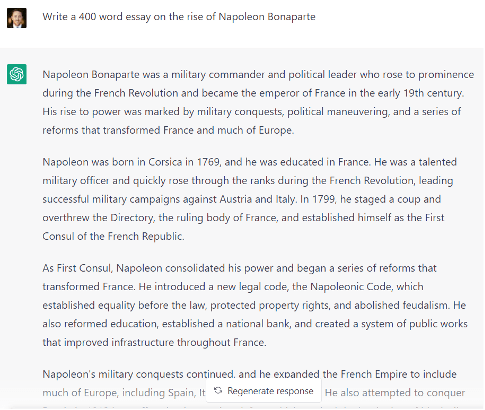

Unless you’ve been living under a bridge, you’ve likely heard of ChatGPT, the new artificial intelligence chatbot launched by Microsoft-funded OpenAI. I’ve spent the last week playing with it. And frankly… it’s scary what this thing can do.

Imagine something with Google’s knowledge base… but instead of finding a list of websites for you in response to a search query, it effectively scans all known information and summarizes it for you, even expressing opinions. And it learns from your follow-up questions.

Just for grins, I asked it to write a 400-word essay on the rise of Napoleon Bonaparte. It produced a good but not necessarily unique summary that looked like it came out of a well-written encyclopedia. I would expect something similar from a college history major.

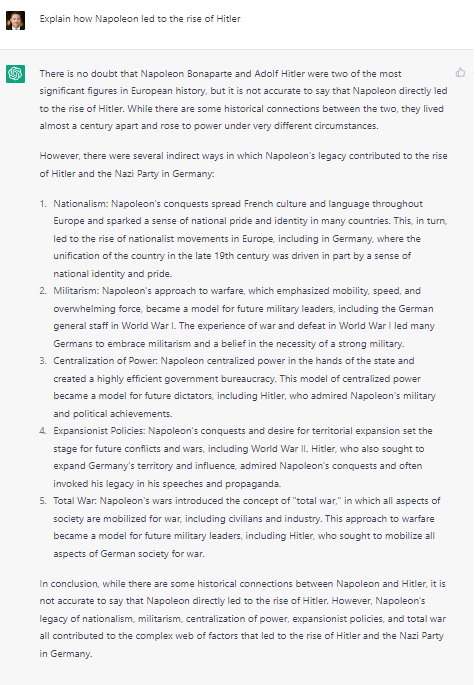

But here’s where it starts getting interesting. In response to its essay, I asked it to explain how Napoleon led to the rise of Adolph Hitler.

And within seconds, it detailed how Napoleon’s rise coincided with nationalism, militarism, centralization of power, expansionist policies and total war… all of which defined the rise of Nazi Germany. It was an explanation I would have expected from a PhD candidate.

And then I really started going down some obscure rabbit holes. I asked its sister AI module, Dall E, to create an image of Napoleon Bonaparte that looked like a Picasso painting. And it did.

Now, I’m just playing with this. A computer-generated image of Napoleon that looks like it was painted by Pablo Picasso is a funny conversation starter at a party but hardly anything of value.

But then…

I was having drinks in Playa del Sol in Peru last week with a friend who happens to be the head of marketing for a major telecom firm in the region. He told me he started playing with OpenAI’s toys… and ended up creating a marketing campaign that went viral.

A task that would normally take a team of marketing folks six weeks to put together was done by one man in a matter of minutes doodling on his laptop.

Think about the potential applications as the capabilities improve.

Coding projects that might have taken teams of software engineers might be done by one or two. Legal briefs that might have needed an army of attorneys to put together might be written by a single lawyer and a chatbot. For all you know, the next issue of Banyan Edge might be written by ChatGPT… though I’d like to think we’re a little harder to replace.

We’re on the verge of a productivity explosion. This will create opportunities we can’t even imagine.

And this massive shift is happening just as the internet transitions to Web 3.0.

Make no mistake, AI will become a huge part of the Web 3.0 story.

Right now, the most direct exposure you can get to AI is through Microsoft (MSFT), with its recent $10 billion stake in OpenAI. But don’t be surprised to see opportunities in the cryptocurrency space spring up in the coming years.

Ian King’s the most connected crypto researcher I know, and he just released a new presentation on what he’s calling Crypto’s Turning Point.

Ian believes right now is the time to get prepared for the next crypto bull market. Learn why right here.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge