peepo

A person does not grow from the ground like a vine or a tree, one is not part of a plot of land. Mankind has legs so it can wander. ― Roman Payne

Today, we take a look at transportation firm that is seeing rapid sales growth and moving towards profitability sooner than projected as well. Add in a rock-solid balance sheet and this small cap concern seems heading to brighter horizons in 2024. An analysis follows below.

Seeking Alpha

Company Overview:

November Company Presentation

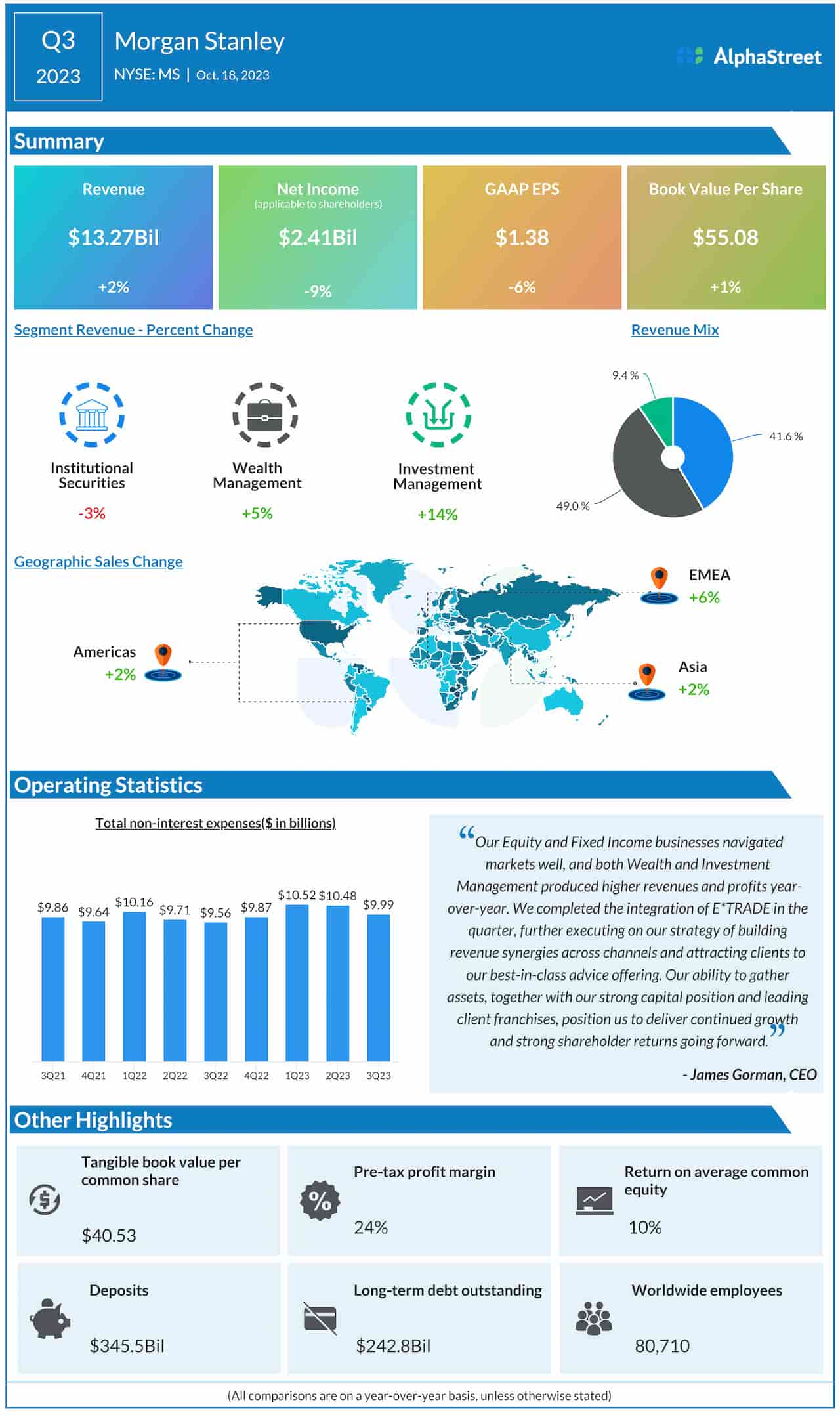

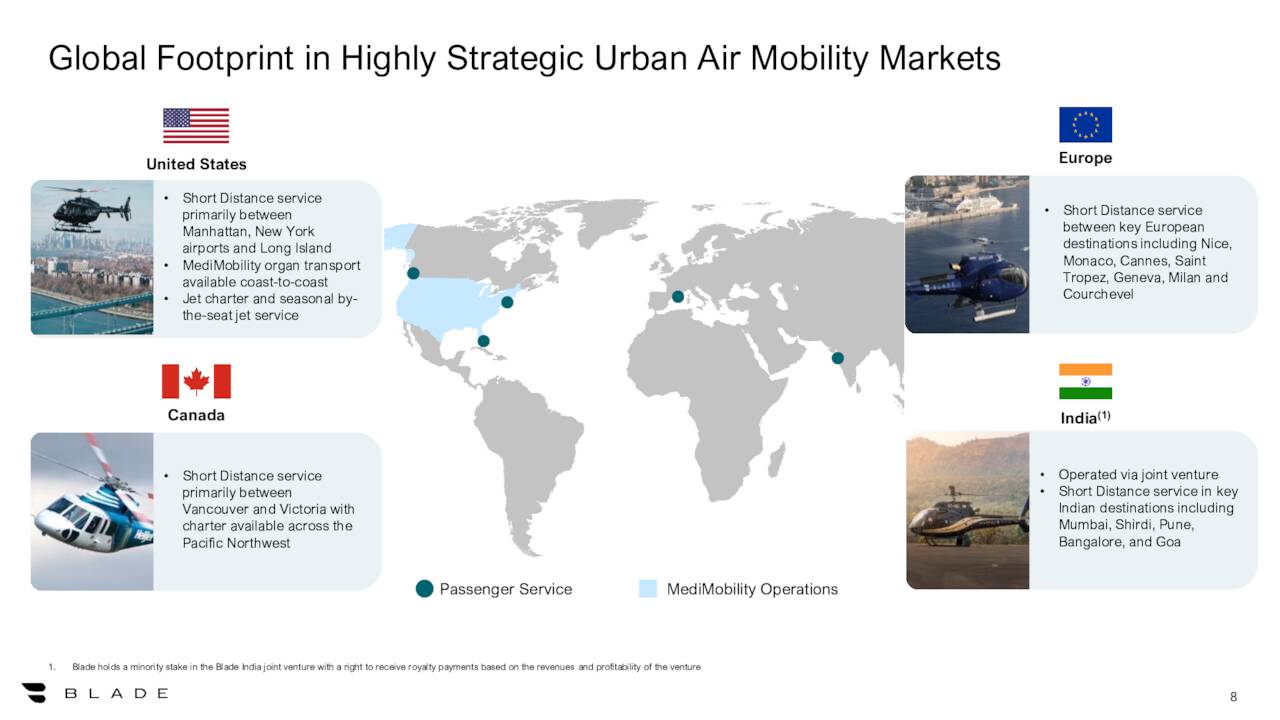

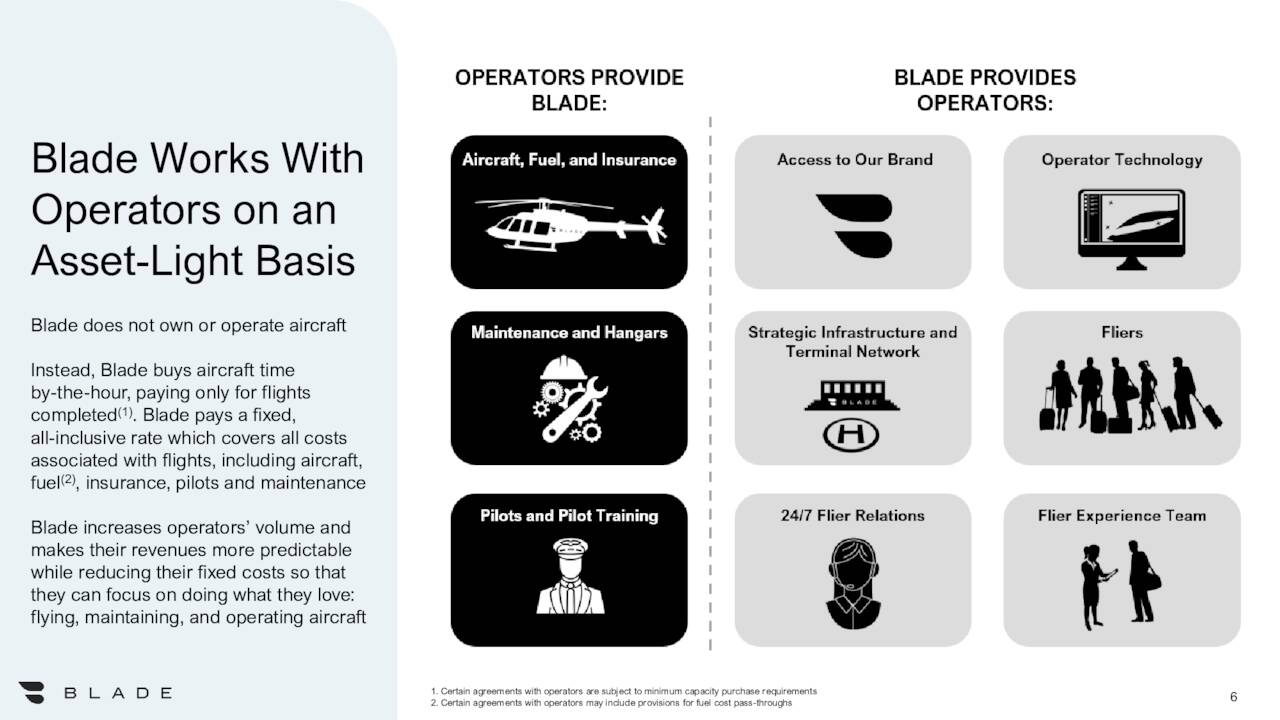

Blade Air Mobility, Inc. (NASDAQ:BLDE) is a New York City based provider of urban air transportation services, primarily employing helicopters, amphibious aircraft, and (in some instances) jets to shuttle passengers and human organs to and from highly congested areas. The company operates an asset-light platform, where it does not own the aircraft, but rather employs a network of operators, which provide flying time at fixed hourly rates. Blade was formed in 2014 and went public in 2021 when it reversed merged into special purpose acquisition company Experience Investment Corp. with its first trade transacted at $9.73 per share. Its stock trades just under $3.00 a share, translating to an approximate market cap of $210 million.

November Company Presentation

Business Model in More Detail

As stated in the prior paragraph, the company does not own the aircraft. It also does not directly pay for pilots, maintenance, hangar, insurance, or fuel, the cost of which are borne by its network of operators. However, to maintain its operator relationships and guarantee dedicated aircraft, Blade does endure the economic risk of offering by-the-seat flights to passengers, where it guarantees an operator a flight from (for example) 30th Street Manhattan to JFK Airport. The helicopter cost (hourly rate of ~$1,500 per hour times 0.2 hours, or ~$300) and JFK landing fee (~$200) are covered by the company irrespective if it can find passengers to transport. Obviously, Blade schedules its ‘guaranteed’ routes at high volume automobile traffic times to attract demand. That said, its largest contributor to its top line is the transportation of human organs and attendant medical staff to and from medical centers.

November Company Presentation

As part of its initial road show, management also discussed transitioning from essentially leasing helicopters to leasing electric vertical takeoff and landing (eVTOL) aircraft, in an effort to realize stronger margins. The sexy aspect of eVTOLs is that they are virtually noise free, permitting their deployment in more areas of the city, which expands the total addressable market for sky taxis.

November Company Presentation

That said, its stock has floundered since going public as investors and Street analysts began buying into a notion that Blade would become the Uber (UBER) of the skies with electric powered hovercraft and a nearly unlimited total addressable market. Owing partially to the fact that eVTOLs are still not approved to transport passengers and partially to the fact that there are only a finite amount of available pilots, those expectations haven’t materialized and as a result its stock has fallen 66% since going public.

Revenue Disaggregation

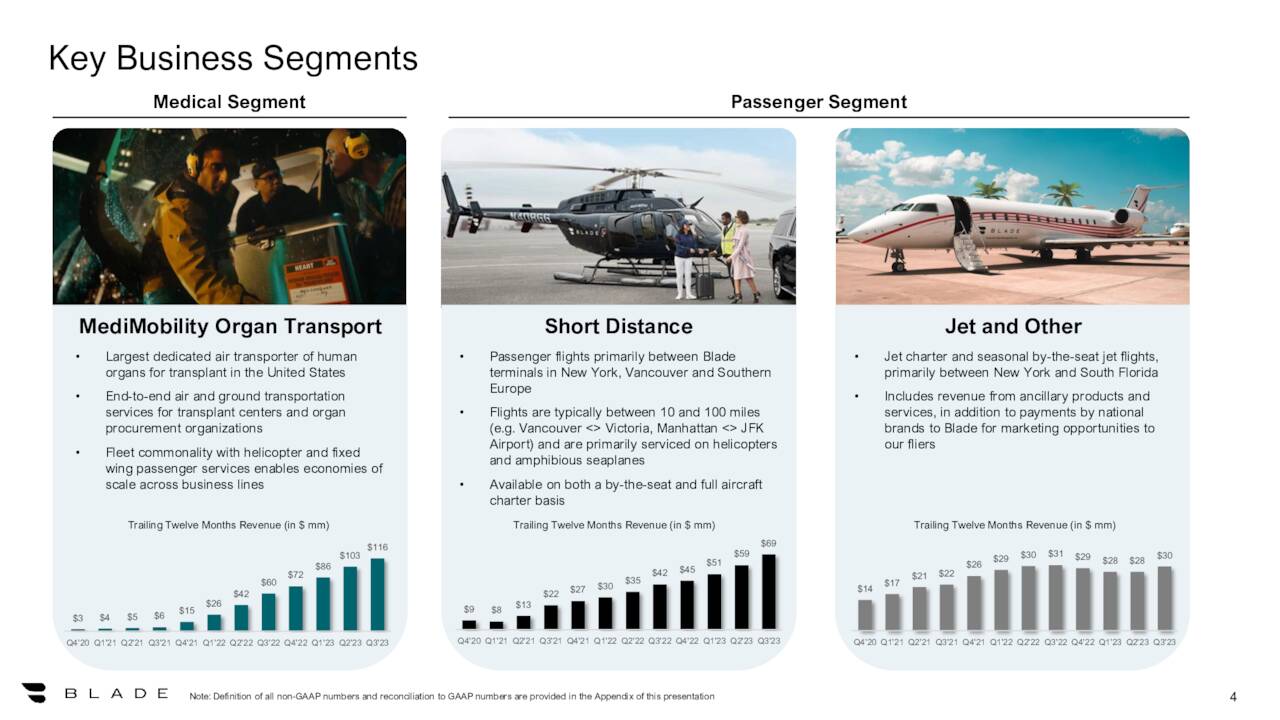

The company disaggregates its revenue across three categories: Passenger Short Distance, Passenger Jet and Other, and MediMobility Organ Transport.

November Company Presentation

Short Distance involves the use of helicopters and seaplanes to transport individuals and small parties to and from airports (and in some instances events) in New York City, Vancouver, and Cote d’Azur. Blade also has a small partnership in Mumbai. Flights are primarily between 10 and 100 miles, transporting up to six passengers with a travel time of five to 40 minutes. The copter can be chartered or seats can be purchased on an individual basis. Prices range from $125 to north of $215 per seat. During the first nine months of 2023 (YTD23), Passenger Short Distance generated revenue of $60.0 million, up 69% over YTD22, which was primarily a function of the company’s $48 million acquisition of Monacair, Heli Securite, and Azur Helicoptere (collectively Blade South Europe) in September 2022. The increase was also attributable to higher volumes in New York and Vancouver, the latter of which was made possible by the company’s $12 million acquisition of Helijet in November 2021.

The company has recently entered into an agreement with the Ocean Casino in Atlantic City to charter individuals to its resort. Furthermore, Blade passengers at Nice Airport will be able to enter a newly established on-tarmac security checkpoint, allowing them to bypass queuing up at commercial airline gates.

Jet and Other consisted primarily of seasonal jet charter and by-the-seat flights between New York and South Florida (West Palm Beach and Miami) between November and April. However, Blade has suspended the by-the-seat portion of this service, sticking strictly to charter. Other consists of revenue from brand partners for exposure to Blade’s high-end clientele and certain ground transportation services. This category provided YTD23 revenue of $23.1 million, up 4% from the prior year period and 13% of total.

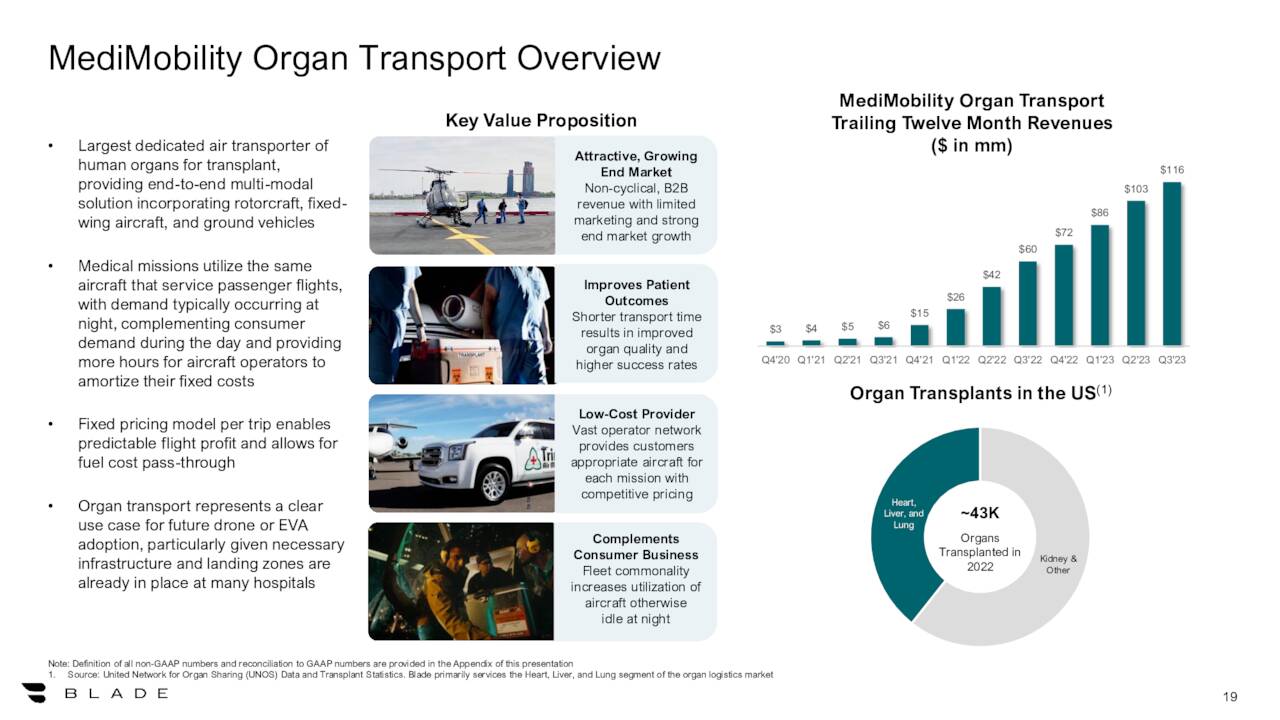

MediMobility Organ Transport is one of the country’s largest provider of transportation services for human organs and the medical teams supporting them, with over 70 contracted hospitals. This description was realized when the company purchased Trinity Air Medical for $23 million in September 2021. The line item is Blade’s largest, generating YTD23 revenue of $94.6 million, up 89% from YTD22 and representing 53% of total. Although operating on slightly lower gross margin than its Passenger segment, it does benefit from less marketing spend to add new hospital clients.

November Company Presentation

Q3’23 Financials

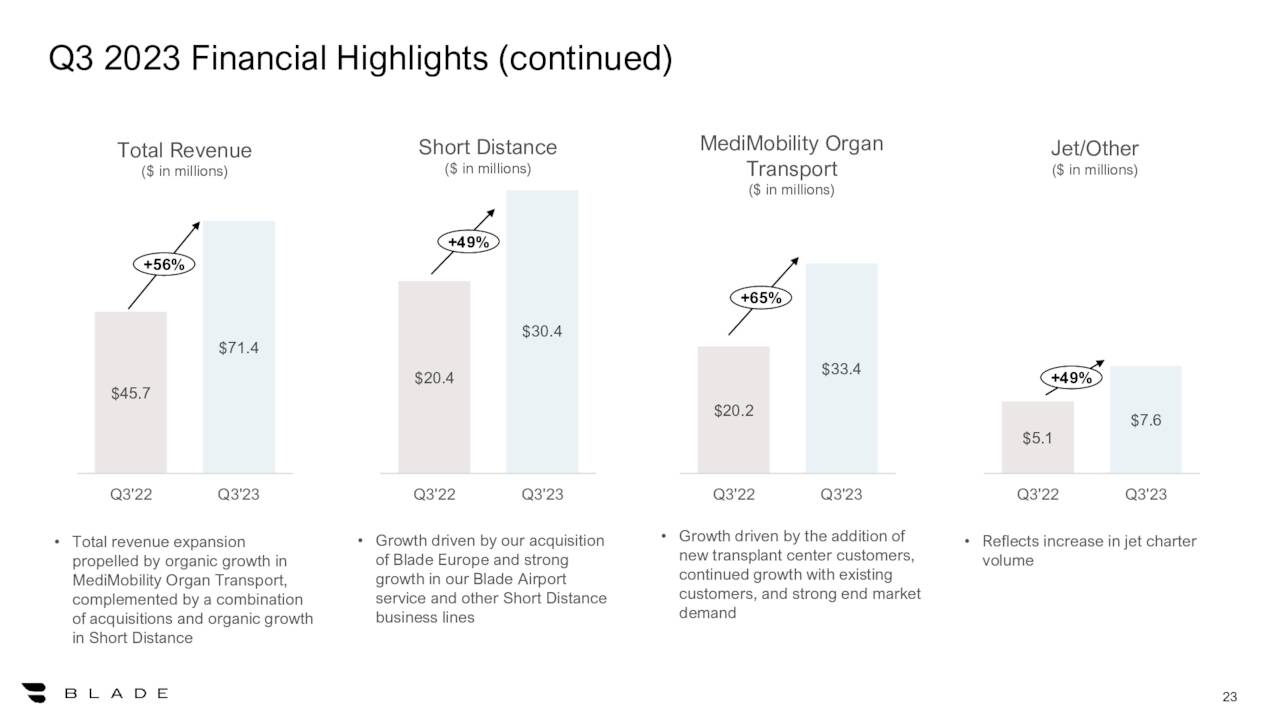

With that as the backdrop, Blade’s third quarter of FY23 proved to be a milestone with the company achieving both positive free cash flow and Adj. EBITDA for the first time. On November 8, 2023, the company posted breakeven earnings (GAAP) and Adj. EBITDA of $787,000 on revenue of $71.4 million versus a loss of $0.13 a share (GAAP) and Adj. EBITDA of negative $4.5 million on revenue of $45.7 million. The 56% improvement at the top line was driven by a 49% increase in Short Distance, largely a function of its Blade South Europe acquisition, as well as 65% year-over-year growth from its organ transport service as increased business from existing clients supplemented new hospital adds in the quarter.

November Company Presentation

Total paying passengers increased 79% year-over-year from 28,440 to 50,821, leading to an 89% increase in Passenger segment (Short Distance and Jet) Adj. EBITDA to $2.8 million. Medical segment Adj. EBITDA improved 124% to $3.3 million.

November Company Presentation

Although the company did cross the threshold into free cash flow positivity ($1.3 million) and achieved breakeven net income on a GAAP basis, its Q3’23 operating loss was still firmly in the red at negative $7.4 million, albeit an improvement over negative $10.4 million in the prior year period. That said, year-to-date, operating losses have only improved 4% with YTD23 at negative $32.5 million versus negative $33.9 million in YTD22.

Irrespective of this undercurrent, the market focused on the positive Adj. EBITDA result, rallying shares of BLDE 30% to $2.94 in the subsequent trading session. They have enjoyed a bid ever since.

Balance Sheet & Analyst Commentary:

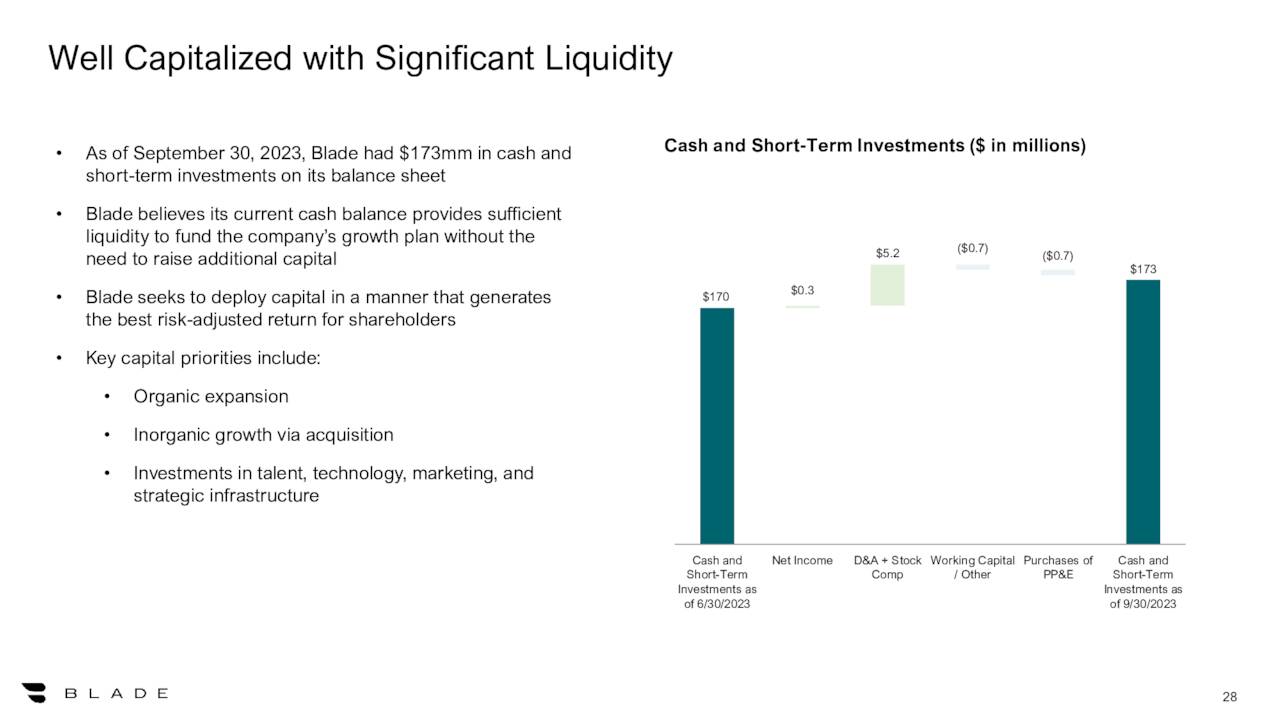

That said, Blade is very well capitalized, holding cash and investments of $173.2 million against no debt, putting it in a strong position to continue to grow through acquisition. Unless it makes a major acquisition, the company should be able to continue its growth without having to access the capital markets.

November Company Presentation

Despite their ‘Uber of the skies’ visions not yet materializing, the Street is still unanimously on board with Blade’s trajectory, featuring five buys or outperform ratings and a median price objective of $7. On average, they expect the company to lose $0.41 a share (GAAP) on revenue of $226.2 million in FY23, followed by a loss of $0.37 a share (GAAP) on revenue of $257.2 million.

Verdict:

With the Uber narrative not playing out, shares of BLDE bottomed at $2.06 a share on October 30, 2023, representing an 11% discount to cash. Since then, they have rallied over 60%, partly driven by a decent Q3’23 and partly driven by a ‘nowhere-to-go-but-up’ valuation. Even in a tough economic environment, there should be significant demand for a service that can potentially save up to two hours going to local airports during high travel windows. This service is here to stay, and Blade is at its forefront. The more it grows, the better its unit economics become. With $2.32 a share in cash and bleeding next to none of it, Blade can cherry pick its expansion opportunities. Buttressed by a strong human organ transport business, this company merits at least a small investment.

You can easily judge the character of a man by how he treats those who can do nothing for him. ― Johann Wolfgang von Goethe