Zbynek Pospisil/iStock via Getty Images

There’s no better way to sum up the commercial real estate sector than Ray Bradbury’s classic, Something Wicked This Way Comes.

I remember reading the book over three decades ago (when I was in high school) and this nightmarish novel analyzing the conflicts of good and evil is relevant today:

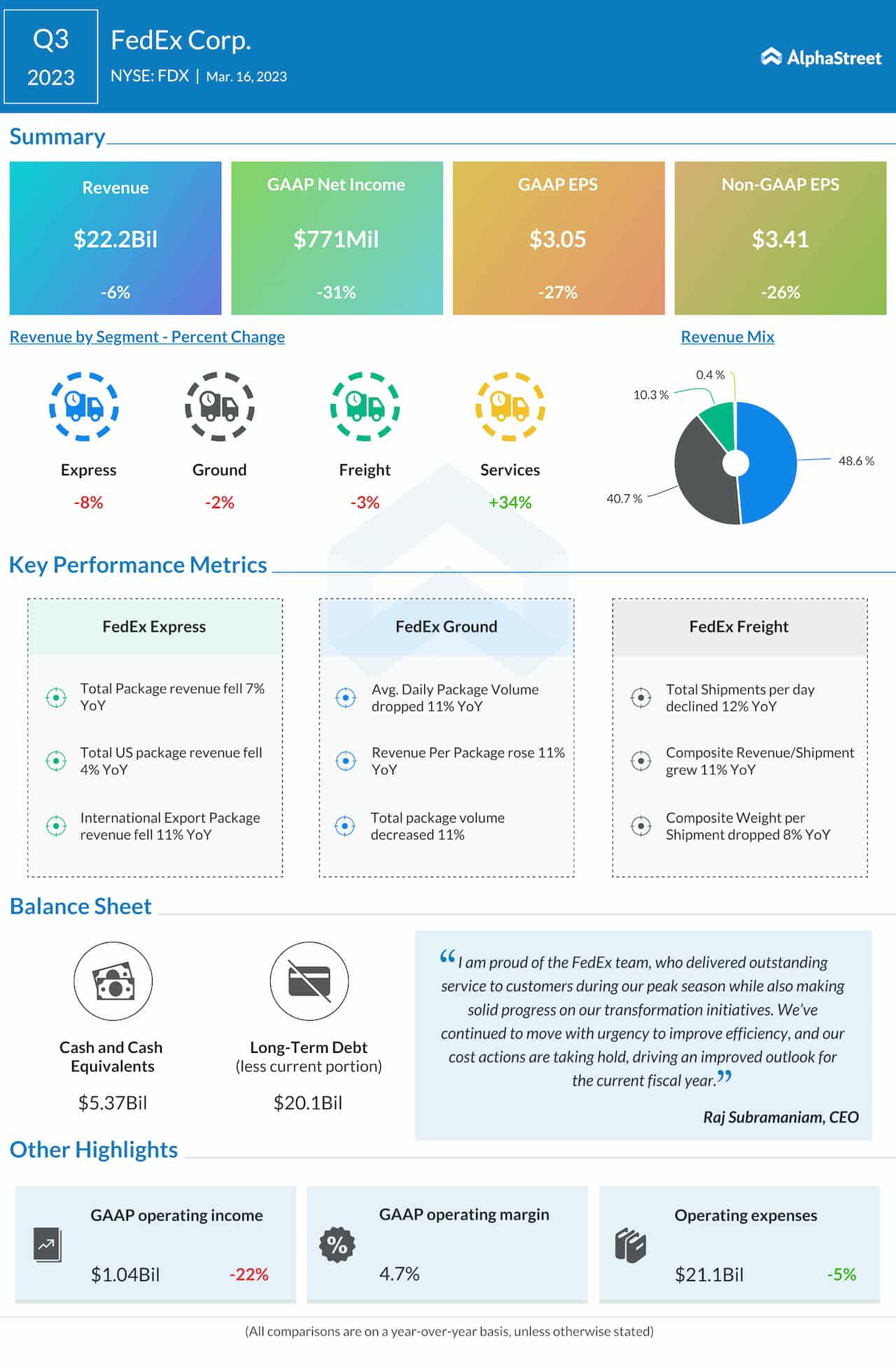

- Overdue property loans reach 10-year high:

@rbradthomas

2. $728 billion (16% of total loans) will mature in 2023, with another $659 billion (15%) maturing in 2024.

Hotels/motels have the largest share of their loans maturing in 2023 (34%), followed by office (25%). Multifamily has the smallest share of outstanding mortgages maturing this year (9%).

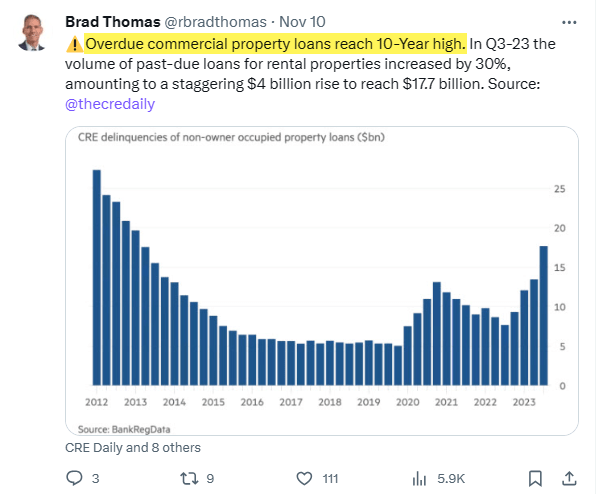

3. Office space is at 50.8% occupancy, the most since the pandemic hit in March 2020. This means that major corporate offices are only half as full as they once were — and many experts think this could be as good as it gets.

Kastle Systems – The Leader in Managed Security

Our team covers all property sectors, which means that we have terrific insight into all of the nooks and crannies of commercial real estate.

Also, because of our deep experience in commercial real estate, we can analyze all property sectors in order to design and construct portfolios with the best risk-adjusted returns.

In the battle between “good versus evil,” we recognize that risks are always relevant and by focusing on fundamental analysis we cast the light on the otherwise scary darkness and make actionable investment decisions.

As the title to this article suggests, we will now be taking a closer look at Blackstone Mortgage (NYSE:BXMT) to determine how to play it.

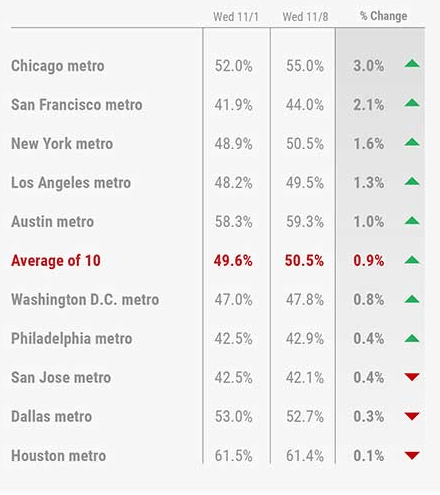

The Basic Business Model

BXMT is a commercial mortgage REIT managed by “big brother” Blackstone Inc. (BX), the largest alternative asset manager with $1 trillion of assets under management.

BX has a global footprint with 12 offices, across one fully integrated real estate platform. This “big brother” relationship enables BXMT to source leading sponsors and financial institutions.

A Look at Blackstone Inc.

BXMT IR

As most of my readers know, I typically don’t favor external management, however, with BXMT I’m making an exception. I consider the BX relationship a competitive advantage that provides unique access to attractive investments globally, and a breadth of resources to inform risk management decisions.

BXMT has a simple business model, it originates senior loans with conservative leverage, backed by institutional-quality real estate.

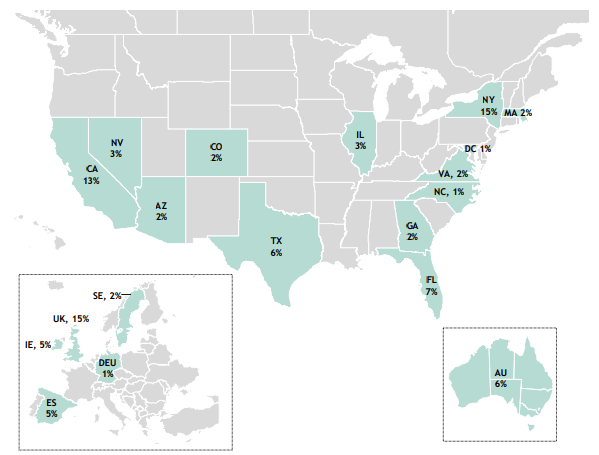

As shown below, BXMT has a well-diversified portfolio of 185 senior loans, secured by institutional assets across sectors and markets.

BXMT IR (non-US: UK 15%, Other Western Europe 15%, Australia 6%)

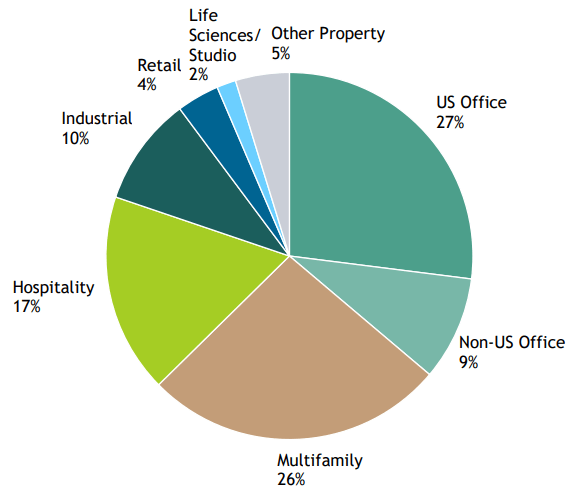

In Q3-23 BXMT owned a $22.1 billion loan portfolio secured by institutional quality real estate, with a weighted-average origination loan to value (‘LTV’) of 64%. Here’s a snapshot of the property sector diversification:

BXMT IR

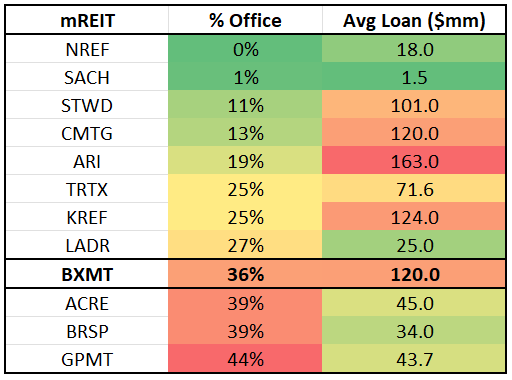

As you can see (above) BXMT has 36% exposure to the office sector with an average loan size of $120 million.

iREIT®

On the surface, BXMT is exposed to higher risks, vs. its peers, given the fact that 36% of its loans are secured by office properties, with an average loan size of $120 million.

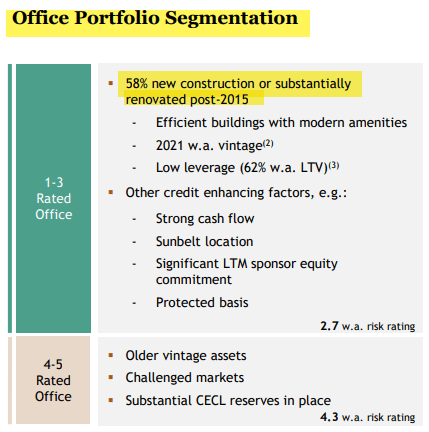

However, BXMT’s portfolio is weighted toward newer properties that have been built or renovated since 2015. This means that physical quality, amenities, and location are driving leasing decisions. In Q3-23 BXMT saw several significant leases signed in the portfolio, including flagship deals in Chicago, West LA, Miami, and New York. U.S. Office represents 27% of BXMT’s overall portfolio.

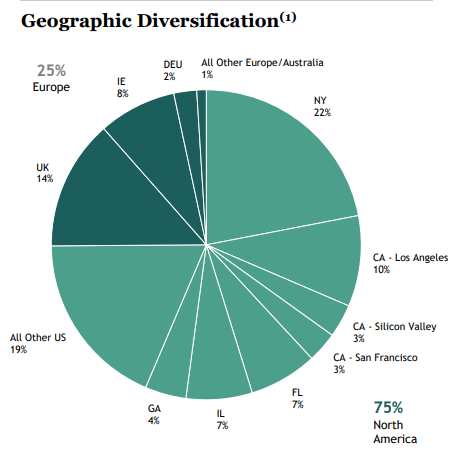

BXMT IR

In Q3-23 BXMT downgraded and recorded impairments on three previously watch-listed loans, office assets in the Bay Area and Chicago. These loans were current on interest. However, BXMT wanted to remain proactive anticipating potential deterioration ahead of maturity dates.

Furthermore, BXMT has increased its office reserve by more than 10X in the past year with marks on 5 rated loans, implying an average decline in asset value of over 50%.

Collectively BXMT has either impaired or watch-listed nearly 40% of its U.S. office loans. Nearly 60% is backed by new or substantially renovated assets where BXMT is seeing stronger leasing momentum.

BXMT IR

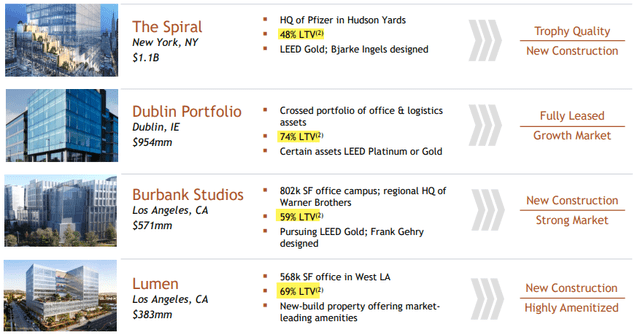

BXMT’s four largest office loans exemplify its targeted credit profile: Low-leverage loans backed by highly-amenitized, well-located assets and best-in-class sponsors:

BXMT IR

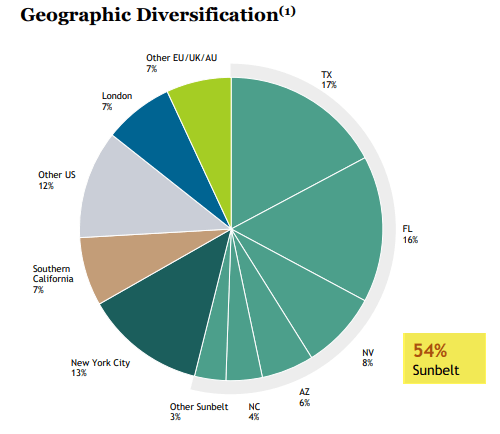

26% of BXMT’s loan portfolio is multifamily and 74% of the multifamily portfolio is located in the Sunbelt, New York City, and Southern California.

BXMT’s multifamily assets are located in markets exhibiting higher rental growth relative to the U.S. average, with less competitive new supply under construction than their respective markets.

BXMT IR

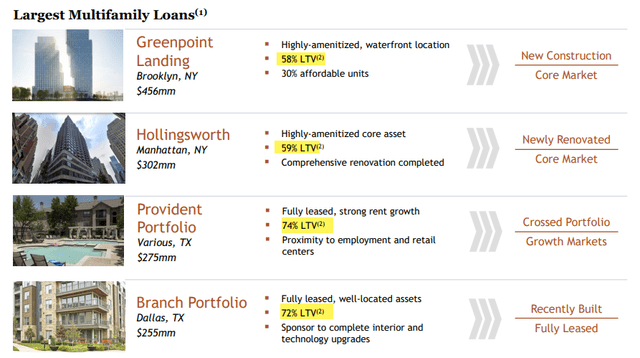

The four largest multifamily loans typify the BXMT portfolio, with a concentration in Sunbelt markets and New York City, where rent growth has shown strong momentum.

BXMT IR

BXMT’s largest multifamily asset is a newly constructed trophy building in Brooklyn that’s nearing completion of its lease up at rents well above the initial underwriting. This has resulted in a projected debt yield nearly 100 basis points higher than the base case.

BXMT’s multifamily portfolio, 68% origination LTV on average remains well positioned to perform.

The Balance Sheet

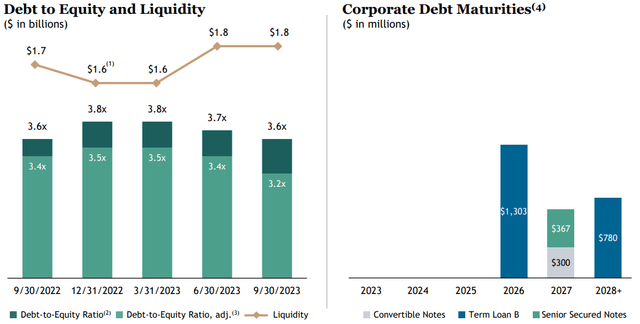

BXMT maintains record liquidity of $1.8 billion, up from $1.6 billion at the start of 2023, despite a net repayment of $1.1 billion of debt so far in 2023. Leverage declined by 0.1x quarter-over-quarter.

As seen below, there are no corporate debt maturities until 2026 and no capital markets margin call provisions across term-matched credit facilities.

BXMT IR

Managing Credit

Even in this volatile environment, BXMT’s portfolio remains resilient with 95% of loans performing (5% on cost recovery) although there’s obvious negative credit migration.

BXMT’s watch list represents 13% of the portfolio – loans that are a focus of asset management efforts but remain current and performing.

In Q3-23 BXMT upgraded seven loans and downgraded five loans with a stable weighted-average risk rating of 2.9.

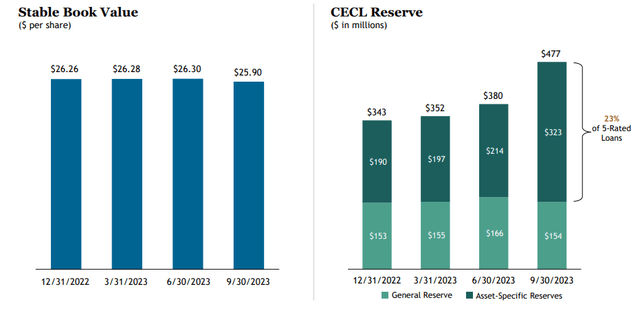

CECL (Current Expected Credit Losses) reserves in Q3-23 were $477 million, over 3x the prior year level, with significant reserves established on 5-risk-rated loans, averaging 23% of a loan cost basis.

BXMT IR

Earnings and Dividends

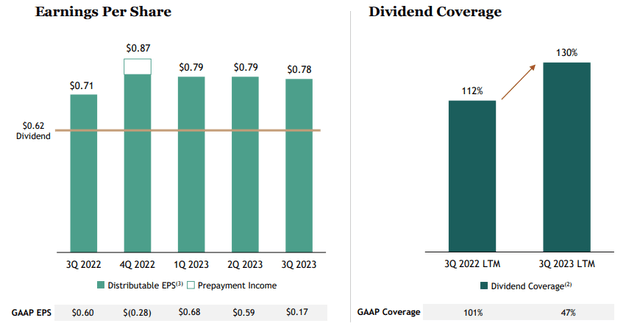

In Q3-23, BXMT generated distributable EPS of $0.78 that provide for robust dividend coverage and support book value ($25.90 per share down just 1% year-to-date).

BXMT paid a Q3-23 dividend of $0.62 per share, equating to an 11.2 annualized dividend yield with substantial dividend coverage of 130%. BXMT’s excess earnings add to its equity base and cushion the impact of credit migration.

BXMT IR

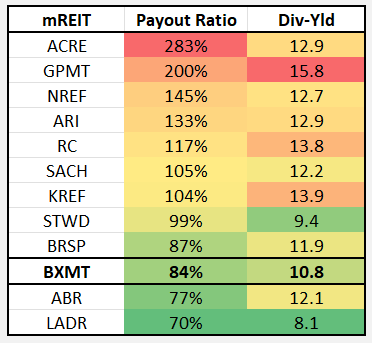

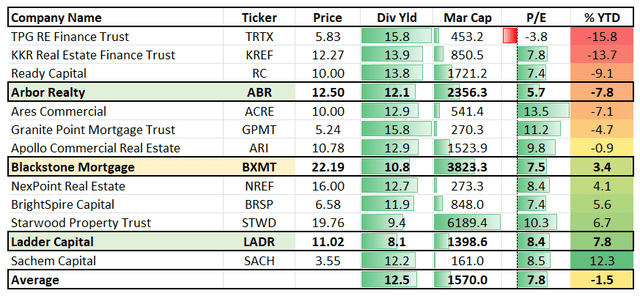

As you can see below, BXMT is one of the safest commercial mREITs based upon its low payout ratio (used 2023 analyst estimates):

iREIT®

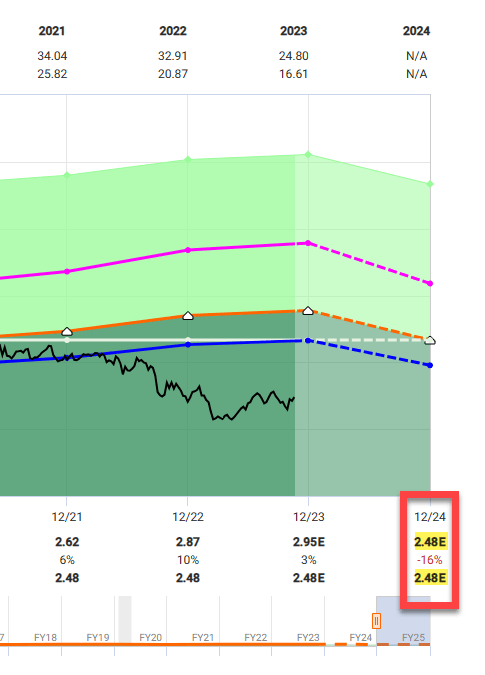

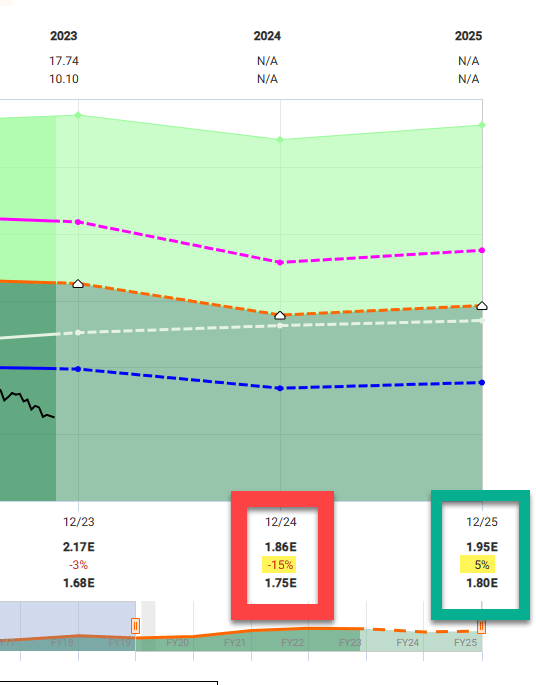

However, as seen below, analysts forecast BXMT to generate EPS of $2.48 in 2024, which translates into negative growth of -14%. This would put the payout ratio at 100% (that’s an average of seven analysts for the 2024 consensus estimate).

FAST Graphs

This puts the dividend at a much higher risk.

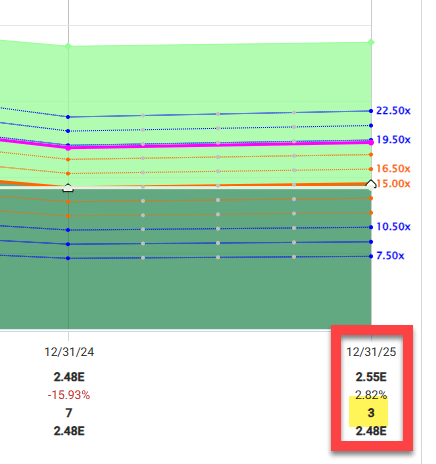

There are three analysts that provide estimates as far out as 2025 and the average target puts BXMT’s EPS at $2.55 or ~3% growth.

This means that there’s more cushion for the $2.48 dividend, assuming the consensus is accurate.

FAST Graphs

How I Play It

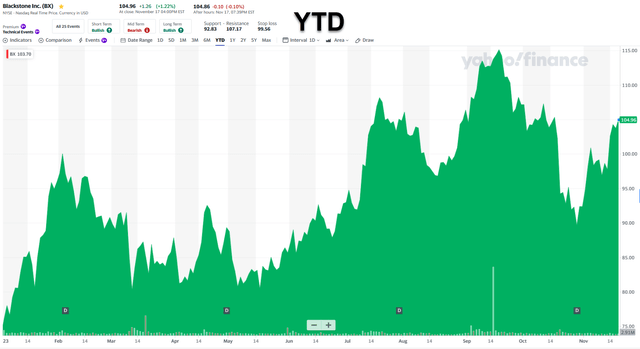

I’ve been long BX, which means that I’m happy with the performance of this big, bad asset manager.

However, I’ve decided to trim shares (+40% in 2023).

Yahoo Finance

I’m also long BXMT (even right now) and I own several other mREITs, including:

- Ladder Capital (LADR) +11% (my portfolio)

- Starwood Property Trust (STWD) +12% (my portfolio)

- Arbor Realty Trust (ABR) -.55% (my portfolio)

- Chicago Atlantic Real Estate Finance (REFI) -1.0% (my portfolio)

- Blackstone Mortgage +1.0% (my portfolio)

Given the elevated office exposure (with BXMT) and outlook (2024 consensus estimates) I’m not increasing exposure.

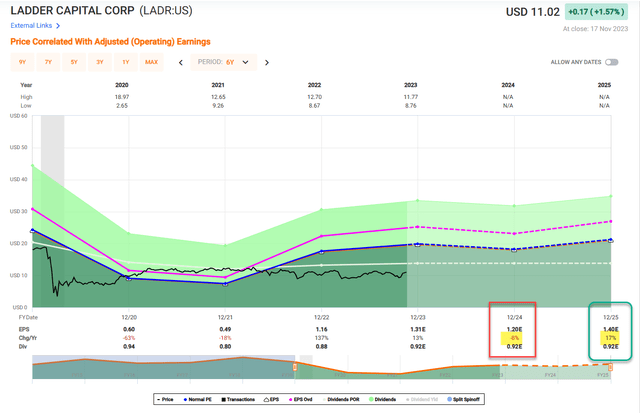

I’m taking a few BX chips off the table to redeploy back into LADR, which also has negative growth forecasted in 2024, but a much better payout ratio.

FAST Graphs

I also like the fact that LADR is much more diversified, with limited office exposure.

Furthermore, LADR is better positioned to capitalize on loans in the $20 mm to $40 mm range given the fact that banks have reduced CRE exposure and debt maturities are increasing. LADR has around $900 million in cash with low leverage (1 to 1).

I also see LADR becoming investment grade in short order as the company has been actively paying off its secured debt (and coming into compliance for IG status).

Bottom Line: LADR is a dividend grower

I’m also adding a few more chips to ABR, given the pullback last week (due to a short report). This specialty mREIT has $1.1 billion in cash and should have no problem paying out a dividend.

Both LADR and ABR have solid insider ownership with buybacks in place: 10% and 12%, respectively, (one negative for external management is buybacks).

ABR has a negative growth of 15% in 2024 (consensus estimates), however, there’s plenty of cushion for the dividend, and 5%-plus growth in 2025.

FAST Graphs

In preparation for the clouds that are forming in the commercial mREIT sector, I’ve decided to allocate capital to the companies that are best positioned to outperform.

The yields in the sector are obviously appealing, but it’s important to maintain strict discipline to prevent possible dividend cuts in my portfolio. As mentioned, I plan to keep modest exposure in BXMT, while trimming BX by at least 50%.

I view LADR and ABR are better alternatives with enhanced total return prospects.

As always, thank you for reading and I look forward to your comments below.

iREIT®

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.