Spencer Platt

Investment thesis

BlackRock (NYSE:BLK) needs no introduction as it is one of the world’s largest asset managers in the world. I think that the company’s fundamentals continue to show relative strength and it is well positioned to remain as the best-in-class asset manager in the world given its consistent commitment to investing for the future.

That said, I think that BlackRock is currently fairly valued. With the AUM trending down and net flows decelerating, I think that we will see a risk in the near-term that BlackRock will see net outflows given the uncertain and pessimistic market conditions today. In addition, BlackRock’s ESG stance has ironically created a risk to its business as there are some who are opposed to their push towards ESG-driven investing, potentially leading to some losses in customers and funds along the way.

Worrying net flows and AUM trends

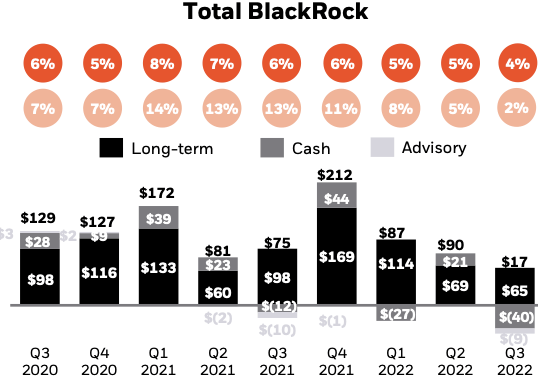

As can be seen below, since 4Q21, the organic growth of BlackRock’s total flows have seen deceleration from 11% growth in 4Q21 to 2% growth in 3Q22. However, I would also like to point out that the figure for 3Q22 is slightly inflated below as BlackRock received about 45% of the previously announced AIG (AIG) mandate, which totals about $140 billion in total, in the current 3Q22 quarter which was also reflected below. Stripping away the 45% of the AIG mandate received would have led to materially lower growth rates for 3Q22.

BlackRock net inflows (BlackRock IR)

With the continued deceleration of organic growth to 2% in the current quarter, I could expect net outflows in the near-term as the global macroeconomic environment continues to be weak and the demand for fixed income remains to be poor. In short, the challenging backdrop in which BlackRock operates in today is posing some challenges to the company’s business as near-term net flows will likely be negative given the market conditions we see today.

A huge drag to the business remains to be the $40 billion in cash management outflows given that institutions and corporate clients likely could access the direct markets for better cash yields.

Naturally, we would also expect BlackRock’s assets under management (“AUM”) to fall in 3Q22 and come under pressure due to the current market conditions. In 3Q22, BlackRock’s AUM fell by 16% year on year to about $7.96 billion, even as the company brought in positive net flows given the sell-off we have seen across asset classes. By asset class, fixed income attracted $91 billion of long-term net inflows while equities and currency & commodities saw net outflows of $29 billion and $8 billion, respectively. The large amount of net inflows for the fixed income asset class should be put into context given that a large majority of that likely came from the remainder of the flows from AIG.

Cost control

BlackRock continues to actively manage its cost base while also re-investing into the business. The company’s 3Q22 adjusted operating margins was down 560 basis points to 42% from the prior year. This was a result of challenging market movements as well as continued strategic investments into its technology and people

Management continues to reiterate that they will be consistent in making the strategic investments that will be made regardless of where we are in the market cycle. I think that what differentiates BlackRock is their relentless push for investments into their critical areas even during tough market conditions that enables them to grow faster than their peers and the ability to do so comes from a platform with a large scale, diversification and relative stability compared to competitors.

That said, management is aware that this market environment may be different from others and has intentionally reduced discretionary spending to be more cautious and also have paused non-critical hiring for the rest of 2022.

Management reduced their core G&A expenses guidance for the full year down from 15% to 20% previously to 13% to 15% today. The reduced guidance and conservatism in G&A expenses is definitely a great early move in anticipation for market headwinds. In particular, I think that this shows that management is able to be pragmatic and flexible in managing expenses as market conditions change. Ultimately, by balancing organic growth and optimising current spending levels, this will ensure that it remains well positioned for an uncertain 2023.

ESG stance brings risks

BlackRock is in a difficult place with regards to its ESG stance. While BlackRock continues to stay its course, there are some politicians and investors that think that the company is not doing enough to promote its ESG products while there are others who see BlackRock as having done too much.

BlackRock has been an early adopter of ESG in its fund management and shareholder proxy activities and is positioned in the industry as an ESG leader, in my view. However, this early advantage has led to increased political risk and regulatory scrutiny as not everyone, investors and politicians alike, are aligned to BlackRock’s push towards ESG. In my opinion, rationally, investors would see BlackRock’s ESG push a positive one as this brings incremental future opportunity while positioning itself as supportive of ESG practices would technically bode well for its brand reputation. In addition, I think that the significant sales that we are seeing from BlackRock’s ESG products means that there is a demand for these ESG-driven investing.

That said, BlackRock has seen a loss of actual mandates as a result of this, as seen by the loss of $800 million from the Louisiana State Treasurer for “anti-fossil fuel policies”. I think that BlackRock’s proactive ESG stance may risk the further loss of mandates. More than 19 red-state attorneys general told BlackRock CEO that its ESG investing violates their laws governing fiduciary duties and that the net-zero carbon emissions agenda sacrifices that.

In addition, there are risks that with the increased regulatory scrutiny, the discussions about BlackRock being a G-SIFI may resurface and cause incremental cost headwinds to the business. Also, some may take issue at the concentration of BlackRock’s market share in ETFs given the heightened regulatory scrutiny. As such, the current ESG debate for BlackRock may bring unintended consequences for a company trying to benefit from the new wave of ESG-driven investing.

Valuation

My 1-year price target for BlackRock is based on an equal weight DCF method as well as P/E multiple method. For my DCF, my key assumptions are a discount rate of 10% and I model BlackRock’s financials 5 year forward, and for my P/E multiple method, I assume an 18x P/E for the 1-year forward multiple. As such, I derive a 1-year price target of $660, implying a downside potential of 10% from current levels.

According to Bloomberg, BlackRock is currently trading at 21x 2023 P/E and 19x 2024 P/E. Putting this into context, BlackRock has a historical 5-year average P/E of about 20x and this period was a relative favourable operating environment for BlackRock, with higher EPS growth than we are seeing today. Based on my estimates, BlackRock’s earnings per share CAGR for 2023 to 2024 is around 6% EPS growth.

While I would prescribe a premium multiple to BlackRock given its stronger fundamentals and its position as the best-in-class asset manager, I am also concerned about the recession risk ahead of us, which might see a prolonged period of outflows for the company as well as a risk of prolonged period where fixed income remains out of favour. As such, I think that based on relative valuations, BlackRock does seem fairly valued at this point.

Risks

Large base effect

BlackRock manages almost $8 trillion in AUM today, which would imply a need for at least $100 billion in net new sales each quarter to drive an annual 5% organic growth rate. While I think that BlackRock is the best of the breed asset manager, the large size and scale it is at today may be the key reason for a slower growth rate in the future. Investors may start to look for opportunities outside of BlackRock to find companies with better growth opportunities due to the opportunity costs involved.

Fixed income weakness

With continued rising rates, fixed income assets have performed poorly as it has remained out of favour in 2022. As a result, if fixed income continues to remain out of favour for a longer period of time, this could mean elevated redemptions from the company’s fixed income segment. Given that BlackRock has a large fixed income mix, this will therefore have a huge impact on the company’s near-term ability to grow.

Multiple compression

The current 1-year forward 21x P/E for BlackRock certainly does not yet take into account the risk of a recession scenario or a prolonged downturn. As such, I would expect BlackRock’s valuation has the opportunity to come down further before I am constructive on the stock. Furthermore, a slower organic growth profile as a result of a large base might also mean that investors are less willing to give BlackRock as big a premium as they used to.

Conclusion

I initiate BlackRock with a neutral rating. I think that BlackRock’s shares are currently fairly valued given the challenging market conditions and risks ahead of it. With market conditions having no signs of improving and an impending recession scenario, this will be negative for BlackRock’s AUM and net flows in the near-term. Furthermore, while its focus on ESG-driven investing should be an incremental benefit to the business, there are now debates on whether the company has done too much or too little for its promotion of its ESG products and there has been loss of mandates as a result of this. I think that the risk-reward perspective for BlackRock is fairly balanced at the moment, with skews towards the negative if we do reach a recession or a prolonged downturn that could result in more challenging market conditions for BlackRock to operate in. My 1-year price target of $660, implying a downside potential of 10% from current levels.