J Studios/DigitalVision through Getty Photos

Lengthy-time readers know I have been bullish on short-term and variable fee bonds since mid-2021, as skyrocketing inflation was nearly actually going to lead to larger charges. I have been bullish on senior mortgage ETFs too, together with the benchmark Invesco Senior Mortgage ETF (NYSEARCA:NYSEARCA:BKLN), in spite of their excessive expense ratios, as financial situations appeared favorable sufficient to beat their bills.

Financial situations appeared to have stabilized by now, with below-target inflation and (nearly sure) fee cuts within the coming months. Below these situations, senior loans are unlikely to materially outperform, BKLN’s 0.65% expense ratio is a vital drag on its efficiency, and a deal-breaker for me. As such, I’d not be investing within the fund at the moment.

BKLN – Overview and Evaluation

Technique and Portfolio

BKLN is an index ETF specializing in senior loans, that are nearly at all times senior secured variable fee loans from non-investment grade companies. BKLN’s underlying index is sort of broad, so the fund ought to transfer alongside senior loans as an asset class, with out important below or overperformance.

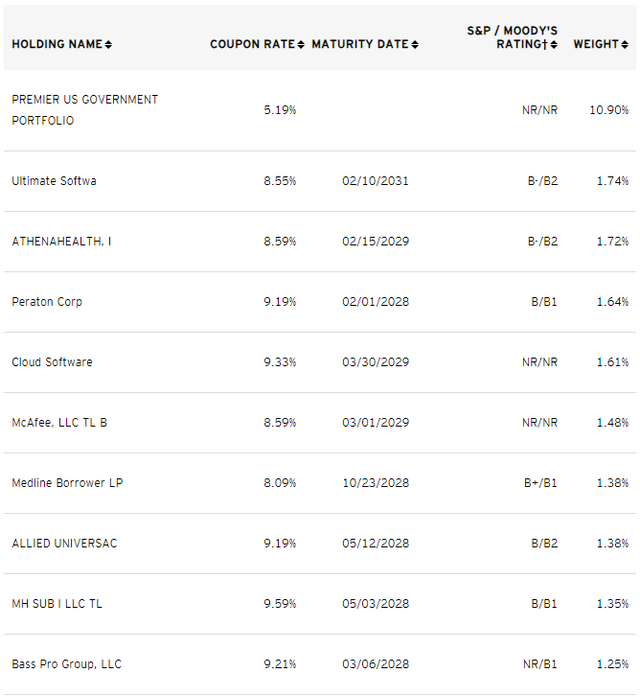

BKLN at the moment invests in over 160 loans. Largest of those are as follows:

BKLN

Curiosity Charge Danger

Some context first.

Most bonds are fixed-rate bonds, and so pay the identical coupon from issuance till maturity. Purchase a 4.25% yielding 10y treasury immediately, and you’ll obtain 4.25% in earnings yearly for the following ten years, no matter what the Fed or the market does.

Charges on treasuries issued sooner or later would possibly change although. Vital fee cuts later within the yr would nearly actually result in decrease coupon charges for treasuries issued later within the yr, older issuers would retain their larger charges. Investor demand for these older, higher-yielding treasuries would improve, resulting in larger costs. Bond funds invariably give attention to older bonds, and so would see capital features / larger share costs from important fee cuts.

Decrease charges would have the alternative impact.

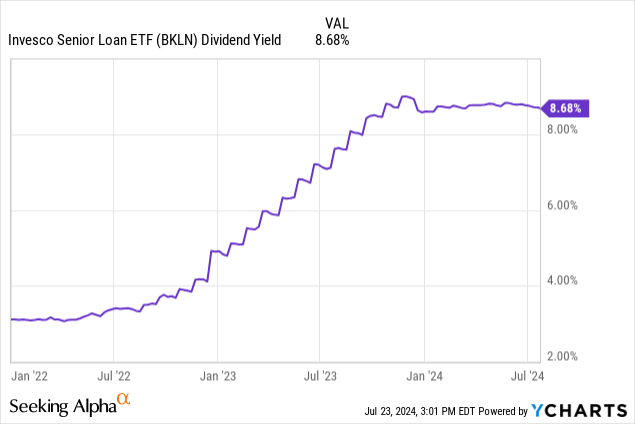

Senior loans are not fixed-rate investments, however variable. Simplifying issues a bit, senior loans are listed to particular benchmark charges, and see larger coupon charges when the Fed hikes, and vice versa. BKLN’s yield has elevated by 5.7% because the Fed began to hike, broadly in-line with Fed hikes.

Knowledge by YCharts

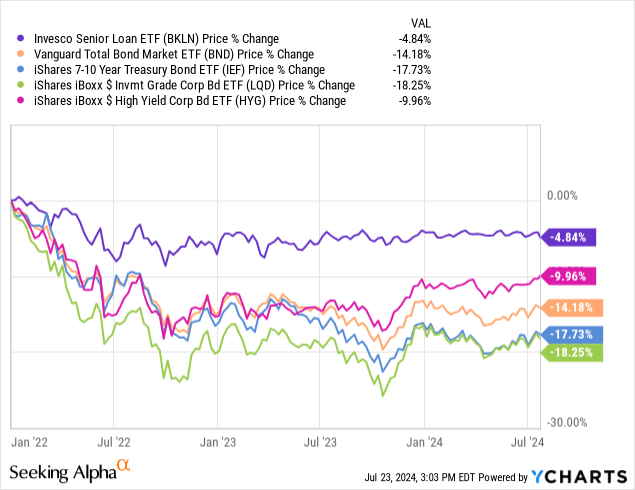

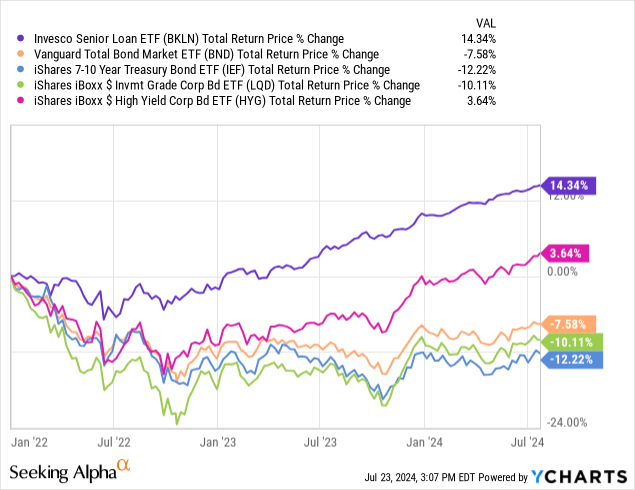

As a result of above, senior mortgage costs usually are not considerably impacted by adjustments in rates of interest. For example, BKLN’s share worth is down solely 4.8% since early 2022, in comparison with double-digit declines for many bonds and bond sub-asset courses.

Knowledge by YCharts

Senior loans are inclined to outperform when charges rise, as has been the case since early 2022.

Knowledge by YCharts

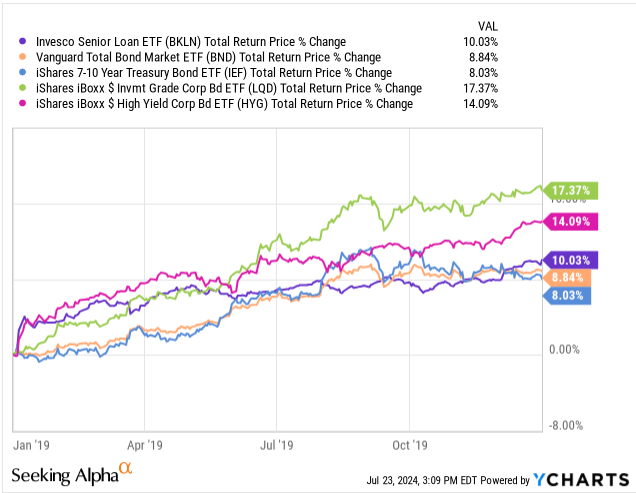

On the flipside, senior loans have a tendency to underperform when charges lower. Excluding the pandemic, final time charges had been down was in 2022, throughout which BKLN underperformed fixed-rate bonds of comparable credit score high quality (high-yield bonds). It outperformed most bonds and treasuries although, resulting from its above-average yield and credit score spreads tightening. Charges are positively not the solely consideration, however positively an vital one.

Knowledge by YCharts

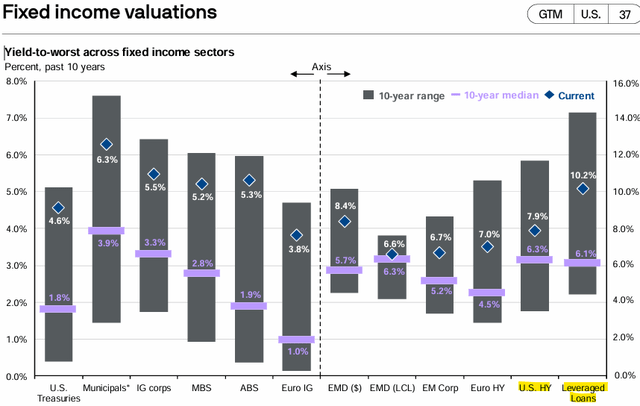

Senior mortgage and BKLN’s yield are each set to say no because the Federal Reserve cuts charges later within the yr. Each commerce with sizable spreads relative to high-yield bonds too, sizable sufficient that yields ought to stay aggressive for just a few years. As per JPMorgan, spreads are at 2.3%.

JPMorgan Information to the Markets

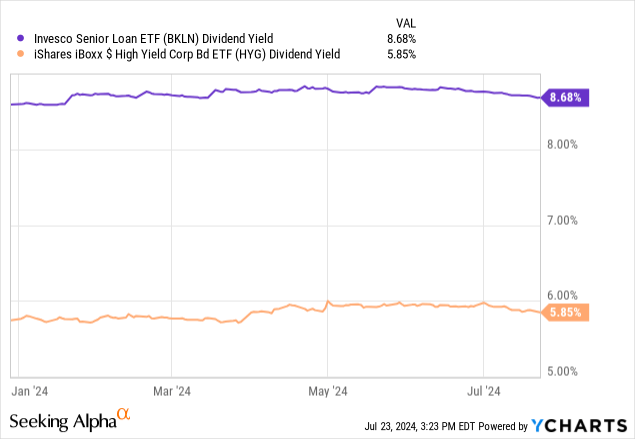

BKLN itself yields 2.8% greater than the most important high-yield bond ETF (spreads are tighter for a few of its friends although).

Knowledge by YCharts

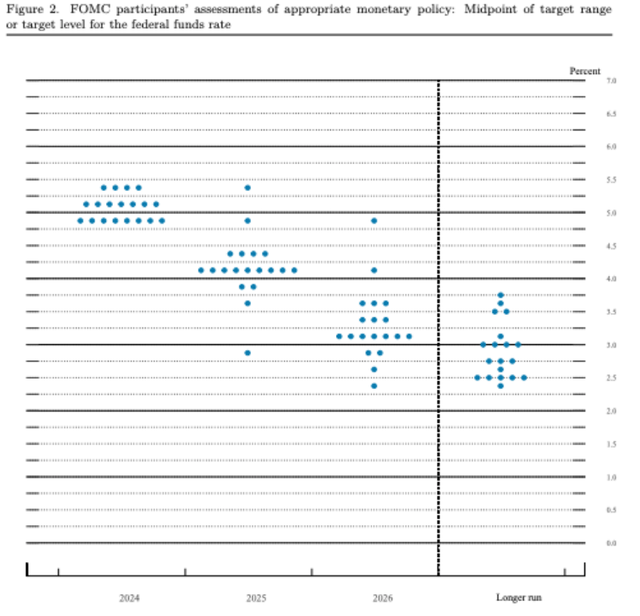

Present Fed steering implies senior loans persevering with to out-yield bonds till at the very least 2026, maybe long-term.

Federal Reserve

Below present market situations, and contemplating Fed steering, senior loans may proceed to carry out fairly effectively even because the Fed cuts charges later within the yr. Yields ought to stay larger than common for a number of years, which ought to assist stabilize share costs. Excessive-yield bonds would nearly actually outperform if charges plummet, however not if these stay larger for longer, or see sluggish, methodical cuts.

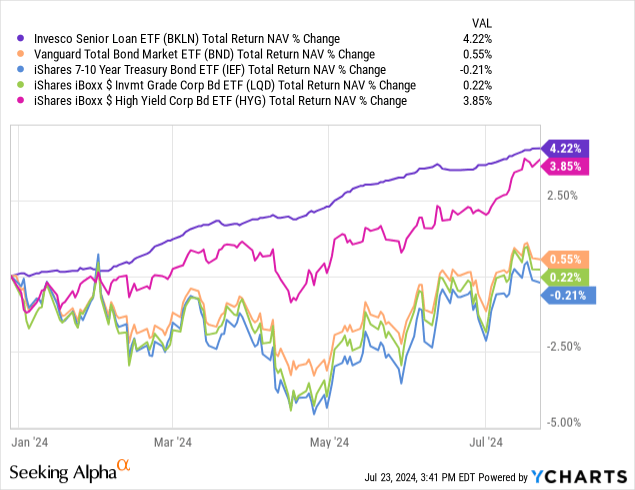

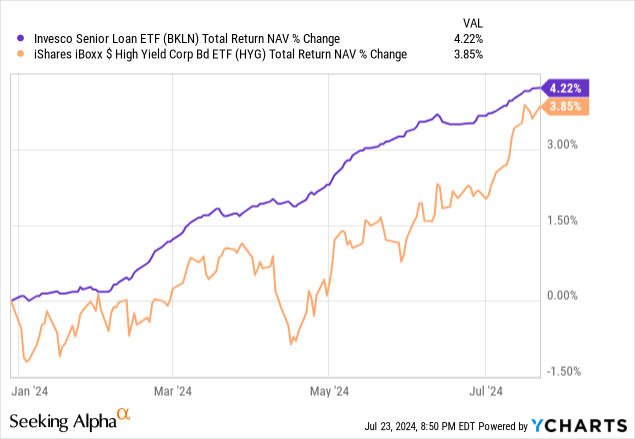

As a (partial) instance of the above, BKLN has outperformed most bonds and bond sub-asset courses YTD although charges are flat. Outperformance may actually proceed if charges are solely reduce 0.25% – 0.50%, however extra important fee cuts would put a lot higher strain on the fund’s efficiency.

Knowledge by YCharts

Credit score Danger

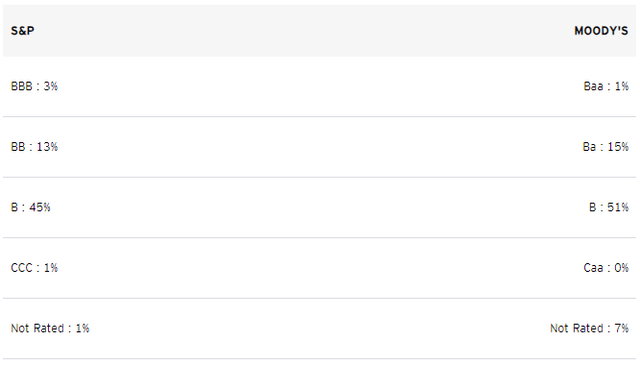

BKLN focuses on non-investment grade loans, with these accounting for 97% – 99% of its portfolio, and with a mean credit standing of B. Total credit score high quality is low and below-average, though not excessively so.

BKLN

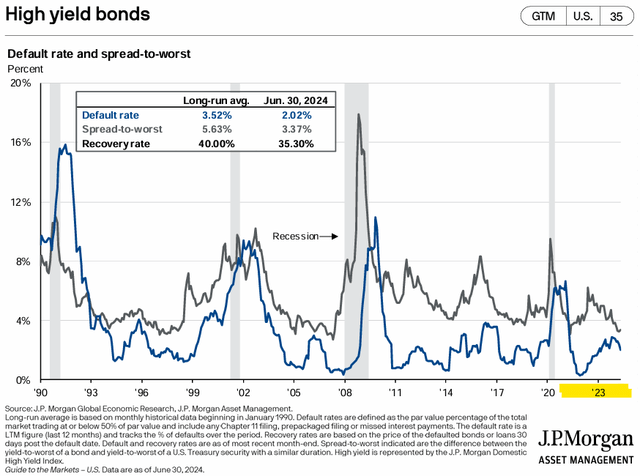

Present financial situations favor high-quality investment-grade investments and securities, not BKLN’s low-quality loans. Particularly, credit score spreads have tightened as default charges rise, that means these riskier loans are seeing larger dangers, decrease (comparative) yields, and below-average risk-adjusted returns and yields. Knowledge as per JPMorgan, give attention to the decrease left of the graph.

JPMorgan Information to the Markets

The above is a vital detrimental for the fund, and drawback relative to higher-quality variable fee ETFs, together with the Janus Henderson AAA CLO ETF(JAAA) and the Janus Henderson B-BBB CLO ETF (JBBB).

Expense Ratio

BKLN has an expense ratio of 0.65%, larger than common for an index ETF, and a lot larger than that of a number of sturdy ETFs. The SPDR Portfolio Excessive Yield Bond ETF (SPHY), as an example, has an expense ratio of solely 0.05%. JBBB prices 0.49%, comfortably decrease than BKLN, although CLOs are considerably area of interest investments (much less competitors, much less strain on charges). Senior mortgage ETFs are typically dear, with the Franklin Senior Mortgage ETF (FLBL) having the bottom expense ratio of 0.45%.

I’ve at all times thought of BKLN’s expense ratio to be a major detrimental, because it essentially results in decrease yields and returns to shareholders. The truth that bills are a sure detrimental is vital. There may be a variety of uncertainty when investing: valuations would possibly by no means enhance, dividends would possibly get reduce, the Fed would possibly reduce or hike charges, and financial situations would possibly enhance or worsen. Bills are at all times a detrimental, so avoiding costly funds is nearly at all times useful. Sufficiently favorable financial situations would possibly outweigh excessive bills, they did for me earlier within the yr, however situations are merely not favorable sufficient. As such, and in my view, I’d not be investing in senior loans or BKLN proper now.

BKLN – Trying Again

I final coated BKLN earlier within the yr. I used to be bullish then, extra impartial now, so thought to elucidate my reasoning.

In brief, spreads have tightened, rate of interest cuts are nearer, and uncertainty concerning inflation and the tempo of fee cuts has decreased. These adjustments make senior loans much less enticing investments than earlier than and have triggered my opinion on these to alter.

One other problem is that situations YTD have been considerably favorable to senior loans, and BKLN has barely outperformed high-yield bonds since. Situations must enhance for efficiency to do the identical, and I do not merely do not see how that would occur.

Knowledge by YCharts

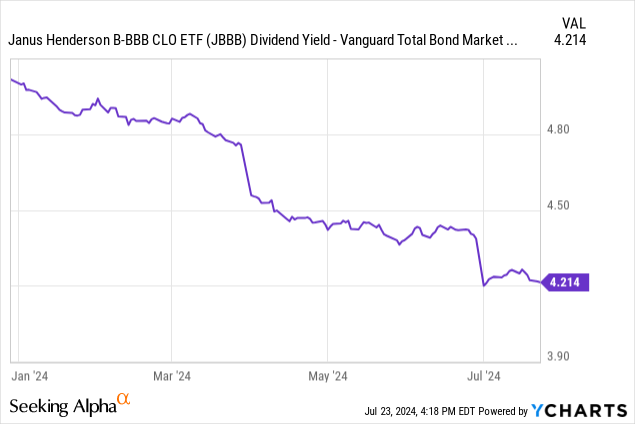

I stay bullish on cheaper, higher-quality variable fee ETFs although, as these do commerce with wholesome spreads relative to fixed-rate friends. For example, JBBB’s 7.6% dividend yield is round 4.2% larger than that of most bonds. Steering is for lower than 4.2% in long-term cuts, so JBBB’s dividend yield ought to stay aggressive long-term. Comparable state of affairs for a number of different ETFs on this house, together with JAAA and CLOZ.

Knowledge by YCharts

Conclusion

BKLN is an index ETF specializing in senior loans. BKLN’s above-average 0.65% expense ratio is a fabric drag on its efficiency, and a deal-breaker for me.