ryasick

Investing in corporate credit at this point in the cycle is risky to me, given just how narrow credit spreads are. Having said that, there is still opportunity, so long as you access the space by limiting exposure to overpriced and vulnerable bonds. That’s why the BNY Mellon High Yield Beta ETF (NYSEARCA:BKHY) is interesting to me. BKHY is a relatively new entrant in the junk bond ETF space, having launched its operations in April 2020. Despite being a newcomer, BKHY has made notable strides, managing to outshine some of the well-established players in the high-yield market, such as the SPDR® Bloomberg High Yield Bond ETF (JNK).

What sets BKHY apart from its counterparts is its cost-competitive structure and its unique approach to investing. It straddles the line between passive and active management, aiming not to beat but match the high-yield index using its proprietary credit model. This model is designed to systematically limit exposure to overpriced or low-quality bonds, thereby mitigating the downside risks associated with the volatile high-yield market.

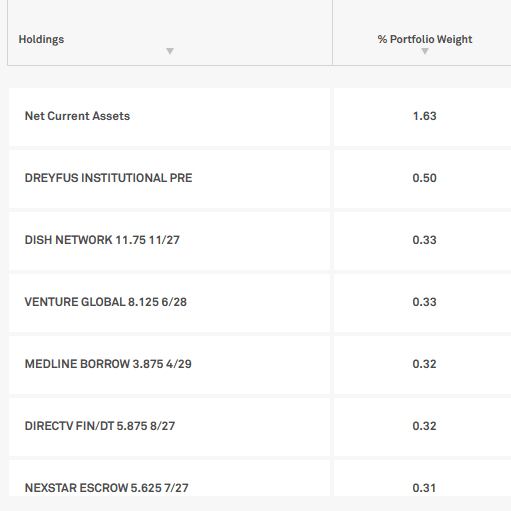

Unpacking the Fund’s Holdings

BKHY includes a wide range of bond holdings, spreading its investments across a large number of individual positions. This wide diversification is a strategic move aimed at mitigating the risks associated with investing in high-yield, speculative-grade bonds. No position makes up more than 0.5% of the fund, making this very well diversified overall.

bnymellon.com

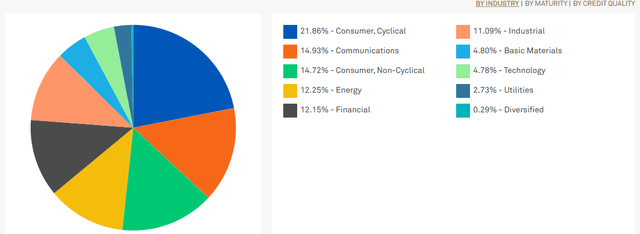

Sector Composition and Weightings

When we look at the sector exposure of the bond positions themselves, Consumer and Communication dominate the holdings, followed by Energy and Financials. This isn’t surprising given that many consumer-oriented debt issuers have not-so-insignificant credit risk, and good yield.

bnymellon.com

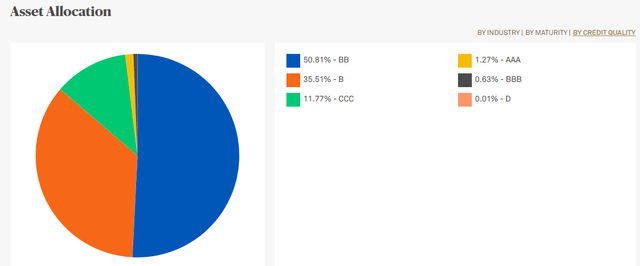

As to credit quality, this is primarily focused on BB rated issuers, which make up over 50% of the portfolio. A small amount are considered junk at 11% roughly. This is an important consideration, as it means there clearly is default risk. Having said that, assuming the credit model being used by the managers weeds out mispriced bonds properly, and with diversification as high as it is, overall risk is likely mitigated.

bnymellon

Peer Comparison: BKHY vs. Similar ETFs

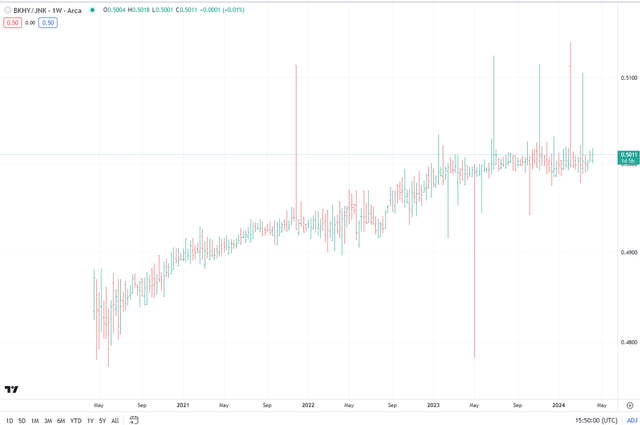

While BKHY has shown promising results in its short tenure, it’s essential to compare it against other similar ETFs to evaluate its relative performance. One of the most popular ETFs for investing in junk bonds is the SPDR® Bloomberg High Yield Bond ETF (JNK). BKHY has outperformed, and the price ratio of BKHY to JNK looks like it continues to trend higher for now.

tradingview.com

The Pros and Cons of Investing in the Theme BKHY Tracks

BKHY tracks the high-yield, speculative-grade bond market, a theme that’s not without its share of pros and cons.

The Pros

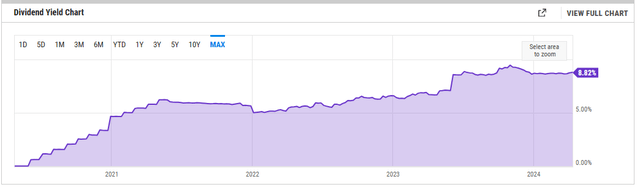

1. High Yield: As the name suggests, high-yield bonds offer higher interest rates than their investment-grade counterparts, potentially leading to higher returns for investors. The yield currently is the highest we’ve seen for a while at 8.82% according to YCharts.

ycharts.com

2. Diversification: Investing in BKHY allows investors to diversify their portfolios, thereby reducing their overall portfolio risk.

The Cons

- High Risk: High-yield bonds, also known as junk bonds, are rated below investment grade, indicating a higher risk of default. I still very much worry about credit spreads here, but I’ve also been wrong in my timing. So it’s more of a macro call to me than anything else. Hopefully, this fund’s screening process mitigates that risk overall.

- Interest Rate Risk: High-yield bonds are sensitive to changes in interest rates. As rates rise, bond prices typically fall, which could lead to losses for investors. Having said that, the duration is just 3.15 years, so it’s not as sensitive as other bond funds.

Conclusion: To Invest or Not to Invest?

While BKHY’s cost-competitive structure at 0.22% and broad diversification may appeal to some investors, its exposure to high-risk, speculative-grade bonds may be a deterrent for risk-averse investors. As mentioned, this is more of a cycle question to me. I think it’s a good fund and I like the screening and low duration characteristics it brings to the table. It’s just a question of when the right time to initiate a new position is.