dulezidar

ProShares Bitcoin Strategy ETF (NYSEARCA:BITO) is one of the first Bitcoin based ETFs, and it was launched in late 2021. The fund doesn’t directly invest into Bitcoin, but rather invest into Bitcoin futures contracts and roll them every month. The fund’s goal is to track the price of Bitcoin futures as closely as possible. This year, investors “woke up” to a surprise. The fund suddenly started paying dividends. Not only was it paying dividends, but it was yielding well into double digits. This made people wonder where these dividends are coming from and if they can treat this fund as an income play. I’ll try to explain what’s going on in this article.

The fund trades Bitcoin future contracts, which is a bit different than holding Bitcoin outright. Why? Because you can buy and hold Bitcoin forever if you choose, and you might never have to roll your position unless you want to add to your position or reduce your position. If you bought a position of 1 Bitcoin, that 1 Bitcoin is basically yours to hold forever. Futures contracts don’t work like that because they have expirations. You have to buy a contract that comes with an expiration date and when that date arrives you have to settle this contract. Remember, futures are not like options where you can choose to exercise them or not. Buying a futures contract actually gives you an obligation to settle your position either with cash or by taking deliver of goods (in this case Bitcoin).

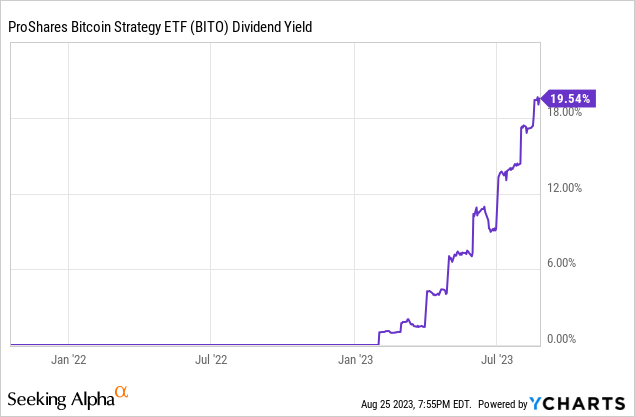

When the expiration time comes, BITO rolls its futures contracts to a later date, and the fund intends on doing this forever. This creates a “problem” for the fund, though, and this is where the rich dividends come from. Sometimes when Bitcoin price is rising, rolling those futures contracts result in booking a profit for the fund. According to Investment Company Act of 1940, all mutual funds and ETFs that book a profit in a given year must either distribute all those profits to investors (in dividends) within that year or face steep taxes. So this is why BITO suddenly started to pay those dividends and the fund’s yield jumped from 0% to 20% in a matter of months.

As a matter of fact, the fund’s latest monthly distribution came at $0.3849 which gives us an annualized yield of 35%.

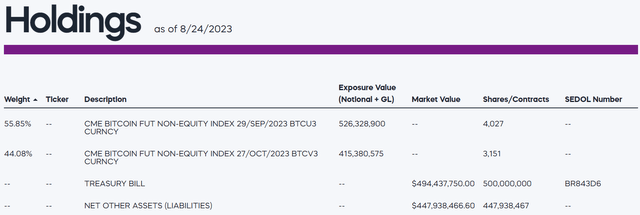

I’ve actually seen some comments on message boards claiming that BITO sells covered calls on Bitcoin, but this is not true. The fund doesn’t do such thing. When you look at the fund’s current holdings, all you see are two sets of futures contracts expiring in September and October (plus some treasury bills it holds as collateral). As a matter of fact, as of writing of this article (8/25) there are no Bitcoin based covered call funds in the US. There are a few in Canada, but most American brokerages don’t have them. I suspect we will see some in a few years, but we simply don’t have any right now. Technically, one can’t sell covered calls on Bitcoin itself, but one can sell covered calls on Bitcoin futures.

BITO holdings (ProShares)

Now you might think that the fund has a rich dividend yield, so this must be a great income play, but this is probably not true. First, the fund can only book a profit as long as the price of Bitcoin is rising. Otherwise, the fund has no way of booking a profit. When you buy this fund for dividends, you are basically making an assumption that the price will rise forever, and in reality it may or may not rise. The sustainability of the dividend payments will be in question forever as they will depend on price appreciation of Bitcoin. At that point, you might as well buy a large Bitcoin position and start selling small chunks of it for income.

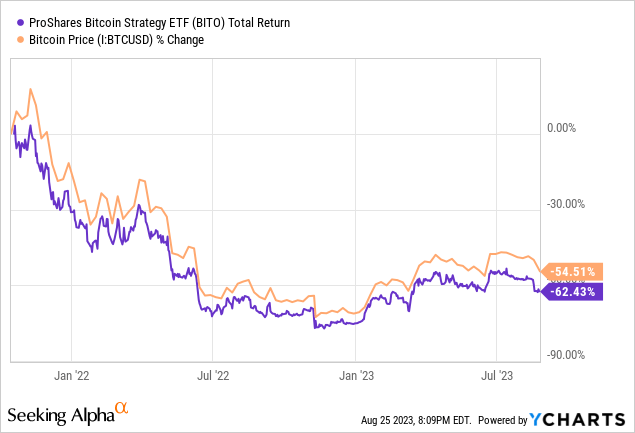

The second problem is that this fund will be in constant decay due to having to roll those futures contracts. Those of you who are familiar with trading options and futures contracts know that rolling a contract from one month to the next has costs because of time decay and implied volatility. Some funds even make money from this phenomenon by shorting certain futures contracts (for example, SVOL shorts VIX futures every month) and take advantage of this. This is why this fund will almost certainly underperform the performance of Bitcoin. Since its inception, the fund’s total return is down -62.4% as compared to Bitcoin, which is down -54.5% during the same period. This is another reason BITO might not be a sustainable dividend play.

This fund is more suitable for short term trading. For example, if expect Bitcoin to jump in the next month or two, you can buy a position and sell it after it reaches your price target. Holding this fund in the long term might result in underperformance. If your goal is to buy and hold Bitcoin in the long run, you might as well just buy and hold Bitcoin instead of paying for time decay plus an ETF fee for BITO.

One of the biggest issues with Bitcoin is that it’s impossible to calculate a fair valuation for it. The asset has no income, no cash flow, no dividends, and it’s just something that trades based on what people think it is worth which seems to change wildly from day to day, hour to hour and even minute to minute (not to mention 24/7). This is also true for precious metals such as gold, and I usually stay away from things that I can’t value properly. Still, I bought a small position in Bitcoin as a speculative position just in case it rises significantly and this makes up less than 1% of my total portfolio value, so I wouldn’t lose sleep over it even if it dropped to zero. I am not saying investors should avoid Bitcoin altogether, but if they must invest in Bitcoin, it would be wise to either keep it as a small percentage of your portfolio or hedge your portfolio somehow.