da-kuk

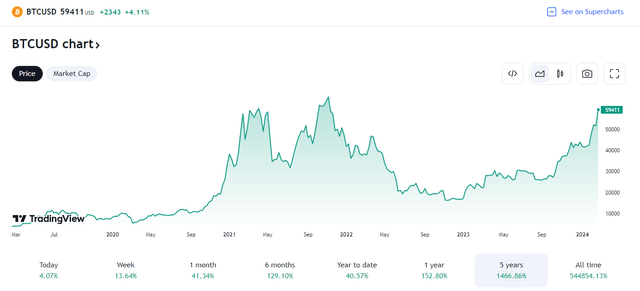

Bitcoin has eyes on the $60,000 level. The volatile cryptocurrency has seen intense buying interest since the SEC approved 11 spot bitcoin ETFs last month. While the price of the world’s most valuable cryptocurrency fell from about $49,000 to near $38,000 in the days after ETF-approval news, money has poured into the space. As it stands, bitcoin is now just 15% away from its late-2021 all-time high of $69,000. It’s possible that as the Mag 7 stocks have cooled off, money could be flocking toward new pockets of riskier growth opportunities.

The rally has also sparked buying of shares in companies related to digital payments, some of which own physical bitcoin. I have a hold rating on the Fidelity Crypto Industry and Digital Payments ETF (NASDAQ:FDIG). The fund trades at a lofty price-to-earnings ratio while the technical chart shows some cautionary signs.

Bitcoin Nears Its All-Time High

TradingView

According to the issuer, FDIG provides investment returns that correspond, before fees and expenses, generally to the performance of the Fidelity Crypto Industry and Digital Payments Index. The Index is designed to reflect the performance of a global universe of companies engaged in activities related to cryptocurrency, related blockchain technology, and digital payments processing.

FDIG is among the top-ranked ETFs per Seeking Alpha’s Quant Ranking System. Still, it’s a small fund with just $105 million in assets under management as of February 27, 2024. Sporting a superb A+ Momentum grade, the fund is near all-time highs despite being less than two years old. What I like about FDIG is that it is not a high-cost ETF – the annual expense ratio is currently 0.39%, though its trailing 12-month dividend yield is modest at just 0.17%.

Of course, being highly exposed to the cryptocurrency landscape, FDIG has poor risk ratings as its annual standard deviation is lofty and the portfolio is highly concentrated. Moreover, the ETF has liquidity issues at times considering that its 90-day average trading volume is barely more than 100,000 shares and Fidelity notes that its 30-day median bid/ask spread is upwards of half a percentage point. Thus, using limit orders during the trading day is prudent, in my view.

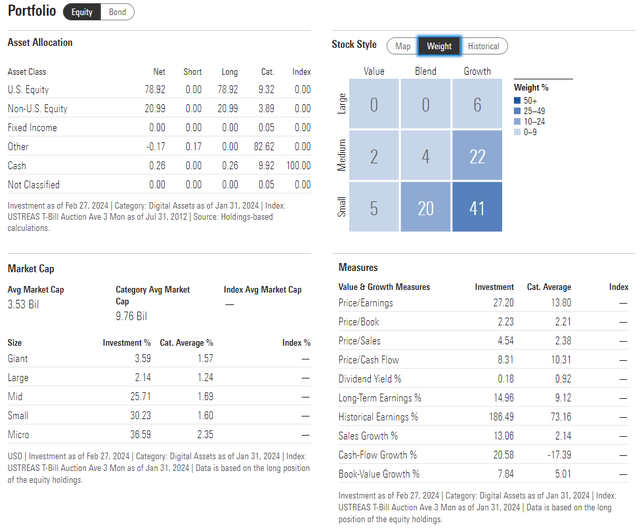

FDIG is concentrated in the lower right section of the Morningstar style box. That means it’s heavily allocated to small-cap growth – a niche that can see wild sentiment swings, sometimes independent of what is happening at the macro level. With just 6% invested in large caps, there’s heightened market-cap and size risk. The ETF’s P/E is north of 27, though long-term earnings growth has been robust.

FDIG: Portfolio Profile

Morningstar

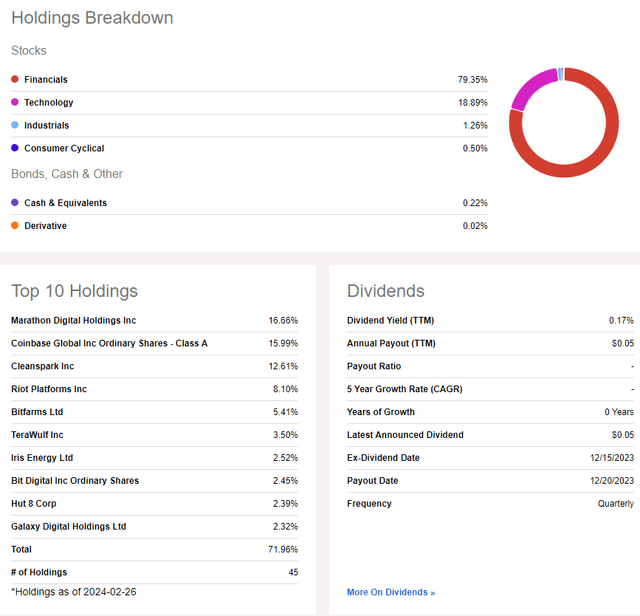

Making FDIG particularly risky is that it’s almost entirely invested in fintech-related areas. Close to 80% of the portfolio is invested in Financials with 19% in the Information Technology sector.

Prospective holders of the fund should monitor fundamental and technical developments in FDIG’s top three holdings: Marathon Digital Holdings (MARA), Coinbase (COIN), and CleanSpark (CLSK). Many of the fund’s top holdings have performed very well in the last six weeks given the rapid rise in bitcoin and other cryptocurrencies, and FDIG’s chart is near a key spot that I will detail later in the article.

FDIG: Holdings & Dividend Information

Seeking Alpha

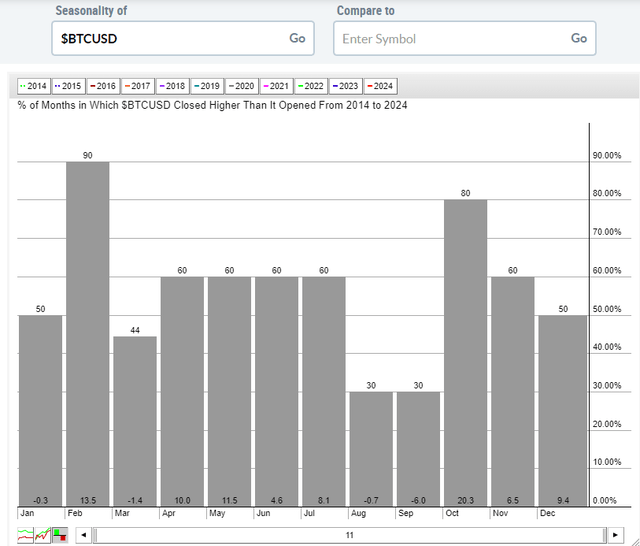

Seasonally, bitcoin did what it so often does in February. As of this writing, spot bitcoin is up more than 40% for the month. Historically speaking, that aligns with how strong Februarys often are. Since 2014, the second month of the year has been up in all but one instance. March, however, has been a rough period according to historical trends, so harvesting gains now could be a wise move.

Bitcoin Seasonality: February Booms & March Weakness

Stockcharts.com

The Technical Take

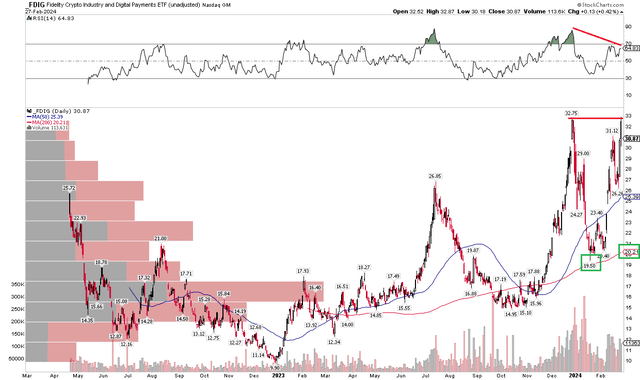

FDIG has rocketed higher in the last handful of weeks. Notice in the chart below that the fund, after dipping under $10 per share in late 2022, has surpassed the $30 mark. The ETF actually notched all-time highs late last year, though it was not in existence back when bitcoin approached $70,000. This latest move has come on a bit softer RSI, but the month is not yet finished. We may see some initial resistance at last year’s highs before a further rally happens.

But take a look at how well FDIG held its rising 200-day moving average during a steep selloff at the start of 2024 – with both the 200dma and short-term 50dma on the rise, the trend clearly favors the bulls. Moreover, volume has tended to jump as the ETF has rallied, a classic bull market signature.

Overall, momentum is decent, but a pause at the December high could be likely as we encroach on more neutral to even slightly bearish seasonality in crypto – that could negatively impact FDIG.

FDIG: Testing Its All-Time High, Monitoring Momentum Trends

Stockcharts.com

The Bottom Line

I have a hold rating on FDIG. A wave of speculation has hit cryptocurrencies and digital payments stocks. I assert that some caution is warranted today ahead of what has historically been a tough month in the space.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.