Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin (BTC) has surged 14.6% over the previous two weeks, rising from roughly $84,500 on April 18 to the mid-$90,000 vary on the time of writing. With this upward momentum, the main cryptocurrency seems to be setting its sights on a brand new all-time excessive (ATH), as a number of technical and momentum indicators trace at a rising bullish pattern.

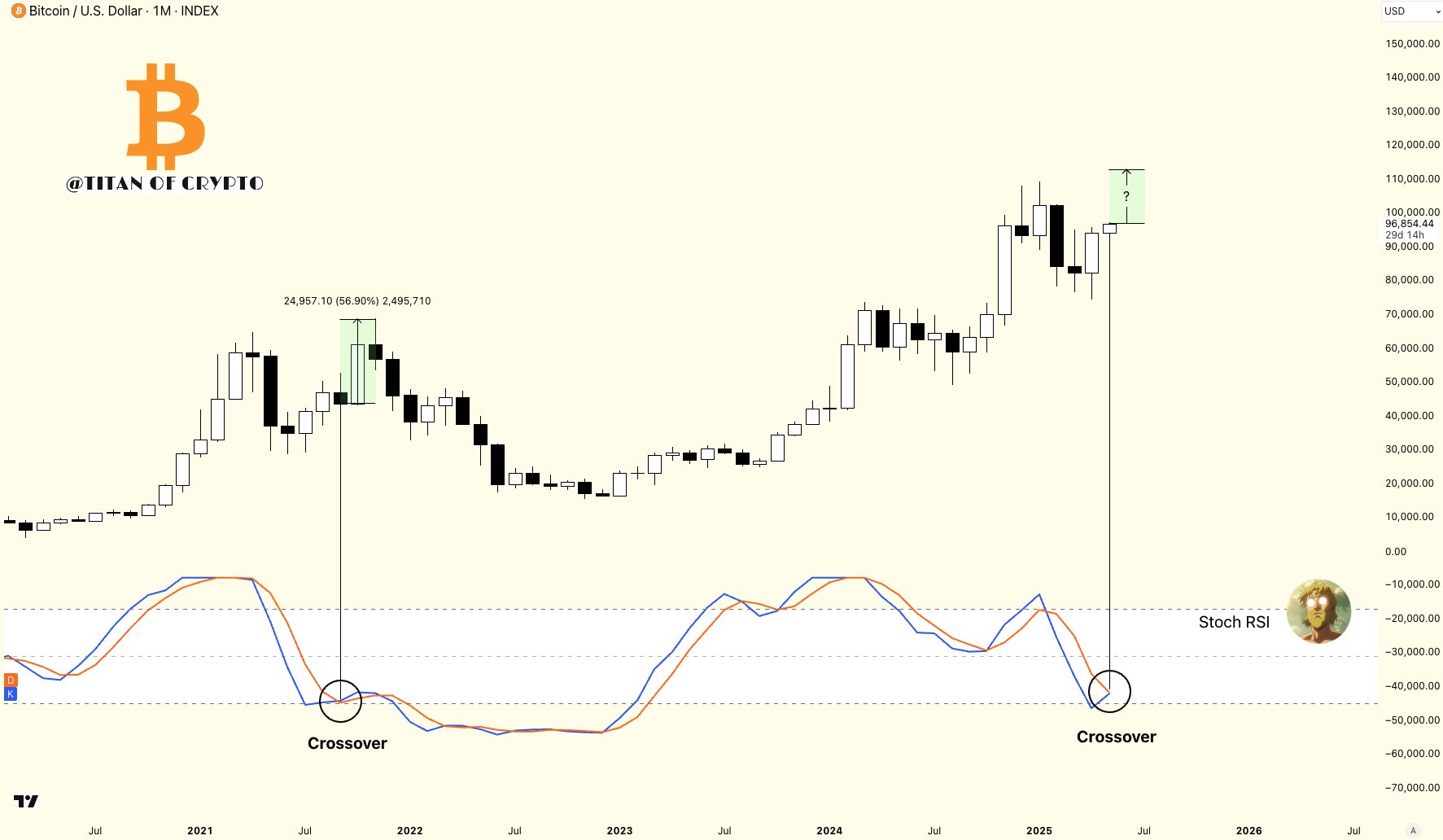

Bitcoin Month-to-month Stochastic RSI Turning Bullish

In a latest put up on X, crypto analyst Titan of Crypto shared a BTC month-to-month chart indicating that the Stochastic Relative Energy Index (RSI) is on the verge of a bullish crossover.

For the uninitiated, a Stochastic RSI bullish crossover indicators rising upward momentum and is usually interpreted as a possible purchase sign or the beginning of a possible rally. Titan of Crypto added that if confirmed, the bullish crossover might provoke BTC’s subsequent leg up.

Associated Studying

For example, the analyst referred to BTC’s worth motion on the month-to-month chart from again in Q3 2021. On the time, the same bullish crossover within the Stochastic RSI preceded a 56.9% surge in Bitcoin’s worth.

Nevertheless, Bitcoin should maintain above essential assist ranges to take care of this bullish construction. In a separate X put up, famend analyst Ali Martinez famous that BTC may re-test the $95,700 assist zone earlier than advancing towards the $100,000 milestone.

On the resistance facet, Martinez emphasised that $97,530 stays a “key degree to observe.” A profitable breakout past this threshold may pave the best way for BTC to revisit or surpass its earlier ATH. Because it stands, Bitcoin is buying and selling roughly 10% under its file excessive.

Analysts Predict BTC’s Subsequent Transfer

Crypto analyst Rekt Capital additionally weighed in on BTC’s potential trajectory. In an X put up revealed yesterday, he recommended that after BTC decisively breaks by way of the $97,000 to $99,000 zone, it may face rejection close to $104,500. Following that, holding the $97,000–$99,000 vary as assist can be essential for BTC to launch towards new highs.

Associated Studying

Equally, analyst Ted famous that BTC is at present buying and selling in a Wyckoff accumulation section. The analyst added that BTC’s slide under $76,000 in early April was seemingly the underside for this market cycle. He added:

Trying on the Wyckoff accumulation sample, it looks like the $96K-$99K degree may act as a resistance. I feel BTC may consolidate right here for just a few days, earlier than ultimately breaking to the upside.

Regardless of bullish momentum, some considerations stay. Analysts warning that Bitcoin is unlikely to face a real provide shock within the quick future, which may mood upside potential. At press time, BTC trades at $97,142, up 0.9% previously 24 hours.

Featured picture created with Unsplash, charts from X and TradingView.com