DNY59

Thesis Summary

Bitcoin (BTC-USD) has barely moved over the last few weeks. However, historical evidence suggests we could see some wild price swings this week. This could come in the form of a relief rally, a final capitulation event, or even an impulsive rally that suggests the bottom is in.

Something Big is Brewing

Bitcoin has been lying dormant for the last few months. The coin has seen reduced volatility, and the price has been almost flat. In fact, Bitcoin has outperformed the broader market since it bottomed in June. While the market S&P has made fresh lows, Bitcoin has held support.

S&P and BTC (TradingView)

Sentiment is at an all-time low for both crypto and stocks, and this could mean that the bottom is near, which would be confirmed with a strong reversal. However, there is also a chance that we will get one final shakedown.

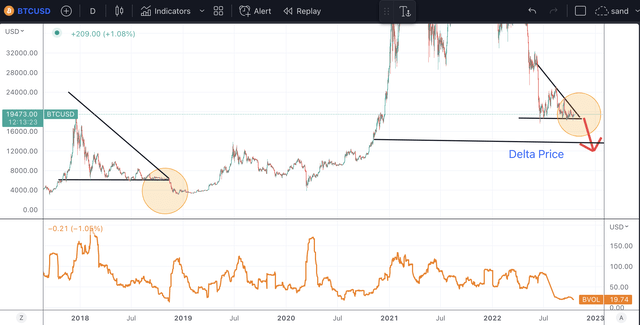

In any case, it seems like Bitcoin is nearing a big move, and this is supported by history. Below, we can see the Bitcoin Price and the Bitcoin Volatility Index since 2018.

BTC volatility (TradingView)

As we can see in the chart, when volatility has reached such low levels in the past, it has often been followed by a big move in price. In October 2018, we got a sell-off which took Bitcoin below $3000. A similar thing happened in the 2020 COVID crash.

On the other hand, we have also seen periods of low volatility set us up for big moves to the upside, which is what happened at the end of 2020.

It looks like this could be an important week for Bitcoin, but are we selling-off or taking off?

Break-Out or Break-Down?

I’ll state it simply. At the moment, I believe we should see Bitcoin break down and make one lower low. This is mostly based on Fibonacci extensions and my current Elliott wave count. But also, a lot of analysts are pointing out this chart as proof that a break-down is imminent:

BTC 2018 vs 2022 (TradingView)

We can appreciate that Bitcoin is forming a very similar structure today, as it did in the 2018 sell-off. We have a triangle forming, and volatility is reaching a similar level as it did in 2018. If history repeats itself, then Bitcoin will break down once it hits the apex of the triangle.

And where will the price land? A key support area is the Delta Price, which currently sits at around $13,500.

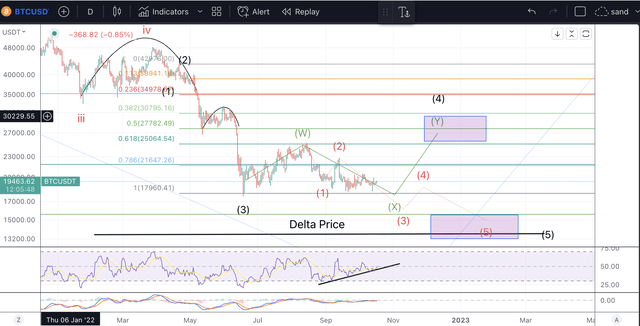

Now, let’s zoom into the current price action to see what’s happening more closely:

BTC EWT Count (TradingView)

Since around March 22nd, Bitcoin has been completing a five-wave structure to finish a larger degree correction. The most likely scenario is that the low we made in June was the low in wave 3, and we are now either finishing wave 4, finishing wave 5, or starting the first wave of the bull cycle.

If we are finishing wave 4, then Bitcoin could now rally as far as $27,782, which is the 50% retracement of wave 3. This would indeed mean Bitcoin is lining up for a big move, but I’d still expect a breakdown after that.

Alternatively, wave 4 could have already topped at the end of August, which is labelled in the chart as wave W. We can then make the argument that we are completing five waves for a final wave 5 bottom, which puts us now in wave 3. This means we could see an aggressive sell-off, typical of a wave 3, which takes us towards the $14,200 region. This is the 1.618 ext of the red wave 1 measured from the top of wave 2. The implication of this is that we would bottom somewhere around this area, but maybe even as low as $12,000. This would be invalidated if we rally over the wave 2 high.

Finally, a case can be made that five waves have already been completed, and we are ready for a reversal. However, this is the least likely scenario since it would mean we have a truncated wave 5 bottom, meaning that wave 5 did not make a lower low, which is unusual.

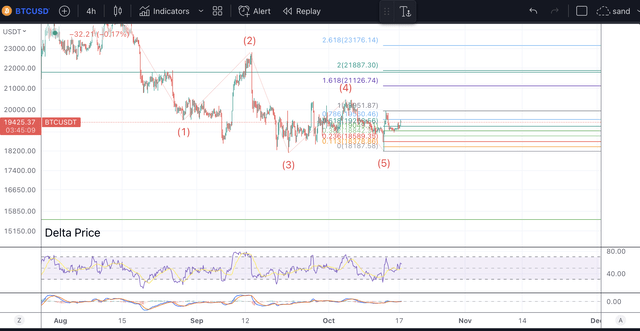

BTC bull case (TradingView)

With that said, we did see a strong reversal on Thursday. If we can now hold the $18,500 level and rally strongly above $20,000, this scenario will gain some more probabilities.

Final Thoughts

Whatever comes next, I believe we are due for some increase in volatility and wild price swings. We should get a lower low in Bitcoin, but I also have to entertain the possibility that the low is in. While the Bitcoin chart doesn’t suggest this, I am getting some evidence of a bottom in other charts, like Ethereum (ETH-USD) and the S&P 500 (SPY). I also see the dollar index (UDN) close to the top, which should spark a rally in crypto.