spawns

Cryptocurrencies and related stocks have stayed dormant for months, with sentiment taking a big hit from the FTX saga back in November 2022.

Markets tend to bottom when news is the worst, things are the most bleak, and at a time when it is the most difficult to put money in.

So far, the FTX low has marked the bottom for cryptocurrencies, and after close to a year of basing and consolidation, they look ready to breakout and transition into uptrends.

Looking at the weekly chart of Bitcoin (BTC-USD) below, we may observe a series of higher lows since the FTX saga. While there has yet to be a spectacular high-momentum breakout, Bitcoin is now trading right at the key 31-32k pivot, which marks the crucial July 2021 swing low.

Weekly Chart: Bitcoin

TradingView

I think Bitcoin is gathering energy for a powerful breakout through this area. If the breakout materialises, then there is a strong chance Bitcoin would be transitioning to an uptrend.

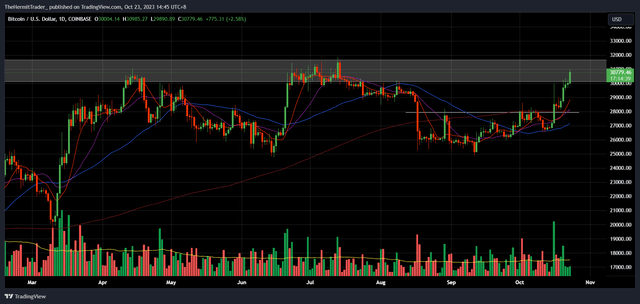

Zooming into the daily chart of Bitcoin, we can see that Bitcoin had built a mini multi-week base recently and broke above the 28k pivot on 16 October. This was on the back of rumours that the SEC was set to approve the launch of Bitcoin-related ETFs.

Though the breakout faded when BlackRock denied the plausibility of these rumours, prices still held above the 28k pivot.

Daily Chart: Bitcoin

TradingView

On 20 October, JP Morgan stated the SEC was indeed likely to approve the Bitcoin ETFs in the coming months, which led to a surge higher in Bitcoin, thus confirming the breakout above the 28k pivot.

Fueled by this positive catalyst, Bitcoin is now making a run for the 31-32k pivot, which will be a more difficult but rewarding test. If the breakout materialises, it is likely to pave the way for a move to the psychological 40k level.

There are a few charts I am watching closely to confirm if cryptocurrencies are ready to embark on a bull run.

For starters, it is imperative that the Ethereum to Bitcoin ratio spikes higher. Now, it is still on a steep downtrend. An uptrending ratio would indicate that altcoins are outperforming the safe, stable Bitcoin. It is akin to healthy market breadth where the Russell 2000 (IWM) outperforms the S&P 500 (SPY).

Daily Chart: Ethereum to Bitcoin Ratio

TradingView

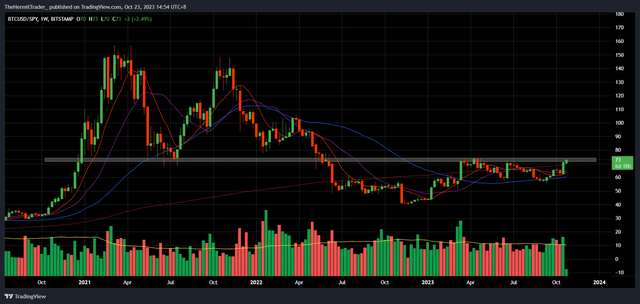

Secondly, I am watching to see if Bitcoin can break out against the SPY. Below is the weekly chart of the Bitcoin to SPY ratio, which is also testing a key pivot. If Bitcoin outperforms equities, I want to be involved in cryptocurrencies.

Weekly Chart: Bitcoin to SPY Ratio

TradingView

Lastly, I am also watching the Bitcoin to Gold (GLD) ratio. This ratio is also testing a pivotal area, similar to Bitcoin against SPY. Breakout successfully, and that would be another big positive for cryptocurrencies.

Weekly Chart: Bitcoin to Gold Ratio

TradingView

From a broader perspective, the recent strength in cryptocurrencies and precious metals, coupled with persistent weakness in financials, might be signaling an increased loss in confidence in the banking sector.

I wrote on 14 October here that gold was poised to break out higher. So far, the signs are good, and gold is making a very strong push towards the $2,000 pivot.

Weekly Chart: Gold

TradingView

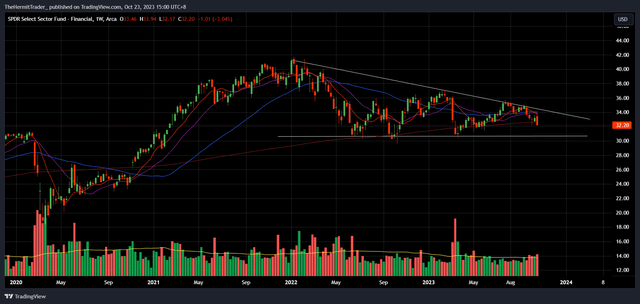

Financial Select Sector SPDR Fund ETF (XLF) looks very fragile. Prices appear to be building out a descending wedge pattern, characterised by lower highs and a flat support at $31.50. This key support looks likely to be tested, and a break below is likely to pave the way for much lower prices.

Weekly Chart: XLF

TradingView

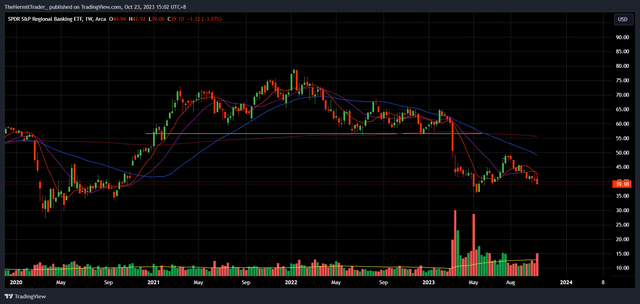

Regional banks (KRE) continue to be plagued by a huge overhanging head and shoulders pattern. The struggles from back in March 2023 appear to be adversely affecting the sector still, and KRE looks likely to take out its May swing lows.

Weekly Chart: KRE

TradingView

All in all, the strength in cryptocurrencies and gold, coupled with weakness in Financials, appear to be painting a bleak picture for the banking sector.

I want to refrain from hastily drawing too many conclusions and will focus on the price action at hand. At the moment, I think the long cryptocurrencies trade looks attractive from a risk-reward perspective.

I am long Bitcoin, and will likely add to my position if it can break the 31k pivot. My target is the 40k level at least.