deepblue4you

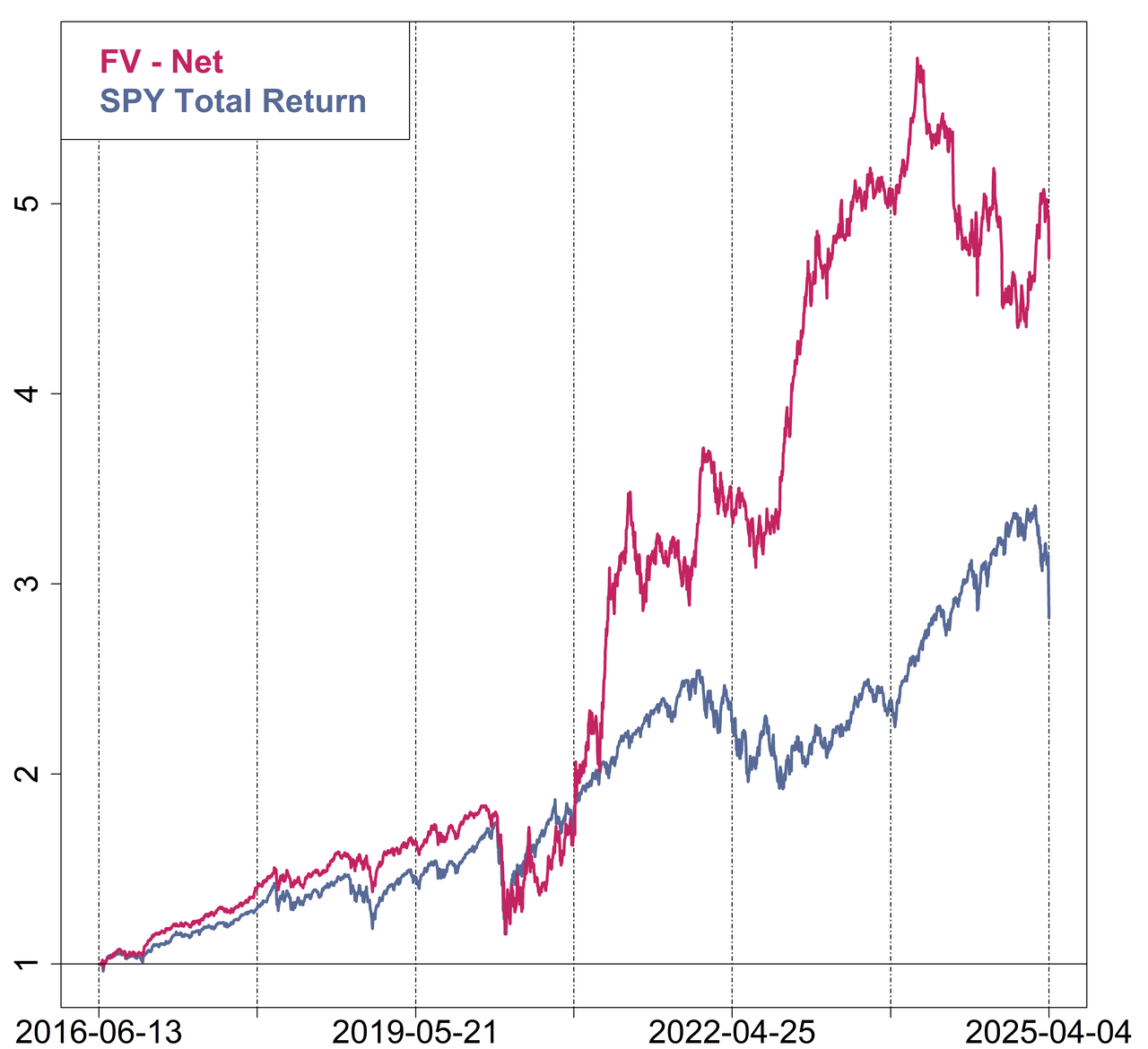

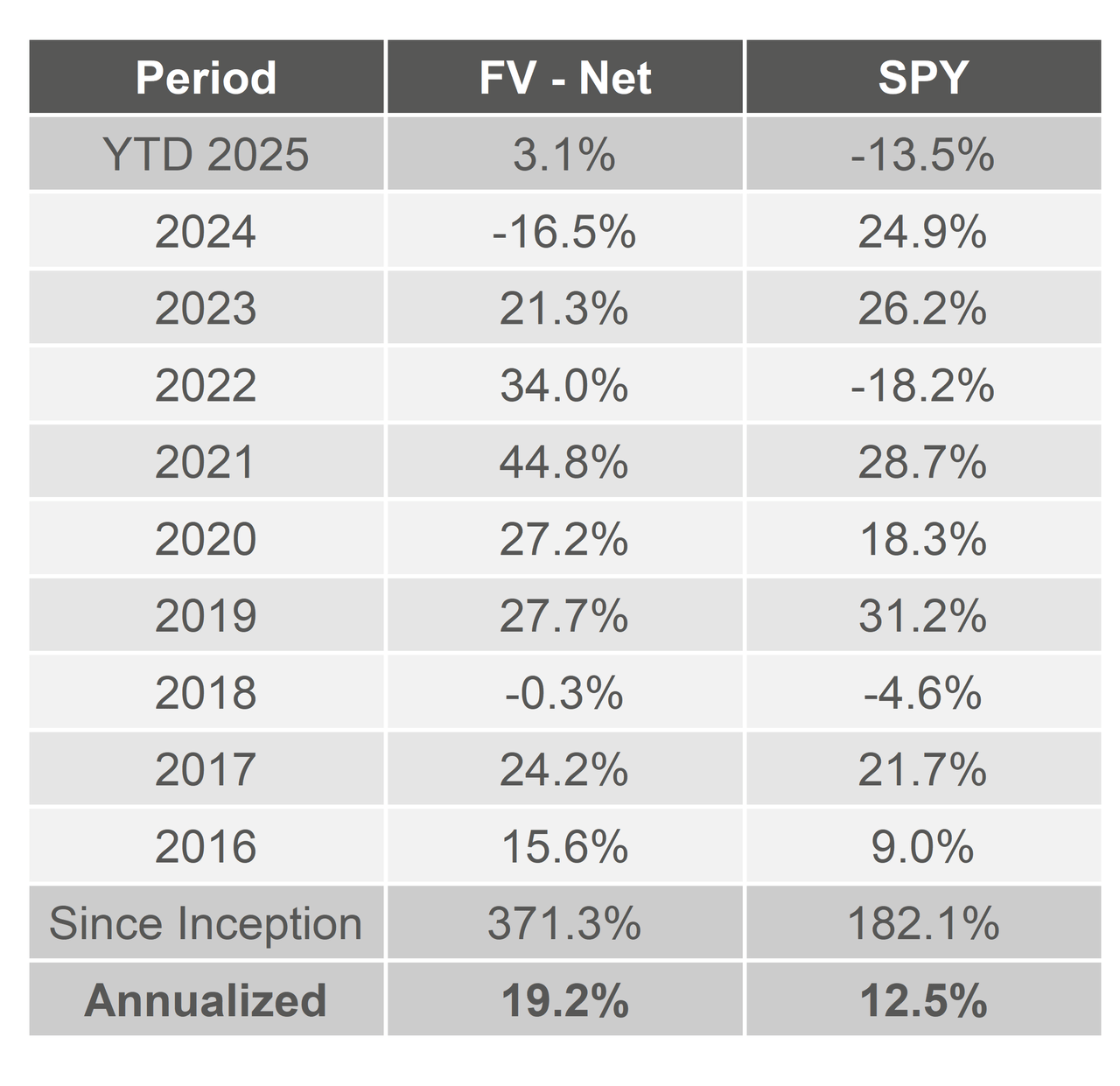

Basic Worth suffered a distressing -16.5% fall in 2024, whereas the S&P returned a stellar 24.9%. By way of April 4th, FV has managed to claw again a piece of that misplaced relative efficiency in 2025, with a 3.1% return vs the S&P at -13.5%. FV is now up 371.3% internet since inception in 2016 vs the S&P at 182.1%, an annual outperformance of 6.7%1. For month-to-month efficiency see our tearsheet.

There may be nothing worse than shedding the hard-earned cash that our shoppers have entrusted us with. We hope that after watching us tilt towards windmills for the higher a part of two years, the previous few months have offered some validation for our view that the US fairness market is deeply unhealthy and susceptible to sharp declines, whereas there may be a lot better alternative abroad.

Our feedback beneath are centered on tariffs. This isn’t our often scheduled programming; we are going to ship out one other letter in a number of days with our typical market and portfolio commentary. We have now a lot to say concerning the unhealthy market of 2024, synthetic intelligence, our Japanese investments, and the speculative extremes we see in our brief guide. However immediately’s urgent challenge is the brewing commerce battle and we might be remiss if we didn’t weigh in.

Market commentary

We launched our letter final June by saying:

Our 2024 returns up to now have been extraordinarily disappointing. Nonetheless, regardless of this underperformance – in actual fact, due to it – we’re feeling more and more inspired concerning the prospect of sturdy relative returns sooner or later. We have now doubled down on our technique of differentiating ourselves from the S&P. We have now elevated the dimensions of our investments exterior the US, and added to our brief guide contained in the US.

We picked up over 600 foundation factors of relative efficiency the day after Trump’s tariff plans had been introduced. Though we weren’t positioned for the tariffs per se, we had been positioned for a downturn within the overextended US fairness market, regardless of the trigger. After a painful and interminable wait, the unwind is occurring faster than even we anticipated.

Whereas Trump’s announcement was an exogenous occasion, the acute valuations main as much as the announcement left shares perilously uncovered to uncertainty.

When markets are priced for perfection and sentiment is euphoric, even a small quantity of unfavourable information stream can set off substantial declines. And actually unhealthy information can set off historic crashes.

Liberation Day

The S&P fell over 10% in two days final week, certainly one of solely 4 occasions within the post-war interval that has occurred. The proximate reason for the market’s epic collapse final week was Trump’s “Liberation Day” announcement of huge tariffs on almost each nation on the earth. If his purpose was to liberate People from their retirement financial savings, he succeeded.

Excessive, broad, and indiscriminate tariffs are an objectively horrible concept. We’re not even certain what else must be mentioned, however we’ll say our piece regardless. Beneath Trump’s at the moment proposed plan, the common efficient tariff price will enhance from about 3% to someplace within the mid-20s (estimates differ). This could be the best price since 1909. A tariff enhance capabilities as a tax enhance on customers and companies. Estimates recommend will probably be one of many largest tax will increase ever as a proportion of GDP, actually the most important for the reason that Nineteen Eighties and doubtlessly since WW2. The typical family will see a number of thousand {dollars} in fast value will increase. Companies will see revenue margins squeezed. Some merchandise specifically will see massive enter value will increase; attire COGS will rise roughly 17%.

Commerce boundaries additionally create monumental deadweight losses. Comparative benefit dictates that, for max effectivity, nations ought to concentrate on producing items the place they’ve a relative benefit. Tariffs will decrease potential GDP by reversing the worldwide specialization course of and suppressing international commerce. We’ll flip to larger value home sources for items and away from decrease value overseas sources. Moreover, some nations will inevitably retaliate with tariffs on US exports; China has retaliated already, Canadians are boycotting American items, and the EU is threatening regulatory motion on American large tech. Commerce battle escalation will lower our exports, inflicting additional harm on each American incomes and company profitability.

It has been disquieting and dystopian to look at erstwhile free-market Republicans defend Trump’s protectionism. The final broad tariff hike within the US, the 1930 Smoot-Hawley Tariff Act, is broadly thought-about to be a significant reason for the Nice Despair. (And the 2025 tariffs are extra excessive than Smoot-Hawley.) Globalization over the post-war interval has ushered in an unprecedented period of worldwide prosperity. Arguably no nation has benefited extra from elevated commerce than the US. Our massive and perpetual commerce deficit with the remainder of the world is testomony to that time. We import bodily items from overseas, and export intangible items like capital and providers (software program, consulting, and so on). Basically, we get to devour greater than we produce, and the remainder of the world subsidizes it.

As advantageous as this example is, there are good causes to be involved. American manufacturing has been hollowed out over the previous few a long time on the expense of native jobs and in some instances our nationwide safety. Many nations have unfair commerce practices that prohibit American companies’ entry to their markets.

Nonetheless, there are different methods to deal with these points which can be much less disruptive and expensive and extra focused and efficacious. For instance, manufacturing specifically fascinating industries could be focused and nurtured by way of tariffs or subsidies or another methodology. Absolutely nobody desires to reshore attire manufacturing, which is laborious and low value-add. Producing textiles within the US could be prohibitively costly – and People don’t desire these jobs anyway. Our most urgent manufacturing want is in semiconductors. Taiwan produces primarily the entire modern chips on the earth. It is a grave nationwide safety concern given China’s said purpose of reincorporating the island nation. But bizarrely, the brand new tariffs (together with 32% on Taiwan) don’t apply to semiconductors, so there will probably be no reshoring profit for this important business. Equally bizarrely, Trump has bashed the bipartisan CHIPS Act, handed in 2022, which seeks to ameliorate the state of affairs by subsidizing onshore chip manufacturing.

Deeply unserious

Not solely are broad tariffs intellectually discredited, this explicit plan is deeply unserious.

The Trump administration claimed they might go nation by nation and enumerate reciprocal tariffs within the curiosity of equity. These reciprocal tariffs would contemplate each tariff and non-tariff commerce boundaries similar to business subsidies, foreign money manipulation and quotas. Commerce offers are usually devilishly complicated, as negotiators go line-by-line by way of particular person merchandise; the US’s Harmonized Tariff Schedule enumerates 13,000 classes.

As a substitute, the Trump administration used probably the most simplistic attainable components and focused buddy and foe alike. For every nation, they took the commerce deficit as a proportion of imports, and divided by two. This simplistic components results in perverse outcomes, like within the case of Lesotho. Lesotho is a tiny, impoverished nation in Africa. Lesotho exports a number of hundred million {dollars} of products to the US (principally diamonds and attire), however imports lower than $5m. Why do not they import from the US? Not due to pernicious commerce boundaries, however as a result of they can not afford costly US items. Common GDP per capita in Lesotho is lower than the price of an iPhone. Nonetheless, as a result of Trump’s simplistic components simply depends on the dimensions of imports relative to exports, Lesotho ended up with a 50% tariff price, the best on the earth. This could be comical had been it not so embarrassing to us and expensive to poverty-stricken Lesotho.

The purpose appears to be to get rid of commerce deficits with each nation. However there isn’t a motive to have balanced commerce with each nation on the earth. That is not how multilateral commerce works. Each citizen runs an enormous commerce deficit with their grocery retailer, and we do not suppose the grocery store is benefiting from us.

There are different indicators of haphazard and unprofessional coverage. For instance, Trump included a tariff on Heard Island. Heard Island is close to Antarctica, some of the distant locations on earth, accessible solely by a two-week boat voyage. However, Trump deemed it worthwhile to slap a ten% tariff on the island’s unlucky inhabitants: penguins. (It hasn’t even been visited by people in a decade.)

That is no technique to be conducting some of the consequential reorderings of the worldwide financial system in residing reminiscence. It additionally endangers the mission.

Justification

One of many purported advantages of the tariffs is to considerably enhance American manufacturing. Nonetheless, we imagine it’s unlikely that firms will probably be dashing to spend money on new US factories on account of this motion. Investing is basically in train in long-term planning. Constructing factories, coaching workers, and reordering provide chains to a brand new location takes years and massive quantities of capital. If firms shouldn’t have confidence the world will probably be steady and predictable, they won’t make investments. Think about proudly owning a manufacturing facility in Vietnam. At some point Vietnam isn’t topic to any tariffs; the following day the nation is hit with a punitive 46% price; the following day it looks like some future negotiation would possibly decrease and even get rid of the tariff. How are you going to make long-term plans? Are you actually going to go to the appreciable bother and expense to maneuver your manufacturing to the US? Trump may change his thoughts tomorrow. Or Congress may repeal the tariffs. Or the following administration may (and sure will) revoke all these tariffs in 4 years, properly earlier than your plant pays itself again. As well as, the elements of onshore manufacturing (capital gear, enter supplies) are all topic to tariffs themselves, which can drive up the price of new amenities.

There’s a world by which excessive tariffs lead to vital capex within the US. If we had common consensus that tariffs had been needed and fascinating, in the event that they had been signed into regulation by way of an act of Congress somewhat than by way of govt motion, and in the event that they had been rigorously deliberate and slowly carried out, then there could possibly be a considerable enhance in funding. This isn’t that world. As a substitute, uncertainty is larger than it has been in our lifetimes. It’s doubtful at greatest to imagine that this uncertainty will result in substantial funding.

We have additionally heard different justifications for the tariffs aside from reshoring.

Some imagine that Trump is secretly a pro-business, free-trade maximalist, and these tariff bulletins are literally an train in “madman idea,” a game-theoretical strategy the place one credibly acts like a madman to achieve concessions from one’s opponents. In line with this idea, Trump will use these tariff threats for leverage in negotiations to decrease commerce boundaries. We desperately hope they’re proper, however that form of strategic irrationality appears implausible: this motion reeks of amateurism, not galaxy-brained 4D chess. However, Trump could also be pressured by the political and financial fallout to belatedly undertake this tack.

We have now additionally seen some Trump apologists search to rationalize the tariffs by mentioning that Treasury yields dropped final week, so now our debt is cheaper to service, and it is a advantage of the tariffs. That is a non sequitur. Treasury yields fell due to a short lived flight to security out of threat belongings and into safer ones, not due to a useful change in rate of interest fundamentals. Tariffs will create a stagflationary atmosphere with rising costs and a recessionary economic system. A smaller and fewer productive economic system isn’t going to make it simpler to repay our debt.

One other purported profit is the tax income tariffs will elevate. We have now lengthy nervous about profligate fiscal coverage and the ever-increasing nationwide debt, and so we aren’t essentially against accountable tax will increase. Tariffs, nonetheless, are a horrible technique to enhance tax income, because of the deadweight losses we mentioned above. And Trump nonetheless has many tax cuts on his 2025 agenda, as he desires to increase the expiring 2017 Tax Cuts and Jobs Act in addition to enact new cuts. Actually, the funds plan at the moment in entrance of Congress is attracting Republican opposition for being too profligate. So the concept that this motion is a part of a plan to cut back the deficit is implausible.

Moreover, decrease commerce deficits means foreigners will run a decrease present account surplus. That’s, foreigners will promote us much less items and thus will obtain much less {dollars} in return. Lots of the {dollars} acquired by foreigners are invested in US belongings, together with federal debt: about 25% of public debt is held by foreigners. Foreigners with much less {dollars} to speculate will enhance upward strain on Treasury charges. This strain will enhance to the extent the US decouples from the worldwide economic system and is seen as a much less dependable actor and enterprise companion.

The place to from right here?

We imagine it’s unlikely that the tariffs as at the moment introduced will persist. They’re far too economically damaging to be politically tenable. We count on certainly one of three issues will occur. First, Trump could blink: he may roll again the majority of the tariffs after negotiating some concessions from overseas governments and spin it as a win. Second, Congress may block implementation. Trump solely has unilateral tariff powers at Congress’s delegation. The Structure grants Congress final tariff authority, and Congress may revoke the president’s powers at any time. Although Democrats are powerless to impact change and Republicans in Congress have been successfully neutered for the primary few months of Trump’s time period, a gaffe of this magnitude may provoke sufficient Republican opposition to derail Trump’s agenda. Congressional Republicans worry Trump’s wrath, however additionally they know {that a} deep, self-inflicted recession would doom them within the midterms. Third, the courts could block it. Trump’s claimed statutory authority is questionable. For expediency, Trump invoked a statute that has by no means been used for tariffs – in actual fact, “tariffs” is notably absent from the checklist of granted powers. The constitutionality of the statue itself may additionally come below scrutiny in gentle of the nondelegation doctrine.

Have been Trump to capitulate or be pressured to desert his plan by Congress or the courts, the market would undoubtedly rally explosively. Nonetheless, it bears repeating that our predictions for poor long-term fairness returns aren’t predicated on a commerce battle that causes company income and earnings to plunge. As we have now detailed up to now, we believed that the US inventory market was costly – and remains to be costly, regardless of giving up a 12 months’s price of return in a number of brief days. Even when we assume there will probably be no revenue recession, the S&P nonetheless trades at a trailing PE a number of round 25 immediately, a degree according to a market prime, not the start of a sustainable bull market. If tariffs are literally carried out and maintained, company income and earnings would plunge. Thus any aid rally could show short-lived.

Even when tariffs are rescinded shortly, one impact of all this drama will probably be extra everlasting than the tariffs themselves: heightened political and financial uncertainty. It is turn into clear that Trump conducts a form of transactional policy-by-deal, the place social media posts and impromptu calls to information media can swing the fortunes of particular person firms and international markets. This capriciousness isn’t restricted to tariff plans. He has additionally pressured regulation companies to undertake his administration’s insurance policies, shut down total authorities businesses in a single day, granted tariff exemptions for favored industries, and pushed the boundaries of unilateral govt authority, which could be reversed on the stroke of a pen and is thus inherently extra unstable than acts of Congress.

It is a dramatic departure from earlier apply. Earlier administrations typically adopted a extra deliberative, principled and rules-based strategy to coverage and had been extra involved with balancing the pursuits of constituencies with their very own targets.

There are downsides to the method obsession of a extra administrative state. There is no query that the US economic system and authorities has turn into extra sclerotic and fewer dynamic over time, and Trump’s promise to interrupt these constraints was an enormous a part of his electoral attraction. Coverage-by-deal doesn’t essentially result in higher or worse outcomes than a extra deliberative coverage strategy, however there are actual dangers: specifically, it’s inherently much less steady and predictable than the rule of regulation. At present, quantitative measures of financial uncertainty are at report highs. As we mentioned above, an atmosphere of excessive uncertainty isn’t conducive to long-term investing.

We fear that companies will probably be loath to make the large, daring, long-term capital expenditures essential to develop whereas working below such uncertainty. We additionally fear that this atmosphere will trigger fairness multiples to contract. To purchase an organization buying and selling at a PE a number of of 25 requires you to imagine you might have visibility on firm earnings a long time from now. You’re solely getting 4% of your capital again in earnings yearly. If you do not have confidence in a steady working atmosphere – not to mention a worldwide commerce collapse – then you definitely would by no means make this funding. Increased uncertainty calls for larger low cost charges, and thus decrease multiples. This all has regarding implications for the flexibility of capital allocators to speculate for the long run and develop the economic system.

Conclusion

Although we have been bearish on the US inventory market for a few years, it offers us no pleasure to foretell doom and gloom for the American economic system and inventory market. The vast majority of our investments are in overseas markets immediately, however that could be a measure of calculated funding worth, not a measure of our allegiance. We’re proud Americans and need nothing greater than for the US to prosper. We hope Trump will use this episode to barter decrease commerce boundaries for American companies all over the world, after which shift his focus to implementing the pro-growth, deregulatory agenda that garnered him a lot enterprise help within the latest marketing campaign. In contrast to an atavistic protectionism that foments a worldwide commerce battle, that would really usher in an period of American greatness.

Within the meantime, we are going to proceed to spend money on a long-term, value-conscious method, and count on to profit – particularly in relative phrases – from any continued turmoil.

Please watch your inbox for a extra conventional letter with market and portfolio commentary shortly.

We’re grateful for your small business and your belief, and a particular thanks to those that have referred family and friends. There isn’t a better praise.

– Bireme Capital

Observe our content material by subscribing right here. 1 FV efficiency is proven internet of a 1% administration charge and 10% efficiency charge. Out there for Certified Purchasers solely as SEC guidelines don’t allow efficiency charges for nonqualified traders. Payment buildings and returns differ between shoppers. FV inception was 6/14/2016. Advisory charges and different necessary disclosures are described in Half 2 of Bireme’s Kind ADV. Reported efficiency is a dollar-weighted common of the securities within the Basic Worth L/S Mannequin Portfolio maintained at Interactive Brokers from inception by way of October 2023. From November 2023 onward, reported efficiency is a dollar-weighted common of the efficiency of all consumer accounts invested solely within the Basic Worth L/S technique with no client-directed customizations to the portfolio composition. Efficiency is proven internet of a 1% administration charge and 10% efficiency charge. Out there for Certified Purchasers solely as SEC guidelines don’t allow efficiency charges for nonqualified traders. Previous efficiency isn’t indicative of future outcomes. Several types of investments contain various levels of threat and there could be no assurance that any particular funding will both be appropriate or worthwhile for a consumer’s funding portfolio. The SPY ETF seeks to trace the efficiency of the S&P 500 Index, and the efficiency described contains each charges and the reinvestment of dividends and different distributions. Registration doesn’t represent an endorsement of the agency, nor does it point out that the advisor has attained a selected degree of ability. See Disclaimer for necessary disclosures. Sources: Bloomberg Finance LP, Interactive Brokers LLC, S&P Compustat, Bireme Capital LLC. |

Authentic Submit

Editor’s Notice: The abstract bullets for this text had been chosen by In search of Alpha editors.