Fabrice Cabaud

Funding thesis

Bio-Rad Laboratories, Inc. (NYSE:BIO) is a multinational producer and distributor of life science analysis and medical diagnostics merchandise. The corporate operates by two major segments: Life Sciences (“LS”) and Scientific Diagnostics (“CD”), offering instruments for organic analysis and medical diagnostics.

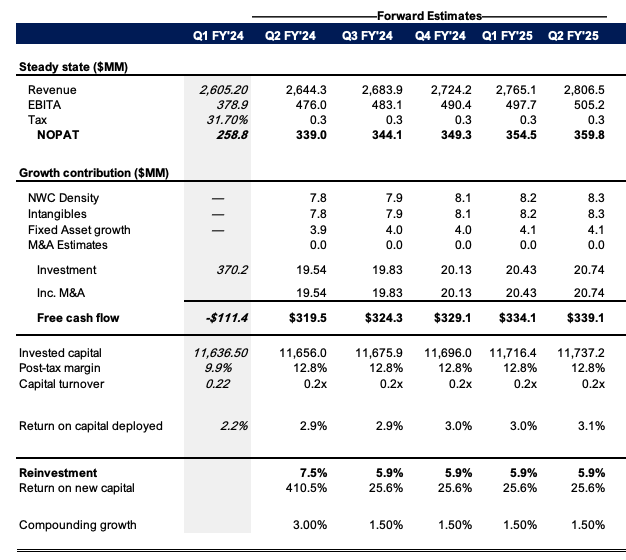

Since FY’21, the corporate’s inventory has been hammered attributable to a litany of pressures, not within the lest its place in German-listed Sartorius AG. That funding continues to be a drag on efficiency and returns on capital (finish of the day, it’s fairness capital). The inventory is -25% YoY and missed the FY’23/’24 rally in broad equities – clear indication of the market’s sentiment. I might say this pessimism might present alternatives – however not with the inventory nonetheless buying and selling >20x EBIT with 1) lumpy working earnings and a couple of) closely contracted FCF per share vs. FY’21 – the place it traded >45x EBIT by the way in which.

This can be a title I do know extensively properly having coated it 7x right here on Looking for Alpha since FY’20 (see the unique thesis right here, and the newest one right here for reference factors).

Having relied on the Sartorius place to submit beneficial properties in market worth from FY’18–’21, an sincere appraisal of the enterprise and its intrinsic worth with out this issue is required.

Regardless of quite a few updates to my modelling, I’m maintain on BIO attributable to 1) abysmal returns on capital [I’m including Sartorius in all numbers to penalize BIO for this investment – it must be indexed as capital invested in my view], 2) weakening fundamentals [margins are <600bps vs. FY’21 whilst capital turnover is flat at ~0.2x] and three) valuations unsupportive with the inventory nonetheless operating at >20x EV/EBIT, however multiples of capital is <1x EV/IC. This divergence is clearly a threat to the draw back in my opinion. Reiterate maintain.

Determine 1.

TradingView

BIO enterprise traits

Firstly we won’t ignore the latest departures of key executives together with the COO and the CFO within the final quarter. Concerning this, the CEO had this to say on the Q1 FY’24 earnings name:

Now we have acquired questions on administration turnover and succession within the final six months. I believed it will be helpful to say a couple of phrases. So, in brief, as I give it some thought, every of those discrete departures is admittedly centered round private selections both associated to different alternatives or, or retirement.

From my perspective, it is all a part of a traditional development for these people and for the corporate.

Take what you’ll from that however from my perspective the “discrete departure” of two executives would have deserved just a little extra rationalization. Nonetheless, it was one other difficult quarter for the enterprise:

- Gross sales of $610.8mm have been –9.8% YoY and –9.6% in CC. Gross margins compressed ~10bps YoY to 53.4% on decrease revenues and decrease margin product combine.

- The LS phase did $241.7mm of enterprise, down ~25% YoY due ongoing weak spot in its biotech and biopharma finish markets. However that is compounded by weak gross sales in China – a guess administration has but to tug off [this is despite the Chinese Gov’t stimulus recently announced there].

- In the meantime CS gross sales have been +470bps YoY to $368mm, underscored by demand in its diabetes markets.

- Administration sees ~100–250bps YoY gross sales development on 13-14% pre-tax margins [these are ~1% and up to 600bps below 5-year averages, respectively].

Potential catalysts

Regardless of lumpiness in course of chromatography gross sales administration transformed early clients from competing resins to its platform in Q1 2024. This could possibly be a long-term lever for BIO, particularly as 1) administration says no buyer losses have been reported and a couple of) it’s sustaining market share.

Added to that, is has numerous product launches in its LS enterprise for FY’24, specifically:

- ChemiDoc Go platform in Q2 ’24.

- Single-cell pattern prep answer in Q2 ’24.

- QX Continuum again finish of ’24.

These are the 2 main catalysts I view proper now. As you’ll be able to see, they’re far and few between as administration first must stabilize gross sales within the LS phase.

Unattractively valued

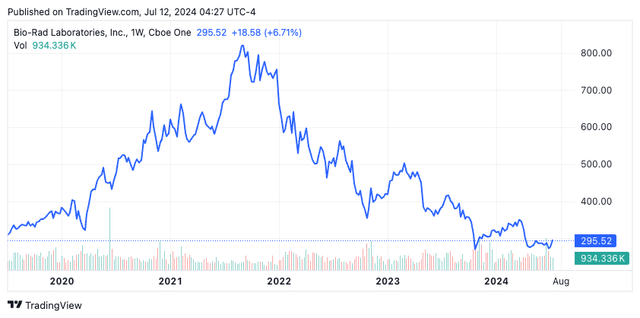

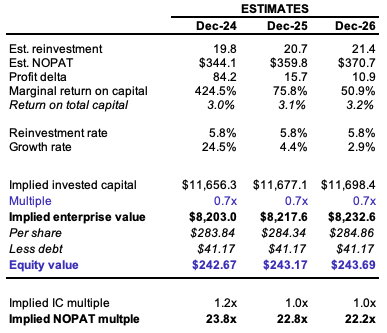

While it trades >20x EBIT and >31x NOPAT (TTM values) capital that is been employed into then invested by BIO is value <100 cents on the greenback. My view it’s value ~$240–$250/share right this moment at ~23x NOPAT or 0.7x EV/IC.

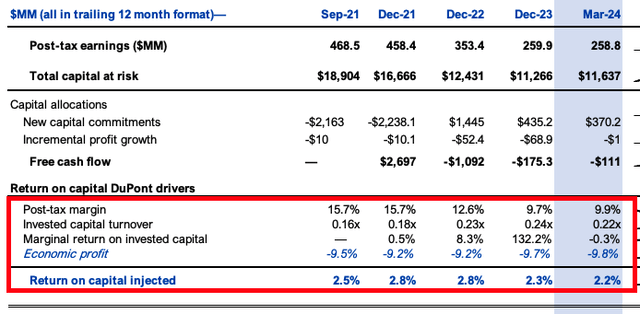

BIO trades at ~0.7x e-book capital regardless of the excessive a number of on earnings (Determine 2). Notice this consists of Sartorius for two causes, 1) as it’s shareholder/debtholder capital invested and in danger in BIO’s ‘operations’ on the finish of the day, and a couple of) all EV multiples embrace it within the calculus anyway. The first causes behind the <1x valuation is (i) BIO’s abysmal ROICs [<3% on rolling basis], and (ii) underwhelming enterprise drivers.

Determine 2. E book capital valued ~70 cents on the greenback.

Creator’s estimates, Looking for Alpha

Valuation insights

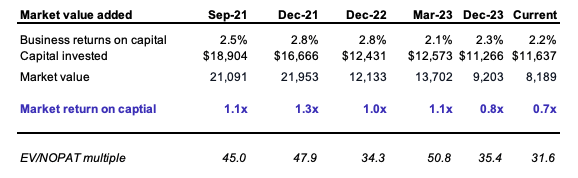

I begin with the corporate’s enterprise drivers:

- I might repeat, it’s extremely uncommon for an organization with <15% 5-year avg. EBITDA development and contracting margins to commerce >30x NOPAT as BIO does. Extra so, post-tax margins are down ~600bps from 15.7% in FY’21 to ~9.9% with capital turns ~0.2x (Determine 3). Thus, administration’s investments now usher in $0.20 on the greenback and produce ~$0.02 on the greenback in NOPAT.

- The problem is administration proceed throwing enormous sums of money again on the enterprise, reinvesting at these <3% returns. Think about giving cash to a fund supervisor, just for them to spend money on high-risk securities (identical to enterprise property are) to supply <3% – when the indices do +10-12% annualized. You would be sad proper? You’d in all probability worth that capital at lower than 100 cents on the greenback, seeing as when you invested there, you would be leaving ~700-900bps p.a. on the desk on common. Therefore my view is 1) the market has BIO priced appropriately at 0.7x capital, and a couple of) it might proceed to commerce ~this stage, however will not create financial worth given these enterprise returns.

Determine 3.

Firm filings

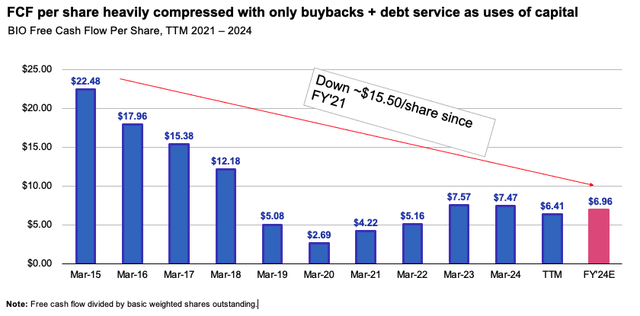

- The results of the ~600bps margin contraction is an equally sharp contraction in FCF/share – from ~$22/share in FY’21 to <$$6.50 share within the final 12 months. There’s been some normalization within the development (Determine 4) nevertheless it is not throwing off piles of money vs. present market capitalization [$6.41 FCF/share yields ~2.1% at current share price of ~$295.50]. Thus pay ~30x NOPAT for (i) capital valued <100 cents on the greenback, attributable to (ii) incomes <3% on this capital, which means (iii) FCF shouldn’t be extremely out there and being reinvested at these abysmal charges. This helps a maintain.

Determine 4.

Firm filings

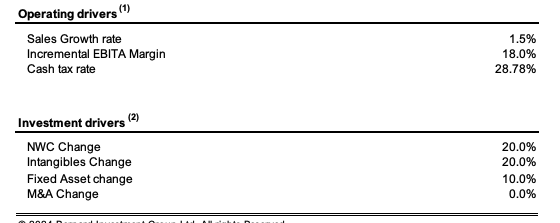

- My view is that gross sales will avg. ~1.5-3% [I’ll run with 1.5% on the conservative side] with ~18% pre-tax margins [generous] and ~$0.50-$0.60 funding to supply a brand new greenback in gross sales (Determine 5). This will get me to ~$344mm in NOPAT this yr [see: Appendix 1], stretching to ~$370mm by FY’26E. Right here I see ~24% development in NOPAT this yr [off a low base] and fade this right down to ~3%, with ROICs of ~3% all through [giving BIO +100bps of ROIC to work with – if it can’t demonstrate an increase value with that, it is an issue]. At ~0.7x my FY’24–’26E estimates of BIO’s invested capital this will get me to ~$243/share implied market worth, ~17% draw back from present vary (Determine 6).

- On the upside, if the a number of expands to >1.2x IC, then we get to ~$323/share implied worth (~9.5% upside) however for this to occur, we want (a) ROICs >8-10% and (b) pre-tax margins of >30% to make it occur. These are each low-probability occasions in my opinion [BIO’s 5yr avg. ROIC is <3% and 5yr avg. EBIT margin is 15% – do I think it is more profitable than 5yrs ago, to see it push to these levels? Answer is: No].

- Briefly, BIO nonetheless seems overvalued in my opinion, and even stripping Sartorius’ affect on its inventory worth, the enterprise’s returns aren’t enough.

Determine 5.

Creator

Determine 6.

Creator

Dangers

The upside dangers to the thesis are 1) BIO producing >3% gross sales with 25% pre-tax margins – this might carry ROICs to +6% and see it probably commerce at ~1x EV/IC, 2) Sartorius place catching a robust bid, and three) earlier charges reduce which is a tailwind to fairness valuations.

Briefly

BIO stays a maintain in my opinion attributable to 1) its <3% ROICs on a recurring foundation, 2) potential catalysts in product launches this yr, and three) valuations implying additional draw back to ~$245/share. Reality is BIO is buying and selling >30x NOPAT regardless of softening fundamentals which is extremely uncommon, as such the calculus stays skewed to the draw back in my opinion. Reiterate maintain.

Appendix 1.

Creator’s estimates