We’re likely in for another rate hike on this Wednesday’s Federal Reserve meeting. However, the signs point to just a 25-basis point increase.

In today’s video, Amber and I are forecasting what this means for inflation this summer (and where the market may go from here!).

I’m predicting that one sector will be making a big rebound soon — and that’s tech stocks.

Here’s why…

Artificial intelligence and automation continue to shape the landscape of this market. “Big-cap” tech giants like Meta, Microsoft and Apple are taking advantage of the AI trend and working through its glitches.

These companies are the most equipped to adapt this groundbreaking technology into their business models, increasing their productivity — and their profits.

And they aren’t the only ones…

In Today’s Video:

Amber Lancaster and I are covering:

- Market News: After this Wednesday’s Fed Meeting, what’s the most likely projection for interest rates and inflation in May (and the rest of 2023)? [0:30]

- Tech Byte: Why “big-cap” giants like Meta, Microsoft and Apple (and other tech companies) will benefit the most from artificial intelligence and automation software in this economic climate. [4:40]

- Big Bank Problems: An update on the March banking crisis comes from First Republic Bank, which will be bought out by JPMorgan Chase. (And why you should take measures to protect your money. Get access to my report on why now is the time to buy into bitcoin.) [6:55]

- World of Crypto: Consensus 2023 — the world’s largest, longest-running and most influential conference of crypto enthusiasts highlights blockchain technology this year. And how it’s being used to fight AI deepfakes and other internet scams. [11:00]

- Mega Trend: Following up on Tesla (Nasdaq: TSLA) — Its new 615-kilowatt, long-range supercharger could be a huge game-changer for EVs. If you’re an EV driver, find out what this means for you! [15:50]

- Investment Opportunity: Gary, one of our loyal readers, sold TSLA for $180 per share. But he’s ultimately bullish on the stock. So what is a good entry or buy back price for TSLA? [20:25]

(Or read the transcript here.)

More Edge: Investing Opportunity 🦾

What do you think about the tech sector? Think it’s a good space to invest, or not really your thing?

Or do you actually want to learn more? Just let us know at [email protected].

But you should know that my latest research points to a major convergence (or an economic boom) in one key area of the tech sector — microchips.

This is the technology that fuels most of our lives, such as:

- Computers, cell phones and other “smart” devices.

- Appliances and cars (gas or electric).

- POS (point-of-sale) systems for retail and restaurants.

- Medical equipment, and much more.

That’s why there’s a chip war happening in this sector. And there are 3 ways semiconductors are going to fuel an economic boom — in the U.S., and even on a global scale.

Some are calling it “the new oil” because this industry has a projected $1 trillion value by 2030.

So in my latest report — Chip Wars — my team and I have pinpointed select stocks that are gearing up for 1000% to as high as 5000% gains in the next 12 months or more.

If you want my full report on how to invest and profit from the chip sector, go here now for more details!

Regards,Ian KingEditor, Strategic Fortunes

Well, we have one less thing to worry about.

After two months of teetering, regulators took over First Republic Bank on Sunday and its assets have been sold to JPMorgan Chase.

First Republic’s demise amounts to the second-largest bank failure in U.S. history. It surpasses Silicon Valley Bank and Signature Bank and ranks just behind the 2008 failure of Washington Mutual.

We can put a pin in the longer story — whether the JPMorgan takeover was “fair,” or if this was another case of a large, politically-connected bank getting a sweetheart deal. And we can similarly hold on to this question: if it’s wise to allow any single bank to become as powerful as JPMorgan is today.

For our immediate purposes, the sale is a good thing. It removes the lingering threat (at least for now) of a disorderly failure that could have led to regional banks falling like dominos. JPMorgan’s actions provided a very useful backstop.

That said…

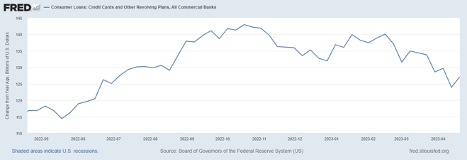

Banks have been retrenching for months. Consumers gorged themselves on cheap credit in 2021 and early 2022, and the banks were happy to oblige. But as interest rates rose and lending standards got stricter, credit card and other revolving consumer loans started to go into decline in October last year.

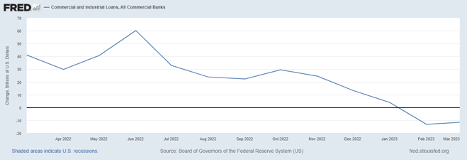

Commercial loans are larger and tend to have a more cumbersome review process. Yet despite this, the drop-off in commercial lending has increased.

The amount lent in commercial and industrial loans has been in freefall since last June. And it’s worth noting that this data only goes through March. Any fallout from the failures of Silicon Valley Bank, Signature Bank and First Republic Bank wouldn’t be showing up in the data yet.

It’s important to remember that the Federal Reserve doesn’t actually “print” money, even though we often refer to their stimulative activities as money printing.

Depending on how exactly you measure money, only 10% to 20% of cash takes the form of physical bills and coins. Most dollars are blips on a screen that are lent into circulation.

So less lending by the banks means less money floating around in the economy, and ultimately, means less growth.

Does this mean we’re in for a recession?

Probably.

The Conference Board, who produces the Leading Indicators Index, is currently assigning a 99% probability of a recession over the next 12 months.

A recession is not the end of the world. We need a recession every now and then to reset the clock, so to speak.

Recessions lower inflation and weed out struggling businesses, which gives a longer runway for strong businesses to grow. And it’s during hard times that new and exciting innovations get put to work.

I expect the next recession to turbocharge some of the trends that Ian has already been writing about for months, or even years now, including automation and artificial intelligence.

What better time to put cost-cutting technology to work than when your back is to the wall.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge