Sometimes “it is cheaper to drill for oil on the New York Stock Exchange than it is to drill directly.”

Those were the words of famous oil tycoon T. Boone Pickens when he dove headfirst into the oil merger mania of the late 1970s and early 1980s.

We saw another flurry of massive oil deals in 1999, when Exxon purchased Mobil Corp. for a staggering $82 billion (creating ExxonMobil). Between 1998 and 2000 alone, there were 25 different transactions worth $1 billion or more in the energy industry.

Now another quarter century has passed, and we’re seeing yet another sudden boom in mergers & acquisitions among the world’s biggest oil companies.

Most recently, Chevron bought Hess for $53 billion in stock. And just two weeks before that, ExxonMobil announced that it would be acquiring Pioneer Resources for $60 billion.

Just like Pickens said, these deals are happening because it’s easier for oil companies to buy additional production capacity than it is to grow organically.

Instead of spending years building a stake in North Dakota’s Bakken shale formation, or in Guyana’s offshore oil fields, Chevron can add those operations (and its earnings) to the business overnight.

And why shouldn’t it?

Oil companies’ stocks are now greatly undervalued after years of ESG talk and green energy initiatives, which led to investors shunning them.

Right now, the International Energy Agency projects oil demand will peak by 2030 and then gradually fall off.

But according to Scott Sheffield, CEO of recently acquired Pioneer Resources: “I personally disagree, the majors disagree, OPEC disagrees, everybody that produces oil and gas disagrees.”

Regarding the viability of renewable alternatives, he simply asked: “Who is going to replace jet fuel?”

Frankly, that’s a really good question.

And it leaves us to wonder — if Big Oil is so bullish about its future prospects … should YOU be bullish too?

Energy’s Complicated Future

As I’ve said in the past, the ongoing “energy war” between fossil fuels and green energy will have a surprise winner: YOU, the investors.

Because it’s going to be decades before we find out whether renewables can truly replace Big Oil. In the meantime, investors are going to see a wave of lucrative opportunities from both sides of the energy war.

The green energy industry is growing at rates that far exceed both economic growth and growth within the fossil fuels industries.

Identifying the best early-movers in the green space isn’t easy, but can be highly rewarding when you get in on the ground floor of just a few of them.

Meanwhile, and just as importantly, oil and gas companies are raking in gobs and gobs of free cash flow today.

The best oil and gas companies have lean and mean cost structures … so every extra dollar they get selling oil and gas on the open market falls directly to their bottom line … and then to shareholders in the form of dividends, buybacks and capital gains.

And with these massive new acquisitions for Chevron and ExxonMobil, the biggest oil and gas companies are massively increasing their production — which results in even more cash flowing back to investors.

But for every outstanding new energy investment, there are bound to be a boatload of duds. Fortunately, we can use Green Zone Power Ratings to quickly tell one from the other.

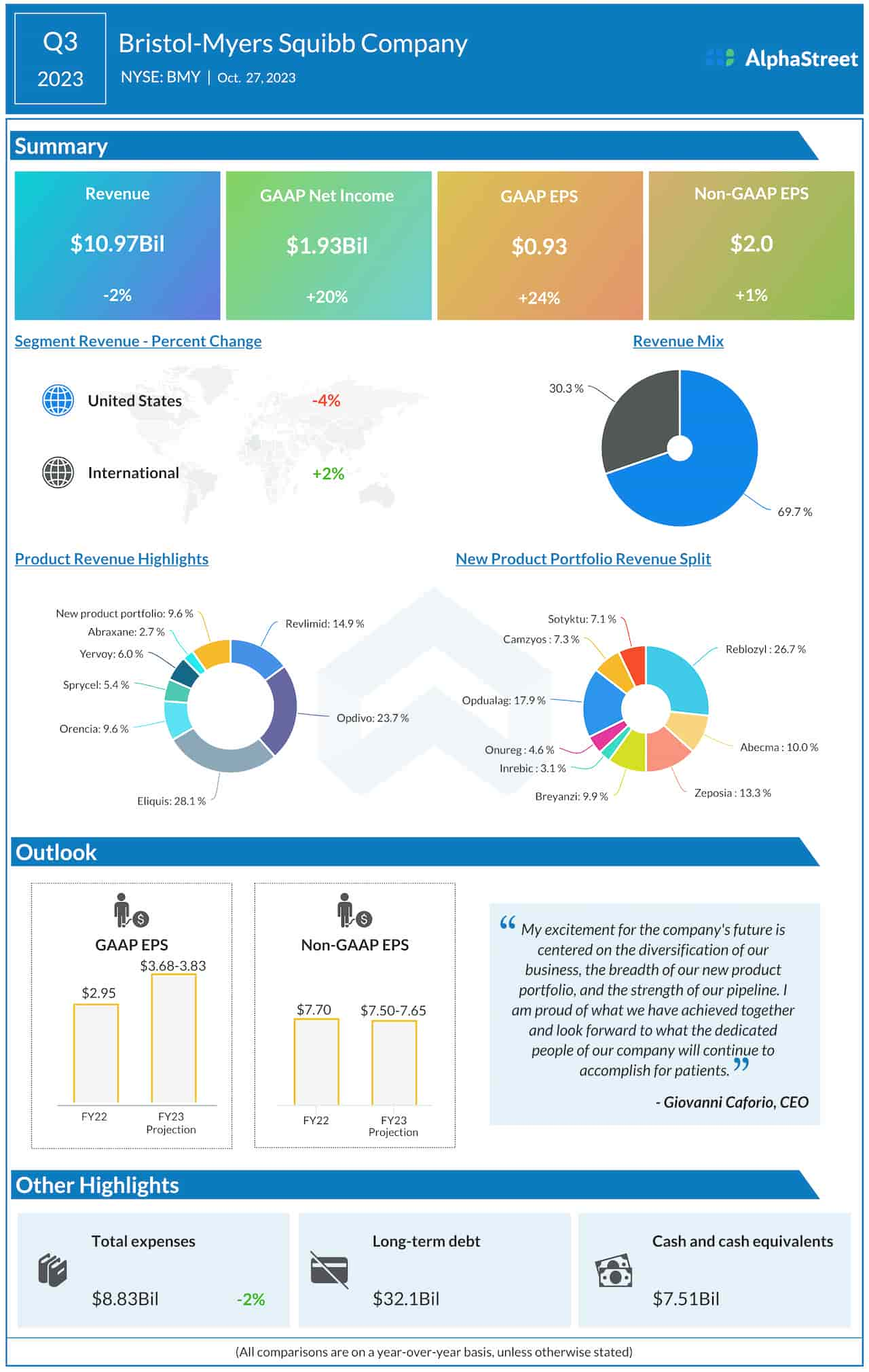

Big Oil by the Numbers

Our proprietary Green Zone Power Ratings system uses a combination of technical and fundamental analysis to give every stock a rating from 0-100.

It’s a simple but extremely powerful tool. And it’s the first thing I look at every time I’m evaluating a stock.

For example, let’s take a look at Hess.

As far as Chevron is concerned, Hess is worth every penny of their $53 billion buyout. Guyana is set to become the world’s fourth-largest oil exporter, offering some much-needed diversification at a time when European oil markets are in upheaval.

Hess’ shale assets are icing on the cake, giving Chevron the chance for a massive payday when oil prices spike again.

That’s all great news for Chevron. But as far as retail investors are concerned, Hess’ stock is still in the doghouse:

The company sports a Green Zone Power Ratings score of just 38.

Hess is especially hindered by its massive size, weak growth and poor value compared to competitors. None of these factors are really an issue for Chevron. But since investors are only buying a few shares (and not the whole company), they’re worth considering.

The same is true on the other side of these mega acquisitions as well.

ExxonMobil’s Green Zone Power Ratings score is substantially higher at 73/100:

It scores substantially higher than Hess on most metrics, especially value and quality. But due to its dominance in the industry, it scores a 0/100 on size.

(Editor’s Note: You can check the Green Zone Power Ratings scores for any stock by visiting the Money & Markets site and typing the ticker symbol or company name into the search bar.)

73/100 is still a bullish score, so ExxonMobil is a good investment at these prices.

But if we dig a little deeper, and look past the headlines, we start seeing even bigger opportunities among smaller energy stocks…

Small-Scale Energy for the Biggest Profits

At $7 billion in market capitalization, Civitas Resources (NYSE: CIVI) is practically microscopic compared to Big Oil.

But as far as investors are concerned, it’s far more promising — with a Green Zone Power Ratings score of 91/100:

Civitas has already completed its own round of acquisitions, including a relatively large $2.1 billion takeover of Vencer Energy’s Midland Basin assets. As a result, the company is on track to produce 335,000 barrels of oil (equivalent) per day in 2024.

Even if prices stay steady at $70 per barrel, Civitas will produce $1.5 billion in free cash flow this year alone. You can expect that to come back to shareholders in the form of a $7 per-share dividend.

This is the kind of stock that could make your year as an investor. But you’d never find it, unless you take a systematic approach to the market using something like Green Zone Power Ratings.

I originally recommended Civitas to my Green Zone Fortunes readers back in March of 2021.

Since then, we’ve seen open gains of 166%.

Civitas is currently a hold at today’s price, but it’s also a great example of what happens when you look past the headlines and zero in on the real gushers in today’s energy markets.

For more on the market’s best energy investing opportunities, I recommend taking a look at our Oil Super Bull Summit, where I shared the details on my #1 oil stock for 2023.

To good profits,

Adam O’Dell

Adam O’Dell

Chief Investment Strategist, Money & Markets