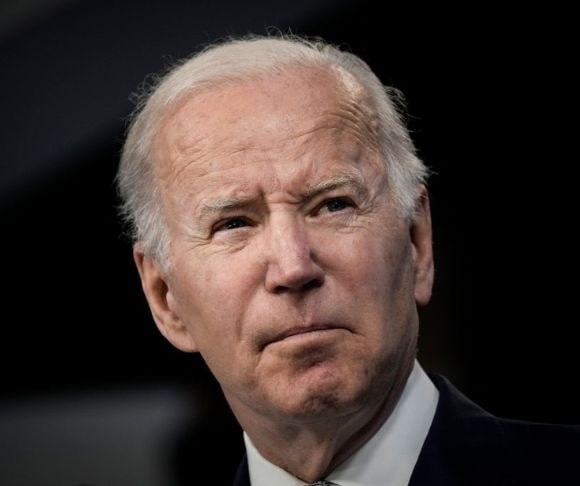

President Biden simply introduced new actions to decrease housing prices, aimed toward company landlords who personal over 50 models, to make housing extra inexpensive for tenants. Further initiatives aimed toward sparking extra inexpensive housing growth may very well be a chance for traders.

The details of the president’s proposal are, in line with a press launch:

- Calling Congress to move laws to both cap lease will increase on present models at 5% or threat landlords dropping invaluable federal tax breaks. The obvious assumption could be to focus on depreciation and 1031 exchanges.

- Repurpose public land sustainably, permitting 15,000 further inexpensive housing models to be constructed in Nevada.

- Rehab distressed housing, construct inexpensive housing, and revitalize Las Vegas neighborhoods.

The president known as on Congress to make housing extra inexpensive for American households by passing the Biden-Harris Housing Plan. It could enable the development of two million properties and supply $10,000 in mortgage aid to allow homeownership.

In keeping with the White Home’s press launch, extra properties are below building than within the final 50 years, and new housing building is up 17% over the Trump administration.

The White Home additionally highlighted a number of high-profile circumstances of company landlords being named in pending litigation (referring undoubtedly to the RealPage lawsuit), citing “their alleged use of proprietary algorithms to lift rents on tenants.”

What Rental Protections Imply for Landlords

Crucially for landlords, the Federal Housing Finance Company (FHFA) is saying new actions to guard renters in multifamily properties financed by loans acquired by Fannie Mae and Freddie Mac. The brand new protections apply to future loans with Fannie and Freddie (the government-backed housing organizations have funded a median of 1.2 million rental models over the previous three years). Landlords in these buildings should adhere to the next:

- Requiring 30-day discover earlier than lease will increase;

- Requiring 30-day discover on lease expiration; and

- Offering a five-day grace interval earlier than imposing late charges on rental funds.

Repurposing Public Land for Inexpensive Housing

Repurposing city-owned land to construct extra inexpensive housing isn’t a brand new idea. It’s usually utilized in dense city facilities comparable to New York Metropolis. Nevertheless, the Biden administration plans to do the identical factor to repurpose federal land to construct tens of hundreds of inexpensive properties in Nevada.

The Bureau of Land Administration (BLM) introduced the opening of a public remark interval on a sale of 20 acres of public land to Clark County, Nevada, for beneath market worth at simply $100 per acre—the largest-ever sale for inexpensive housing below the Southern Nevada Public Lands Administration Act program, which the county estimates will allow the event of almost 150 inexpensive properties for households making lower than 80% of space median revenue.

Different land and housing initiatives all through Nevada have been additionally introduced, together with housing-related requests for the roughly 26,000 acres in Las Vegas Valley that stay below BLM management and are eligible for disposition below the Southern Nevada Public Lands Administration Act program.

Alternative Neighborhood Grants Can Profit Builders and Buyers

The federal government is dedicating $325 million of HUD grants towards Alternative Neighborhoods implementation grants to construct new properties and spur financial growth. Grantees will collectively develop over 6,500 new mixed-income models, together with one-for-one substitute of two,677 severely distressed public housing models. These rewards can be shared amongst nonprofits and native builders, together with home flippers, to revitalize communities that adhere to authorities tips.

Ultimate Ideas

The brand new Biden-Harris housing initiatives accomplish a number of vital duties, some with clear political motives. They prioritize inexpensive housing—which is urgently wanted—and highlight Nevada, a swing state that might determine the 2024 presidential election.

For traders, there are alternatives to work inside the system and make the most of authorities grants to construct and renovate inexpensive housing that matches inside federal tips. The benefit for seasoned flippers is that, in lots of cases, there is likely to be a line of ready patrons who’ve been by government-backed inexpensive homebuying applications with low rates of interest, or they could have preapproved renters prepared to maneuver in with Part 8 vouchers or different government-endorsed applications.

Relating to the 5% lease cap: In different elements of the nation—notably New York Metropolis—it has been widespread apply to have a 5% lease cap on will increase per yr. That can now apply nationwide for buildings of a sure measurement. How this can have an effect on the redevelopment of multi-unit buildings the place traders are counting on elevating rents to show a revenue after renovating an residence stays to be seen.

Prepared to achieve actual property investing? Create a free BiggerPockets account to find out about funding methods; ask questions and get solutions from our group of +2 million members; join with investor-friendly brokers; and a lot extra.

Observe By BiggerPockets: These are opinions written by the writer and don’t essentially signify the opinions of BiggerPockets.