simonkr/E+ via Getty Images

Qurate Retail (NASDAQ:QRTEA) is certainly not experiencing a good time: customers are leaving, the company is facing one round of layoffs after another, and all this after a fire in December 2021 destroyed the company’s second largest logistics center, from which 25-30% of customer orders were shipped.

The company has formulated a multi-year plan to address the situation, providing updates about it in the recent Q2 2023 earnings call. Despite the best efforts of the management, my stance on this stock is bearish, and I believe there are no conditions for a profitable investment in Qurate Retail.

In this analysis, I will primarily focus on three points that form the basis of my rating:

- The company’s recovery plan, mainly based on cost-cutting, is insufficient to change the company’s fortunes;

- Qurate Retail’s debt is worrisome, especially in a time of high-interest rates, and with the company not generating cash from its core business;

- The business model is fragile, especially in the long run.

Business Model Overview

For those unaware, Qurate Retail is a company specializing in video commerce. Essentially teleshopping, increasingly integrated with an online component. The company operated through four business units. Ordered by the percentage of the group’s overall revenues, these business units are:

- QxH, the largest and most affected by the fire at the Rock Mountain warehouse. It mainly focuses on the U.S. market, offering various products (supplements, home, beauty, etc.);

- QVC International, similar to QxH in products and operations, but with activities mainly in Europe and Japan;

- Cornerstone, a brand entirely centered on home products;

- Zulily, an e-commerce specializing in women’s clothing.

Now only the first three business units remain, as Zulily was completely divested during the last quarter.

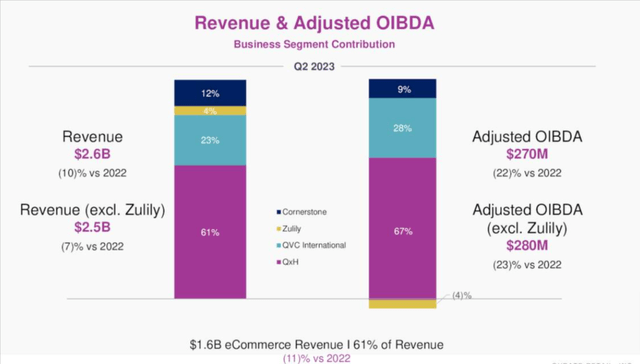

Qurate Retail – Q2 ’23 Earnings Presentation

Q2 ’23 Results: Revenues Keep Falling

The second quarter of 2023 closed with revenues of $2.649 billion, down from the $2.953 billion in the same period of the previous year. The company attributes the decline mainly to a drop in order volume, partially offset by a 5% increase in the product mix price of QxH and QVC.

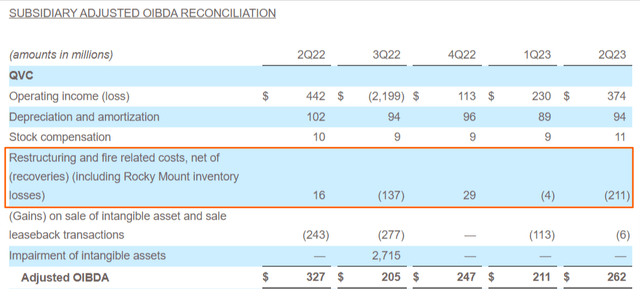

The quarter ended with a net profit of $107 million, which, however, includes $211 million in extraordinary revenues resulting from insurance proceeds related to the Rock Mountain fire. Quoting from the company’s statement:

In the second quarter of 2023, QxH recognized (i) a $209 million net gain on insurance proceeds representing insurance proceeds received in excess of fire-related costs and (ii) a $2 million gain on the sale of Rocky Mount in February 2023 that was released from escrow.

This means that, net of extraordinary events, the quarter would have closed with a loss of $104 million.

The section related to the extraordinary income is highlighted (Qurate Retail – Q2 ’23 Earnings Presentation)

Financially speaking, Qurate Retail received the final $225 million insurance payment for the Rock Mountain logistics center. It also liquidated its stake in Comscore, cashing in $67 million. This last piece of information was only provided during the earnings call in response to a specific question. The capex was $105 million, and Qurate expects FY 2023 capital expenditure to be $230 million. Thanks to these investments, the new Cornerstone logistics center in Arizona was opened, becoming fully operational from June.

The balance sheet situation has not changed much: using the liquidity from the insurance payment, Qurate repurchased $177 million in bonds maturing in 2024 and $15 million in bonds maturing in 2025. Considering that total liabilities are worth over $12 billion, it’s not a significant change.

Here’s Why the Turnaround Can’t Work

Given Qurate Retail’s current situation, high profitability would be needed to encourage investors to navigate through the company’s high debt. As would growth prospects, margin improvements, or other types of catalysts: all things that Qurate cannot provide at this time.

Below, I will analyze the three most important points to understand my pessimism about this stock: the cost-revenue profile, debt levels, and the fragility of the business model. The data on the cost-revenue profile and debt levels come directly from the Q2 2023 quarterly report.

#1 – The Cost-Revenue Profile is Anything But Exciting

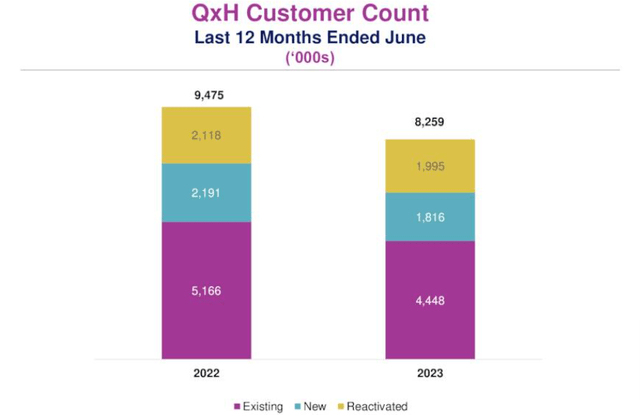

The second quarter saw yet another drop in revenues for all business units: -8% for QxH, -3% for QVC, and -7% for Cornerstone on a constant currency basis. The company reports a 5% higher average sale price for QxH and QVC, but a decline in overall order volume.

Since the figure is not provided, I did the math myself: an 8% decline in revenues with 5% higher prices implies a 12.4% decline in order volume for QxH; a 3% decline in revenues with the same price increase implies a 7.6% order volume decline for QVC.

Marketing spending remained unchanged from 12 months ago, indicating that customer acquisition efforts are yielding less. Against this backdrop, the company’s plan to change trajectory is not based on stimulating demand: it is based almost exclusively on cost-cutting through staff layoffs:

- QxH – After the layoffs in February, more followed in Q2 2023, reducing the workforce by a further 8%. Staff cuts are expected to have ended for now, leading to a cost reduction of $50 million in 2023 and in subsequent years;

- QVC – The company intends to implement a layoff plan with a run rate of $45-55 million in savings by Q1 2025;

- Cornerstone – Cut 100 jobs for a total annual saving of $10 million, of which $4.5 million will already be saved in 2023.

Even when explicitly asked during the conference call, when management was asked when revenues will start growing again, the answer was very vague. The only clear information is that at least two more quarters of decline are expected.

Layoffs and price increases can’t go on indefinitely. They are among the last tools a company has to combat its decline, but against crushing debt and chronically declining revenues, they are not enough. The savings from the extensive restructuring plan are worth less than $30 million per quarter when the company would have lost over $100 million without insurance capital gains and with a deteriorating outlook in the coming months.

All this without considering that up to this point the macroeconomic scenario has remained favorable, with good consumer confidence and an extremely solid job market. If the macroeconomic context were to deteriorate, it could be the death knell for Qurate.

Qurate Retail – Q2 Earnings Presentation

#2 – Debt Levels are Very High

One of the main problems with Qurate is that the company’s debt levels are extremely high, to the point that bears are even betting on a possible bankruptcy. Here are some data points to consider about Qurate Retail’s financial profile (data in $ millions):

Current assets (ex. inventory) | 2.591 |

Current liabilities | 2.397 |

Long-term debt | 6.537 |

Total liabilities | 11.072 |

The tangible book value per share is -$15.87, and the company’s tangible book value is negative by $6.169 billion. It’s not exactly a wonderful situation, especially considering that refinancing today means accepting extremely high interest rates. The key issue, in this context, is that there is no foundation to improve the profitability of the core business, and consequently, not enough liquidity is generated to significantly address the debt.

#3 – The Core Business is Fragile

Even though Qurate Retail reports that 61% of its revenues come from e-commerce, this is just the platform where consumers complete the purchase. Television remains the tool that drives customers to buy on the website, by phone, or in any other way.

Younger consumers watch little television and even fewer teleshopping programs. In the long term, the pool of users that Qurate targets will increasingly dwindle. Additionally, the company sells products at extremely high prices compared to market equivalents: for today’s increasingly tech-savvy consumers, it has become easy to compare the product seen on TV with alternatives available on Amazon.

Below is a table of prices listed on HSN (part of the Qurate network) and the most purchased equivalent product on Amazon.

HSN | Amazon | |

Whey Protein Isolate (1.1 kg) | 139.90$ | 67.09$ |

HP 15.6″ Touch Intel Core i3 8GB RAM 256GB SSD | 419.99$ | 357.90$ |

| Samsung 2023 50″ Q60C 4K QLED | 599.99$ | 477.99$ |

| Birkenstock Gizeh Canvas Thong Sandal | 110$ | 91.90$ |

Gucci Bamboo For Her, 2.5 ounce | 124$ | 75.99$ |

I did not cherry-pick to select the products presented in the table; I simply chose the first product that the HSN site suggested when clicking on different categories. The goal is to provide some practical examples, not necessarily those with the largest price difference. HSN prices are publicly visible on the official website, as are those on Amazon. Regarding isolated whey proteins, HSN sells its own brand, but it’s a commodity: pure proteins extracted from non-hydrolyzed milk serum, like the hundreds available on Amazon. The comparison in this case is with IsoPure isolated whey proteins, which on Amazon are sold at $67.09 for 1.3 kg: not only is the price much lower, but there’s 20% more product in the package. All the other products are associated with a specific brand, so the comparison is between the price of the exact same product on HSN and on Amazon.

The lack of convenience is not the only issue: the quality of the products is also questionable, or at least it seems so when looking at the statistics. In Q2 2023, the return rate increased from 14.8% to 15.8% for QxH and from 19.4% to 19.6% for QVC International. When 1 in 7 products for QxH and 1 in 5 for QVC are returned, the problem is clear: I spent half an hour in an eBay forum thread to understand the benchmarks, and most sellers are concerned when their return rate exceeds 4-6%. Amazon does not publish this statistic, but various sources mention a range of 5-15% depending on the product category.

Conclusions

The teleshopping business is waning, as is the medium itself. Like any other business that heavily relies on a single platform, the company’s fate is intricately tied to that platform. The decline in teleshopping, the misfortune of the Rock Mountain fire, but especially because of the poor profitability and high indebtedness, I prefer to stay away from Qurate Retail’s shares right now.

I might consider opening a short position, but honestly, I don’t think I want to use my portfolio’s liquidity for such an investment. I certainly won’t do it in the near future. My liquidity for side-bets is set to flow soon into the companies to which I have recently assigned a buy rating: as I highlighted in my analysis of SurgePays and that of Illumin, there are several micro-cap stocks different from Qurate that are grabbing my attention right now.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.