The rally that occurred final week was epic. Fairness markets world wide breathed a collective sigh of reduction and the response from buyers was to purchase all the pieces. This was significantly true in beaten-down teams similar to small cap progress, client discretionary, and to a lesser extent, giant cap progress. These are the areas of the market I watch very carefully as a result of they sign whether or not Wall Avenue is in a bullish temper. In spite of everything, if the massive cash thinks we’re going larger, they will allocate to progress areas to reap the benefits of outsized up strikes. It is the identical purpose utilities and different defensive names outperform in occasions of duress.

The massive query, nonetheless, is whether or not or not this transfer was the beginning of a brand new bullish section, or if this was merely the unwinding of large concern throughout choices expiration week. The week of choices expiration is mostly a fairly risky one, and you will recall the throughout rip-roaring bullish intervals, choices expiration tends to see a downward bias. Nonetheless, this time round, since we have been in an prolonged bearish section, the bias was very clearly larger. In different phrases, if there is a predominant pattern heading into choices expiration, it is a pretty secure wager we’ll see a transfer the week of choices expiration in the other way. That is precisely what final week was. Whether or not it has endurance or not is the massive query, and proper now, I am not so certain.

A part of the rationale I am not so certain is one thing we’ll talk about in a bit, however allow me to elaborate on choices expiration, and the position market makers play on this. When an index or a person inventory has made an enormous transfer to 1 facet or the opposite – on this case, we had nearly all the pieces transfer decrease into opex week – in-the-money choices are closely skewed to 1 facet.

On this case, we had actually billions of {dollars} of in-the-money put premium that was set to run out on Friday. That offers market makers an enormous incentive to bid up costs of assorted securities to “stability the scales” between name and put premiums which can be in-the cash. This isn’t a brand new phenomenon by any means, and it’s well-known. However I feel it is value maintaining in thoughts within the context of the large rally we noticed final week, as a result of I am not overly satisfied the state of affairs is as bullish as it will appear proper now.

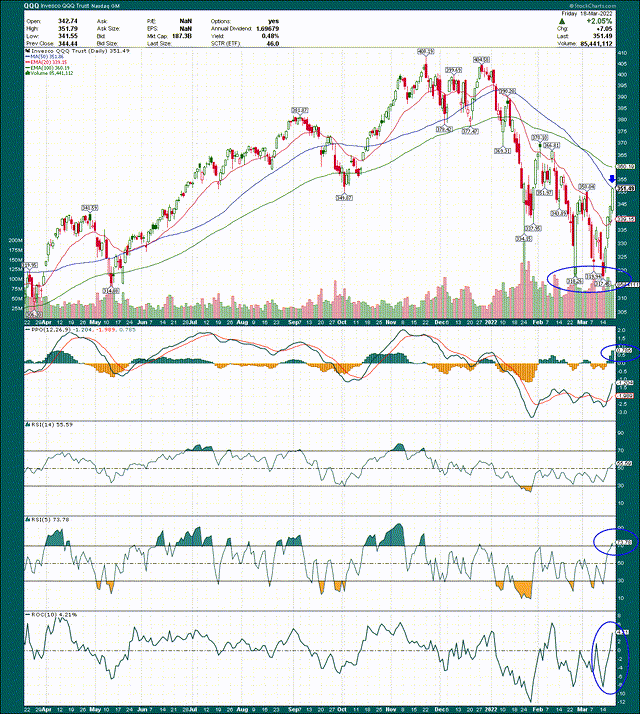

Let’s get to the chart.

StockCharts

The important thing factors of this chart start with the triple backside the Nasdaq (NASDAQ:QQQ) made prior to now few weeks on the $317 degree. Having a triple backside in place supplies an excellent launch pad for any type of bullish transfer, and what a launchpad it was; we noticed a ten% transfer within the QQQ simply final week. That is an unbelievable up transfer in such a brief time period, and I will admit it has considerably broken my bearish case.

The reason being as a result of the QQQ vaulted and sustained a transfer over the 20-day exponential shifting common, or EMA, which is among the first indicators I search for to find out if a inventory/index has bottomed. The second signal is a profitable retest of that EMA, which after all, hasn’t occurred but. When it does, what the QQQ does will likely be very instructive for the following section of this transfer. Does it bounce off the 20-day EMA in a bullish method and go larger, or can we see an extra breakdown. We might get that reply within the coming days.

Now, the QQQ rallied precisely to its 50-day easy shifting common in blue, and I’ve positioned an arrow the place resistance is. Monday will likely be very fascinating as a result of the QQQ has spent at whole of someday in 2022 above the 50-day SMA, and that was the primary buying and selling day of the yr. If this actually is a brand new bullish section, the 50-day SMA have to be crested and sustained. Whereas that is definitely doable, if we have a look at the momentum indicators, I feel it is a tall order for the bulls.

The PPO continues to be very a lot in bearish territory, and actually, is not even near being bullish. The one bullish factor in regards to the PPO is that the histogram is nearing +1, however that additionally means the ETF is overbought on that foundation. We will see different examples of the histogram reaching +1 (or thereabouts) and it has signaled that the ETF wants no less than a breather, or maybe a pullback to work that off. It is no shock the QQQ is overbought after rising 10% within the house of some days.

Second, the 5-day RSI is in overbought territory, and whereas it could change into extra overbought, it creates one other headwind for bulls. The 14-day RSI appears to be like extra bullish now as properly, having lastly crested the centerline after weeks of failing to take action. This is the reason I mentioned earlier that some harm had been carried out to the bearish case for this chart, as a result of these are, in reality, bullish developments, and I am not blind to them. I nonetheless assume this was an opex-related oversold bounce, however we will discover out if I am proper or not very shortly.

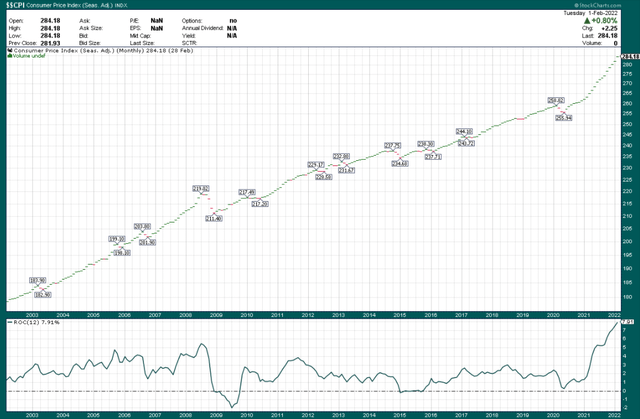

Inflation and inventory valuations

Let’s now flip our consideration to a different potential challenge for the bulls, which is that of inflation and rates of interest. We’re all totally conscious of what is going on on with inflation, however let’s recap with a long-term chart. Under I’ve 20 years of CPI information charted on a month-to-month foundation, together with the one-year fee of change within the backside panel.

StockCharts

We will see that for essentially the most half, inflation strikes regularly larger over time. Nonetheless, we do get deflationary intervals, similar to the start of the COVID disaster, and so they’re typically resolved inside a couple of months. That occurred once more this time, however as an alternative of a gradual transfer larger, we’re racing larger. The one-year fee of change is now at 8%, and is more likely to transfer larger for no less than yet one more month given how early-2021 seemed. Other than all of the impacts this has on customers, it additionally has impacts on rates of interest. Since rates of interest impression inventory valuations, inflation is essential, and we’ll illustrate that time now.

Charges are an enormous potential headwind

Under we now have the 10-year Treasury fee and the QQQ’s correlation to that fee beneath, on a 100-day foundation, so it is a medium-term indicator on this case.

StockCharts

What’s clear is that usually, we have seen an inverse relationship between QQQ and TNX, and that is sensible on condition that if the risk-free fee is larger, the fairness threat premium we’ll see in inventory valuations have to be decrease. That drives P/E (or P/S or no matter else) decrease as a result of buyers can theoretically obtain a better risk-free return from Treasuries, all else equal.

Certainly, the 100-day correlation between QQQ and TNX is -0.82 proper now, it is a very sturdy inverse relationship. You is perhaps saying now, so what, why do I care? Properly, if inflation continues at a fee of 8% or extra, rates of interest will go larger. That is a reality of life and you’ll have a look at any interval of inflation in our previous to see that. Certainly, the interval following the Nice Recession had extraordinarily low inflation, and we had historic lows in varied rates of interest; the identical factor occurs in reverse, and it is not a coincidence.

Thus, if that sample follows and we see elevated inflation, we should always elevate charges, and due to this fact, we should always see a unfavourable response in progress areas particularly, such because the QQQ. That is one thing that performs out over weeks or months, not days, so intervals of bullishness like final week are to be anticipated.

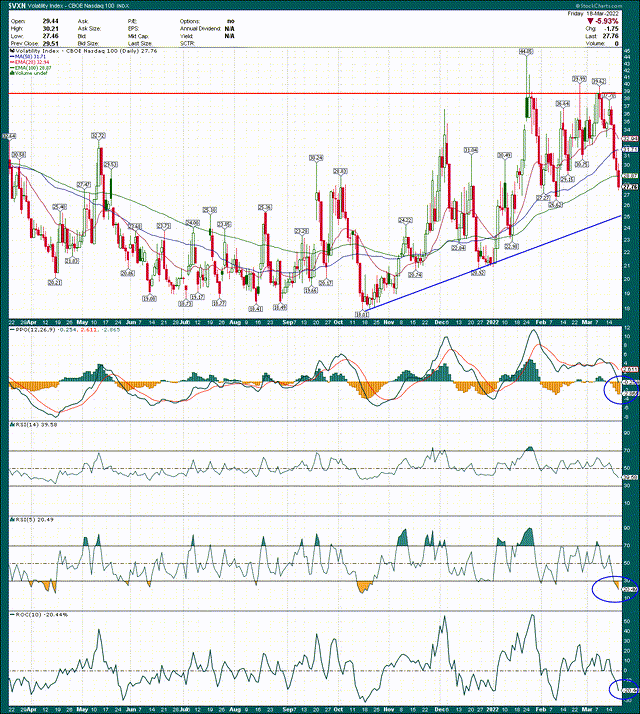

Volatility stays a problem

Lastly, let’s check out the VXN, which is the volatility index for the Nasdaq. This is identical factor because the VIX for the S&P 500; it is merely a measure of volatility.

StockCharts

The VXN made a fairly clear high within the space of 39/40 prior to now a number of weeks, which coincided with the near-term bottoms made within the QQQ. That is regular habits as a result of volatility readings that top are extraordinarily uncommon, so seeing some reduction rallies from these extremes is not surprising. Nonetheless, I feel this chart is signaling that buyers ought to stay cautious proper now, and just like the QQQ chart itself, we’ll get some type of decision fairly rapidly on this one to find out if I am proper or not.

There is a trendline that is quickly approaching the worth of the VXN, which is one thing the bulls might want to negotiate. It is about $2 beneath the present value, and in at this time’s market a $2 transfer within the VXN can occur in a couple of hours, so it is shut.

I additionally assume the momentum indicators are displaying the VXN has declined too quickly, too rapidly, and {that a} snapback is extra doubtless. The PPO is displaying a centerline take a look at, coinciding with the histogram displaying oversold ranges at -3. Whereas the VXN definitely can transfer decrease, this means that volatility has doubtless moved down too rapidly.

We see related habits within the RSIs, and the 5-day RSI is definitely properly into oversold territory. If you have a look at the 10-day fee of change at -20%, you’ll be able to see why the 5-day RSI is in oversold territory.

Sum it up for me

What all of this implies is that we had a market that was extraordinarily bearish and oversold heading into an choices expiration week final week. Market makers had actually billions of {dollars} of incentive to bid share costs as much as work off the acute in-the-money put premium that had accrued, and that is precisely what occurred.

My view is that I am remaining cautious except we get a comply with via of bullish habits within the coming week, as a result of a snapback rally from oversold circumstances into opex shouldn’t be precisely a strong basis for a brand new rally. Might it occur? Completely. Is it going to? I am not satisfied.

Given all of this, I feel the bulls have a tricky highway forward and I nonetheless assume we now have a fairly good likelihood of not solely revisiting the lows, however breaking down beneath them within the coming weeks. That opinion might be fairly unpopular at this stage and I may even see some digital tarring and feathering within the feedback. However I feel the macro headwinds are too nice for the time being for this rally to stay, and I feel there’s yet one more large down transfer to return earlier than we truly backside. We will see.