ILLUSTRATION BY EMILY SCHERER

For the past few weeks, we’ve been trying to figure out to what extent, if any, Republicans have regained ground in the race for control of Congress. And the answer is … probably some, but not necessarily as much as the conventional wisdom holds.

In FiveThirtyEight’s Deluxe forecast, the GOP now has a 34 percent chance of recapturing the Senate. That’s up from a low of 29 percent in mid-September.

In betting markets, there’s been a much sharper shift. In fact, the markets have the race at nearly even, with Republicans having a 49 percent chance of Senate control. That’s up from a low of 33 percent in late August. The markets were in pretty good alignment with FiveThirtyEight’s forecast for most of the cycle; now they’re not.

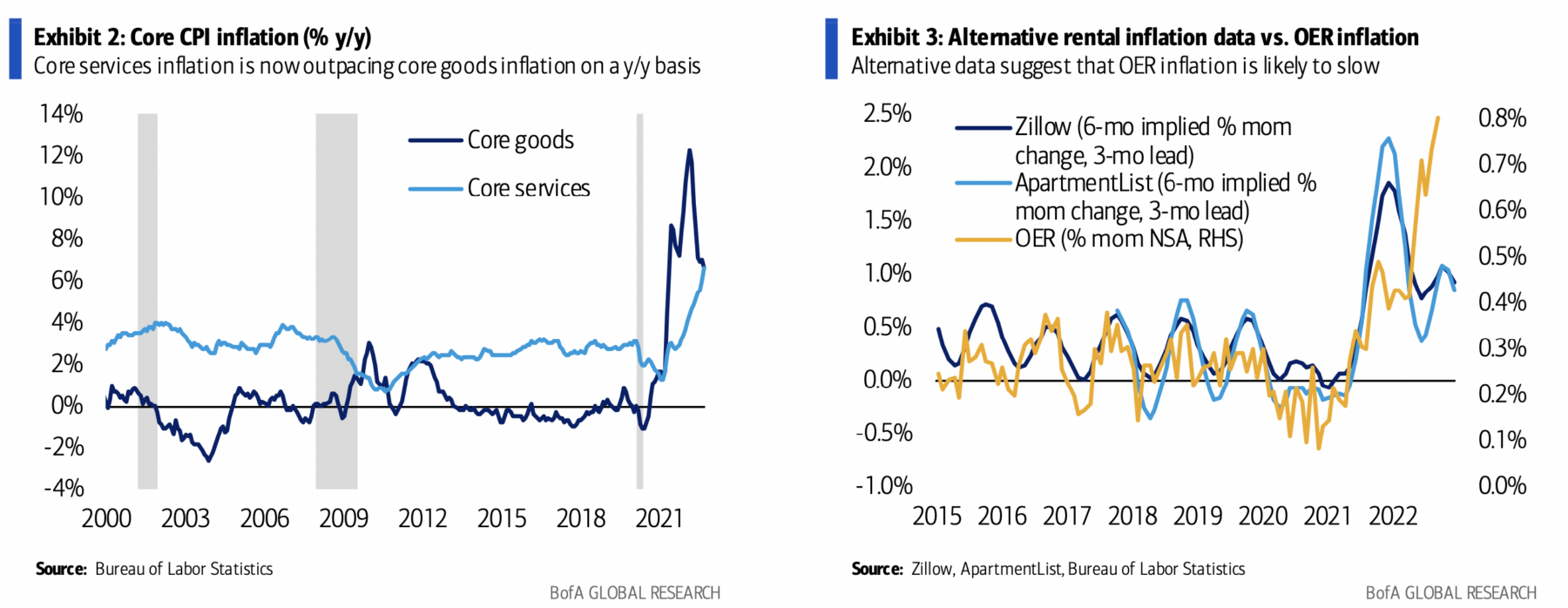

How come? Well, as I wrote two weeks ago, I don’t think it’s crazy for the markets to be concerned about systematic polling bias. It’s also not crazy for markets to have anticipated some fallout for Democrats from Thursday morning’s worse-than-expected inflation report.

But the gap between the markets and the models is big — and growing. And it’s not just FiveThirtyEight’s model. Several other models are similar or don’t even show a Republican rebound at all.

I wouldn’t care about this much if there had been a steady gap between the markets and the models. If the markets want to take the hypothesis of predictable polling bias more seriously than the models do, or to put more weight on the long history of the president’s party having a poor midterm, that’s fine by me. Aggregating different hypotheses is a strength of markets generally.

The three races bringing down Democrats’ odds of holding the Senate | FiveThirtyEight

The markets and the models are also telling very different stories about the trajectory of the race, though — and I think this gets at two potential ways in which political betting markets sometimes aren’t that smart.

One weakness of these markets is that they tend to follow the media narrative about the race more so than they do the underlying evidence. The source for this claim: yours truly, because I’ve been doing this for a very long time.

My impression for the past few weeks is that media coverage has been leaning into the Republican-rebound story. (So has ours, to be unhypocritical about this.) And in some ways, this coverage is justified. Republicans have unambiguously gained ground in the Wisconsin, Pennsylvania and Nevada Senate races — and those are important contests! The steady improvement in political fortunes that Democrats experienced in the summer is over.

But the Republican position hasn’t really improved in Arizona’s Senate race, and Herschel Walker has probably lost ground in Georgia. In Ohio and North Carolina, momentum is murky, and any poll movement is hard to distinguish from statistical noise. The generic ballot and President Biden’s approval rating have also not shifted very much. The outlook in the House continues to favor Republicans but hasn’t changed much in either direction.

It’s a messy story. People tend not to click on headlines such as “Republicans Gaining Ground In A Few Key Senate Races, But With A Setback In Georgia; National Trends Unclear, Perhaps Some Hint Of A Republican Rebound, But It Could Just Be Noise ¯_(ツ)_/¯.”

The other weakness in these prediction markets is that the traders don’t have a lot of technical sophistication about election forecasting. That’s not to say they aren’t sophisticated in general. Traders may know a lot about politics, they may have a good sense for market psychology, and they may be smart people who are good general-purpose estimators. But there are some questions for which actually going through the process of building a model helps a lot, such as in determining how much an election forecast should shift in response to a modest but noisy shift in the polls.

Most of these traders aren’t building election models themselves. I’m confident about that, because I know the sort of people who bet on elections. Poker players, sports bettors, quantitatively minded academics — they all have a lot of overlap with Nate World and I often encounter them in personal and professional settings. They’ll mention that they bet on elections, they’ll mention that they follow FiveThirtyEight and other forecasts, but they usually aren’t building election models from scratch.

Nor should they be building them, frankly, because doing so wouldn’t be greatly time-consuming. Building a halfway decent election model would take — I’d estimate from my own experience — a couple of months of hard work if you had a lot of help, and more than that if you didn’t. It’s not a great investment when an election is held only once every other year. You’d be better off working on models to do options trading or to bet on football, where there’s more liquidity and more frequent opportunities to make money.

A lot of the value the models provide, as I mentioned, is in looking at all the polls and not just the ones that get highlighted in the media, which are often a highly nonrepresentative sample.

The models also understand an important fact about midterms: They tend not to turn on a dime, in the way that presidential elections sometimes do. (Although even for presidential elections, most “game changers” are false alarms.) If you hear about momentum shifts in midterms, you should generally be wary.

Why? Well, voters aren’t paying all that much attention. Yes, you’re paying attention because you’re a FiveThirtyEight reader. But the general public pays much less attention to midterms than to presidential elections. Take a look, for example, at Google searches for the word “polls”:

The spikes for presidential elections are much bigger, about three or four times bigger. People certainly notice big stories such as inflation or Roe v. Wade being overturned, but they aren’t following daily news stories in the way they do in presidential years. What happens on cable news tends to stay on cable news.

That’s why, we’ve found, you should be cautious in interpreting shifts in the generic ballot; your default should be to assume that the public’s preference for which party controls Congress is fairly steady, even more so than for whom they’d like to see elected president. It takes a lot to move the needle.

Another dissimilarity between midterms and presidential elections is more obvious but still worth mentioning: There are different candidates on the ballot in every state and district. A scandal involving Biden or former President Donald Trump will spill over into every state; one involving Herschel Walker will probably have an impact only in Georgia. Unlike in presidential races, it is very much not safe to make inferences about how one state is moving based on how others are; a change in the polls in Pennsylvania tells you approximately nothing about one in Arizona.

It’s probably bad for FiveThirtyEight site traffic to say this, but the final few weeks of the midterm campaign may not be all that climactic or action-packed. Certainly, a lot of the individual races are quite fascinating, but “October surprises” that affect one race may not affect others. There may be some changes in the big-picture, topline numbers, but probably not huge ones. And that means we’ll enter Election Day with a lot of uncertainty about which party will emerge with control of Congress.