Earthquake in Haiti, volcanic eruption in Indonesia, Hurricane Ida within the US, storm Rai within the Philippines, and floods in Australia, Belgium, China, Germany, India, and Nepal – over the past yr, these have illustrated the depth and the frequency of pure disasters all around the world. The financial prices of pure disasters have risen dramatically over the past a long time, reaching $190 billion in 2020, in opposition to (2020) $1.3 billion in 1970 (Sigma 2021). Pure disasters impacted insurers, with $89 billion of insured losses in 2020. For the big uninsured half, they impacted households, companies and banks (Hosono and Miyakawa 2014).

Determine 1 New Orleans

Supply: https://pixabay.com/photographs/new-orleans-louisiana-81669/

Apart from the escalating local weather disaster, this rise within the financial prices of disasters is basically defined by the rising variety of folks and companies in uncovered areas and the worth of their belongings (Hallegatte 2012). Many areas which might be uncovered to catastrophic dangers are certainly inhabited and used for financial actions. In China, as early as 2004, 50% of the inhabitants was dwelling within the 8% of land space within the midstream and downstream elements of the nation’s seven main flood-prone rivers. They contribute over two-thirds of the nation’s whole agricultural and industrial product worth. In Florida in 2012, 80% (or $2.9 trillion) of insured belongings had been positioned close to the coasts – the very best danger areas within the state. Globally, the world’s coastal areas host a big and rising inhabitants in most of the world’s largest cities.

This rising urbanisation in uncovered areas is partly attributable to facilities linked to danger – riversides are engaging. Notion biases play their roles – folks underestimate danger, are forgetful of previous occasions or are unaware of the continuing local weather change, to not point out local weather scepticism. Native public authorities may fail to speak about precise dangers for worry that the world’s attractiveness or real-estate values could be negatively affected (Burby 2006).

Financial additionally incentives matter. Urbanisation is favoured when households who settle within the uncovered areas don’t bear the total value of the chance they take. Our focus on this column and in our 2019 paper is on such a free-riding (Grislain-Letrémy and Villeneuve 2019). We restrict our scope to the non-life losses from these disasters.

The options to regulate urbanisation in uncovered areas mix land-use and insurance coverage insurance policies:

- Land-use insurance policies lead generally to robust actions. For instance, for the reason that Nice Flood of 1993 within the US, the Federal Emergency Administration Company has acquired almost 4,500 flood-prone houses within the state of Missouri; complete cities, akin to Valmeyer, Illinois, have additionally moved from the floodplain to increased floor.

- Insurance coverage insurance policies also can restrict free-riding by making households and companies in uncovered areas pay for the chance they take. For instance, the earthquake insurance coverage premiums in Japan or the flood insurance coverage premiums within the US enhance with the chance publicity. Even in these circumstances, the premium enhance is regulated.

To indicate how land-use laws and insurance coverage premiums form danger publicity, we develop an city mannequin of a linear metropolis with a major danger gradient, the place we endogenise the land rents, insurance coverage premiums, and placement selections.

Threat capitalisation in property values and the influence of insurance coverage costs

Dangers impose a servitude to actual property. Asset values ought to mirror variations in danger. Thus, a property in a flood zone or in a area topic to earthquakes is depreciated by the true property market. If insurance coverage is out there, the unfavorable capitalisation originates from insurance coverage premiums. Empirical research based mostly on the hedonic value technique verify that actual property markets worth the capitalised circulate of pure disaster insurance coverage premiums (Bin et al. 2008, MacDonald et al. 1990, Harrison et al. 2001). Expertise reveals that actual property costs react extra to revisions in insurance coverage premiums than to different danger revelations (Skantz and Strickland 1987).

Insurance coverage is usually location-blind. Location-blind premiums are of two varieties. The primary is implicit common insurance coverage, specifically, help anticipated from the state in case of catastrophe. In Australia, Canada, China, and in lots of European international locations akin to Austria, Czech Republic, Germany, Iceland, Italy, the Netherlands, Norway, Sweden, and Poland, flood compensation depends on state-funded help schemes with a de facto obligatory and uniform contribution to protection (personal insurance coverage being both non-existent or bought by few households or companies) (Ahvenharju et al. 2011, Consorcio de Compensación de Seguros 2008, Maccaferri et al. 2012). Even within the US, flood insurance coverage is bought by a minority of households, partly due to the expectation of federal help (Dixon et al. 2006, Kunreuther and Pauly 2005) and the non-requirement of flood insurance coverage for money consumers (Palm and Bolsen 2022). The second kind of location-blind premium is legally non-discriminatory insurance coverage pricing, akin to exists in Denmark, France, Spain, and Switzerland. This second kind is usually the modernisation of the primary (Dumas et al. 2005).

In most international locations, inefficient pricing (of both of the 2 varieties) is accompanied by constructing prohibition. For instance, in France, Germany, Italy, Poland, Spain, and Switzerland, there’s binding laws limiting or prohibiting the event of flood-prone areas (Santato 2013).

Below location-blind insurance coverage – assuming that the insurance coverage is full – all properties develop into artificially equal, resulting in overuse of the riskiest locations. In observe, this unfavorable impact is considerably moderated by the truth that insurance coverage is in truth incomplete.

A typical results of financial evaluation is that the insurance coverage premiums (value incentives) are, in precept, as environment friendly as zoning (amount regulation). Equivalence goes even additional. Costs and zoning are substitutes at any scale. Zoning can enhance levels of effectivity in a territory uniformly handled by insurance coverage; insurance-tariff differentiations could make up for the imperfection of zoning.

Analyzing the ability of second-best options: Pink-zone insurance policies

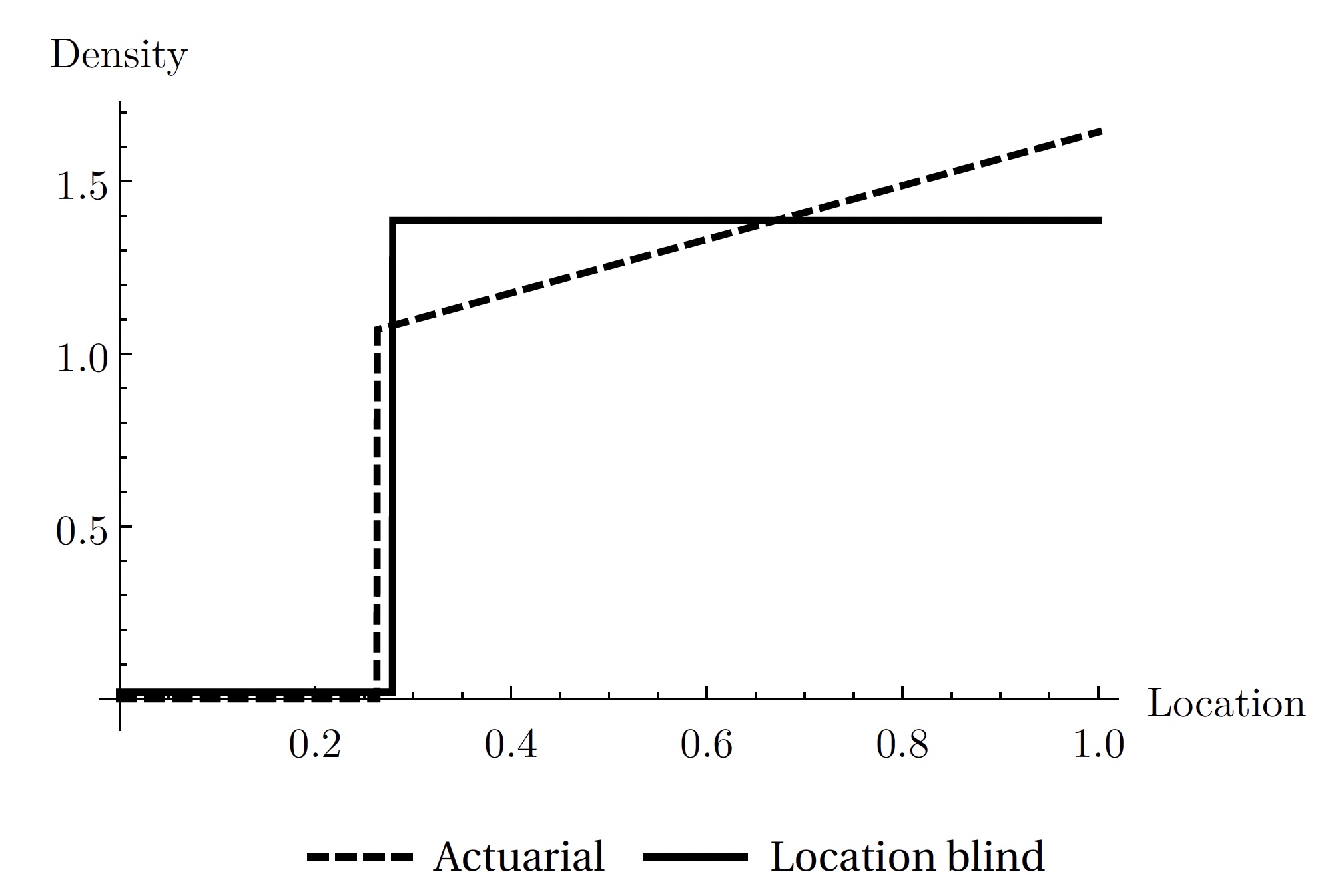

We totally examine probably the most generally used two-zone coverage. Within the crimson zone, dwellings are prohibited; within the constructing zone, authorised density and insurance coverage premiums are location-blind.

Determine 2 Pink zone

Total, potential losses enhance with the floor used and with the variety of inhabitants. If floor principally issues, then forbidding the worst locations is environment friendly. In distinction, if density principally issues, then density restrictions should lower with primary danger. But, we illustrate with simulations that the red-zone coverage is comparatively environment friendly.

Determine 3 reveals a simulation of the equilibrium densities beneath location-blind insurance coverage with the optimum crimson zone (strong line) and a simulation of the first-best equilibrium with actuarially honest pricing (dashed line). Location-blind premiums result in uniform use of the entire authorised house; actuarially honest insurance coverage supplies clean incentives for households to pay attention in much less dangerous areas. Below actuarially honest insurance coverage, the riskiest areas are spontaneously abandoned. This zone is smaller than the optimum crimson zone: actuarially honest premiums allow higher and extra in depth land occupation.

Determine 3 Equilibriums: Actuarially honest premiums versus location-blind premiums and optimum crimson zone

Notes: Simulation of the equilibrium densities beneath location-blind insurance coverage with the optimum crimson zone (strong line) and a simulation of the first-best equilibrium with actuarially honest pricing (dashed line).

Along with the intense circumstances of actuarially honest and location-blind insurance coverage, we simulate the equilibrium when insurance coverage is partially subsidised. These simulations verify that red-zone insurance policies are extra helpful because the subsidy is excessive, which will be seen as substitutability between the monetary incentives and the bodily constraints. These simulations additionally present insights about substitutability when there are facilities or finely tuned constructing codes.

What occurs when danger modifications?

Updating the zoning as danger modifications is essential. We decide the influence of local weather change and demographic strain on optimum crimson zones. Presently, the rising value of pure disasters is basically defined by the rising urbanisation in uncovered areas. The European Parliament and the Intergovernmental Panel on Local weather Change present how local weather change will enhance the depth and the frequency of pure disasters. International flood injury for giant coastal cities will enhance eightfold between 2005 and 2050, with projections based mostly solely on rising inhabitants and property worth. As soon as local weather change and subsidence are added, world flood injury for giant coastal cities may enhance 19-fold and value $1 trillion a yr if prevention is just not upgraded.

The influence of local weather change and demographic evolution on the design of optimum crimson zones will be counterintuitive. We suggest an intensive description of the competing results within the basic case. As anticipated, extending the crimson zone as catastrophe frequency or seriousness will increase accommodates the ultimate incidence. In distinction, a inhabitants enhance raises the chance however will increase the demand for land on the similar time. The online influence of demographic strain generally is a discount within the crimson zone when anticipated damages per head are small (and an extension within the crimson zone when anticipated damages are massive) in comparison with anticipated damages per floor unit.

Tough administration of the prevailing

How ought to we take care of the folks and belongings already positioned in extremely uncovered areas? The logic of incitement has a pitfall right here: it’s tempting to exempt current dwellings from unfavourable revisions of danger publicity. ‘Grandfather rights’, extensively taken up, result in repeated losses. There needs to be as a substitute a transparent danger replace and a shift in insurance coverage compensation from a pay-to-rebuild to a pay-to-move precept.

References

Ahvenharju, S, Y Gilbert, J Illman, J Lunabba and I Vehvilainen (2011), “The position of the insurance coverage business in environmental coverage within the Nordic international locations”, Nordic Innovation Publication (2).

Bin, O, J B Kruse and C E Landry (2008), “Flood hazards, insurance coverage charges, and facilities: Proof from the coastal housing market”, Journal of Threat and Insurance coverage 75(1): 63–82.

Burby, R J (2006), “Hurricane Katrina and the paradoxes of presidency catastrophe coverage: Bringing about clever governmental selections for hazardous areas”, Annals of the American Academy of Political and Social Science 604(1): 171–91.

Consorcio de Compensación de Seguros (2008), Pure catastrophes insurance coverage cowl: A range of programs.

Dumas, P, A Chavarot, H Legrand, A Macaire, C Dimitrov, X Martin and C Queffelec. (2005), “Rapport particulier sur la prévention des risques naturels et la responsabilisation des acteurs”, Mission d‘Enquête sur le Régime d‘Indemnisation des Victimes de Catastrophes Naturelles, French Treasury Normal Inspection, French Setting Normal Inspection and French Normal Council of Civil Engineering.

Grislain-Letrémy, C, and B Villeneuve (2019), “Pure disasters, land use, and insurance coverage”, Geneva Threat and Insurance coverage Overview 44(1): 54–86.

Hallegatte, S (2012), “Towards a world of bigger disasters? Concepts for risk-management insurance policies”, VoxEU.org, 14 April.

Harrison, D M, G T Smersh and A L Schwartz (2001), “Environmental determinants of housing costs: The influence of flood zone standing”, Journal of Actual Property Analysis 21(1–2): 17–38.

Hosono, Ok, and D Miyakawa (2014), “Pure disasters, agency exercise, and injury to banks”, VoxEU.org, August 13.

Kunreuther, H, and M Pauly M (2005), “Insurance coverage decision-making and market conduct”, Foundations and Tendencies in Microeconomics 1(2): 63–127.

MacDonald, D N, H L White, P M Taube and W L Huth (1990), “Flood hazard pricing and insurance coverage premium differentials: Proof from the housing market”, Journal of Threat and Insurance coverage 57(4): 654–63.

Maccaferri, S, F Cariboni and F Campolongo (2012), Pure catastrophes: Threat relevance and insurance coverage protection within the EU, European Fee, Joint Analysis Heart, Scientific Help to Monetary Evaluation Unit, Institute for the Safety and Safety of the Citizen.

Palm, R, and T W Bolsen (2022), “Coastal house consumers are ignoring rising flood dangers, Regardless of clear warnings and rising insurance coverage premiums”, The Dialog, 25 March.

Santato, S (2013), The European Floods Directive and alternatives supplied by land use planning, Local weather Service Heart.

Sigma (2021), Pure catastrophes in 2020, Sigma Report, Swiss Re Institute.

Skantz, T R, and T H Strickland (1987), “Home costs and a flood occasion: An empirical investigation of market effectivity”, Journal of Actual Property Analysis 2(2): 75–83.