Choosing the proper funding platform in Canada can really feel overwhelming—particularly when two well-liked names like Questrade and Wealthsimple dominate the dialog.

Whereas each intention to empower Canadian buyers, they take very totally different approaches to the way you develop your cash.

This comparability breaks down Wealthsimple vs Questrade charges, buying and selling instruments, funding choices, and total expertise that will help you determine which inserts your monetary objectives finest: hands-on management or automated simplicity.

Preserve studying to determine which is one of the best low cost Canadian brokerage for you!

What Is Questrade?

Questrade (learn: QUESTRADE REVIEW) is one in every of Canada’s most established on-line brokers. Based in 1999, it operates as a reduction brokerage with a robust give attention to flexibility, cost-efficiency, and superior instruments for self-directed buyers.

The platform provides entry to Canadian and U.S. equities, ETFs, mutual funds, choices, and overseas alternate buying and selling. Its desktop platform, Questrade Edge, is well-liked amongst energetic merchants for its real-time market knowledge, customizable charts, and technical evaluation options.

There’s additionally Questrade Cell, its cell app, which is accessible for each Android and iPhone customers.

Registered accounts corresponding to TFSAs, RRSPs, RESPs, and LIRAs are absolutely supported.

A key benefit of Questrade is the power to carry USD in registered accounts—very best for lowering overseas alternate (FX) charges when buying and selling U.S. property.

Professional Tip:

Need to take again management of your funds? Get began at the moment with Wealthsimple or Questrade!

What Is Wealthsimple?

Wealthsimple (learn: WEALTHSIMPLE REVIEW) is a fintech-driven funding platform designed for ease of use and automatic wealth constructing. Launched in 2014, it appeals to new buyers and people on the lookout for a simplified expertise.

With Wealthsimple Make investments, customers can entry robo-advised portfolios tailor-made to their objectives and danger ranges. Portfolios are robotically rebalanced and might embrace socially accountable or halal investing choices.

For self-directed buying and selling, Wealthsimple Commerce provides commission-free buying and selling of shares and ETFs.

The platform is minimal by design. Whereas it’s straightforward to make use of, it lacks extra superior options like real-time quotes, in-depth charting, and numerous asset choice until customers improve to the Premium plan.

Charges and Pricing Comparability

With regards to value, Questrade and Wealthsimple function on related however not equivalent fashions.

Each provide commission-free buying and selling, however there are some key variations.

Buying and selling Charges & Account Minimums

Questrade used to cost fee for buying and selling shares and ETFs, however they’ve switched to a extra aggressive, commission-free mannequin.

The platform costs $9.95 per mutual fund transaction.

Questrade used to have a $1,000 minimal to open an account. At present, there’s no minimal for self-directed accounts and a $250 minimal to speculate with Questwealth Portfolios.

Wealthsimple Commerce provides zero-commission buying and selling for each Canadian and U.S. shares and ETFs. There are not any charges for getting or promoting ETFs and no minimal deposit is required to start investing.

This distinction in pricing construction makes Questrade extra interesting for knowledgeable buyers who worth full entry to instruments and merchandise, whereas Wealthsimple’s no-cost entry level is right for learners testing the waters.

Foreign money Conversion Charges

Foreign money alternate charges influence cross-border investing. Right here’s how they stack up:

Questrade costs a 1.5% FX price on USD trades and helps true USD-registered accounts like RRSPs and TFSAs. This permits frequent U.S. fairness merchants to keep away from repeated forex conversions.

Wealthsimple additionally costs a 1.5% FX price. In addition they help USD-registered accounts, however these can be found solely to Premium or Era shoppers.

Subscription Charges

One factor that’s fascinating about each Questrade and Wealthsimple is that neither costs any account subscription charges.

Questrade doesn’t presently provide any tiered plans based mostly on whole investments.

Wealthsimple has its primary plan, with no minimal account stability required. There’s a 0.5% price should you go for managed investments. For buyers with bigger portfolios, there are two choices.

- The Premium plan requires a complete stability (money and/or investments) of $100,000. The price for managed investments is 0.4% and also you’ll earn 2.25% APY on uninvested money balances.

- The Era plan requires a complete stability (money and/or investments) of $500,000. Managed funding charges vary from 0.2% to 0.4%, and also you’ll earn 2.75% APY on invested money balances.

Wealthsimple robotically upgrades plans when buyers attain a brand new threshold.

As you possibly can see, Wealthsimple charges and Questrade charges have rather a lot in frequent, however for high-volume buyers, Wealthsimple has some benefits (and downsides, as we’ll see within the subsequent part).

Professional Tip:

In it for the long term? Take a look at Questrade and Wealthsimple’s automated portfolio choices at the moment!

Funding Merchandise and Entry

Questrade stands out for its numerous funding choices, together with Canadian and U.S. shares, ETFs, mutual funds, choices contracts, overseas alternate buying and selling, and even treasured metals by ETFs.

This in depth product lineup permits buyers to construct extremely tailor-made portfolios throughout asset courses and areas.

Wealthsimple, then again, retains its funding catalog easy. Buyers can commerce Canadian and U.S. shares and ETFs or go for professionally managed portfolios by Wealthsimple Make investments. The platform additionally permits customers to purchase and promote cryptocurrencies immediately, which is a key differentiator.

In the end, Questrade helps extra subtle funding methods, whereas Wealthsimple prioritizes ease and accessibility for many who choose a extra passive or streamlined strategy.

Platform Expertise and Options

Questrade caters to skilled buyers with a platform that emphasizes flexibility and real-time market entry. Its Questrade Edge platform delivers extremely customizable charts, streaming knowledge, and superior order sorts corresponding to bracket and conditional trades.

These options enable energetic merchants to fine-tune their methods and make well timed choices with precision.

Alternatively, Wealthsimple is constructed for simplicity. The interface is minimal and intuitive, permitting new buyers to put trades with ease. Whereas it lacks superior instruments, the expertise is clear and environment friendly.

For customers who need enhanced efficiency, Wealthsimple Plus unlocks decrease charges and a few further instruments that could be helpful.

Each platforms serve their respective audiences properly, with Questrade leaning into energy and Wealthsimple specializing in usability.

Cell Expertise and Academic Sources

Questrade’s cell app mirrors the desktop expertise. It delivers stay quotes, customized alerts, account entry, and analysis instruments, making it a robust alternative for buyers on the go.

Wealthsimple’s cell app is designed with simplicity in thoughts. It’s excellent for checking balances and making primary trades. Some customers have famous that there are worth lags and want there have been extra buying and selling choices accessible.

When it comes to training, Questrade provides a sturdy library of webinars, how-to guides, and analysis powered by Morningstar.

Wealthsimple’s training assets are extra entry-level, together with weblog posts and FAQs written in a beginner-friendly tone. In addition they have some helpful calculators for determining monetary objectives.

Person Critiques and Neighborhood Suggestions

Person suggestions highlights the distinct strengths of every platform.

Questrade typically receives reward for its low buying and selling charges, broad asset entry, and superior customization instruments. Many seasoned buyers admire the pliability it provides, although some have reported lengthy wait occasions for help throughout peak hours.

Wealthsimple earns excessive scores for its intuitive design and beginner-friendly onboarding course of. Customers ceaselessly commend the platform’s commission-free mannequin and cell expertise. Nevertheless, extra skilled merchants typically specific frustration over the shortage of real-time knowledge and restricted asset selection.

Total, opinions reinforce every platform’s area of interest: Questrade appeals to skilled buyers on the lookout for flexibility and depth, whereas Wealthsimple is favored by newcomers looking for simplicity and automation.

Buyer Help and Safety

Is Questrade legit? What are you able to count on should you open an account when it comes to help and safety?

Questrade provides buyer help by a number of channels together with telephone, stay chat, and electronic mail. Customers can even entry a sturdy assist middle with detailed documentation, FAQs, and platform tutorials. As a regulated agency underneath the Canadian Funding Regulatory Group (CIRO) and a member of the Canadian Investor Safety Fund (CIPF), Questrade gives insurance coverage protection for as much as $1 million per account in case of insolvency.

Identical query: Is Wealthsimple legit?

Wealthsimple matches Questrade’s help choices, additionally offering telephone help and chat help throughout enterprise hours. There’s additionally an choice to get tax help, one thing that Questrade doesn’t provide.

The platform is geared extra towards onboarding and primary account administration, making it straightforward for newer buyers to get fast help. Like Questrade, Wealthsimple is regulated by CIRO and can also be a CIPF member, making certain related protections for consumer accounts.

Investing Model and Account Varieties

Questrade helps a broad number of account sorts, together with TFSAs, RRSPs, RESPs, LIRAs, margin accounts, and company accounts. These choices give buyers important flexibility in constructing a personalised funding technique.

Questrade additionally permits for a number of forex holdings, corresponding to USD inside registered accounts—an interesting characteristic for cross-border merchants.

Wealthsimple retains issues easy by providing private, TFSA, particular person and spousal RRSPs, LIRA, RESP, and company accounts. They don’t have as many account sorts as Questrade, however they’ve expanded their choices.

For those who’re on the lookout for flexibility and management, Questrade provides a wider vary of choices. For many who choose an easy-to-navigate platform and streamlined account choices, Wealthsimple will get the job finished with minimal friction.

Extra Options

Past commonplace buying and selling capabilities, every platform provides distinctive extras that may improve the general expertise.

Questrade helps on the spot deposits, permitting customers to behave shortly on market alternatives with out ready for financial institution transfers. Its Dividend Reinvestment Plan (DRIP) characteristic makes it straightforward to robotically reinvest earnings, and superior screeners assist uncover commerce concepts aligned with an investor’s technique.

Wealthsimple leans into monetary accessibility. Buyers can purchase fractional shares, making it straightforward to construct diversified portfolios even with smaller quantities of capital. Wealthsimple Money integrates banking and investing options, and the platform additionally provides direct entry to cryptocurrency buying and selling—one thing Questrade doesn’t present immediately.

These additions mirror every firm’s goal demographic: Questrade for hands-on, data-driven buyers, and Wealthsimple for contemporary customers on the lookout for a seamless, all-in-one monetary expertise.

Professional Tip:

Get $25 for referring a good friend to Wealthsimple, or get your first month of choices buying and selling free with Questrade at the moment!

Superior Buying and selling Instruments and Platform Options

When evaluating on-line investing platforms, the supply of superior buying and selling instruments can considerably affect an investor’s expertise, particularly for many who are extra energetic within the markets.

Questrade stands out on this regard by providing a complete suite of superior buying and selling instruments. Their platform gives real-time market knowledge, customizable charting choices, and quite a lot of technical indicators. For merchants who depend on in-depth evaluation, Questrade’s instruments facilitate detailed market assessments, aiding in making knowledgeable choices. Moreover, Questrade helps a number of order sorts, together with stop-loss and restrict orders, catering to numerous buying and selling methods.

Alternatively, Wealthsimple Commerce adopts a extra streamlined strategy. Whereas it provides a user-friendly interface appropriate for learners, it lacks among the superior options present in Questrade. For example, Wealthsimple Commerce gives delayed market knowledge and has restricted charting capabilities. This simplicity may be advantageous for brand new buyers however may be restrictive for these looking for extra subtle instruments.

In abstract, buyers who prioritize superior buying and selling instruments and a feature-rich platform could discover Questrade extra aligned with their wants, whereas these preferring simplicity may lean in direction of Wealthsimple Commerce.

Actively Managed Portfolios and Robo Advisor Providers

For buyers interested by a extra hands-off strategy, each Questrade and Wealthsimple provide options by robo advisor companies and actively managed portfolios.

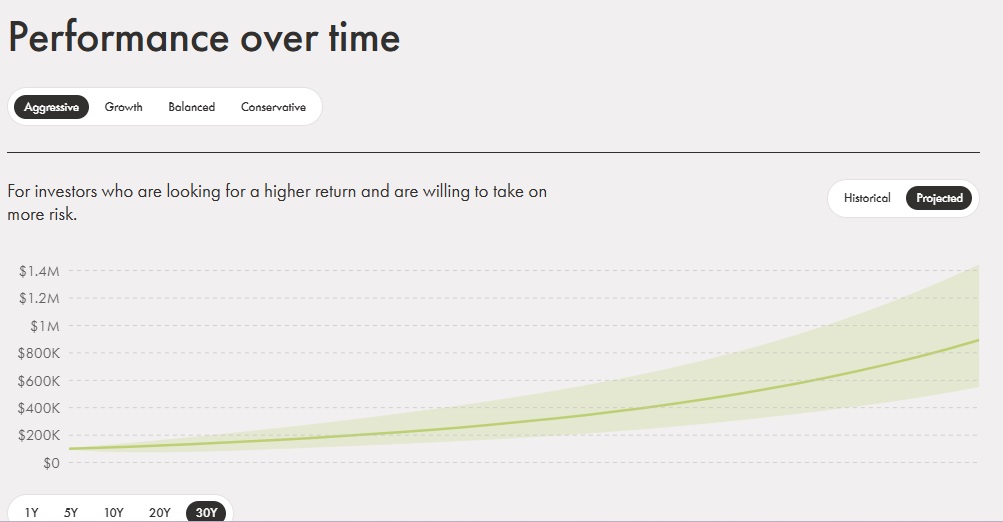

Wealthsimple has established itself as a pacesetter within the robo advisor house in Canada. Their platform gives a spread of portfolios tailor-made to totally different danger tolerances and funding objectives. Notably, Wealthsimple provides choices for socially accountable investing, permitting shoppers to align their investments with private values. Their portfolios are robotically rebalanced, making certain that asset allocations stay constant over time.

Questrade, by its Questwealth Portfolios, additionally provides robo advisor companies. These portfolios are actively managed, that means funding professionals make changes based mostly on market situations. This energetic administration strategy goals to capitalize on market alternatives, probably enhancing returns. Moreover, Questrade’s robo advisor service sometimes costs decrease administration charges in comparison with Wealthsimple, making it a lovely choice for cost-conscious buyers.

Each platforms present entry to Canadian investments and permit contributions in Canadian {dollars}, simplifying the method for home buyers. Nevertheless, the selection between them could hinge on preferences for energetic versus passive administration and concerns round charges and funding philosophies.

Conclusion

Once we evaluate Questrade vs Wealthsimple, each are strong Canadian robo advisors—however for various kinds of buyers.

Select Questrade should you:

- Choose DIY investing

- Need entry to a variety of property

- Are comfy navigating extra advanced instruments

Select Wealthsimple should you:

- Need a no-hassle, automated expertise

- Worth simplicity and clear design

- Are beginning with smaller quantities or need passive investing

- Have a big portfolio and wish to reap the benefits of decrease administration charges

In the end, it comes all the way down to your stage of involvement. Questrade is for builders and strategists. Wealthsimple is for hands-off growers. Both method, you’re selecting a trusted Canadian platform to help your monetary objectives.

FAQ

Each platforms provide commission-free buying and selling for shares and ETFs and cost the identical FX price of 1.5%. Wealthsimple provides decrease administration charges for high-volume merchants.

Sure. Wealthsimple Make investments provides managed portfolios with automated rebalancing and low charges—excellent for passive investing.

Sure. Questrade lets customers maintain and commerce in USD, lowering conversion prices for cross-border investing.

Solely Wealthsimple provides direct crypto buying and selling. Questrade offers publicity by crypto ETFs.

Wealthsimple has the best onboarding, however Questrade gives extra long-term worth when you’re able to develop.