Marko Geber

Berkshire Hills Bancorp, Inc. (NYSE: BHLB) had endured pandemic disruptions within the final two years. Its development has been hampered because the rates of interest approached near-zero ranges. Even so, it’s nonetheless operational, and its efforts appear to be paying off this yr. Revenues and margins are rebounding with its prudent and environment friendly asset administration. Its contraction helps it handle its bills higher to generate extra revenue. Additionally, its interest-sensitive property comprise extra performing property, bettering its viability. In the meantime, its monetary leverage is well-managed, which exhibits its wonderful liquidity place. Borrowings are comparatively low even after the current notes choices. It matches with its current share repurchases, maintaining its monetary leverage manageable. Dividends are well-covered as money ranges stay steady. Likewise, the inventory worth is decrease however not low-cost but.

Firm Efficiency

The previous two years had not been thrilling for Berkshire Hills Bancorp, Inc. In reality, it was one of many few corporations within the monetary sector that shrank amidst the near-zero rates of interest. As a part of the S&P 600, BHLB is already thought of a big public financial institution. Its property are interest-sensitive, so it is probably not stunning that it needed to contract to deal with the drastic adjustments available in the market. All its loans decreased, given the decrease rates of interest. In flip, its curiosity charges on loans dropped as effectively.

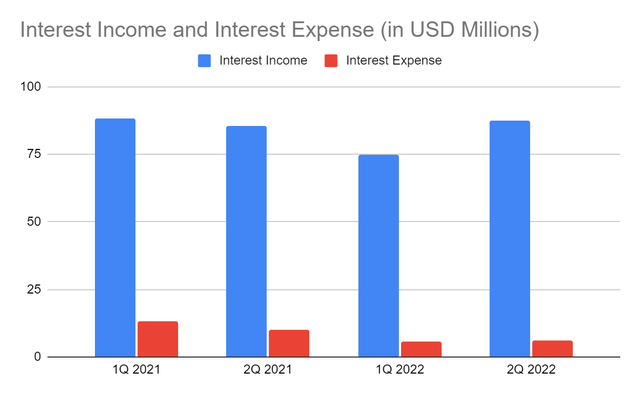

However now, the corporate is making a powerful rebound. Its discount of non-performing property and enchancment of the standard of loans and deposits are paying off. Its prudent asset administration, particularly its enhanced mortgage originations are driving its development. Additionally, its funding securities have been yielding increased returns within the final yr. Its curiosity revenue as its main income quantities to $87 million, a 2% improve from the comparative time sequence. Likewise, its dividend revenue from its funding securities can also be in an uptrend. Once more, the rise isn’t pushed by the growth of its operations, however by the improved high quality of its incomes property. Its strategic mortgage and funding portfolio diversification are a part of its core competencies.

Curiosity Revenue and Curiosity Expense (MarketWatch)

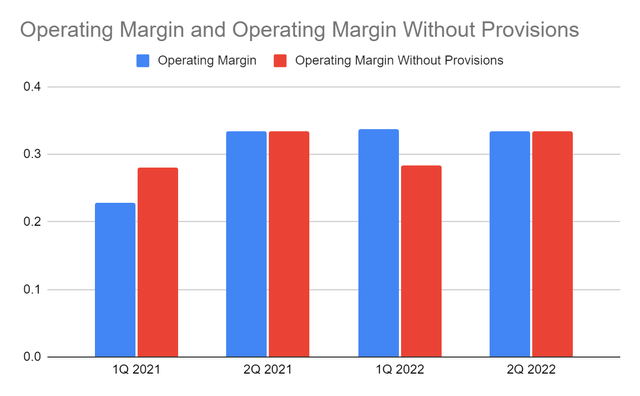

Furthermore, environment friendly Stability Sheet administration can also be evident. It’s resulting in decrease and extra steady bills. It’s a formidable pattern, given the rising rates of interest. It’s extra evident in its enhanced loans and deposits. With its higher mortgage origination, deposit administration, and disposal of non-performing property, revenues and bills are shifting in the wrong way. With or with out provisions, its internet curiosity margin and working margin are increased at 93% and 33%. As such, it derives extra returns to maintain its strategic enterprise combine adjustments and optimization initiatives. It stays according to its plans to finance its BEST program and scale back non-strategic loans. It concentrates on its core enterprise and maintains its spectacular ESG rating. With the continued improve in inflation, curiosity, and mortgage charges, BHLB should brace itself. Fortunately, it seems ready for the macroeconomic pressures. I’ll focus on extra of its core competencies within the subsequent part.

Working Margin (MarketWatch)

Macroeconomic Forces To Think about

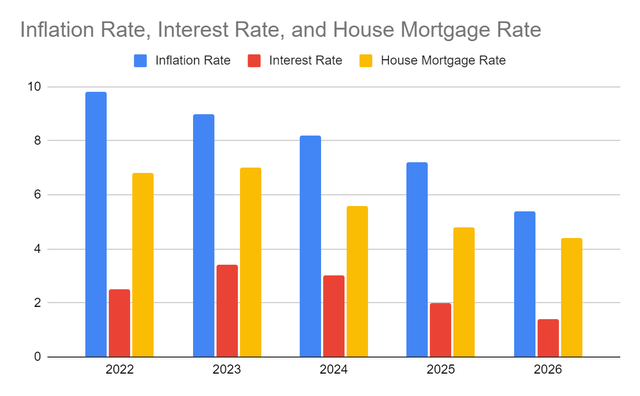

Berkshire Hills Bancorp, Inc. is confronted with a number of exterior pressures as borders reopen. The financial rebound within the final yr has led to elevated consumption and manufacturing. So now, we’re seeing the influence of pent-up demand throughout industries. The continued improve within the normal worth stage is obvious now. In June, it had one other all-time excessive inflation charge in 4 many years at 9.1%. Given the present pattern, the estimation for this yr could also be increased. Likewise, the geopolitical unrest in Europe is one other issue since Russia is an vitality supply. The availability chain disruptions amidst port congestion additionally have an effect on costs. However, the pent-up demand seems to be the first driver of the upsurge. These humongous adjustments are most evident in the actual property and car market. As such, I’ve to boost my inflation estimation. It’s such a disgrace that I first thought it could transition and decelerate through the second half. The present pattern might point out that it’s but to achieve its peak. This yr, I estimate it to climb as much as 9.8%. However within the following years, the financial system might turn out to be extra steady, so it might drop to five.2%.

To make sure this optimism, a sequence of curiosity and mortgage charge hikes should happen. In reality, the Fed has already raised the Federal Funds charge by 75 foundation factors final month. Additionally, the anticipated curiosity has been raised to three.4% from the preliminary estimation of 3-3.25%. These projections at the moment are far increased than the 1.7-2% projection earlier this yr. Likewise, the mortgage charge has skyrocketed to five.7%. It’s already increased than the estimated mortgage charges at 5.1-5.3%. So, it is probably not unsurprising if it reaches 7% this yr. Nonetheless, I anticipate these macroeconomic indicators to turn out to be extra manageable in 2024-2026. The fiscal and financial insurance policies might repay though not as swiftly as initially anticipated.

Inflation Price, Curiosity Price, Mortgage Price (Writer Estimation, Barron’s, and Forbes)

Why Berkshire Hills Bancorp, Inc,, Might Keep Afloat

Berkshire Hills Bancorp, Inc. continues to make up for its slippages within the final two years. It maintains its giant market visibility and improves its operational efficiencies. It may possibly additionally cater to extra clients, particularly in New England, New York, and the Mid-Atlantic. It’s also well-capitalized as a part of the S&P 600. However what makes it well-positioned within the rising charge surroundings is its stellar Stability Sheet. Its asset-sensitive Stability Sheet consists of extra strategic incomes property. Its efforts to scale back its non-performing property and diversify its mortgage and funding portfolio at the moment are paying off. I already mentioned its prudent mortgage and deposit and funding safety administration. However now, we’ve to examine the strategic composition of its Stability Sheet that drives its viability and liquidity.

Loans, notably mortgages and CI, stay its main property. That’s the reason Berkshire should watch out for the current adjustments in curiosity and mortgage charges. Luckily, asset high quality metrics show its efforts and prudence. For example, the delinquency charge of its loans stays low at 0.55% vs 0.63% in 4Q 2021. It’s also decrease if we evaluate it to 2Q 2021. Likewise, non-accruing loans are decrease by 9%. These percentages present that Berkshire turns into extra environment friendly in dealing with loans. However after all, it stays conservative to maintain its spectacular liquidity place. Its provisions for credit score losses are nonetheless real looking at 1.26%. On common, a financial institution of its measurement has provisions starting from 0.9% to 1.2%. So, BHLB seems to be extra cautious than a lot of its shut friends.

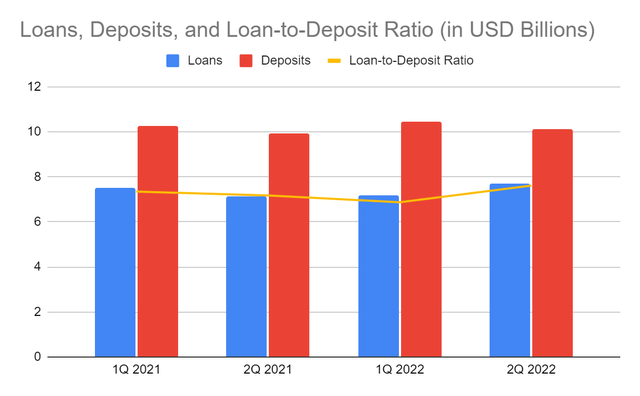

Even higher, its loan-to-deposit ratio stays low at 76%. The perfect ratio ranges at 80-90%. With that, it has extra reserves to cowl surprising defaults and delinquencies. It additionally has extra capability to extend its loans to derive extra curiosity revenue. Observe that it seems extra interest-sensitive, so it has higher positioning within the rising curiosity mortgage charges. Deposits are additionally increased since increased rates of interest entice extra deposits. It may possibly use these to take a position or mortgage them out to derive extra returns. It has an enormous capability to cushion the disruptive blows of inflationary pressures. Additionally, about 30% of its deposits are non-interest bearing. So, curiosity bills might keep manageable amidst the rise in rates of interest. The strategic strategy to handle its loans and deposits might assist it maintain its viability and liquidity.

Loans, Deposits, and Mortgage-to-Deposit Ratio (MarketWatch)

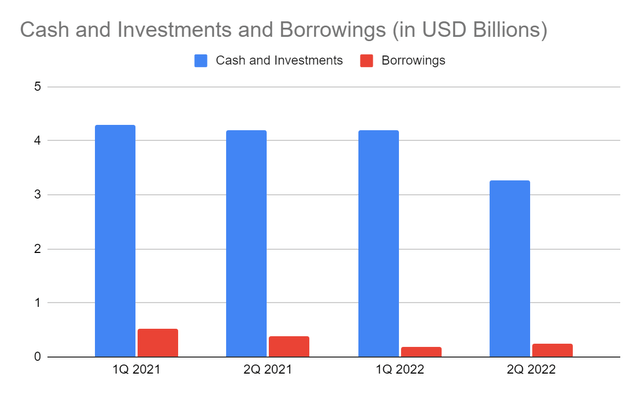

Likewise, its money and funding securities comprise 28% of the whole property. They’re extra liquid property, permitting them to suffice pressing enterprise wants. Additionally, they’re twelve occasions increased than borrowings. Money alone can cowl borrowings, together with the current notes supplied. Berkshire is so liquid that it could make a single cost for its monetary leverage utilizing money and investments alone. Additionally, it had a current share repurchase, making its monetary leverage well-managed even after issuing notes. That’s the reason it’s able to increasing its operations and sustaining its optimization initiatives.

Solely, funding securities seem to have slowed down in 2Q. It’s logical since excessive rates of interest scale back the attraction of bond and mortgage securities, that are typical for banks like Berkshire. For example, yields weren’t as excessive as in 1Q. Breakeven yields for bond and mortgage securities reached 3% in April however decreased to 2.4% final month. Additionally, there could also be extra unrealized losses. The great factor is that BHLB retains its provisions for safety losses excessive, making its monetary place extra conservative. Within the second half, securities might regain their attraction as recession considerations reemerge. Additionally, volatility doesn’t seem to enter a lull this summer time. These are nonetheless logical situations because the present inflation charge might drive the rise in rates of interest. In flip, financial savings might rebound and drive the rise in funding safety yields to offset long-run capital impacts. So, the rise in rates of interest should work for the corporate.

Money and Investments and Borrowings (MarketWatch)

One other potential development driver is its digital banking transformation. It’s a should for me as extra individuals go cashless. E-payments, digital wallets, and digital and contactless playing cards are extra of a staple immediately. Whether or not in rising or mature economies, the lower in money transactions has sped up within the final two years. Within the US, money transactions dropped from 51% in 2010 to 22% in 2020. The identical state of affairs is noticeable in Europe, particularly in Scandinavia. That’s the reason the digital transformation of the financial institution is lengthy overdue and a should. It’ll permit the financial institution to boost its effectivity and seize extra clients.

Inventory Value Evaluation

The inventory worth of Berkshire Hills Bancorp, Inc. has been in a downtrend because the begin of the yr. Though there was a rebound within the final month, the present worth stays decrease. At $26, it has already been reduce by 8-10% from the beginning worth. It makes the inventory worth seem cheaper and extra enticing. Its PE Ratio adheres to the cheapness of the inventory worth, which trades at a 10x earnings a number of. It’s decrease than the 15x valuation earlier than the discharge of the 2Q report. However different valuations, such because the PB Ratio of 1.2 and the PTBV ratio of 1.24 exhibits that the inventory worth isn’t low-cost. The Value-to-Working Money Circulation of 13.80 additionally exhibits that the inventory worth is pretty valued.

In the meantime, it nonetheless seems a gorgeous dividend inventory even after the noticeable lower in 2020. Fortunately, dividend funds are constant however with a median dividend development charge of 0.08%. Even so, dividend yield stays ultimate at 1.79% vs the common of S&P 600 parts at 1.41%. It’s a side to think about earlier than making a place. We are able to use the DCF Mannequin and the Dividend Low cost Mannequin to evaluate the inventory worth higher.

DCF Mannequin

FCFF $24,000,000

Money and Money Equivalents $872,000,000

Borrowings $254,000,000

Perpetual Progress Price 4.8%

WACC 9.8%

Widespread Shares Excellent 45,788,000

Inventory Value $26

Derived Worth $24.42

Dividend Low cost Mannequin

Inventory Value $26

Common Dividend Progress 0.00824

Estimated Dividends Per Share $0.48

Value of Capital Fairness 0.07475353643

Derived Worth $24.67812987 or $24.68

Each fashions present the potential overvaluation of the inventory worth though it’s nonetheless affordable. There could also be a possible draw back of 8-12% within the subsequent 12-24 months. Even so, it’s nonetheless decrease than pre-pandemic ranges, making it comparatively cheaper. The bullish pattern within the final week is logical because it surpassed the current earnings estimates. However, traders might have to attend for a greater entry level.

Backside Line

Berkshire Hills Bancorp, Inc. is making a noticeable comeback with its spectacular margin growth. It has a well timed market and monetary positioning, given its stellar Stability Sheet and optimization methods. Additionally, dividends and monetary leverage are well-covered with steady money ranges. However, the inventory worth doesn’t look like low-cost proper now, so traders should look forward to a greater entry level. The advice, for now, is that Berkshire Hills Bancorp, Inc. is a maintain.