YouraPechkin/iStock via Getty Images

Investment Thesis

I wanted to take a look at Bel Fuse (NASDAQ:BELFB), as it is trading at what I think is a very low earnings multiple, given the recent success of higher profitability margins. I believe that the management has been doing a fantastic job bringing the company towards being more profitable than before and this has not been reflected by the investor community just yet. I rate the company a strong buy due to its outstanding financial position and the management’s fantastic efforts to make the company much more profitable in the long run.

The Company

Bel Fuse manufactures many products that protect and connect electronic circuits. They also sell products that are used in networking, consumer electronics, and high-speed data transmission. Products include front-end power supplies, external power products, ethernet, fiber optic connectors, and integrated connector modules. The company has three revenue segments: Power Solutions and Protection, Connectivity Solutions, and Magnetic Solutions.

Briefly on Outlook – Impressive Margins May Remain

The most impressive thing I found about the company is how it managed to improve gross margins in just a year. This tells me that the management is very capable of running the company efficiently and profitably, which should in turn create shareholder value in the long run.

In the latest Bel Fuse Inc. Q2 2023 Earnings Call Transcript, the management said that they are confident the FY23 will finish in line with the same margins as in Q2 ’23, which to me looks like it may be the new normal going forward. Even with the lack of growth in sales projected for the rest of the year, the company is going to more than make up for that in terms of margin expansion in my view, which will turn into higher EPS.

The way the company is aiming to keep this new level of gross margins is to focus on the products that provide much higher margins going forward. I can commend the management for this effort because I believe it means that they truly care about the company and know the ins and outs of it and know exactly what is working and what isn’t.

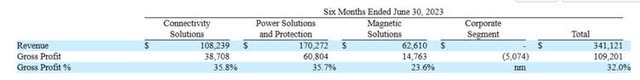

It looks like all three segments have not seen the same bad year as many other companies have in FY22 and also in the first half of ’23. There has been a little bit of a slowdown recently, however, I don’t think the company is going to perform very badly over the next half of the year and will finish strong in my opinion.

I do believe that margins will stay at around the levels we are seeing right now, however, we will have to wait for the next few quarters to be completely sure. The company offers a lot of different products in the three segments it reports its revenues in, which means that it is very well diversified in case of a serious downturn in one particular segment.

Risks

So, the whole outlook, which I think is on the more optimistic side, relies on the company’s ability to keep margins higher. If the company’s products become much more expensive to produce and there is a lot more competition, the margins may not reach the potential I am assuming. This will lead to the company’s EPS plummeting and in turn the share price may follow.

The company is also very small and there is not much activity in trading every day. This may present a lot of volatility if one person, for example, an insider, decides to buy a substantial number of shares and drive up the price, or an institution decides to unload its shares and bring the stock price substantially down. The long-term investor should be ready for such fluctuations.

A lot of investors are also looking at small-cap companies and expect to see high revenue growth, if the company doesn’t show some decent numbers going forward, mainstream investors will likely ignore the company, and the potential that the company has may not be reached.

Financials

Just to note, the graphs below will be as of FY22 because this way we will be able to see any trends over the last few years, which will give us a better picture of where the company is heading. I will include the most recent numbers if I believe they are relevant for additional color.

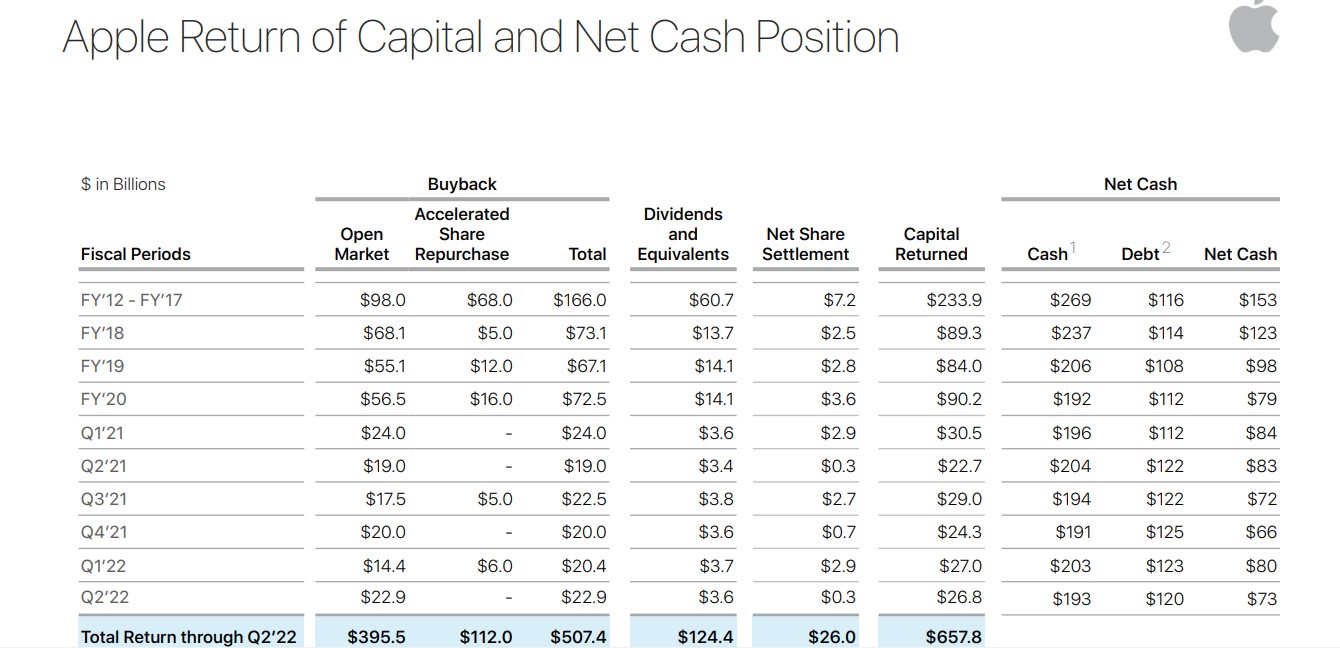

As of Q2 ’23, the company had $65m in cash and $60m in long-term debt. The company managed to pay off $35m of variable debt and now has fixed-rate debt left. This is a really good position to be in, in my opinion. Even though the debt looks like it’s substantial, I don’t think it is an issue if the interest expenses on it are manageable and that is very much the case for Bel Fuse. The company’s historic interest coverage ratio has been very high. EBIT of the company can pay off interest expense on debt over 20x, and for reference, an interest coverage ratio of 2x is considered to be healthy.

Interest Coverage Ratio (Author)

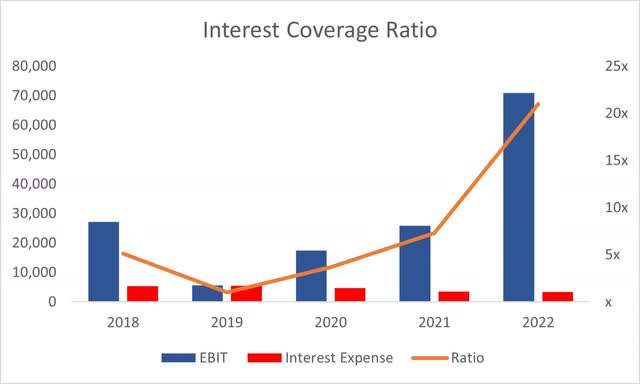

The company’s current ratio is slightly too high in my opinion, which isn’t a bad thing, however, this tells me that the company could be using that cash pile more efficiently and be more aggressive in future growth, for example, acquiring more small companies for growth or do some share buybacks (if the share price is low). I would like to see the current ratio of around 1.5- 2.0. That is where I think the company is using its assets very efficiently and is still very comfortably able to cover all its short-term obligations.

Current Ratio (Author)

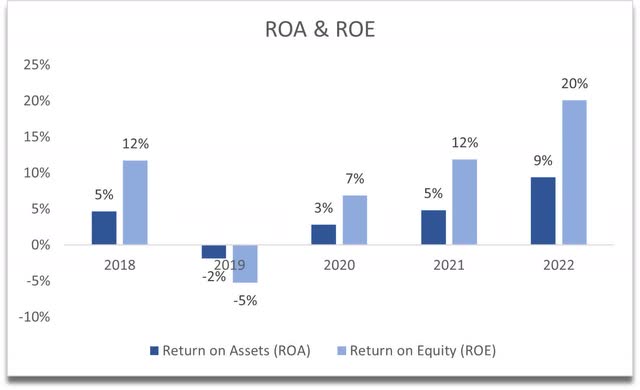

I like the trend that the ROA and ROE have been experiencing since FY20. It has been going steadily up for the last three years and is showing no signs of slowing down. I do think that the level achieved at the end of FY22 will be repeated at the end of FY23, but we will have to wait for those to come out. It seems like the management is using shareholder capital very efficiently and is creating value. The company is also utilizing its assets efficiently enough, however, if the company was using its cash pile more aggressively, ROA would have been higher still.

ROA and ROE (Author)

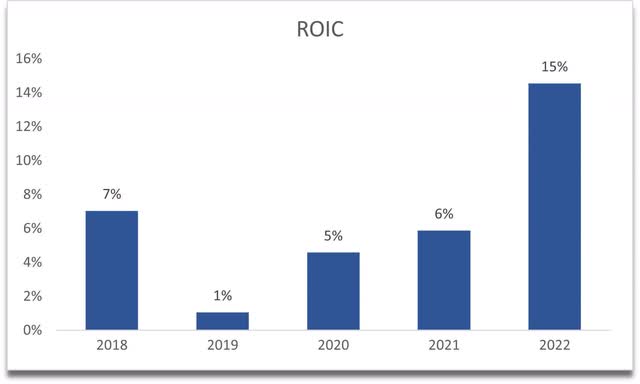

The same story can be said about return on invested capital or ROIC. The company has passed my minimum threshold of around 10% and has achieved 15% as of FY22. This tells me that the company has a competitive advantage and a strong moat, which is what you want to see in any of your investments.

ROIC (Author)

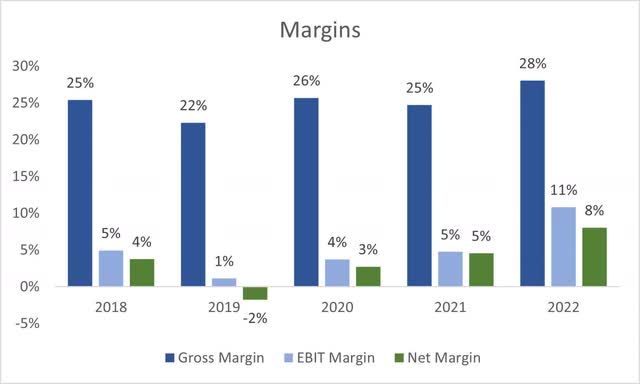

In terms of margins, we can already see that these have improved quite a bit since FY21 and are very respectable by the end of FY22. What I like about margins going forward is that the company has already managed to improve these by another 400bps in the last 6 months of ’23, which is very impressive. To be fair, the next two quarters might be a little tougher on margins, but I don’t think these will get much worse.

Margins (Author) Margins (10-Q Report)

Overall, I see a company that has improved a lot in the last couple of years and even if it stays here at these current levels, the company seems like a good long-term hold. Now, let’s see what kind of price I would be willing to pay.

Valuation

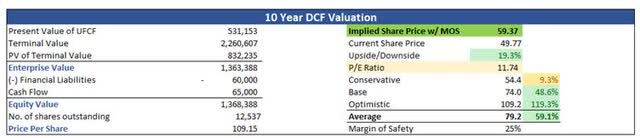

In terms of revenue, the company has been experiencing a lot of fluctuations there, and over the last decade, it managed to grow at around 8% CAGR. For my base case, I decided to go with a 7% CAGR over the next decade, just to be on the safer side. For the optimistic case, I went with 11% CAGR, while for the conservative case, I went with 5% CAGR.

In terms of margins, I decided to leave gross margins at 32% which I think are very achievable over the next decade. This will improve net margins from 8% in FY22 to 11% by FY32, which is rather conservative I believe. I also left operating expenses as they were at the end of FY22.

On top of these assumptions, I will add a 25% margin of safety to give myself even more breathing room. With that said, the company is currently undervalued right now and offers around a 19% discount on the current valuation. I believe the company’s intrinsic value is $59.37.

Intrinsic Value (Author)

Closing Comments

According to my estimates, the company is trading at around 8.6 times FY23 earnings, which is very cheap in my opinion. The management is doing a lot of good work getting the company to be more profitable and from listening to the last few earnings calls, they are not going to stop there and will continue to improve the company’s profitability further and create shareholder value for years to come.

The company has very solid financials and the outlook looks very promising even with the lack of revenue growth, the company will be much more profitable and that will be very beneficial for investors.

Even after a 55% runup YTD, the company still looks very attractive as a long-term investment. I am giving the company a Strong Buy. I would also be looking at the B-class shares because the class A shares have very little daily trading volume. Sure, you’ll lose the voting rights, but I think I’d rather be in a more liquid position.