Michael M. Santiago/Getty Pictures Information

Funding Thesis

Mattress Bathtub & Past (NASDAQ:BBBY) bought off on the again of its Q1 2022 outcomes, and the inventory had returned again to the Covid lows of sub-$5 per share.

The extremely shorted inventory continues to present naysayers loads of ammunition after the corporate critically mishandled its capital allocation.

Merely put, this can be a flawed enterprise mannequin. And if there’s any upside to be comprised of this inventory, it should solely come from the occasional quick squeezes. There’s little or no worth right here.

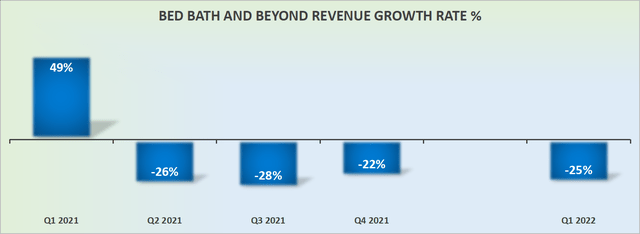

Income Progress Charges Stay Detrimental

BBBY income progress charges

Final week, BBBY reported yet one more uninspiring set of outcomes. The corporate reported unfavorable 25% top-line revenues, and unfavorable 23% comparable gross sales progress.

In the meantime, BBBY contends that the second half of fiscal 2022 ought to see sequential comparable gross sales. If the enterprise is predicted to go from unfavorable 25%, in opposition to what are tremendous straightforward comps, and BBBY nonetheless expects to report someplace round unfavorable 10% to fifteen% comparable progress, this may solely level to at least one factor. A really flawed enterprise mannequin.

And I consider that administration most likely is aware of this. Or I ought to say, administration ought to know this. Nonetheless, this hasn’t stopped plenty of capital going up in flames.

Capital Allocation Fiasco

Over the previous twelve months, BBBY repurchased greater than $500 million value of inventory. Certainly, not solely did BBBY repurchase $589 million throughout fiscal 2021, but it surely went on to repurchase an extra $43 million value of inventory throughout fiscal Q1 2022.

As you possibly can know, these repurchases amounted to treasured capital that went out the door at a really unsuitable time. It is not solely that these shares had been clearly not accretive to long-term shareholders, however extra importantly, the capital that went out the door is greater than the corporate’s whole market cap.

That is clearly a lower than optimum capital allocation technique.

And now, so as to add insult to damage, recall that again in This autumn 2021, it had a internet money place of $150 million. And extra not too long ago? BBBY’s newest outcomes present a enterprise with a internet debt place of roughly $1.3 billion.

The enterprise is now very a lot over-leveraged.

BBBY Inventory Valuation: Tough to Worth

As famous within the part above, BBBY’s stability sheet carries roughly $1.3 billion of internet debt. Take into consideration this for a second. Not solely is its debt excellent bigger than BBBY’s market cap, I now battle to see a path to unlocking shareholder worth.

This time final yr, when the inventory was costlier, I truly believed on the time that there was worth in BBBY. You had a enterprise mannequin that was reporting breakeven money flows and had a robust stability sheet with ample money. Sure, I used to be unsuitable to have thought that. However alas, that is what I believed.

Immediately, you’re eyeing up a enterprise that’s quickly burning by means of money and has little or no money on its stability sheet.

The Backside Line

Mattress Bathtub & Past’s inventory is roughly 30% shorted. That implies that there are doubtless occasions when there are going to be quick squeezes alongside the best way.

However as I look by means of and think about the prospects of a enterprise that’s reporting unfavorable comparable gross sales progress and gross margins which might be 1,100 foundation factors worse off, I battle to seek out a lot, if any, significant upside on this inventory.

Subsequent catalyst for the inventory? BBBY has roughly $285 million value of debt due 1 August 2024. At this second in time, administration must work very arduous to get forward of this debt stack.

Provided that BBBY has no reasonable method to repay this excellent debt at maturity, will probably be absolutely on the mercy of collectors to refinance this debt.

Consequently, the query just isn’t whether or not or not this debt will likely be paid off or rolled ahead. It is merely a query of what kind of coupon will the brand new notes carry? Something at about 8% rates of interest will likely be a transparent indication to all stakeholders that this enterprise is slowly being put to mattress.