Marti157900

2022 has been a challenging year for consumer discretionary retail companies as many people reduce spending amid the sharp rise in living costs. While this trend has weighed on virtually all consumer stocks, it has pushed some to the point of bankruptcy. Bed Bath & Beyond (NASDAQ:BBBY) has lost around 70% of its value this year and is roughly 95% below its all-time high. The company is racing for liquidity after S&P global ratings downgraded the firm’s debt, expecting it to enter selective default. Bed Bath & Beyond fell dramatically last week as it filed to offer up to $75M in new shares, dramatically diluting its ~$400M in market capitalization.

While the company is trying to stave off a liquidity crisis, it appears there is little it can do to avoid bankruptcy and may only delay the inevitable. Many of its bonds are down nearly 80% this year, offering staggering yields of 50%+. Of course, it is questionable, and likely improbable, that the firm finds the liquidity to make coupon payments. The stock faces a short-interest level of around 40% and quickly reversed after its last short-squeeze in August. It has an option implied volatility of ~125%, meaning massive price action is expected. BBBY’s short borrowing cost is currently around 8% – a high figure, but well below the ~17% level, it was during the last short-squeeze. This data indicates some investors are buying BBBY’s stock today in the view it is a fire-sale discount opportunity. However, while the stock has lost much of its value, I believe its debt and liquidity issues are significant enough that it is a matter of months, if not weeks, before the company declares Chapter 11 bankruptcy. It is not a question of whether its stock will recover but whether there is value in BBBY’s distressed debt.

A Look At Bed Bath & Beyond’s Solvency

From a big-picture perspective, Bed Bath & Beyond is failing due to core business issues and a failure to adapt to a changing environment. Over the past decade, the rise of Amazon (AMZN) and other e-commerce alternatives has shifted most purchases away from large department store chains. Fundamentally, most firms in this industry cannot compete with e-commerce due to their higher overhead operating costs and supply-chain inefficiencies. As detailed in “Kohl’s: The End Of The Department Store Era Draws Close” regarding Kohl’s (KSS), I believe we may be on the precipice of a final wave of large department store bankruptcies.

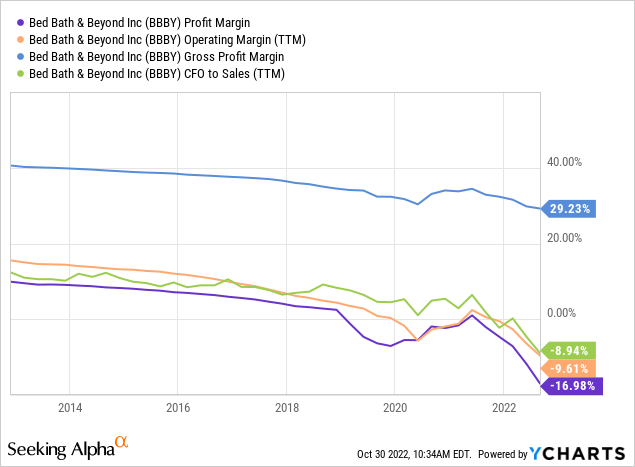

The one benefit of outlets like Bed Bath & Beyond is that they allow people to view products physically before purchase. However, to compete with bargain hunting, Bed Bath & Beyond must sell at increasingly meager profit margins. Over the past decade, the accelerating decline in its gross margin has pushed its net profit margins below zero and even its operating margins. See below:

Since 2019, Bed Bath & Beyond has not earned a consistently positive operating profit (before interest costs). The fact that the company is not earning an operating profit is critical, since it will not be able to make any debt interest payments without a positive operating profit. While Chapter 11 bankruptcy seems likely, Chapter 7 “liquidation” may also be, since it is unclear if the firm has any value without an operating profit.

Some companies, such as airlines and energy firms, often go bankrupt multiple times, as high debt causes their net profits to be negative, but more rarely face negative pre-interest margins. Looking at Bed Bath & Beyond’s 50%+ yield bonds, investors may be interested as even if a default occurs, they could become equity owners as the firm leaves financial restructuring. However, without operating profits, it may not have any earnings due to failure in its core business model.

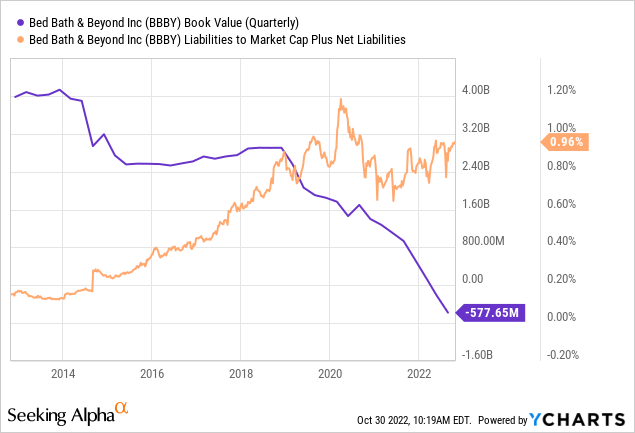

More recently, this trend has resulted in the company’s operating cash-flow to become quite negative, creating immense liquidity strain. The company has no book sheet equity value, with nearly $600M negative net book value. Its market capitalization plus net liabilities is only around 4% of its total liabilities. See below:

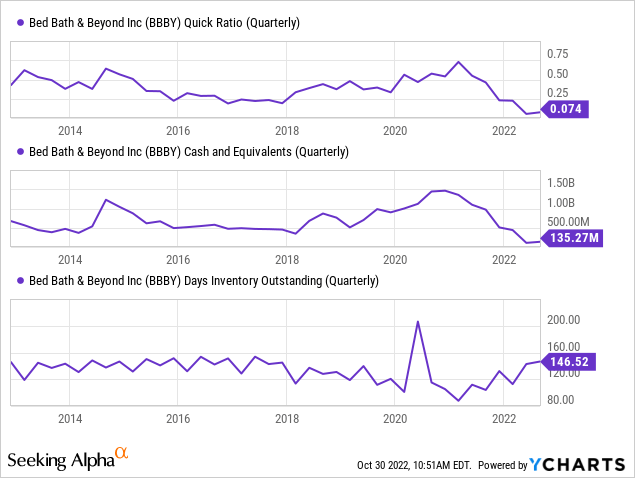

BBBY’s net market capitalization is extremely low compared to its total liabilities, and its net book value is quite negative. Most of its liabilities are its lease obligations, with the remaining $1.75B in financial debt – around 4.5X greater than its current market capitalization. Further, looking at the company’s balance sheet, it appears it may run out of cash by the end of Q4 or Q1 next year. See below:

Bed Bath & Beyond has meager cash mixed with relatively high inventories. For BBBY to survive winter, it will need to see strong holiday sales, preferably at a gross margin high enough that the company can have positive cash flow. The firm is authorized to raise cash through equity sales, but given its low equity price, doing so will likely accelerate the pace of shareholder dilutions significantly. If the stock faces yet another short squeeze and can sell shares at an elevated price, it may survive without immense dilutions. Still, I believe that is unlikely, considering it is currently coming down from a short squeeze (or likely a dead-cat-bounce). Of course, the company also has remaining credit facilities, but a weak holiday shopping season could rapidly exacerbate declines in its liquidity position.

Liquidation or Restructuring?

In my view, BBBY will lose its remaining value over the next six months unless an unlikely black-swan event saves it. Given the state of its balance sheet and economic conditions, there is seemingly nothing the company can do but try to delay through equity dilutions or debt exchanges. The financial benefit of these efforts declines the more pursued, since they tend to result in lower equity prices and credit rating cuts. To me, we must question whether the firm will stay in business in the long term or face liquidation.

Firstly, before 2019, the retailer saw a consistent decline in gross profit margins and operating margins. In 2019, its operating margins fell to near zero, prompting the company to race to close unprofitable stores. Ironically, 2020 may have aided the company since interest rates plummeted, and many people made large purchases amid the sharp rise in personal savings and fiscal stimulus. Of course, that stimulus came with the economic cost of rampant inflation, ongoing supply chain and labor shortages, and, most recently, much higher interest rates.

In 2022, Bed Bath & Beyond’s decline has accelerated dramatically as inflationary forces cause its operating costs to rise (electricity, labor, freight, etc.) and has negatively impacted discretionary consumption demand. Amazon’s sharp profit decline shows that even large e-commerce giants are not safe as people reduce spending. The holiday shopping season begins amid negative real wage growth, rapidly rising consumer debt, and near-record-low personal savings. In my view, these economic trends make it very likely that the 2022 holiday shopping season will see lower-than-expected sales as many people cannot afford to spend unnecessarily.

The rise of e-commerce and Bed Bath & Beyond’s failure to truly compete with it has set the company on a long-term trend toward bankruptcy. That said, I believe its track record of poor financial decisions (over-leveraging), and the more recent declines in consumer discretionary spending power, significantly accelerate its bankruptcy timeline. Furthermore, the firm has blamed its negative operating margins on special discounts; those price cuts are occurring so frequently that its fundamental business model appears untenable.

The Bottom Line

Overall, I am very bearish on BBBY stock and believe it will lose its remaining value over the next six months. Additionally, I would not purchase the company’s distressed bonds despite their immense declines, since I do not believe it will manage to earn a consistently positive operating profit. There are two core reasons for this view. Firstly, the department store consumer discretionary business model appears unworkable in the long run due to its competitive weakness compared to larger e-commerce companies. Secondly, negative economic inflationary trends limit consumption spending while increasing operating costs, thus accelerating the pace of Bed Bath Beyond’s decline.

Bed Bath & Beyond’s management can take some measures to attempt to delay its decline by raising liquidity. That said, at this point, I do not believe there is anything the company can do to change sufficiently to remain profitable in the long run. As its core business model becomes increasingly uncompetitive, immense innovation and change are necessary to stay in business. In my view, it has too little time and resources to do so – particularly in light of shifting economic conditions.

Due to high option implied volatility levels and BBBY’s short-squeeze potential, I would not bet against the stock directly or through options. However, if the stock rose on another short squeeze, then I may do so. That said, I would be surprised to see BBBY trading above pennies one year from now.