Figuring out the size of a market cycle requires wanting on the previous conduct of its contributors. On the subject of Bitcoin, there are two main currents that change the course of its value actions — long-term holders (LTHs) and short-term holders (STHs).

Lengthy-term holders are outlined as addresses which have held Bitcoin longer than 155 days. They’re usually seen because the “sensible traders” within the area, as the vast majority of them have withstood market volatility and managed to build up on the backside and promote on the high.

Quick-term-holders are addresses which have held Bitcoin for lower than 155 days and are seen because the extra price-sensitive group considerably affected by volatility.

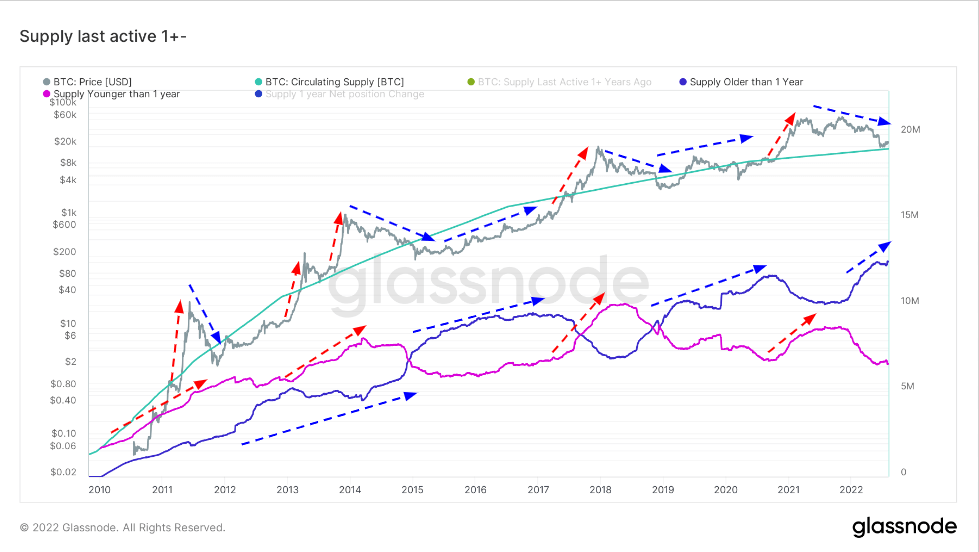

Trying on the conduct of LTHs and STHs additional corroborates this. Since 2010, long-term holders have purchased BTC each time its value was pushed downwards and bought into nearly each peak.

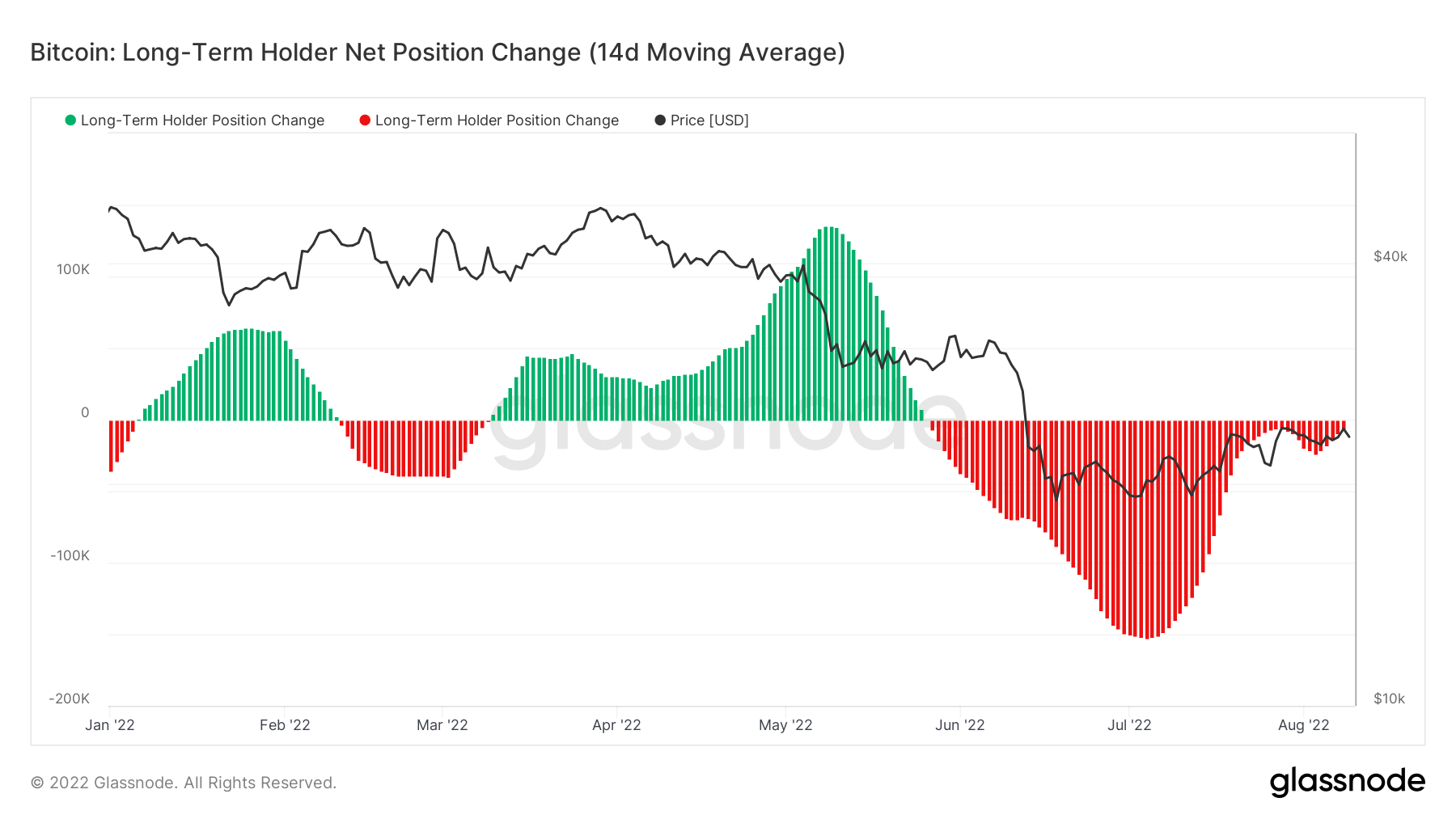

Latest modifications within the internet positions of long-term holders present that they’ve been capitulating. Bitcoin’s stoop, brought on by the Terra (LUNA) blowback and the Celsius disaster, has pushed many LTHs to promote their positions.

Nevertheless, LTHs promoting their positions is normally taken as an indication of a market backside.

In response to information from Glassnode, the sell-off that started in Might reached its peak in July and is now really fizzling out. The graph under illustrates the change in place for long-term holders, with the crimson highlights displaying a lower within the general place and the inexperienced highlights displaying a rise of their holdings.

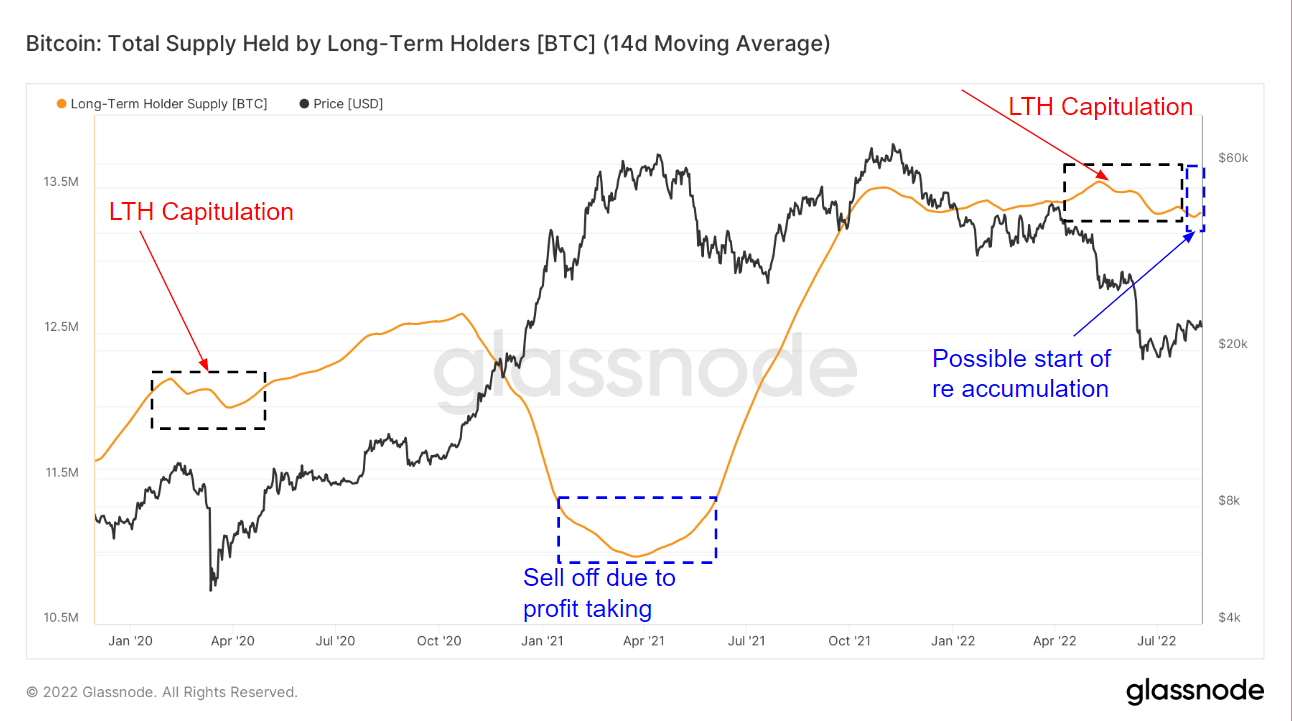

Zooming out reveals different intervals that pushed long-term holders to dump their holdings. In March 2020, when the onset of the COVID-19 pandemic crushed world markets, long-term holders capitulated out of concern and uncertainty. Their capitulation set off a pointy value drop that took till July that yr to recuperate.

The following main sell-off occurred between January 2021 and Might 2021. Nevertheless, with Bitcoin deep in a bull run, the sell-off meant long-term holders had been taking vital income.

The capitulation we’ve seen start in April 2022 remains to be ongoing. Just like the one in March 2020, this capitulation has additionally triggered an enormous value drop, pushing Bitcoin right down to $20,000 for the higher a part of the summer season. And whereas we’ve seen promoting subdue since August started, the buildup charge stays small.

We’re but to see whether or not that is the beginning of one other accumulation interval and whether or not the small uptick within the accumulation charge will overtake the sell-off. If the earlier bear cycles repeat, Bitcoin’s value might see a gradual rise, adopted by a rise within the quantity of BTC amassed by LTHs.