mphillips007

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the third week of December.

Market Action

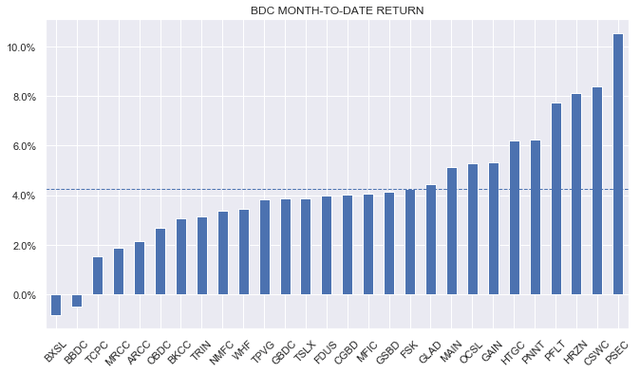

BDCs continued to rally this week with a total return of close to 1%. Month-to-date, the sector has delivered a total return of 4% despite an expectation of significantly lower rates over the medium term.

Systematic Income

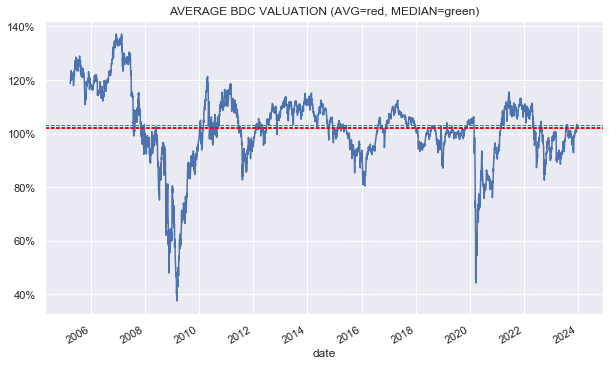

BDC valuations are right on top of their longer-term average, just north of 100%.

Systematic Income

BDCs, as gauged by proxy ETFs, are the best-performing income sector in the chart below, marginally outperforming both MLPs and stocks. That is a great result for investors who chose to stick with the sector this past year. It’s fair to say that next year will make for somewhat harder sledding.

Systematic Income

Market Themes

The view that seems to be taking shape among many BDC investors is that, once the Fed starts to cut rates, BDC net income will start to fall which, in turn, should drive BDC prices lower.

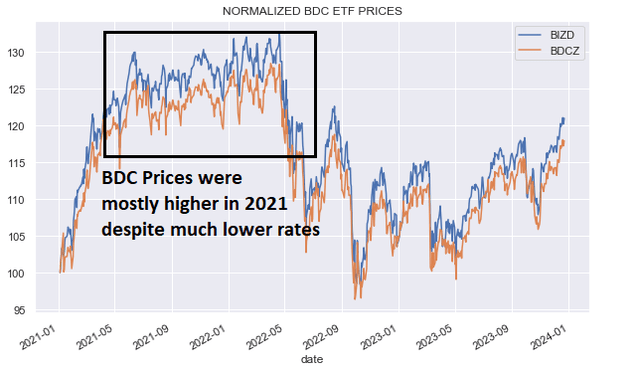

There are two problems with this view. One, it’s a historic – in 2021 BDCs generated much less net income than they do now, and yet their prices were mostly higher.

We can see this in the chart below when BDC ETF prices were significantly above today’s level despite short-term rates being at rock-bottom levels.

Systematic Income

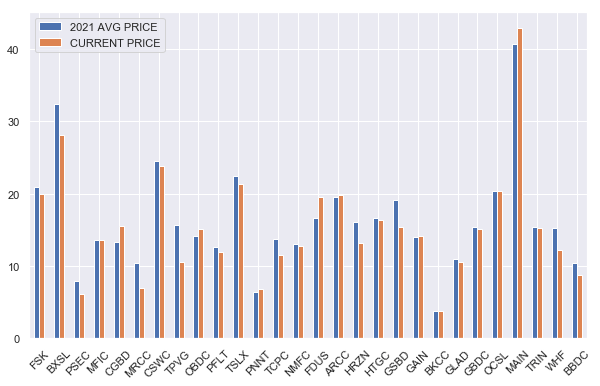

We can also look at individual price levels in the chart below which shows the average 2021 price (blue bar) vs. today’s price (orange bar). If we look at the last price in 2021, rather than the average, the results would be even more stark with nearly all BDCs 2021 prices above today’s price.

Systematic Income

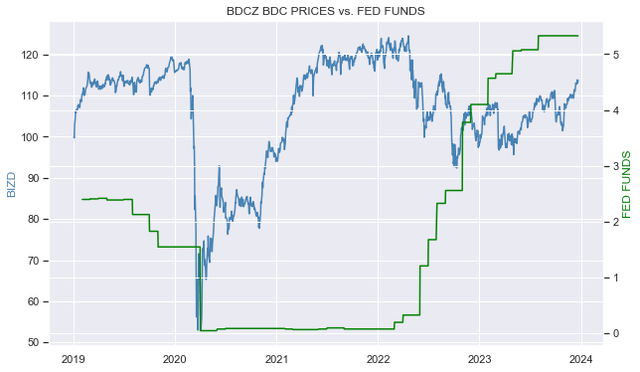

Further, if we plot BDC prices (again, proxied by an ETF like BDCZ) against short-term rates we see the opposite relationship of what we often hear. For example, after 2020 when short-term rates collapsed, BDC prices soon rose to new highs and in 2022, when short-term rates began to rise, BDC prices started to fall.

Systematic Income

The second problem with the view that lower rates will mechanically push BDC prices lower is that changes in rates don’t have much impact on BDC NAVs. Because BDCs hold mostly floating-rate assets that have no duration, interest rates have no direct impact on the value of BDC portfolios.

Third, and most importantly, BDCs, like many other financial securities, are primarily sensitive to things like risk sentiment (which drives valuations) and credit spreads which is what drives NAVs.

This explains why BDC prices were mostly higher in 2021 – credit spreads were very tight and risk sentiment was strong, pushing both NAVs and valuations higher. Sure, BDC net income was much lower than it is now but yields across the income market were also lower. This is a point that often eludes investors which is that if interest rates fall, yields will tend to fall across the income market. It’s not like BDC net income will drop but yields of all other securities will remain the same. Capital has to be invested somewhere and BDCs don’t exist in a vacuum. If you didn’t like BDCs at yields of 7-8% in 2021, you could go into cash for zero yield or Treasuries for yields of around 1-2%.

In short, if we go back to a 2021 type of environment of lower short-term rates and lower net income, we would expect BDC prices to rise despite a drop in net income so long as risk sentiment holds up. This should be supported by the fact that most BDCs have large coverage cushions so we don’t expect to see big cuts in base dividends in the sector.

However, if short-term rates drop because we enter into a bad recession then we could very well see much lower BDC prices however this won’t be because of lower rates – it will be because of wider credit spreads and poor risk sentiment.

Stance And Takeaways

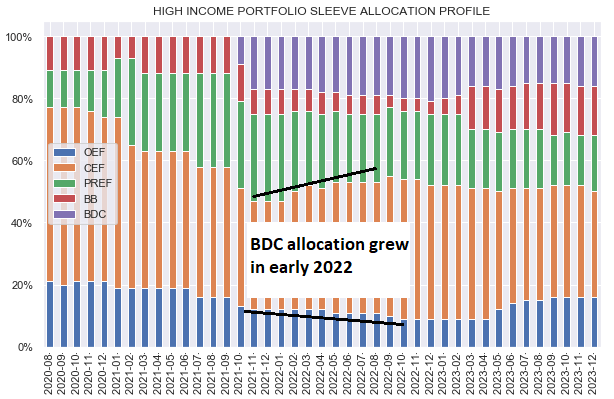

As we close out 2023, we can also close out what was a Goldilocks period for the sector. Since 2022, short-term rates were rising, BDC valuations were mostly below today’s level and credit spreads were above today’s level. This created significant margins of safety in BDC net income, valuations, and NAVs. These were the key reasons why we added to our BDC allocation in the first half of 2022 and maintained a healthy allocation over most of 2023.

Systematic Income

However, the market environment is now very different. Investors are now looking at above-average valuations, increasing default rates, very tight credit spreads, and likely decreasing net income. None of this means investors should run for the hills but it plainly means that BDCs are less attractive than they were in 2022 and even 2023.

This is why we have marginally reduced our BDC allocation in the last few months. We also continue to maintain a preference for higher-quality companies such as those that have been able to maintain net realized gains and stable to growing NAVs over previous recessionary periods.