ClaudioVentrella

A month ago, I placed a “Strong Buy” rating on Baytex (NYSE:BTE), saying the stock was cheap and that the company should be able to quickly deleverage following an acquisition at current oil prices. With the company already exceeding expectations on this front, I’m going to increase my target price. With the E&P recently reporting its Q3 results, let’s catch up on its progress.

Company Profile

As a quick reminder, BTE is a Canadian based energy producer focused on light and heavy oil production in Canada and the U.S. In Canada, it owns acreage in heavy oil basins Peace River, Peavine, and Lloydminster, as well as light oil basins Viking and Duvernay.

Following its acquisition of Ranger in June, the Eagle Ford in the U.S. is now the company’s biggest basin, representing about 60% of its production.

Q3 Results

For the quarterly results announced on November 2nd, BTE saw its revenue climb 94% to C$1.16 billion, helped by its acquisition of Ranger. That topped analyst estimates of C$1.11billion.

Production climbed 68% to 150,600 boe/d, of which 85% was liquids. Light oil & condensate production soared 115% to 75,763 bbl/d, while heavy oil rose 7% to 35,204 bbl/d. BGL production jumped 109% to 18,004 bbl/d, while natural gas production climbed 66% to 129,780 mcf/d.

BTE brought on 13 operated Eagle Ford wells online in the quarter. The wells had 30-day initial production rates of 1,495 boe/d, of which 78% was liquids, and well production ranged from 769 boe/d to 2,355 boe/d. Seven of the wells from three pads had 30-day initial production rates of 2,000 boe/d, of which 65% was liquids. Overall, it bought 21.3 net Eagle Ford wells online in the quarter.

In Canada, BTE brought 35.5 Viking net wells online in the quarter and six wells in the Pembina Duvernay. The six wells in the Pembina Duvernay generated average production rates of approximately 950 boe/d.

The company also brought 25 heavy oil wells onstream in the quarter, including 14 at Peavine, 8 at Lloydminster, and 3 at Peace River. The 14 wells at Peavine had 30-day initial production rates of 725 bbl/d, helping increase production in the basin by 69% to 13,821 bbl/d.

WTI prices were $82.26 in the quarter, up from $73.78 a year ago. WCS heavy oil was C$93.02 versus C$78.85, and the differential to WTI improved to -$12.89 from -$15.07.

The E&P saw its adjusted funds flow rise 113% to C$581.6 million. On a per share basis, it rose 45% to 68 cents from 47 cents. Cash flow from operating activities soared 131% to C$444.0 million, and was up 58% on a per share basis to 52 cents. Free cash flow jumped nearly 65% to $158.4 million and was up 13% on a per share basis to 18 cents.

The company ended the quarter with C$2.7 billion in debt, which was 1.1x leverage based on its Q3 EBITDA run rate. During the quarter, the company repurchased 16.8 million shares at an average price of C$5.29, reducing its share count by 2%. It also paid out a 2.25 cent Canadian dividend.

Looking ahead, BTE narrowed its full-year production range to 121,500-122,000 boe/d compared to a prior outlook of 120,500-122,500 boe/d.

It expects to spend around C$1.35 billion on exploration and development capex versus a previous forecast of between $1.005-1.045 billion. BTE also noted that it expects operating and transport costs per boe to be towards the top end of its prior guidance. It is expecting to generate about $650 million in free cash flow for the year.

For Q4, the company forecast production of between 158,000-160,000 boe/d. It is looking for the mix to be around 47% light oil, 24% heavy oil, 13% BGLs, and 16% natural gas. It is projecting to generate free cash flow of about $400 million in Q4.

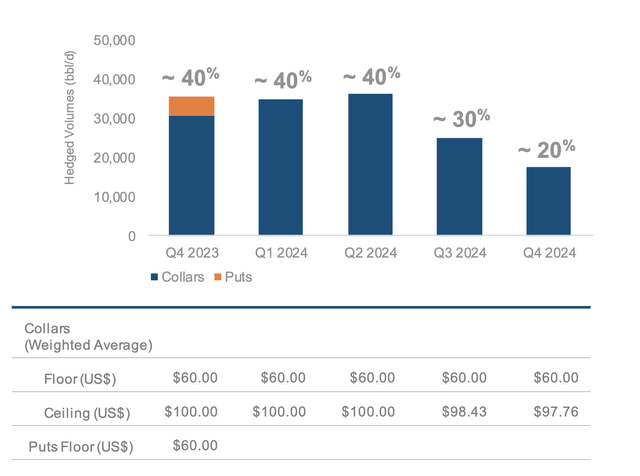

For Q4, BTE has hedged 40% of production mostly with two-way collars with a floor price of $60 and a ceiling of $100, along with a 5,000 bbl/d put at $60. It has 40% of its first half 2024 production also hedged using two-way collars with a floor price of $60 and a ceiling of $100, and 25% of it second half 2024 production with two-way collars with a floor price of $60 and a ceiling of $98.

BTE Hedges (Company Presentation)

BTE reported solid Q3 results and issued strong guidance for Q4. Production was solid, and its generating strong cash flow. The company is projecting to generate C$558m in free cash in the second half ($158 million from Q3 and $400 million projected for Q4), which is a full-year run rate of C$1.1 billion, or about US$811 million. That equates to an over 22% free cash flow yield. That should allow the company to pay down debt and repurchase shares at a good pace

Now oil prices have to remain around current levels for BTE to achieve this. A $5 change in WTI price has about a C$218 impact on its adjusted fund flows for the year. BTE is assuming a WTI price $83, and WTI is currently trading at just under $79. So oil price fluctuations remain the biggest risk to the company.

Changes to the WCS heavy oil differential and changes to the Canadian-USD exchange rate are also risks. WCS is heavier oil and more difficult to refine, and thus trades at a discount. The gap can widen and narrow based on a number of things, including natural gas prices (high nat gas prices can make it more expensive to refine heavy oil), heavy oil refinery shutdowns, exports from places like Mexico, and pipeline capacity. Phillips 66 (PSX), the refiner with the largest Canadian imports, was asked earlier this month where it saw WCS differentials going. On its Q3 earnings call, that they were currently sitting around $25, but it thought it would likely narrow to around $15 next spring/summer.

Moving Forward

The key for BTE moving forward is free cash flow generation, which it will then use to evenly pay down debt and buy back stock. Based on a full year of Ranger, it looks like it could produce up to C$1.6 billion in free cash at $85 oil. If it can achieve that, the stock will have a ton of upside.

That said, I’m going to be a bit more conservative and assume free cash flow closer to C$1.1 billion, as predicting oil prices a year-out isn’t easy, so this should leave a lot of conservatism. Overall, though, I remain bullish on oil with two wars raging on, the U.S. Strategic reserve depleted, China looking to ramp back up after lockdowns, and OPEC+ regaining its influence. I also expect the WCS-WTI differential to narrow next year, which should benefit the company.

Valuation

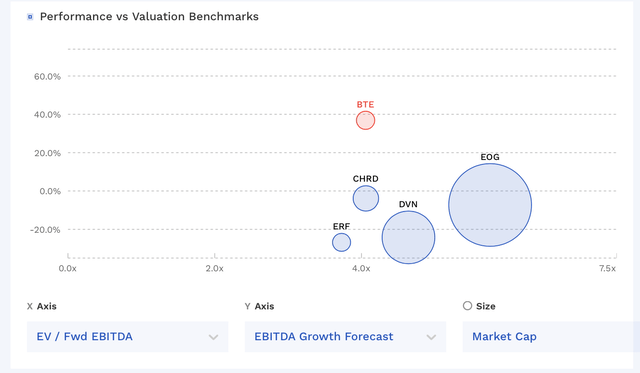

BTE trades at 2.9x EBITDA based on 2024 analyst estimates of $1.84 billion. Based on the 2025 consensus of $1.77 billion, the stock trades at a 3.0x multiple. Of course, the price of oil and natural gas can change the actual results immensely.

BTE is valued in the low-end of the pack compared to other independent E&Ps

BTE Valuation Vs Peers (FinBox)

If the company can reduce debt by C$500 million over the next 12 months and it lowers it share count by 100 million, and you put an under 4.5x EV/EBITDA on the 2025 consensus from there (which is closer to its U.S. peers), you can get an $8.50 stock. The company currently looks on track to exceed my prior expectations of cash flow – assuming energy prices hold up – so I am raising my price target from $8 to $8.50.

Conclusion

If oil prices can remain around $80 or higher over the next year, BTE should be a huge beneficiary as it can use its prolific cash flow at those prices to reduce debt and buy back its undervalued stock. The company is growing production nicely, and the addition of Ranger’s acreage in the Eagle Ford so far seems to be generating solid results.

At this time, I like where BTE is headed even more than previously, and continue to rate the stock a “Strong Buy.” The company is making progress more quickly than I expected with its free cash flow, and the Ranger acquisition early on looks like it is indeed a good acquisition. Thus, I’m raising my target from $8 to $8.50.