DNY59

One of the companies reporting full-year results today, was the German life science and pharmaceutical company Bayer AG (OTCPK:BAYZF). And so far, investors are neither optimistic nor pessimistic about the results – the stock is fluctuating around the previous day’s closing price.

And while investors can be relieved about the stock not taking another hit today (at least so far), the past has been a catastrophe. Since my last article published in November 2023, the stock lost about 30% in value and the stock is now in a bear market lasting nine years. I would really like to present some positive news and a glimmer a hope, but the results aren’t providing any hints for optimism. Let’s take a look.

Annual Results

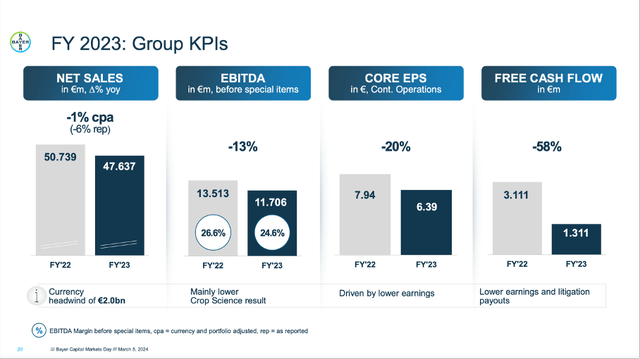

Today, on March 5, 2024, Bayer reported fourth quarter and full-year results for fiscal 2024 and the results were once again not great. While Bayer generated €50,739 million in sales in fiscal 2022, top line declined 6.1% year-over-year and in fiscal 2023 the company generated only €47,637 million in sales. The top-line decline can be seen as rather moderate at this point, EBIT however declined steeply from €7,012 million in fiscal 2022 to €612 million in fiscal 2023 – resulting in a 91.3% year-over-year drop. And reported earnings per share switched from €4.22 EPS in fiscal 2022 to a loss per share of €2.99 in fiscal 2023.

Bayer Q4/23 Presentation

And even when looking at adjusted metrics, the picture is not great. EBIT before special items declined from €9,257 million in fiscal 2022 to €7,589 million in fiscal 2023 – resulting in 18.0% year-over-year decline. And core earnings per share also declined 19.5% year-over-year from €7.94 in the previous year to €6.39 this year. Free cash flow – another very important metric – also declined from €3,111 million in fiscal 2022 to €1,311 million in fiscal 2023 – resulting in 57.9% year-over-year decline.

Quarterly Results

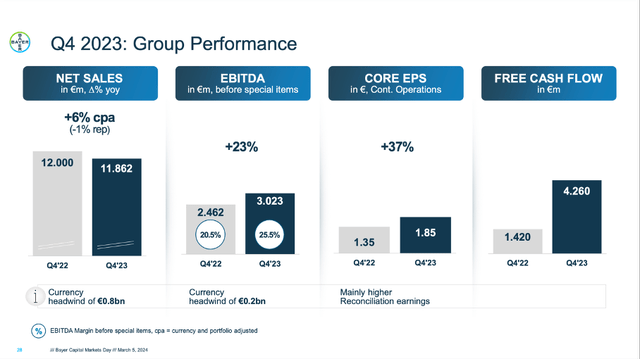

When looking at the quarterly results for the fourth quarter, the picture looks a little brighter. Sales still declined slightly from €12,000 million in Q4/22 to €11,862 million in Q4/23 – resulting in 1.2% YoY decline. However, when adjusting for currency effects, sales increased 6% year-over-year. Core earnings per share also increased from €1.35 in the same quarter last year to €1.85 this quarter – resulting in 37.0% year-over-year growth. And free cash flow in the fourth quarter tripled from €1,420 million in Q4/22 to €4,260 million in Q4/23.

Bayer Q4/23 Presentation

But especially for free cash flow, we see extreme fluctuations in the past and the great results for one quarter should not be used as hint for better times to come.

Segment Results

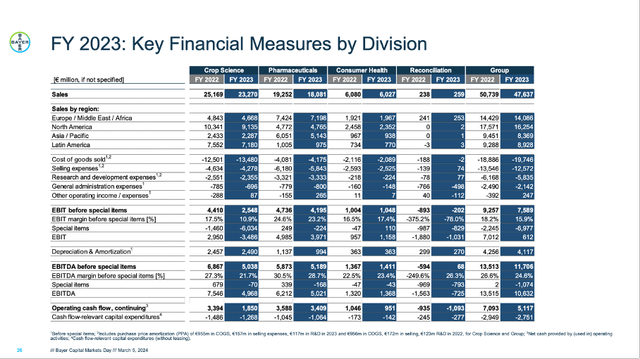

When looking at the segment results for the full year, all three reported declining revenue and two of the three segments also reported a declining EBIT (only consumer health is an exception here).

Bayer Q4/23 Presentation

Crop Science

Let’s start with Crop Sciences, the most important segment for Bayer as this segment is generating the biggest part of revenue and is an important contributor to EBIT. In fiscal 2023, sales declined 7.5% year-over-year to €23,270 million. And EBIT also declined – even when looking at the adjusted numbers before special items. Compared to €4,410 million in fiscal 2022, the segment generated only an EBIT of €2,548 million this year – resulting in 42% year-over-year decline.

Pharmaceuticals

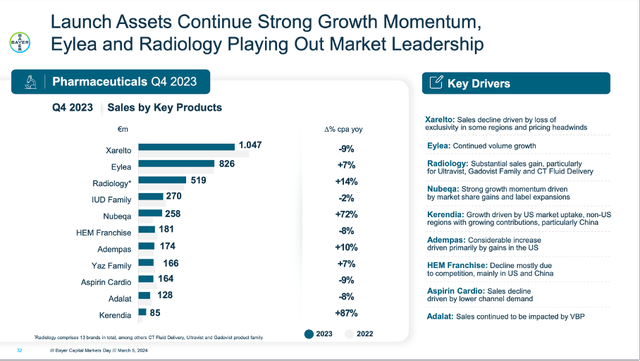

Pharmaceuticals also saw its revenue decline and had to report €18,081 million in sales (6.1% decline compared to fiscal 2022). EBIT before special items also declined from €4,736 million in fiscal 2022 to €4,195 million in fiscal 2023 – resulting in 11.4% YoY decline. And while Xarelto, which will lose patent protection in about two years in its major markets, had to report a 9% decline year-over-year in the fourth quarter (due to the loss of exclusivity in some regions), promising drugs like Kerendia and Nubeqa reported growth rates in the high double-digits. However, it remains unclear if the declining sales that will most likely result from patent loss can be compensated by newer drugs.

Bayer Q4/23 Presentation

And finally, Consumer Health reported a small decline of sales – 0.9% YoY decline to €6,027 million. And while the segment had to report a small decline for sales, it reported 4.4% YoY increase of EBIT before special items to €1,048 million in fiscal 2023.

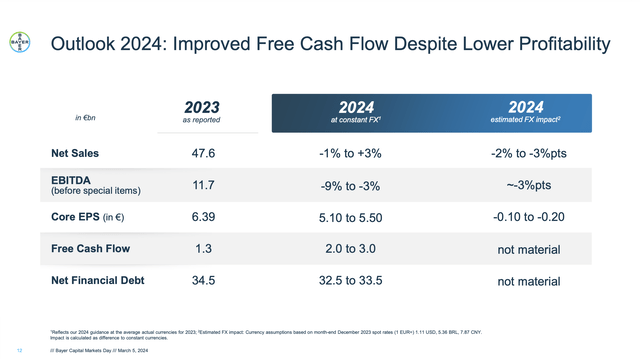

Outlook for 2024

Management also published its outlook for fiscal 2024 and in my opinion the guidance is neither great nor bad. When looking at currency-adjusted numbers, Bayer is expecting sales to be in a range between €47 billion and €49 billion, which would result in a low single digit increase compared to fiscal 2023. EBITDA before special items is expected to be in a range of €10.7 billion and €11.3 billion and compared to €11.7 billion in fiscal 2023 this would result in a mid-single digit decline.

Bayer Q4/23 Presentation

Finally, core earnings per share are expected to be between €4.95 and €5.35 – resulting in 16% to 23% year-over-year decline. Free cash flow is expected to be in a range between €2 billion and €3 billion, which would be a huge improvement compared to about €1.1 billion in FCF in fiscal 2023. However, free cash flow in fiscal 2023 was extraordinarily low.

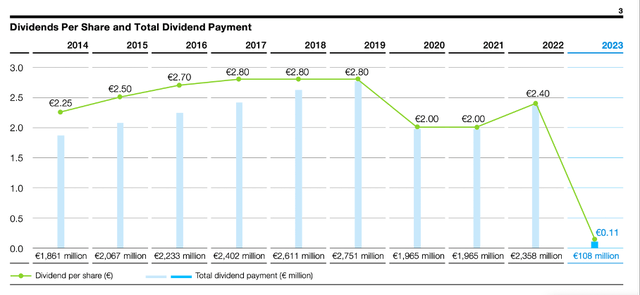

Dividend Cut

Aside from a mediocre guidance, management had another surprise for investors – the dividend was cut from €2.40 in the previous year to only €0.11 this year. And I must admit I did not expect this to happen – especially as Bayer only started to increase the dividend again last year. Considering the small dividend, we don’t really have to talk about a dividend yield or payout ratio.

Bayer Annual Report 2023

And although I did not expect management to cut the dividend – especially as this is a cut to almost zero – I can understand why management made that move. In the current situation, management should preserve cash wherever possible and use it to reduce debt levels.

Problem: Debt

The debt levels of Bayer are still one of the major problems for the business and by reducing the dividend payout about 2,250 million the cash can be used to reduce the debt levels instead. In fiscal 2023, net financial debt even increased from €31,809 million at the end of December 2022 to €34,498 million on December 31, 2023. This is the highest net financial debt level in the last few years and while Bayer should really focus on reducing its debt levels, it continues to struggle.

And considering the free cash flow Bayer generated in the last few years, it would take several years to repay the outstanding debt. Even when being optimistic and using the highest free cash flow Bayer was able to report in the last five years (€4,214 million in fiscal 2019) it would take more than 8 years to repay the outstanding debt – a ratio that is not acceptable.

For 2024, management is expecting to reduce net debt slightly to a range between €32.5 billion and €33.5 billion. But unless the company is able to increase its free cash flow in the years to come, the problem will remain. By the way, Bayer had to spend €2,672 million on interest payments in fiscal 2023 – almost 35% of the adjusted EBIT before special items that had to be used only for interest payments.

Bottom Line

When calculating an intrinsic value for Bayer or looking at simple valuation metrics (the stock is currently trading for only 4.5 times its core EPS), we must come to the conclusion that Bayer is undervalued and a clear “Buy”. And I also rated the stock as a “Buy” in the past, but I don’t know if this is justified anymore.

Considering the dividend cut, the extremely high debt levels, the ongoing legal matters following the Monsanto acquisition and management being not able to turn the ship is making me rather cautious now (in hindsight, maybe we should have been cautious years ago). Nevertheless, I will not sell now as all the negativity seems to be reflected by the stock price and a P/E ratio of 4.5 really seems absurd for a business that is able to generate solid profits and grow with a solid pace – at least in theory.

It seems like the new CEO seems to be taking steps to improve the business – and he doesn’t shy away from taking drastic measure, including the dividend cut or discussing the possibility to break up Bayer (see my last article mentioned above). But in a universe with thousands of stocks, I can’t find any particular reason for anybody to invest in Bayer right now – undervalued stocks can also be found somewhere else. I will continue to hold my shares, but maybe you should stay to the sidelines.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.