BackyardProduction/iStock Editorial via Getty Images

Investor graveyards are strewn with the bodies of failed small cap turnarounds. For every success there are many more failures where expectations don’t line up with reality. So, with that out of the way, let’s dive into a recent pivot by Barnes & Noble Education (NYSE:BNED) and their attempt to escape a dying legacy business.

History

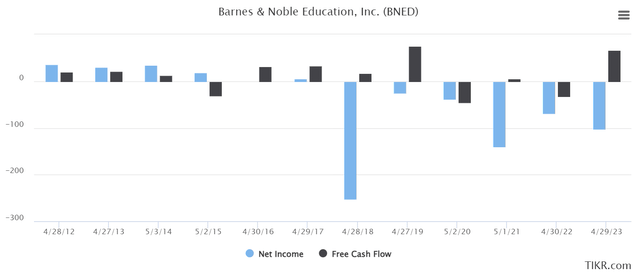

You may hear Barnes & Noble and picture something very different from what BNED is. That Barnes & Noble was taken private by Elliott in 2019. BNED was spun out back in 2015, focused on on-campus bookstores purveying primarily textbooks. As you can see from their results post-spin, it’s been a rough go:

BNED Chart (Seeking Alpha) BNED Financials (TIKR)

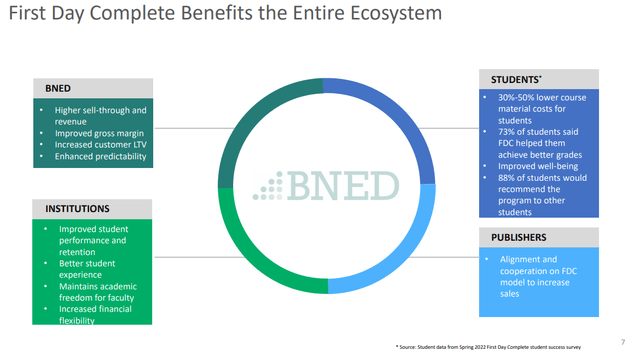

The key to BNED’s survival rests on their new initiative – First Day Complete (“FDC”). By bundling textbooks with tuition/course costs, BNED asserts that this new model benefits the entire education ecosystem:

First Day Complete (BNED Investor Presentation)

Impact

By converting campuses to a “subscription-like” model, BNED thinks they can fix their P&L degradation and survive the pivot away from the traditional textbook model. The question with this transformation becomes, “Can they escape the drag of their legacy stores before the new revenue stream pulls them back to profitability?”

I have some concerns, as the company guided to $20-30m of FY23 EBITDA at the end of Q3 (March) before reporting -$8.2m for the full year last month. Not the best forecasting, or at least not the best business trend. But they continued expectations to improve with a $40m FY24 guide, which was maintained after their Q1 report. Getting extensions on their debt and launching strategic alternatives suggests they have some momentum.

Opportunity

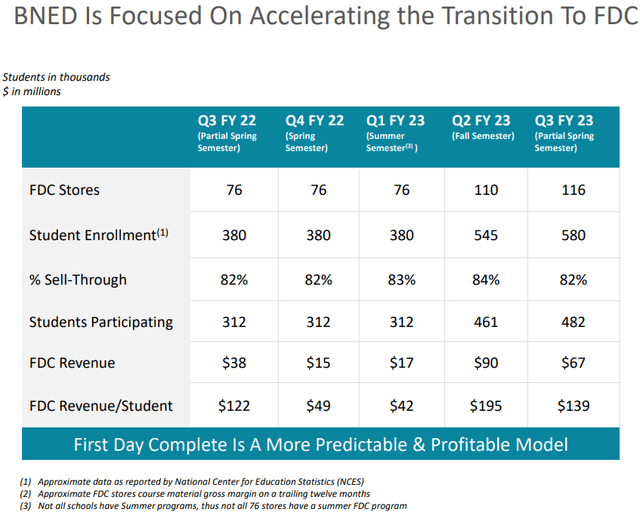

For this fall, BNED has guided 157 campuses and 800k students participating in FDC, a large bump to their recent program enrollment. They seek to see its 35% gross margins help offset razor-thin retail margins in the BNED business. On their Q1 call, they tried to push back on fears about decreased foot traffic, suggesting that more students getting books through their FDC offering is actually increasing presence in stores.

FDC Metrics (BNED Investor Deck)

BNED has about 1,400 total physical and virtual stores, so FDC penetration of their network has only hit ~10%. If they can continue to transition students to this model, they believe they will be able to stem the poor financial performance they have been combating.

There are some interesting partners involved in the BNED story as well. Fanatics has a BNED partnership for the sale of campus branded merchandise. Lids is also involved with the JV, with both companies establishing their stake in 2021 at higher prices.

Valuation

Where BNED gets interesting is if you assume some level of “escape velocity” for their FDC model. Any kind of recurring revenue model can be very attractive and trade at a high multiple of sales or gross profit. Assuming FDC revenues can hit $300-400m in the next 12 months through planned growth, the stock looks extremely cheap at a ~$300m EV. The problem will be how much this gets dragged down by the legacy business struggling to generate cash. I’m not sure you can separate the textbook subscriptions from the legacy stores, forcing BNED to continue to be valued as a legacy retailer at ~8x adjusted EBITDA guidance. Not that exciting given some retail valuations today.

Risks

As mentioned above, BNED doesn’t have a great track record of hitting estimates. General estimates had been for $50-60m of FY23 EBITDA, after missing initial guidance of $100m of FY22 EBITDA and blaming Omicron’s Covid resurgence. This is the basis for my fear that BNED is underestimating the amount of cannibalization taking place in their legacy business.

BNED finished FY23 with 12.8% of their revenue coming from the FDC model, which is becoming material but could have some unintentional knock-on effects. With most of their revenues still coming from other sources, and ~600 remaining physical stores, prior revenue streams like used books will be decimated, reducing the net contribution to the business.

As mentioned above, Fanatics and Lids invested a couple years ago at $6.50 a share to partner on retail store merch. The company has indicated they continue to be strong partners, but if this relationship deteriorates it would be a major concern for BNED shareholders. They are offering a 1-year bump in commissions to help BNED, which will help FY24 margins but be a potential headwind for FY25 growth.

Other entities are trying to launch their own version of FDC. Pearson is offering $15/month for access to over 1,500 books online. Cengage is doing the same. It’s not clear to me that the FDC model will be able to win this battle, or at least see limited profitability with better capitalized peers who can compete on price.

BNED is leveraged and paying double digit rates on their debt. The recent deal to extend their credit into 2025 gives them breathing room, but they will need to prove they can generate meaningful earnings via FDC growth without torpedoing their legacy business. Even with the extension, debt will be current starting in January. With current guidance, I don’t anticipate BNED can generate meaningful cash from operations.

Conclusion

BNED is a very interesting call option on executing a seismic shift in the college textbook industry. Can books be bundled with tuition at scale in a way that improves outcomes for students, universities, and the companies like BNED that sell the materials, without scuttling their legacy business beyond repair? If they can find the sweet spot, BNED may be worth multiples of where it trades today. But for now, I am skeptical, and leaving BNED shares in the “too hard” pile but welcome any feedback on the story.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.