Hero Images Inc

After the banking collapse occurred earlier this year, I immediately began searching for some attractive prospects. These are companies that have fallen significantly, that have shown signs of resilience during the drop, and that have not yet staged a full recovery from the decline. One interesting prospect in this space that found its way on to my radar is Banner Corporation (NASDAQ:BANR). With a market capitalization of $1.53 billion and deposits of $13.10 billion, it is not a small institution, but it is far from being a large one. Interestingly, the stock has barely recovered from its lows, and that might be because deposits have weakened. But when you look at overall financial performance and you see how cheap the company is, it does seem likely to me that the market is perhaps being a bit harsh to the institution. As things stand, I don’t see this as a great prospect. But I do think it is worthy of a soft ‘buy’ rating for those who believe we are not likely to see more turmoil in this space.

Plenty of good and bad

Before we get into the financial data, it would be helpful to paint a picture of what Banner Corp is and how it operates. In various parts of the country, centered mostly on the West Coast, Banner Corp operates 137 different branch offices and 18 loan production offices. These offices are located throughout Washington state, Oregon, California, Idaho, and Utah. And through these locations, it provides customers a wide array of services. Primarily, it focuses on traditional banking activities such as accepting deposits and originating loans in the areas in which it operates. In addition to this though, the company is quite active in the secondary loan market, mostly centered around trading in the mortgage business for single family and multifamily residential loans.

The company also offers services related to construction activities and seeks to meet a variety of other business needs. On the commercial side, the company prides itself in focusing on small and medium sized businesses, lending out amounts that usually range between $3 million and $25 million. Agricultural lending and consumer loan lending are also areas of interest for the company, with some loans used for things like automobiles, boats, and recreational vehicles. The company also receives fees from institutional owners of debt for loan servicing contracts that it has entered into. But this is a relatively small portion of what the company does.

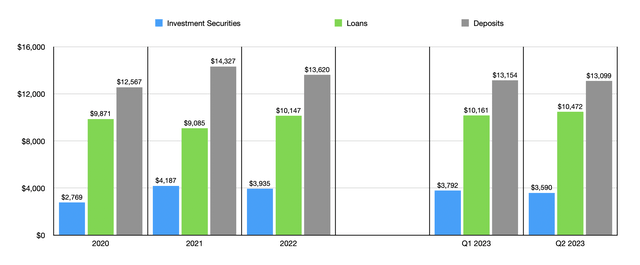

Author – SEC EDGAR Data

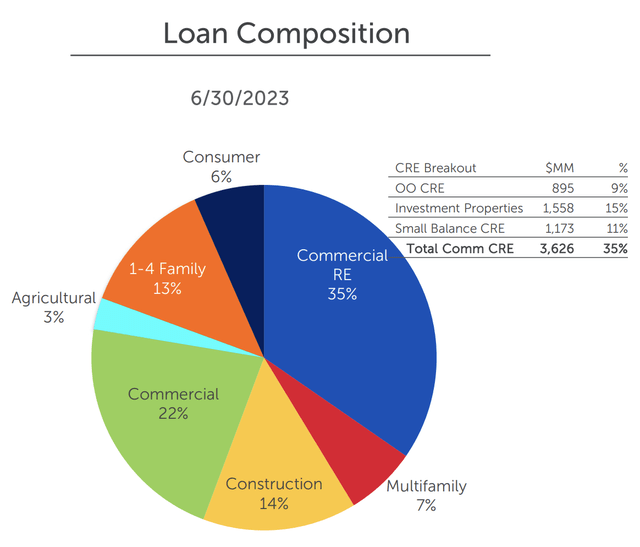

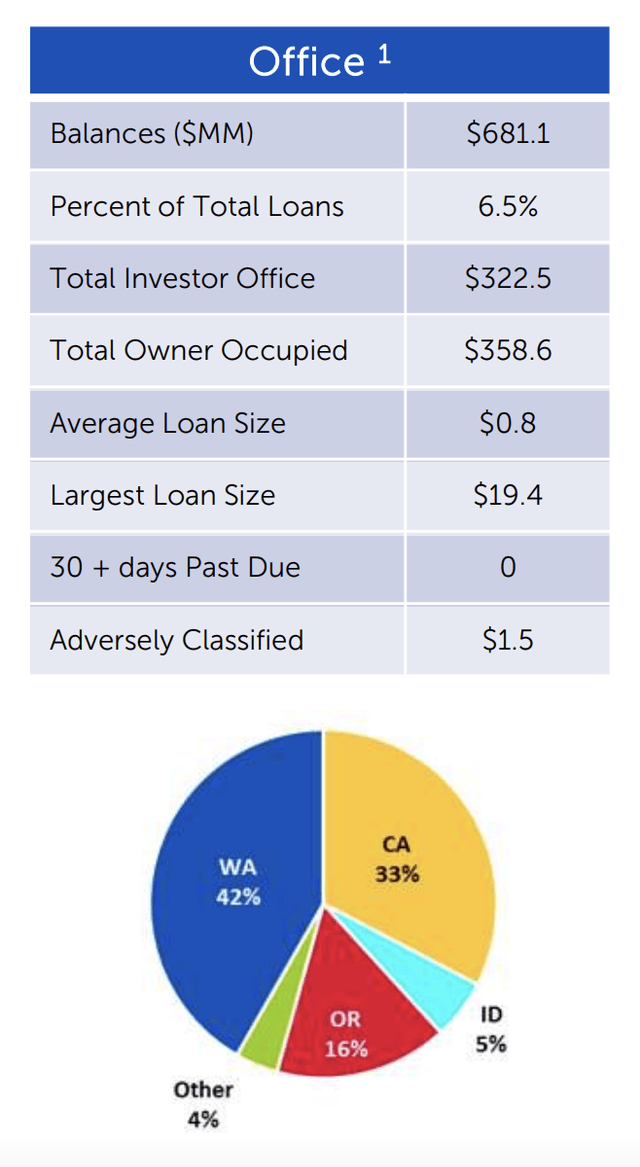

In recent years, management has done a fairly good job growing the company. Loans, for instance, managed to rise from $9.87 billion in 2020 to $10.15 billion in 2022. However, this was also accompanied by an increase in available for sale securities from $2.77 billion to $3.94 billion. Since the end of last year, the value of loans that the company has grew further to $10.47 billion while available for sale securities has dropped to $3.59 billion. On the loan side of the equation, 35% of the company’s portfolio in all is dedicated to commercial real estate. Commercial properties comprise another 22%. This is followed up by construction loans at 14% and single family to four family properties at 13%. The high exposure to commercial real estate and commercial properties might have some investors worried about the firm’s exposure to office assets. High vacancy rates across the nation are an issue that could lead to some pain for financial institutions down the road. The good news is that only about 6.5% of the company’s total loan portfolio is dedicated to these types of assets.

Banner

Banner

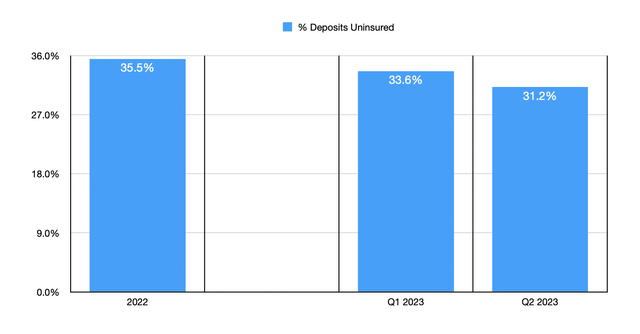

The overall growth in loans and investment securities that are available for sale has only been made possible by a growth in the company’s deposits. These grew from $12.57 billion in 2020 to $13.62 billion in 2022. However, the business has seen some weakness since then. Driven in part by the banking crisis, and also likely in part by high interest rates that have caused depositors to look for higher yields elsewhere, overall deposits dropped by $465.9 million by the end of the first quarter to $13.15 billion. By the end of the second quarter, they had fallen another $55.1 million to $13.10 billion. While this is painful, it is worth noting that the company’s exposure to uninsured deposits has dropped. At the end of last year, 35.5% of deposits were uninsured. That number has since fallen to 31.2%. The sweet spot for me is a reading of 30% or a lower. But the overall trend that we are seeing, combined with how close we are to 30%, makes this tolerable.

Author – SEC EDGAR Data

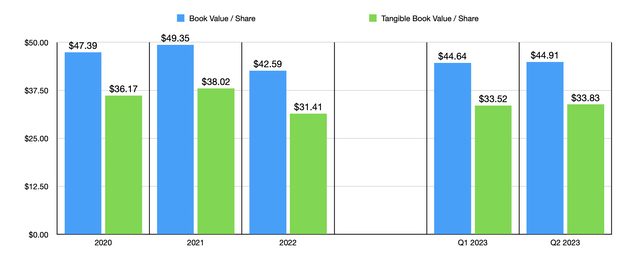

Some financial institutions decided or were forced to take on large amounts of debt in recent quarters because of the need to cover cash outflows. The debt owned by Banner Corp has increased during this time. But in the grand scheme of things, it’s not all that significant. By the end of 2022, total debt was $456.6 million. Today, that number is closer to $622.9 million. Despite the deposit issue and the growth in loans, the bank has seen some growth in its book value per share. After peaking at $49.35 in 2021, book value per share plummeted to $42.59 per share at the end of last year. But by the end of the second quarter of this year, it had increased back to $44.91. A similar trend can be seen when looking at tangible book value per share, with it ultimately rising from $31.41 at the end of 2022 to $33.83 today.

Author – SEC EDGAR Data

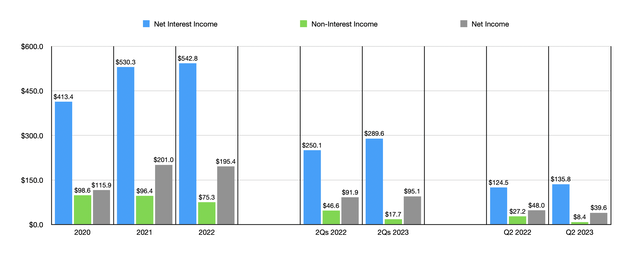

The overall growth in loans and available for sale securities has allowed the company to grow in recent years as well. Net interest income grew from $413.4 million in 2020 to $542.8 million last year. Along this window of time, non-interest income contracted from $98.6 million to $75.3 million. But this did not stop net income from rising from $115.9 million to $195.4 million. As you can see in the chart below, financial performance for the first half of this year has also been positive, with both net interest income and net profits rising year over year. However, there was some weakness on the bottom line in the second quarter on its own.

Author – SEC EDGAR Data

When it comes to overall valuation, it is important to note that shares are trading at a rather low price to earnings multiple of 7.8. On top of this, the company is trading at a modest discount of $0.25 per share compared to its book value. Some banks trade at premiums to their book value, but I have seen some that have traded at significant discounts to them as well. So this is not all that significant. However, the price to earnings multiple is near the lower end of the range of what I have seen in recent months.

Takeaway

Based on all the data provided, I would argue that Banner Corp is a decent prospect. The company continues to grow, even though deposits have experienced continued weakness. That picture is stabilizing, however. The stock looks fundamentally cheap, at least relative to earnings. And while uninsured deposits are higher than I would like them to be, they are moving in the right direction and are close to the sweet spot that I look for. All combined, this gives us a picture of a company that looks mildly attractive, but that is far from being a best of breed prospect. Because of this, I have decided to rate it a soft ‘buy’ at this time.