With Dalal Street investors studying the last leg of December-quarter earnings reports from India Inc, analysts have mixed views on the crucial banking space going forward.

Private vs public sector banks

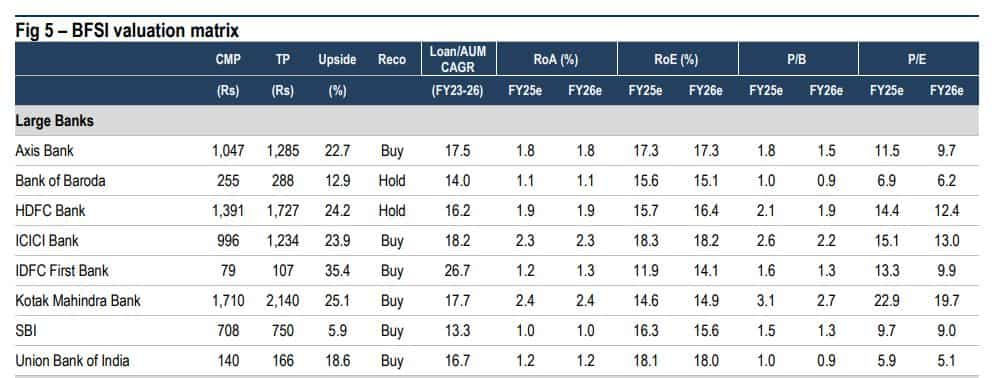

Large-cap private banks have a better risk reward than others in the banking, financial services, and insurance (BFSI) segment on the back of the government loosening its purse strings, improving the banking liquidity coupled with the robust underlying credit demand, wrote analysts at brokerage Anand Rathi in a research report.

Conversely, analysts at InCred Equities believe that public sector banks are better placed on the liquidity front compared to private sector banks with their lower loan-to-deposit ratio (LDR) and higher liquidity coverage ratio (LCR). While the loan-to-deposit ratio is the proportion of a bank’s total loans against its total deposits, the liquidity coverage ratio determines the share of highly liquid assets to be able to survive a period of short-term liquidity stress.

Here is a look at LCR and LDR of various private bank and public bank:

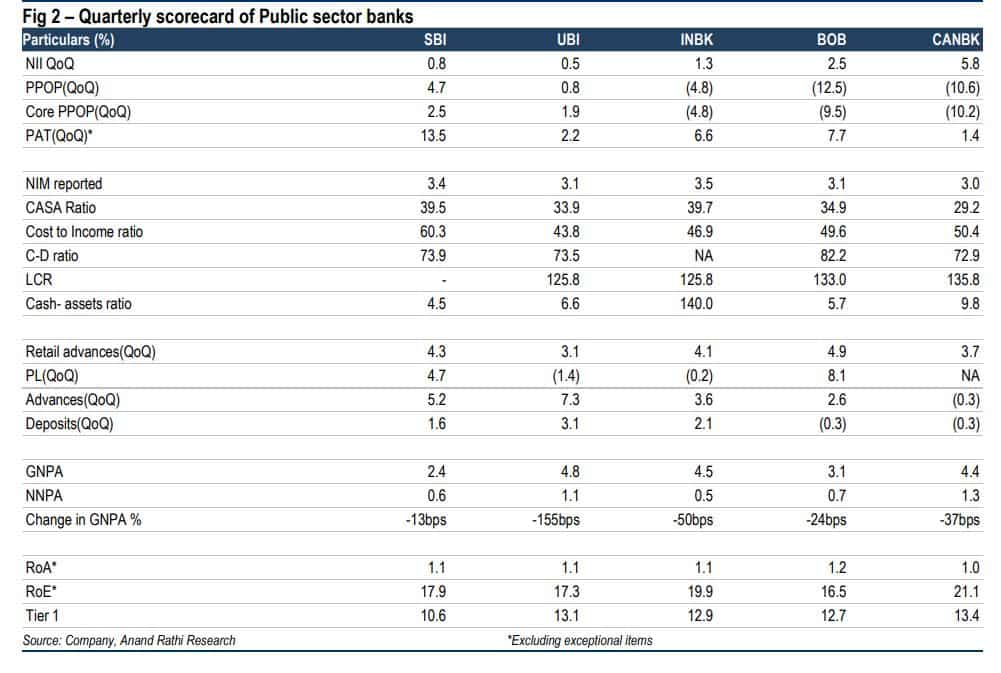

Barring State Bank of India, private banks fared better than their public sector peers on the loan growth front in the quarter ended December 31, 2023, according to Anand Rathi. However, the compression in net interest margin, a key measure of profitability for lenders, was lower in public sector banks than their private sector peers, according to the brokerage.

Analysts at Anand Rathi also pointed out that loan growth was faster in old private banks in comparison to public sector banks, though slightly slower than private banks.

A glance at the quarterly score by Anand Rathi

Private sector bank:

Public sector bank:

Here are some other key points highlighted by analysts the brokerage:

Here are some other key points highlighted by analysts the brokerage:

Despite Q3 being seasonally strong for SME lenders, Retail growth is faster for peers

-Improved asset quality continued

-NIM pressure across the segments

-Overall profitability strong on account of favourable credit costs

-Liquidity on the balance sheet strong in the form of LCR

Overall banking sector outlook

Until the policy easing cycle starts, margin pressure is inevitable for all banks for a couple of quarters, according to InCred. Even after the policy cycle eases, immediate relief is difficult as the decline in lending rates would be faster as compared to the repricing of deposit rates due to a higher share of variable-rate loans in the system, according to analysts at financial services platform InCred.

They peg a limited improvement in credit costs which will ensure a gradual decline in the return on asset (RoA), a metric that indicates a company’s profitability in relation to its total assets, for banks, and will weigh over their valuation premium.

A valuation premium is the additional amount a buyer is willing to pay over the perceived fundamental value of a business or asset.

What should investors do?

Analysts see a consolidation phase for banking stocks till the margins start to improve.

InCred recommends adding HDFC Bank, ICICI Bank and SBI shares for targets of Rs 2,000, Rs 1,150, and Rs 800 apiece, respectively. It suggests investors hold Axis Bank and IndusInd Bank for targets of Rs 1,100 and Rs 1,750 per share, respectively.

Anand Rathi’s top picks from the banking space include ICICI Bank, Axis Bank, SBI and Bank of Baroda.

Catch the latest stock market updates here. For all other news related to business, politics, tech and auto, visit Zeebiz.com.

DISCLAIMER: The views and investment tips expressed by investment experts on zeebiz.com are their own and not those of the website or its management. zeebiz.com advises users to check with certified experts before taking any investment decisions.

Here are some other key points highlighted by analysts the brokerage:

Here are some other key points highlighted by analysts the brokerage: