The Financial institution of England is predicted to boost rates of interest to their highest degree since 2009 on Thursday, because the central financial institution seeks to strike a stability between tackling document inflation and never taking motion that will exacerbate the UK financial slowdown.

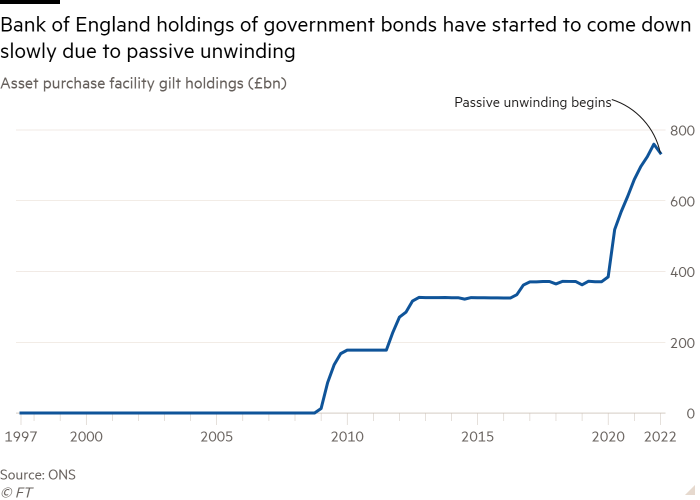

Growing charges from 0.75 per cent to 1 per cent would imply the BoE hits a self imposed threshold to disclose subsequent steps in its plan to scale back billions of kilos value of property constructed up over 12 years of quantitative easing following the monetary disaster.

Monetary markets have been anticipating the BoE Financial Coverage Committee to boost charges by half a proportion level this week, however have proven indicators of revising their calculations down in current days, with most economists now predicting a 0.25 proportion level enhance.

The consensus amongst economists is that the MPC will resolve to maneuver extra cautiously as UK households are squeezed by inflation, resulting in decrease demand and slower financial development.

The stress on the BoE to tighten financial coverage stems from persistent and broad will increase in costs alongside a decent labour market, and disruption to world provide chains attributable to Russia’s invasion of Ukraine and the coronavirus pandemic.

Extra uncertainty surrounds the BoE’s intention for unwinding quantitative easing, however some economists count on the central financial institution to a minimum of announce a plan to start asset gross sales in some unspecified time in the future this 12 months.

Analysts at Financial institution of America stated any charge rise wouldn’t stop headline inflation rising to about 9 per cent this 12 months, whereas some economists, together with these at Capital Economics, count on value development to extend at a double digit charge within the autumn. Shopper value inflation hit a recent 30-year excessive of seven per cent in March.

However the want for aggressive motion to curb inflation is offset by indicators of weakening demand, as households battle with hovering vitality payments alongside broad-based will increase within the costs of products and companies.

Chris Hayes, economist at HSBC, stated: “There’s a rising argument that the vitality shock pushed inflation of as we speak — to the extent that it squeezes on actual incomes — means decrease inflation tomorrow.”

The prospect of the squeeze on incomes taking the wind out of the financial system is one thing that Andrew Bailey, governor of the BoE, is anxious about.

Talking on the sidelines of the IMF and World Financial institution spring conferences final month, he stated the MPC was “strolling a really tight line” between tackling inflation and never pushing “too far down” on costs.

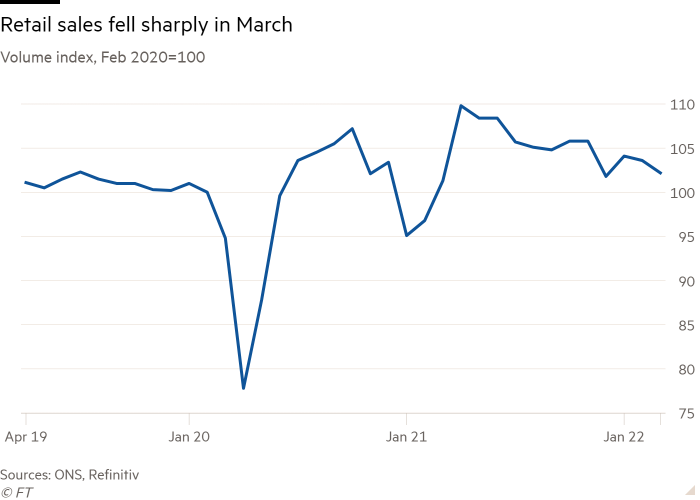

Financial information final week additional buttressed the argument that inflation is starting to damp financial exercise. UK retail gross sales information for March confirmed volumes fell by a greater than anticipated 1.4 per cent — one of many first indicators that top costs are having a unfavorable influence on shopper spending.

Development in gross home product slowed to only 0.1 per cent in February, from 0.8 per cent in January.

Not all economists are satisfied, nonetheless, {that a} weakening financial system will convey costs down, with some predicting a really actual threat of extended stagflation — a time period used to explain a interval of low GDP development and persistently excessive inflation.

Ruth Gregory, economist at Capital Economics, stated “numerous indicators are telling us . . . that second spherical results of the preliminary inflationary shock may maintain inflation past the financial institution’s [2 per cent] goal charge regardless of a weaker financial system”.

She added {that a} lack of migrant staff as a result of Brexit, together with a big drop in labour drive participation after the pandemic, would maintain the roles market tight and lift wage inflation.

“Charges might want to rise additional” regardless of the danger of recession, in an effort to “lean towards the danger that inflation turns into sticky as wages rise”, stated Gregory.

Because the MPC makes an attempt to strike a stability between curbing inflation with out weighing too closely on GDP development, it should resolve whether or not to start out energetic gross sales of the federal government bonds it owns.

In August 2021, the MPC determined that reaching an rate of interest of 1 per cent can be the edge at which it might “actively contemplate” promoting the gilts on its books. In February this 12 months, it stopped reinvesting the proceeds of maturing bonds when charges elevated to 0.5 per cent, a transparent sign that its stability sheet would start to scale back in measurement.

Given the maturity of its present holdings of presidency bonds, a “passive” unwinding can be gradual and reaching the 1 per cent charge threshold would give the MPC a possibility to extend the tempo at which it shrinks the central financial institution’s stability sheet.

Nonetheless, economists count on the MPC will probably be cautious of not disrupting markets. Bailey stated final month the BoE wouldn’t be “promoting bonds right into a fragile market” and can be versatile to altering “monetary circumstances”.

The BoE could really feel that it has time on its palms, as not like the US Federal Reserve, it has not proven any inclination to make use of a discount in its stability sheet to attempt to increase long-term authorities borrowing prices, stated James Smith, economist at ING.

The main target of the BoE is extra prone to be on reaching an “equilibrium degree” of presidency bonds which leaves sufficient reserves at business banks to fulfill their demand for cash, in accordance with Sanjay Raja, an economist at Deutsche Financial institution.

The BoE has not indicated what this degree can be, however Bailey has repeatedly stated it might be markedly increased than the place earlier than the monetary disaster.

q.jpg?itok=g0oVnLiz)