matejmo

With markets rallying again on the back of lower inflation and an expected pause in Fed rate hikes, it’s a good time to rotate our portfolios into value names – as elevated interest rates are likely to sustain even if they don’t march higher, putting downward pressure on valuations. We need to be careful, however, about what value stocks we put into our portfolios, as stock-picking remains as essential as ever to beating the broader market.

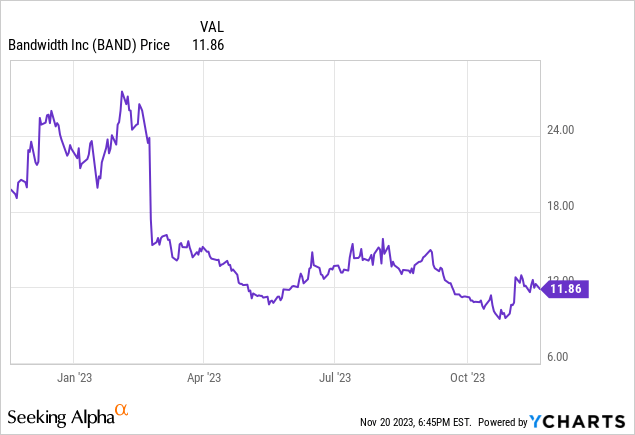

Among value tech plays, few stocks are as cheap as Bandwidth (NASDAQ:BAND), the smaller-cap competitor to Twilio (TWLO) and a CPaaS platform that enables text and voice capabilities within mobile applications. The stock has lost nearly 50% of its value year to date, and I think there’s more downside to go.

A bad situation with no cure

I last wrote a bearish opinion on Bandwidth in September. Since then, the stock has fallen a fresh ~10% (while most other software companies are up in the time since) and the company has released relatively poor Q3 results that showed continued degradation in revenue growth rates as well as net revenue retention rates.

The company is attempting to put product momentum back into play to make up for poor go-to-market execution. Its latest product, Maestro, has a new AI bridge functionality added in Q3 that enables routing calls to virtual agents first, when customers place inbound requests to contact centers. Still – it’s unclear how and when Bandwidth will be able to re-spark its growth engine, especially as its larger competitors (Twilio) are gaining share.

As a reminder to investors who are newer to this name, here are the core risks that I see in Bandwidth:

- Bandwidth continues to shed active customers- Amid weak revenue performance, we should be mindful that Bandwidth is actually losing customers, indicating that it may be losing market share.

- Tepid growth- It’s a bad sign when a small-cap software company is growing at a mid-single-digit pace, especially when that company is still unprofitable – a formula that typically leads to cost cuts that further limit the company’s capacity to return to growth.

- Net revenue retention rates continue to be weak- Barely now over 100%, Bandwidth is failing to execute the “land and expand” strategy that makes CPaaS an attractive business and allows the company to scale its bottom line.

- Strained liquidity- Bandwidth barely has over $100 million in cash remaining and is in a net debt position after considering its convertible debt note. The company is also burning free cash flow, so it may have to raise capital soon in a tough environment.

The bottom line here: I remain bearish on Bandwidth’s prospects. A company like Bandwidth, with extensive capex investments to enable its communications network, relies more than anything on economies of scale. Customers recognize this as well, and are unlikely to invest in building out a CPaaS strategy with Bandwidth when competitors like Twilio appear much sturdier. With no line of sight to a fundamental turnaround, it’s best to ditch this stock and invest elsewhere.

Q3 download

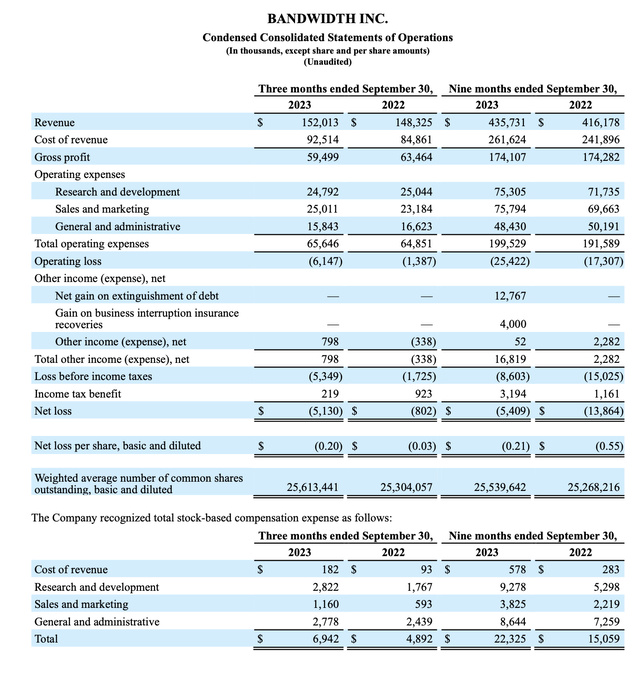

Let’s now go through Bandwidth’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Bandwidth Q3 results (Bandwidth Q3 earnings deck)

Bandwidth’s revenue grew just 5% y/y to $152.0 million, ahead of Wall Street’s expectations of $149.1 million (flat y/y). Growth did, however, decelerate relative to 7% y/y growth in Q2.

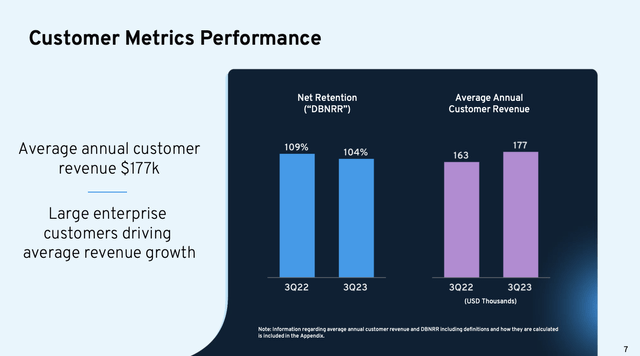

Dollar-based retention decay is the other core concern here. As a reminder, one of the key premises of Twilio and Bandwidth is that once installed with a customer, that customer (and its underlying users) will grow and expand their usage of the CPaaS solution, enabling a profitable source of growth that does not require additional sales resources to close down. During pandemic peaks, Bandwidth had net revenue retention rates above 130%. In Q3, as shown below, that rate had fallen to just 104% – indicating that upsells are barely outweighing churn – down two points sequentially, and five points year over year.

Bandwidth net retention rates (Bandwidth Q3 earnings deck)

Management noted that usage trends remained choppy. Per CEO David Morken’s remarks on the Q3 earnings call, made during the Q&A portion of the call:

We’ve navigated through the environment which we described as choppy and as expected throughout the year. Usage trends across our categories of service are as we would have hoped that supported our results for the period.

And we think that looking into the fourth quarter that they’ll continue to trend the way we’ve expected and guided and we’re encouraged about what that will mean for 2024.”

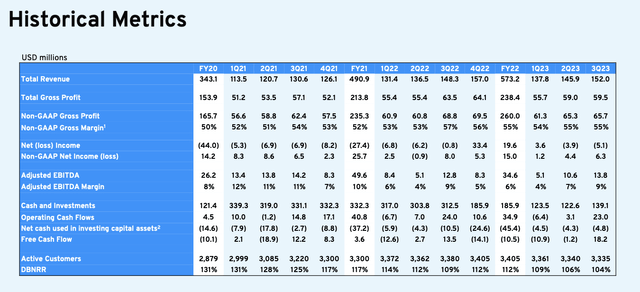

To make matters worse: Bandwidth continues to shed clients, though the company dismisses these as smaller, unprofitable names that the company wasn’t invested in retaining. Still, it’s not a confident look for the company, which saw its customer base drop down to 3,335 as of the end of the third quarter – down by five customers versus Q2, and 45 customers (or -1.3%) versus the prior-year Q3.

Bandwidth key trended metrics (Bandwidth Q3 earnings deck)

Note as well that for investors expecting meaningful growth contribution from the company’s new Maestro product that since its launch in September, six customers have signed up. It is early, of course, but with total customers dropping I wouldn’t pin too much hope on new products.

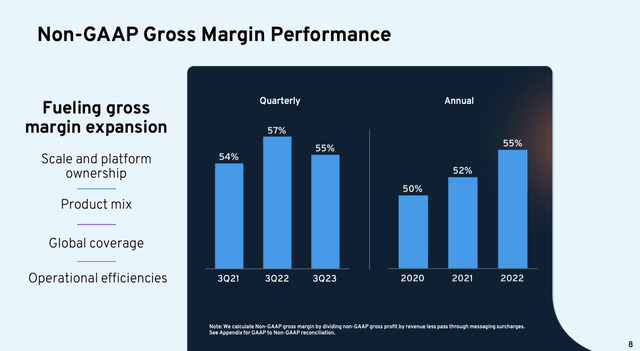

To add final insult to injury here: Bandwidth’s pro forma gross margins also dropped to 55%, down 2 points year over year.

Bandwidth gross margins (Bandwidth Q3 earnings deck)

Overall adjusted EBITDA margins did improve sequentially to 9% (though flat to the prior year), but it’s very clear that absent a return to top-line growth, it will be very difficult for Bandwidth to scale toward any meaningful profitability.

Valuation and key takeaways

At current share prices near $12, Bandwidth trades at a market cap of $304.3 million. After we net off the $139.1 million of cash and $418.0 million of convertible debt on the company’s most recent balance sheet, its resulting enterprise value is $583.2 million.

Meanwhile, for next fiscal year (FY24), Wall Street analysts are expecting the company to generate $669.3 million in revenue, representing 14% y/y growth – which is a very aggressive assumption, considering the recent slowdown to single-digit growth. Nevertheless, taking consensus at face value, we arrive at evaluation of 0.9x EV/FY24 revenue.

Again, Bandwidth is cheap- but that’s the case for a reason. With limited growth prospects, towering competition from Twilio, and weakening gross margin profile with potential dis-economies of scale from customer churn, there’s no reason to be invested in this name.