Mauricio Graiki

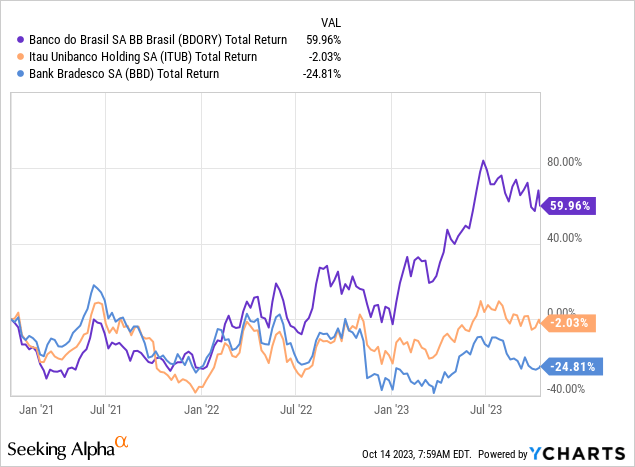

Being majority-owned by the Brazilian state might raise eyebrows among some readers, but Banco do Brasil (OTCPK:BDORY)(“BdB”) has nonetheless registered meaningful outperformance recently versus privately-owned peers Itaú (ITUB) and Bradesco (BBD)(BBDO).

There are a number of things to like about this bank. For one, while Brazilian banks currently face a number of headwinds right now, BdB is navigating the current climate well, and its profitability remains near cycle highs. Relatedly, it is Brazil’s biggest agribusiness lender – and the country’s agriculture sector is booming right now, helping to prop up the economy more generally. More importantly, these shares don’t look particularly stretched from a valuation perspective. While there are risks to contemplate, below book value is commensurately cheap given the bank’s earnings power.

Resilient In A Tough Environment For Banks

Brazilian banks have been facing some headwinds of late. The Brazilian Central Bank (“BCB”) has raised rates sharply in response to the post-COVID rise in inflation, with the current 12.75% base rate almost 11ppt higher than the COVID-era lows. While it may be a tad premature to claim victory, real interest rates are currently in the high single-digit area, and that is having the expected dampening effect on the economy. For banks, that means lackluster loan growth and deteriorating credit quality, while net interest margins at some banks have also come under pressure from the steep uptick in funding costs, with that outpacing the repricing of their investment securities.

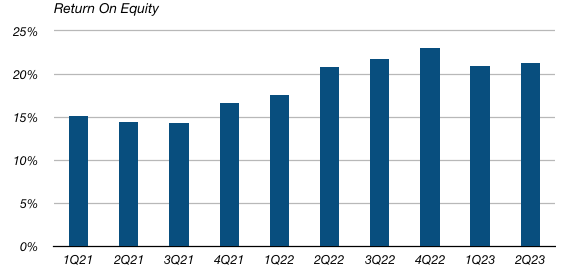

BdB has held up well in the face of these challenges. We still have to wait a month or so for Q3 results, but BdB’s net income and return on equity (“ROE”)(Fig1) was still close to its local cycle peak as of Q2. That is in sharp contrast to recently covered Bradesco, which has seen the issues above hit its net income much harder. To back that up with some figures, BdB was still earning a 21% ROE in Q2, while Bradesco’s ROE was a much more pedestrian 11%.

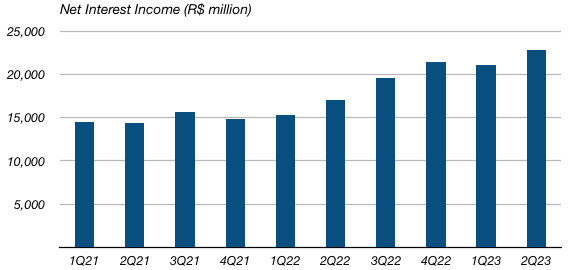

Fig 1. (Data Source: Banco do Brasil) Fig 2. (Data Source: Banco do Brasil) Fig 3. (Data Source: Banco do Brasil) Fig 4. (Data Source: Banco do Brasil)

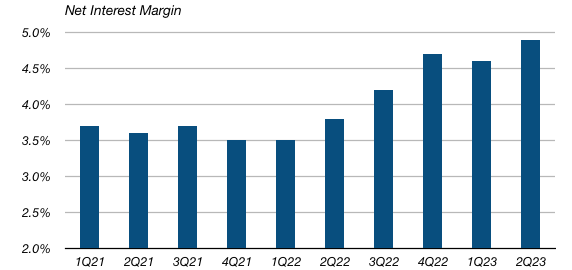

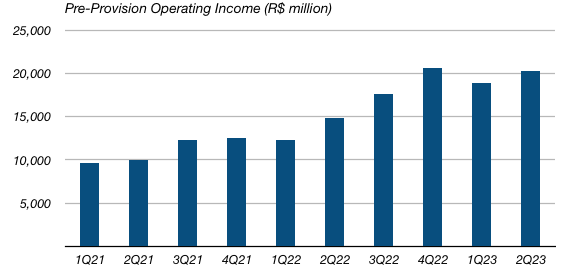

There are a few things going on here. For one, BdB’s net interest income has remained quite strong (Fig 2), with net interest margin still expanding as of Q2 (Fig 3). Worth noting is that demand deposits – the cheapest source of bank funding – still accounted for around 10% of BdB’s total deposits, which is around double that of Bradesco’s. Furthermore, BdB’s loan growth, though slowing, has remained just about positive on a sequential basis in nominal terms. Loan growth is nothing to shout about in inflation-adjusted terms, but again it has so far outpaced Bradesco in what has been a tough environment for loan growth in general. As a result of all this, pre-provision operating profit (“PPOP”) growth has also been fairly robust (Fig 4).

Another point I would add concerns credit quality. Rapidly rising rates and the roll off of COVID-era stimulus has led to worsening asset quality right across the sector. While BdB is no exception, delinquency ratios are still below pre-COVID levels. Provisioning expenses have also risen, but PPOP growth has helped absorb this in terms of net earnings and ROE.

Risks To Consider, But Shares Look Good Value

Being a Brazilian bank, an investment in BdB obviously doesn’t come without risk. There are the general political, regulatory and currency risks that apply to any emerging market bank stock to consider, while the fact that the state owns a 50% stake adds an extra layer of potential risk on top.

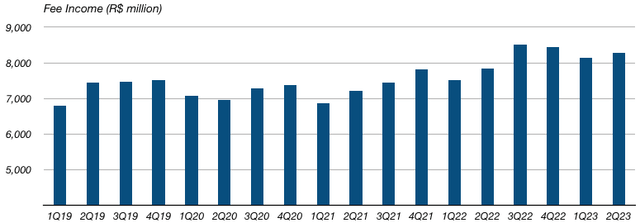

One of my other main long-term concerns is BdB’s fee income growth (Fig 5). Fee income doesn’t contribute as much to overall income compared to Bradesco (including its insurance operations), but it’s still around 35% of the mix. A number of these lines face secular headwinds, like asset management (e.g. margin compression due to the rise of passive solutions like ETFs) and credit/debit card fees (e.g. from Pix, a low-cost payment system introduced in 2020 by the BCB). Those two lines account for around a third of BdB’s total fee income. Without wishing to go overboard – card usage is still a secular growth story, for example – there is a risk that future fee income growth will be structurally lower than in the past.

A more near-term concern is the macroeconomic environment in Brazil. GDP growth has actually been surprising to the upside recently, but a slowdown brought on by high interest rates remains a concern, given the potential impact on non-performing loans (“NPLs”) and loan growth.

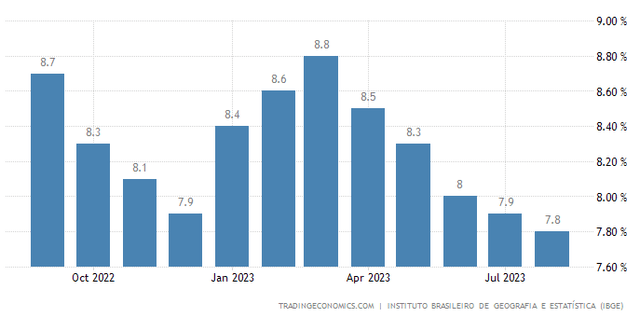

Still, there are some positives to cling to as well. While it’s true that CPI has been ticking up over the past three months, analysts expect the BCB to proceed cautiously with further easing, having already cut 50bps from the peak. The job market also remains encouragingly tight, with the unemployment rate falling below 8% after several consecutive months of decline (Fig 6). I’m hoping that will help alleviate credit quality deterioration.

Fig 5. (Data Source: Banco do Brasil) Fig 6. (Source: Trading Economics) Fig 7. (Source: Banco do Brasil Q2 2023 Results)

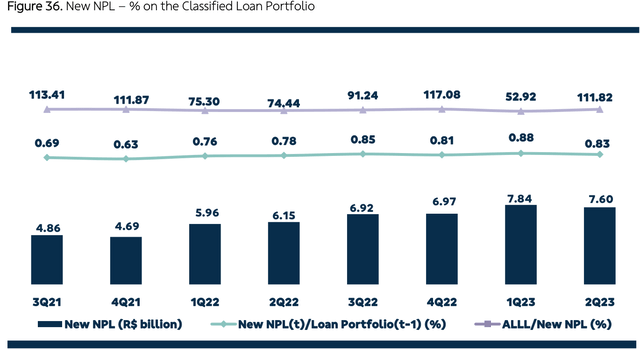

Moreover, Brazil’s agriculture sector is booming right now, and BdB’s loan book skews heavily to agribusiness (~30% of the total loan book). While total NPLs and delinquency rates were still rising as of Q2, NPL formation eased off (Fig 7). One quarter doesn’t make a trend, of course, but it is a positive sign. I would also note that reserves look prudent here, covering around 5.5% of total loans and 200% of loans 90+ days delinquent.

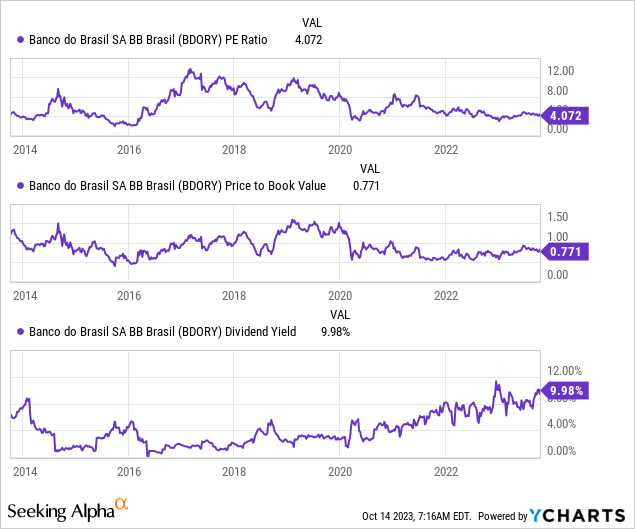

To top things off, BdB shares look attractively valued. The ADSs currently trade for $9.12, which puts them at around 0.85x book value per share. The bank made around $1 per share in net income in the first half of the year alone, so the annualized P/E is somewhere in the 4x area. Sure, the bank may be over-earning right now: through-the-cycle average ROE won’t be the 20% it is currently, but the shares are nevertheless cheap versus their historical past on a number of metrics. Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.