naphtalina/iStock via Getty Images

Investment Summary

Casino and gaming majors offer compounding factors with interesting economics, provided the business returns stack up on capital employed into operations. Bally’s Corporation (NYSE:BALY) does not meet these requirements in my view. The company has piled investment to grow operations with minimal earnings to show for this. Sure, revenues, pre-tax income and operating cash flows are up over time. There’s no denying the financials. But the economic performance isn’t there on closer examination. This report will unpack all of this for the benefit of investors, linking back to the broader hold thesis. Net-net, I rate BALY a hold.

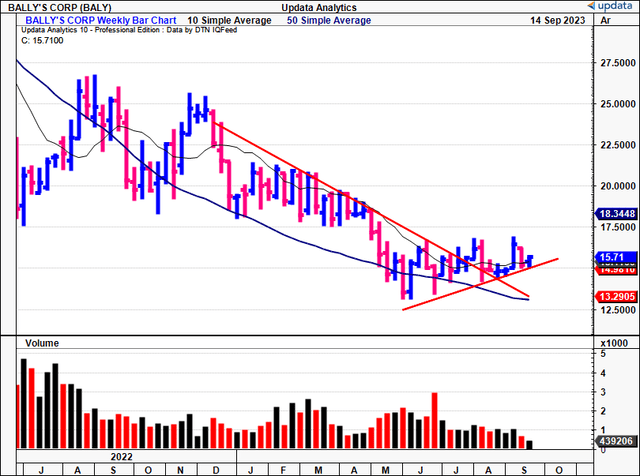

Figure 1.

Data: Updata

Critical investment factors underpinning hold thesis

1. Overview of operations, core assets, and core markets

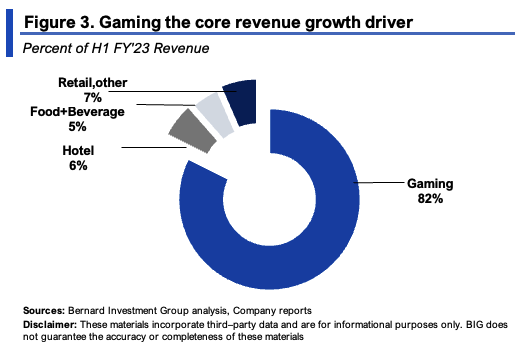

BALY calculates its retail gaming revenue based on the net win from gaming activities, determined by subtracting gaming outflows from gaming inflows. Fairly simple calculus. Gaming revenue also accounts for cash and free play incentives, but these components are deducted from the overall amount, so there’s no major impact to the unit economics. A portion of VLT revenue from its Twin River and Tiverton assets is also included in gaming turnover.

Online gaming operations follow the same revenue model as its land-based casinos, whereby revenue is generated from player wagers after deducting payouts, incentives and so forth. This category also includes online bingo and casino revenue from Gamesys.

In sports betting, revenue is determined by fixed odds and derives from player wagers. Revenue is recognized as total wagers net of payouts and incentives. Theoretical margins are incorporated for each sports wagering opportunity offered. Meanwhile, racing revenues are booked from live racing and the import of simulcast signals,

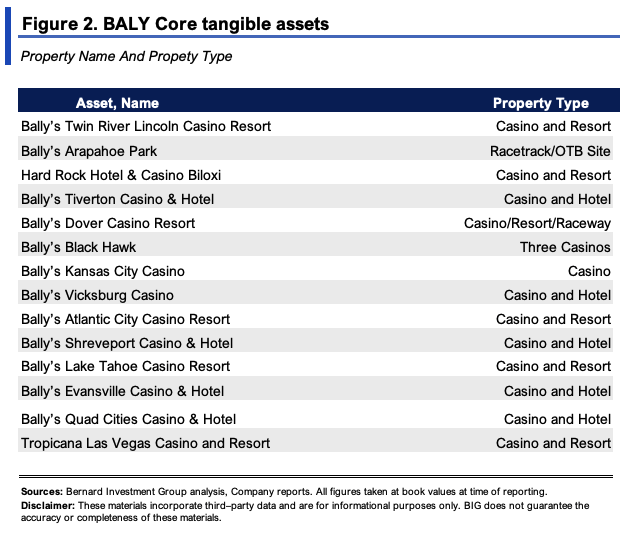

The company’s core tangible assets are observed in Figure 2. The core assets are casinos, hotels, resorts and the like (note, no intangible assets are included).

BIG Insights

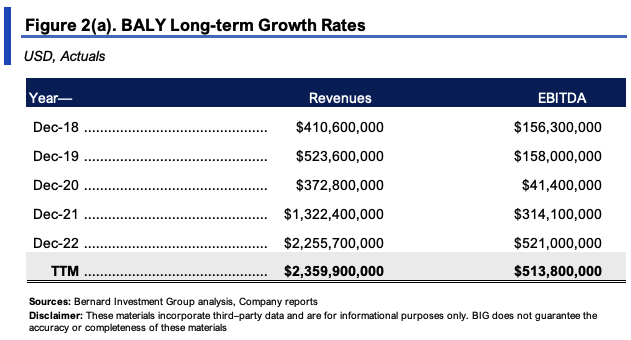

BALY is also a qualified ‘growth’ company in financial terms based on the record observed in Figure 2(a). Revenues have climbed from $410mm in 2018 to $2.4Bn in the last 12 months, sporting a compounding growth rate of ~42%. Meanwhile, pre-tax earnings have been lumpy, but on aggregate, have grown at a geometric rate of ~27% over the same period.

BIG Insights

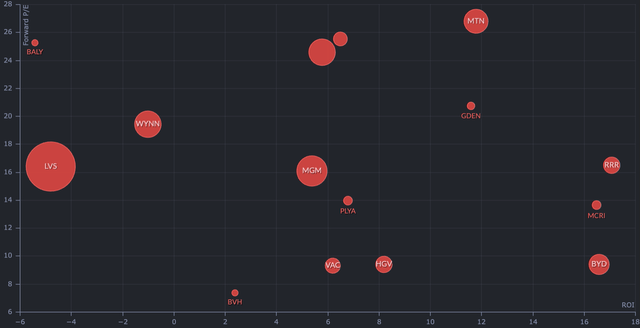

The casino and gaming business is a competitive one where profits are produced on wagering/betting, including tables and the likes (both in-casino and online), along with various non-gaming sources, in accommodation and general hospitality. It produced $263Bn in revenues from FY’18—’23 YTD globally, and employs over 2mm people worldwide. It is forecast to grow at CAGR 4.9% over the coming 5 years. Moreover, the distribution of the profit pool is quite wide, with a number of companies offering tremendous returns on capital whilst trading at sub-18x forward earnings multiples, as seen in Figure 2(b) [you can see BALY in the top-left-hand corner].

Figure 2(b).

Source: FinViz

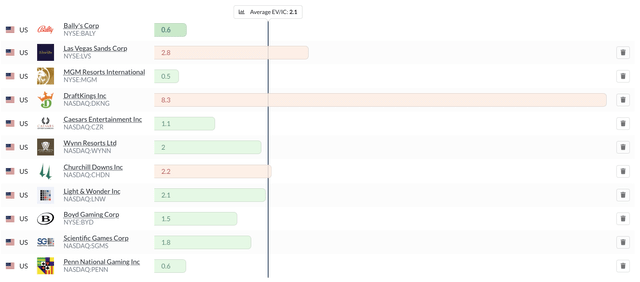

Market valuations are dispersed equally as wide. The average EV/Invested capital is ~2x, nothing flattering in my view. A handful of names rest above this average. But it’s safe to say, from the list presented in Figure 2(c), the market doesn’t place a high premium on the assets employed in the casino and gaming domain.

Figure 2(c).

Source: Alpha Spread

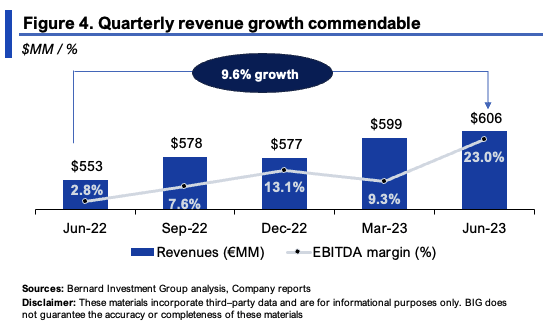

2. Insights from latest numbers

BALY put up Q2 revenues of $606mm, up 10% YoY, on core EBITDA of $161mm, a c.27%. Quarterly growth has been commendable since 2022, as seen in Figure 4. Management reinstated its FY’23 guidance which projects $2.5Bn—$2.6Bn at the top on adj. EBITDA of $665mm—$700mm. I’d also comment these forecasts bake in a loss of ~$50—60mm in North America Interactive, its online casino, due to additional development costs to be incurred in H2. It is eyeing CapEx of $160mm, excluding its Chicago investments. Maintenance CapEx for casinos is estimated at ~$50mm, meaning growth CapEx for its casinos is expected to be in the $70mm range.

As to the divisional highlights:

- The Casinos & Resorts business did quarterly revenues of $333mm, growing 11% YoY. It pulled this to adj. EBITDA of $111mm, a 12% YoY gain. But the division’s profitability has drags on profitability from lower-margin properties like Atlantic City and Tropicana. For example if you strip these out, pre-tax margins lift to 39.4%. Included, it drops ~6 points to 33.3%.

BIG Insights

- International Interactive contributed $248mm to the top line and $84mm in adj. EBITDA with a margin of 33.9%. Growth was underscored by upsides from the U.K. via by content and marketing efforts. As a reminder, the company has access to swaths of data that it uses to then 1) optimize its customer experience, but more importantly, 2) optimize is customer acquisition spending. In that vein its U.K. offerings were up 12% increase in both dollar and GBP (so no FX tailwinds). International sales grew 6%.

- Regarding its Medinah Temple—its temporary casino in Chicago—all remains on track following preliminary suitability approval from the Illinois gaming board. in June. The project remains on track for a September opening, with an estimated EBITDA contribution of $50mm to $60mm in 2024.

BIG Insights

3. Economic leverage on capital/assets deployed

The next part of this analysis hones in directly on BALY’s ability to create shareholder value over the coming years. We are linking the P&L and cash flows to the balance sheet here. It will answer several questions, namely:

(i) How much the company has invested;

(ii) At what rates of return; and

(iii) How much capital it will need to invest going forward to maintain its current industry position, and, how much can it invest.

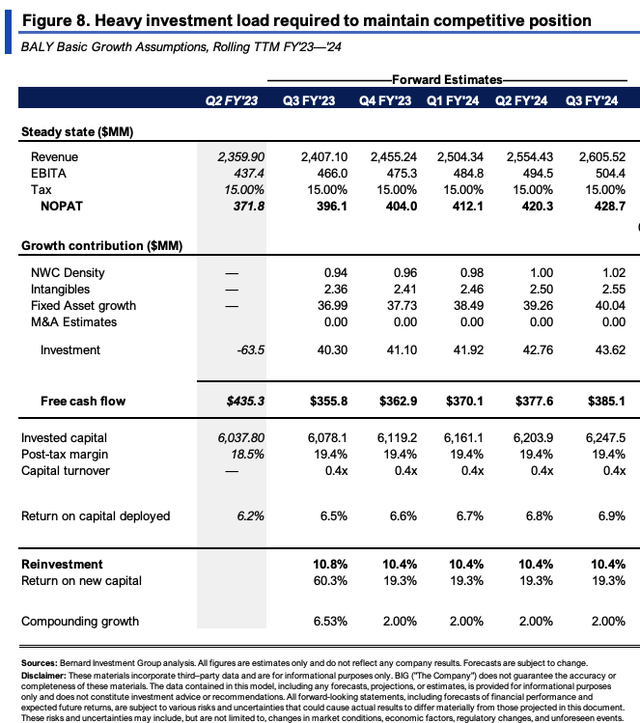

Right off the bat, it’s abundantly clear this is a capital-intensive business. In my view, a heavy investment load is required to maintain BALY’s competitive position going forward, especially if it wants to continue growing at the rates it has been.

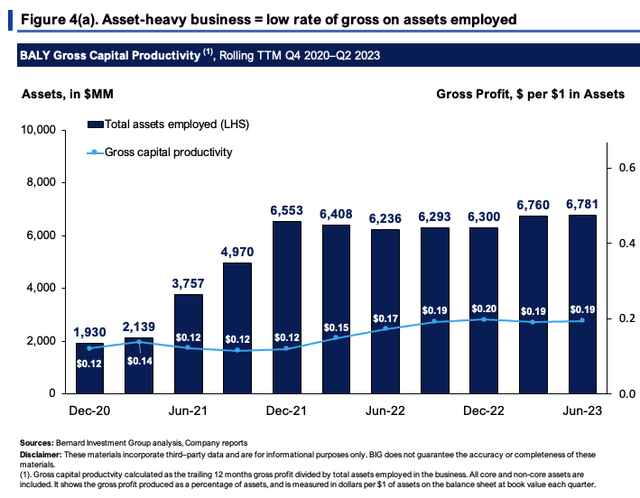

Figure 4 captures the gross profitability on assets employed to run the business. It is shown on a rolling TTM basis since 2020. All core and non-core assets are included. BALY has $6.78Bn tied up on the balance sheet, 88% of which is in its real estate, intangibles, and acquired goodwill. Only $192mm is in cash and marketable securities.

Critically, it is rotating back just $0.19 on the dollar for every $1 of assets employed. Whilst gross margins on revenues at 56% is reasonable, not so much as a percentage of the resources required to produce them. For reference, a number >$0.30 is considered attractive here.

BIG Insights

The picture is even more challenging when looking at the rate of returns produced on BALY’s investments.

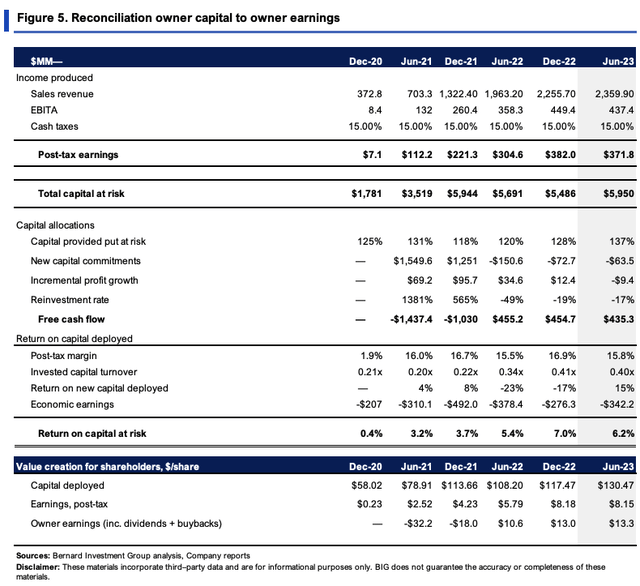

Figure 5 is a more granular reading on the rate of earnings produced on BALY’s capital (TTM values). Critically, NWC is negative at present. This squares off with the economics of the business. It gets paid upfront, usually in cash (through the betting/wagers placed). It doesn’t need to pay purveyors until sometime afterwards. This is a positive.

Thinking in the terms from above:

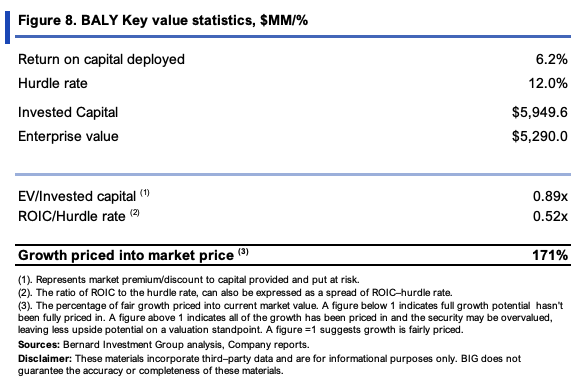

(i) It has $5.95Bn in business capital directly at risk, contributing to operations, about $130/share.

(ii) The $130/share produced $8.15/share in post-tax earnings last period, just 6.2% return on investment. Including all buybacks, the return to shareholders was 10.1%.

Companies, like portfolio managers, and investors, are stewards of capital. They must allocate cash to investments that produce a profitable stream of cash flows. Key word—profitable. That means, the earnings produced give a reasonable return on investment. If you bought an entire business, you’d want it to throw off as much cash as possible, no? Moreover, you’d want it to beat the next best investment. For most of us, that’s the equity benchmarks, which, on average, have compounded capital at ~12% over the long-term. This is why we use 12% as the required rate of return on capital as a key competency to buy a company’s stock.

BALY doesn’t meet these requirements right now.

The reasons are clear, too:

- Post-tax margins of ~16%, which is a puzzle, because you’d expect wagering and gaming to bring in higher margins than that.

- Capital turnover of 0.4x does nothing to help this. That’s $1 in capital, producing $0.40 in revenue. Again, not acceptable for an investment-grade company.

Note: Tax rate is taken as 15%, even though no tax payment was made in respective periods. Source: BIG Insights

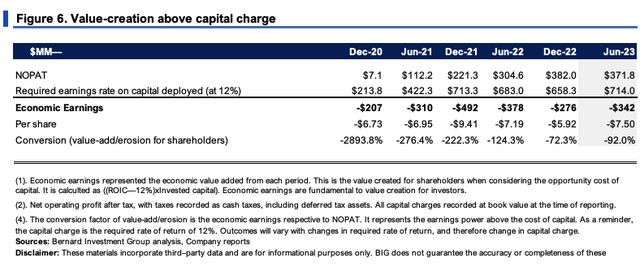

At 6.2% trailing ROIC, the capital BALY has deployed to grow the business is not pulling its economic weight. If you need a rate 12%, this is a negative 5.8% spread, an economic loss. Figure 6 quantifies this well. It shows what BALY needed to produce on the capital at risk, compared to what it did. The outcomes are shown as economic earnings/losses, with a conversion rate.

This is the problem I see here with BALY. All of this capital is required to run the business—both tangible (in casinos, resorts) and intangible (in gaming software and the like)—but it isn’t giving investors an attractive rate of earnings. In economic terms, the loss on capital was $7.50/share. Not attractive in my view.

BIG Insights

Value drivers and steady-state expectations

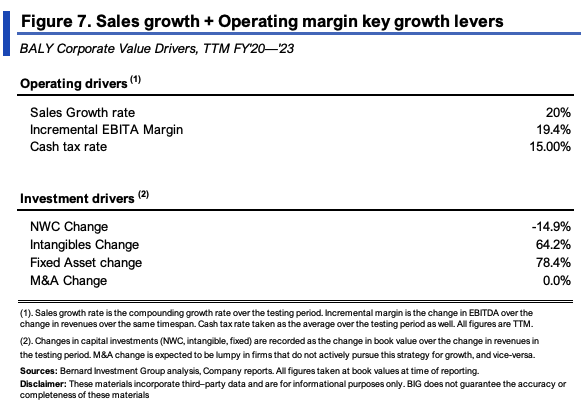

The drivers of value for BALY’s economic performance these past 3 years are seen in Figure 7. Sales and operating margin are the keys, up 20%, and at 19.4% on average, respectively. Operating margin has actually increased substantially over time.

But true to form—and what’s been discussed already—capital intensity is tremendously high. Each new $1 in revenue required an additional $1.42 investment, $0.64 to intangibles and $0.78 to fixed assets. And this doesn’t even include any M&A, which I’ve opted to exclude here. As mentioned earlier, NWC requirements decreased on revenue growth, given the economics of the business.

BIG Insights

The question is what is required going forward to maintain this steady-state of operations. Figure 7 depicts this, albeit with some minor changes. Sales are pared back to 2% (slightly below global GDP), and NWC requirements are put at positive 2%. To do this, BALY would need to invest ~$40–$45mm each quarter from NOPAT of $465–$500mm. But it would still be hitting 6–7% return on its capital at risk, spinning off ~$350–$385mm in FCF. Here I’d see it compounding intrinsic value at ~2% each period, ~8% over the next year.

Say it wanted to continue growing at a 3-year rate of 20%. The picture is vastly different:

- At a 20% revenue growth rate, BALY would likely need $400–$600mm investment each quarter ($1.6–$2.4Bn annualized) and throw off ~$190–$290mm in FCF.

- Returns on existing capital would still hover around 9–10%, with post-tax margin of ~19% and capital turns of just 0.6x. This would require an 80% reinvestment each quarter just to continue the growth. Over time, cash flows simply wouldn’t keep up in my view.

So in order to retain its competitive position, and continue growing at similar rates, an enormous investment is required, and much higher profitability at that. If it produced a 25% rate on capital, to continue growing at 20%, it could reinvest just 20% of earnings each quarter. That’s the benefit of a higher ROIC—the reinvestment requirements are much less. And, if you do decide to plough all the cash back in, you’re producing an economic leverage of higher profits. Not the case here though.

BIG Insights

Valuation and conclusion

It shouldn’t be surprising to see BALY selling at such tight multiples, therefore. It sells at just 5.8x forward earnings and 11.8x forward EBIT, 25% cash flow yield. This isn’t one of those ‘cigar-butt’ types the Ben Graham crowd talks of either. Something has to cause it to turn higher in that scenario.

Instead, the market values at a discount to invested capital, ~0.9x to be precise. Normally, this could be immensely attractive, provided the business returns were there. In contrast, they are even weaker, at a ratio of just 0.5x to the 12% hurdle rate we use (similar to the -5.8% spread from earlier).

So in my view the market’s well and truly priced in any of the earnings power BALY has in its economic arsenal. My estimates get to a value of $14.80 when projecting out to FY’28, discounting at 12%. This supports a hold rating.

BIG Insights

In short, BALY’s offerings are interesting with plenty of technological and entertaining rigor. But this is by no means a capital-efficient business. On the contrary—it has enormous sums put at risk, recycling back small sums of earnings relative to these sums. In my view, there are more selective opportunities elsewhere right now. One point is that BALY is tremendously cheap right now, 5.8x forward earnings cheap. So there’s ‘value’ in the price, not necessarily in the business. Based on all the factors raised here, I rate BALY a hold.